FatCamera

Thesis Summary:

AirBoss stock has been a beneficiary of pandemic-era, non-competitive U.S. government contracts for PPE. We believe these contracts are one-time in nature, any future contracts will be more competitive and that material facts pertaining to these historical contracts are not widely known by the market. Specifically, these facts are:

- $26.8M lawsuit brought against AirBoss by FedEx

- U.S. Customs and Border Protection (CPB) has detained nitrile gloves produced by AirBoss’ Malaysian supplier under a Withhold Release Order (WRO) for suspected use of forced labor

We believe these events could lead to legal settlements and potential inventory write-downs. More importantly, we believe these could adversely impact AirBoss’ chances of winning other U.S. government contracts that investors appear to be hanging their hats on.

At CAD$13/share, we believe there is ~50% downside to the stock. AirBoss could also soon violate financial debt covenants if they do not secure new large government contract wins.

Note: We have contacted AirBoss and requested for comments with regards to the findings in this report including the WRO on suspected use of forced labor from their glove supplier. In response, they cited pre-existing investor disclosures on a record high sales pipeline and strong government relationships. We did not receive specific evidence contradicting the points made here.

Business & Situation Overview:

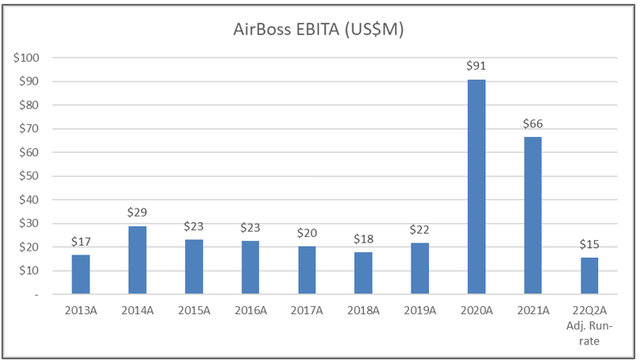

AirBoss of America (OTCQX:ABSSF), (TSX:BOS:CA), (TSX:BOS) is a Canadian-headquartered company that sells protective equipment to the U.S. government and rubber-based products to automotive and other end markets. During COVID, a former U.S. Army four-star general assisted AirBoss in securing government PPE contracts on a non-competitive basis from the Trump administration (see here). These contracts led to EBITA increasing ~4x from $22M in 2019 to $93M in 2020. TTM EBITA in 22Q2 is $58M as these contracts are now rolling off.

We believe these non-competitive contracts are largely one-time in nature.

- Various organizations have raised concerns and launched investigations into these no-bid contract awards. For example, Select Subcommittee on the Coronavirus Crisis (article), Brennan Center (article), and ProPublica (article).

- These contracts were awarded by FEMA and HHS for the Strategic National Stockpile (SNS). SNS PPE is stored for use in the event of “a public health emergency severe enough to cause local supplies to run out” (source).

- In Feb’22, HHS awarded a vendor $55M for the “management, maintenance, and storage support services” of powered air purifying respirator (PAPRs) – presumably to manage the (unused?) PAPRs procured from AirBoss in Jul’20.

- HHS declined to renew the nitrile glove contract with AirBoss and even truncated the original base contract by ~18%.

FedEx sued AirBoss for $26.8M.

In June 2022, FedEx filed a suit against AirBoss for $26.8M (case number: 1:2022cv01313):

- During June to December 2021, FedEx provided ocean transportation for 578 containers of nitrile gloves from Malaysia to the U.S.

- FedEx completed delivery of 376 containers.

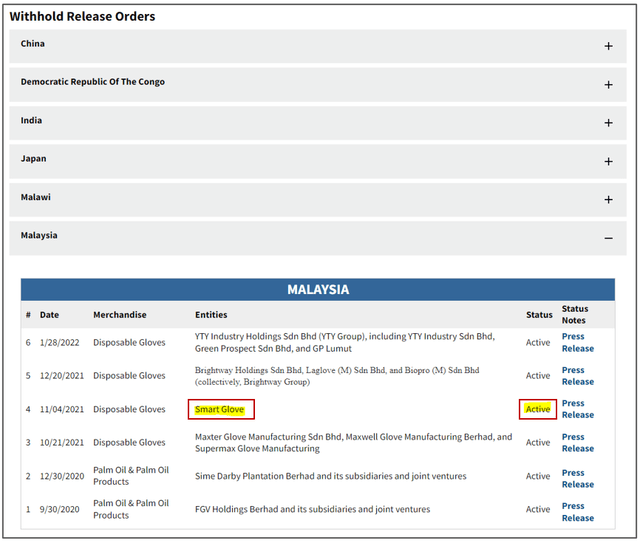

- On November 4, 2021, U.S. CBP issued a WRO “based on information that reasonably indicates” that AirBoss’ Malaysian supplier utilized forced labor.

