Glo Danke/iStock via Getty Images

August CPI, Inflation, and a Not-So-Soft Landing

So much for a soft landing! Following Tuesday’s hotter-than-expected inflation reading, which sent indexes and stocks on a freefall, mounting inflationary pressures have indicated that the odds of a big Fed hike are on the horizon. And as I previously wrote in Bad News is Good, Good News is Bad, weeks of a bear bounce have given way to some heavy lifting needed by the Fed, which has to reevaluate how to proceed. Bad news for the Fed sets the stage for more aggressive tightening, which is seen as bad news for the markets.

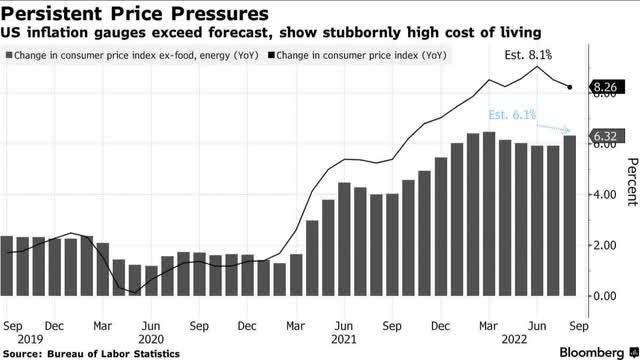

CPI Pricing Pressures (Bureau of Labor Statistics – Bloomberg)

The August Consumer Price Index (CPI) rose 0.1% from the previous month, with core CPI advancing 0.6%, prompting a Nasdaq drop of 4%, an S&P 500 fall of 3%, and the DOW erasing 1200 points. Led by Consumer Discretionary, Consumer Services, and Tech sectors, this “bad news” may result in further Fed increases. Although fuel has come down in price, persistent pricing pressures like shelter still play into the CPI figures, as showcased in the chart above. With a deceleration of inflation, will the Fed maintain a 0.75% rate hike next week, or are the odds of a full percentage point hike more probable? Growth and tech stocks are feeling the heat.

The Biggest Losers: Growth & Tech Stocks

Uncertainty in today’s market is the name of the game, with some investors believing inflation has been priced into the markets and rolling the dice on investments. But the markets took a big hit Tuesday, exposing a grim picture. Interest rates have been suppressed for several years, and coupled with quantitative easing, the Fed has its work cut out in attempting to reverse these policies.

With inflation as the primary focus and the reversal of Fed policies, slowing economic growth is likely, impacting companies’ profits and earnings potential as recession fears persist. Growth and tech stocks like (CVNA), (W), (UPST), (META), (NVDA), (PTON), (AMD), (SOFI), and (SPOT) that our Quant Ratings & Factor Grades have warned investors to proceed with caution or sell long before their earnings miss experienced some of the biggest declines Tuesday. While some investors are keen on jumping headfirst into buying beaten-down stocks, there are consequences associated with poor future performance. While some growth and tech stocks may offer potential upside, it’s crucial to consider their underlying metrics and consider the long-term outlook.

Focus on long-term investing

The Nasdaq is down more than 25% YTD; S&P 500 -17.61% YTD; Dow Jones -14.70% YTD, and investing in a bear market is not the easiest, especially as stocks that may have been on your radar are nearing attractive entry points. But the key is focusing on fundamentals and selecting quality stocks, which is why I emphasize characteristics like valuation, growth, momentum, profitability, and EPS revisions before selecting stocks for a portfolio.

High inflation and astronomical food and housing costs are pressuring the Fed to raise rates. Growth and tech stocks are also sensitive to these pricing pressures because discounted future earnings coupled with high-interest rates can lead to less growth and profitability from an expectation perspective. When you look at some of the more popular stocks in the headlines, many retail and young investors tend to focus on short-term investing and making a quick buck. And while it’s possible, the volatility that has taken over the broader stock market and resulted in losses is why investing for the long term typically results in lower volatility and weathers down markets. Let us look at a few of the growth and tech stocks with substantial declines year-to-date that were also some of the biggest losers following the latest CPI figures.

Wayfair Inc. (W)

Wayfair, for example, is a stock that performed well during the pandemic but has struggled to gain footing post-pandemic. Over the last year, the stock has plummeted more than 82%, with the latest decline on the heels of the August inflation report.

Wayfair (W) Falls following August CPI Report

Wayfair 5-day Price Performance Following CPI (Seeking Alpha Premium)

The fundamentals of this stock continue to worsen as the COVID-19 stimulus effects on discretionary spending have worn off, and inflation pressures are high, causing households to watch the spending, resulting in revenue declines and the company’s profitability wavering. W’s 2022 Q2 Earnings resulted in an EPS of -$1.94, missing by $0.06. Along with a revenue decline of 14.87% Y/Y, e-commerce and the Consumer Discretionary sector (XLY) -24% YTD, are feeling the pain. Among countless companies aiming for profitability, Wayfair is laying off its workforce in droves. With approximately 870 employees being let go, the company anticipates $30M to $40M in severance and benefits expenses.

NVIDIA Corporation (NVDA)

Popular semiconductor NVIDIA is another example of a stock on a strong bearish trend, trading below its 200-day moving average and lagging behind the S&P 500. I’m usually a big proponent of semiconductors, but NVDA is getting crushed. Let’s look at its poor investment characteristics below after NVDA hit a new 52-week low, down almost 10% following the CPI report.

