Marco Bello

In 2022, Cathie Wood’s ARK Innovation ETF (NYSEARCA:ARKK) underperformed due to a revaluation of high-risk, high-priced technology businesses.

Since the market was jolted yesterday by higher-than-expected August inflation statistics, high-multiple equities are particularly vulnerable in the short term.

The ARK Innovation ETF has also not changed its risk management policy, which means the exchange traded fund is still heavily overweight in a few select high-multiple company names.

Inflation Is The Newest Risk For The ARK Innovation ETF

The Dow Jones Industrial Average fell nearly 4% yesterday, losing 1,276 points, as higher-than-expected inflation caught the market off guard. Valuations fell across the board, with technology equities particularly heavily impacted.

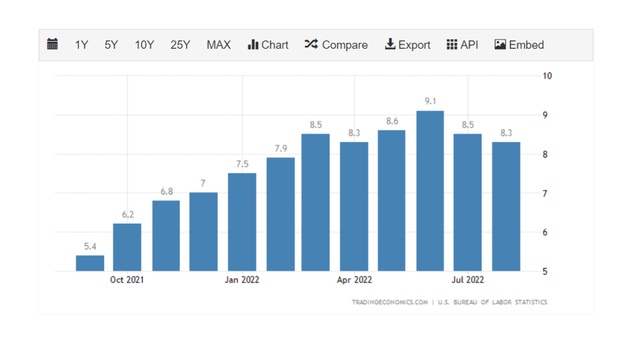

In August, inflation remained high at 8.3% despite a 5% decline in energy expenses for the month. Energy costs were a major driver of inflation this year and will continue to be a substantial risk factor for stocks in the future.

Since inflation has not abated, the risks for stocks in general have increased, as evidenced by the stock market’s near 1,300-point decline. Given the persistent uncertainty around the rise in consumer prices, volatility levels are expected to stay elevated in the future.

Inflation Rates (TradingEconomics)

Because the ARK Innovation ETF maintains overexposure to a few select technology stocks with unsustainable multiples, the fund’s price fell 6.79% yesterday, but I believe the fund’s net asset value has fallen even more in the short run.

While rising inflation is primarily viewed as a negative for companies in the retail and consumer staples sectors, technology companies with high valuations and a lack of profits are especially vulnerable to market selloffs.

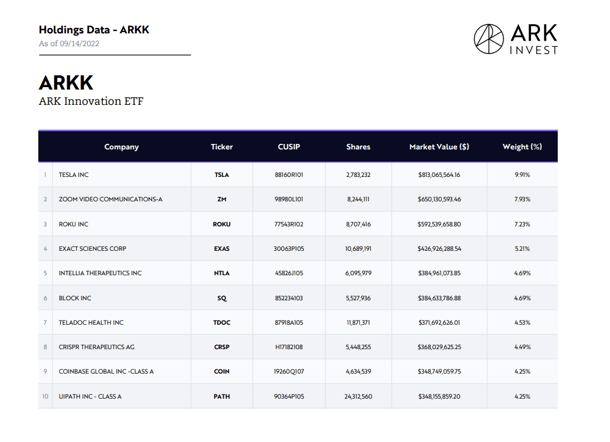

It’s disappointing that the ARK Innovation ETF hasn’t learned from past mistakes and reduced its risk profile by investing in less risky stocks or spreading the fund’s assets across a broader range of investments. The fund’s assets are still heavily concentrated in just a few names, with the top five holdings accounting for 35% of the ARK Innovation ETF’s assets.

Tesla (TSLA) (with a weighting of 9.91%), Zoom Video Communications (ZM) (7.93%), Roku (ROKU) (7.23%), Exact Sciences (EXAS) (5.21%), and Intellia Therapeutics (NTLA) (4.69%) were the five largest assets in the ARK Innovation portfolio as of September 14, 2022.

All of these stocks continue to trade at high multiples: Tesla trades at a 13x sales multiple, Roku at a 3x sales multiple, Zoom Video at a 5x sales multiple, Exact Sciences at a 4x sales multiple, and Intellia at a 105x sales multiple.

The top ten holdings of the ARK Innovation ETF include the following companies:

ARKK Top 10 Stocks (ARK Innovation ETF)

The top three stocks in the ARK Innovation ETF fell more than the average stock in the Dow Jones Industrial Average yesterday, owing to the fact that the ARK Innovation ETF is likewise overweight high-beta stocks. Yesterday, the top three holdings of the ARK Innovation ETF (Tesla, Zoom, and Roku) fell 4.04%, 6.21%, and 5.50%, respectively.

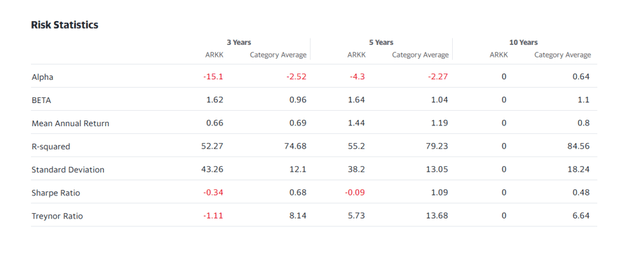

The beta factor is an important risk indicator that tells investors how hazardous a stock or fund investment is. For example, Tesla has a 5-year beta factor of 2.19x. Zoom Video Communications has a beta value of -0.49x, while Roku has a beta factor of 1.71x. A portfolio of stocks comprised primarily of high beta-stocks has a high beta factor.

The 5-year beta factor for the ARK Innovation ETF is 1.64x, which suggests that the exchange traded fund magnifies general market volatility times 1.64x. As a result, a 1% increase in the market would result in a 1.64% upward movement in the price of the ARK Innovation ETF. A beta factor greater than one suggests that the investment is riskier than the market.

Risk Statistics (ARK Innovation ETF)

Why ARKK ETF Could See A Higher Valuation

There is a chance that I am incorrect about the ARK Innovation ETF, and if inflation suddenly drops and the economic outlook improves, the fund’s high-beta, high-multiple firms could see their prices rise.

However, I believe the chances of this happening are small at best, given that continuously high inflation poses a fundamental threat to the market. The almost 1,300 point collapse yesterday also demonstrates that the market is not prepared for increased interest rates, which might continue to weigh on the market.

My Conclusion

The more than 1,200-point market drop yesterday demonstrates that concentrated investment portfolios predominantly comprised of high-beta equities are particularly vulnerable to bad market news and may be heading for another storm.

While the previous four months have been relatively calm for the ARK Innovation ETF, I believe the fund is in for more difficulties in the future, particularly given it has not improved its risk management processes and has not diversified its fund holdings further.

Because the top stocks are also high-beta equities that are still highly valued, the ARK Innovation ETF’s net asset value is expected to fall further.

Be the first to comment