- Subsequently, U.S. CBP detained the remaining 202 containers of gloves on which AirBoss, as of June 2022, “have accrued and continue to accrue demurrage, detention and related storage charges and costs.”

- FedEx sued AirBoss for $26.8M of unpaid ocean freight and insurance charges and accrued storage and demurrage costs.

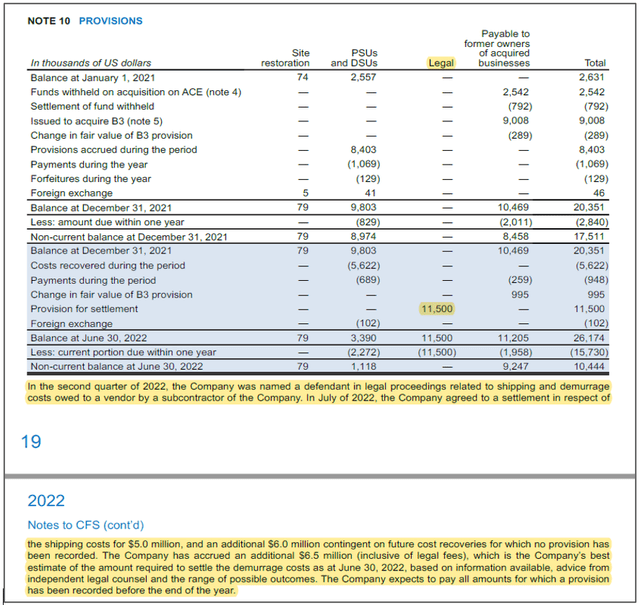

In a footnote (Note 10) in their 22Q2 financial statement, AirBoss made a legal provision for $11.5M (see screenshot below) which they expect to pay “before the end of the year”. We otherwise find no mention of this lawsuit in the press release, MD&A or any discussion by management on earnings calls.

Public Filings: AirBoss Financials (SEDAR)

On August 25th, 2022, the lawsuit was dismissed. The parties appear to have reached a settlement (undisclosed amount). We suspect investors not in the weeds in the footnotes might be surprised to see a ~$11.5M or more (FedEx sued for $26.8M) legal payment in the next few months.

Importantly, we believe the facts shared in the lawsuit could have other material adverse implications on AirBoss, which we discuss below.

AirBoss might face potential inventory write-downs given the active WRO and significant decline in glove prices.

It appears that the nitrile gloves are still being detained by U.S. CBP. As of September 6th, 2022, the WRO on Smart Glove (AirBoss’ Malaysian glove supplier) remains “Active”.

Source: Withhold Release Orders and Findings List

Per WRO procedures, AirBoss will not be able import these gloves into the U.S. until they provide adequate evidence to show that these gloves were not produced using forced labor.

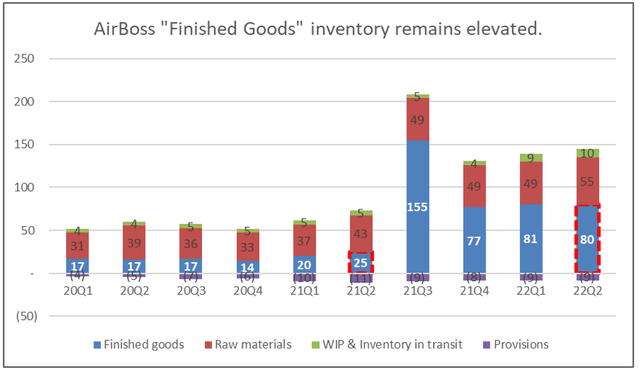

Hence, we find it strange that management communicated confidence in liquidating elevated inventory levels (see chart below) in the latest 22Q2 earnings call:

- “we’re very focused on converting that in the coming quarters” – AirBoss CFO

- “There is demand with customers, and we’re working with some potentially large ones at the moment” – AirBoss CEO & Chairman

- “we’re very comfortable right now that we’re working towards moving that down” – AirBoss CFO

- “So I’d say we’re at the height [in inventory levels], and it’s going to only go down from here going into the end of the year, subject to any inventory build on new awards” – AirBoss CFO

Public Filings: AirBoss Financials (SEDAR)