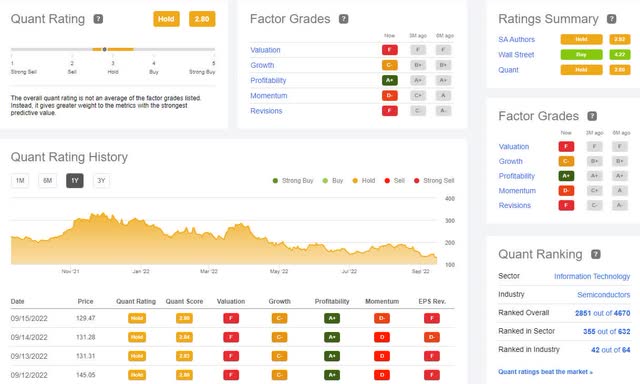

NVDA’s Poor Report Card & Ratings on Key Investment Characteristics

NVDA’s Poor Report Card & Ratings on Key Investment Characteristics (Seeking Alpha Premium)

Despite the stock’s Hold rating and A+ profitability that has managed to take advantage of pricing competition and high demand for chips, it has not boded well for NVDA’s overall price performance. The stock is highly overvalued relative to its industry peers, and with bearish momentum and 37 downward analyst revisions over the last 90 days, Heed the Warnings! Over the year, NVDA has experienced a decline of 41.96%.

I like to focus on valuation metrics because the price is a quick snapshot of what investors are willing to pay. However, investing in overvalued companies or higher valuations can eat into long-term returns. Seeking Alpha’s Quant Grading System is an excellent resource that offers grades and warning banners when a stock is at risk of performing badly, allowing investors to focus on quality stocks to grow their investment portfolio.

Stock Valuation

Investors want to know a stock’s worth and whether it is priced at a premium or discounted. Using NVDA as the valuation, momentum, and revisions grade example, this popular chip maker, with a whopping $326.76B market cap offers game-changing and multi-cloud universe artificial intelligence (AI) and computer networking solutions globally. With an overall F valuation grade, not only is NVDA considered highly overpriced compared to its sector peers, given its forward P/E ratio of 72.09x is 239.93% higher than the sector, and its underlying valuation metrics are less than attractive.

NVDA Stock Valuation (Seeking Alpha Premium)

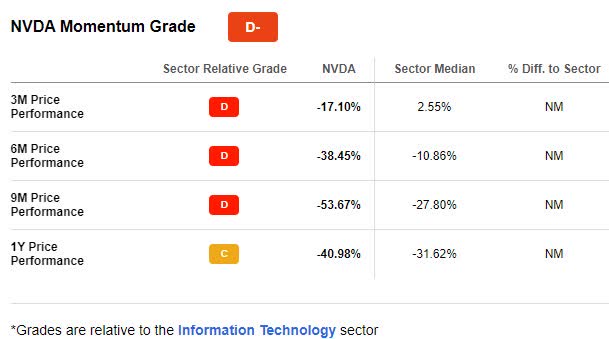

We consider the Momentum Factor Grade one of our five core factors concerning price predictability. Although NVDA is rated a Hold, the quant ratings and factor grades certainly offer caution. In addition to its valuation, investors may want to proceed cautiously, as NVDA’s D- Momentum grade showcases a substantial quarterly price decline relative to its peers. Investors on the prowl for stocks coming down in price should assess a stock’s quarterly momentum and YTD share price.

NVDA Momentum Grade (Seeking Alpha Premium)

The stocks mentioned throughout this article, CVNA, W, UPST, META, NVDA, PTON, AMD, SOFI, and SPOT, have been bearish over the last year and experienced substantial price declines following the latest CPI figures. Before jumping into bearish ideas, consider the overall picture, macroeconomic factors, and underlying metrics tempting you to invest. Not all dips are worth buying.

Don’t fall for the fall in price

After a 5.16% fall in the Nasdaq on Tuesday, the Dow Jones’ loss of 1200 points, and the S&P 500 -4.32%, the Fed and Wall Street’s optimism doesn’t appear so great. As the September 21st Fed meeting approaches, there’s a lot of doubt clouding the notion that inflation has peaked. Before diving into investments that have taken a beating, which our quant ratings have deemed Sell or Strong Sell recommendations, consider evaluating your stock pick(s) by creating a Seeking Alpha portfolio. This tool will help determine the losers in a portfolio that can save you from catastrophic losses.

If you have some of the stocks mentioned in this article, CVNA, W, UPST, META, NVDA, PTON, AMD, SOFI, SPOT, while the appeal of buying at a lower price may prompt you to buy these growth and tech stocks, they come with extreme risks. Consider the Quant System that can readily identify stocks at risk versus those with Strong Buy recommendations. Focusing on collective investment characteristics of Valuation, Growth, Profitability, Earnings Revisions, and Momentum help to instantly characterize stocks with solid fundamentals and strong investment metrics and avoid the stocks with poor fundamentals. Don’t fall for the bear. We’ve got dozens of stocks for you to choose from with great fundamentals, including Top Technology Stocks, Top Value Stocks, and many more.

Be the first to comment