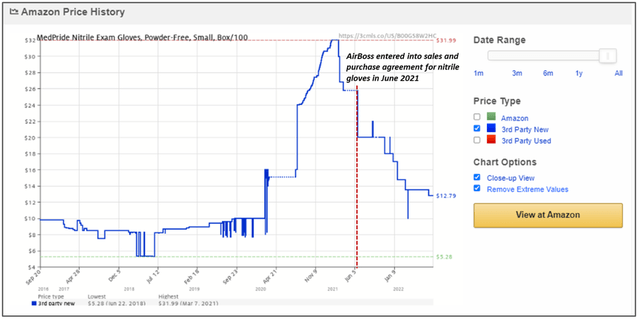

Even if AirBoss manages to sell these gloves, we suspect they might still need to issue inventory write-downs. Nitrile glove prices have fallen significantly from the peak or ~50% since June 2021 when AirBoss entered into a sales and purchase agreement for nitrile gloves – see chart below.

Prices of MedPride Nitrile Exam Gloves on Amazon (link) have fallen from a peak of ~$32 per box in early 2021 to ~$13 in August 2022:

Website: Amazon & Camelcamelcamel Price Tracker

Source: MedPride Nitrile Exam Gloves, Powder-Free, Small, Box/100

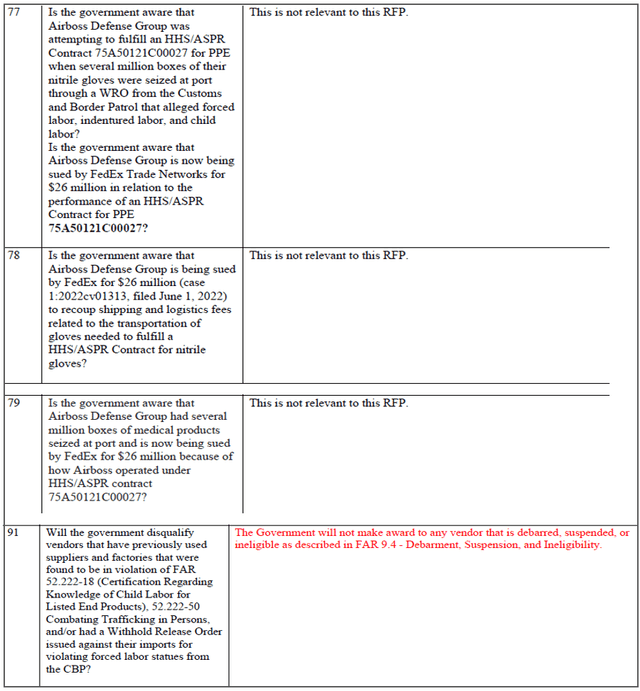

We think these events lower AirBoss’ chances in winning incremental government contracts.

AirBoss has discussed two important pipeline opportunities: i) Level 2 Isolation Gowns, ii) Level 3 and 4 Surgical Gowns. Both of these contracts are being tendered by HHS – the very same organization that purchased the nitrile gloves from AirBoss.

HHS has listed “Past Performance” as an evaluation criteria in the Level 2 Isolation Gown solicitation (attachment link). Hence, we believe the FedEx lawsuit against AirBoss and the outstanding WRO on AirBoss’ nitrile gloves could negatively impact their chances of winning.

These issues have received scrutiny from other vendors and been brought to the attention of HHS as evidenced by the numerous questions in the Level 2 gown contract solicitation (attachment link):

Website: HHS Level 2 Isolation Gown Q&A Solicitation

Furthermore, both of these gown contracts appear to be highly competitive. Even without being plagued by the WRO and FedEx lawsuit, we question AirBoss’ chances of winning these contracts and the size of any potential awards.

Level 2 contract (link):

Website: HHS Solicitation Website: HHS Level 2 Gown Solicitation

Level 3/4 contract (link):

Original Posting (Nov’21):

Website: HHS Level 3 Gown Solicitation

Amended Posting (Jan’22):

Website: HHS Level 3 Gown Solicitation

We further note that the Level 3/4 contract was posted in Nov’21 but taken down by HHS in Jan’22. In the recent 22Q2 earnings call, management claims that HHS told them it will be reposted in the upcoming government fiscal year but we have not seen any public announcements from HHS yet. The Level 3/4 contract is still listed as “Inactive”.

We find it unlikely that HHS would award AirBoss with the gown contract(s) when there are many other proven vendors. Below is a non-exhaustive list of vendors that have supplied U.S. government agencies with gown related PPE in excess of $1M (source):

- Parkdale Advanced Materials Inc.

- Hanesbrands Inc.

- Standard Textile Co. Inc.

- Milliken & Company

- Federal Resources Supply Company

- Unifire Inc

- New York Embroidery Studio Inc.

- Coulmed Products Group LLC

- Americare LLC

- Health Supply Us LLC

- Cardinal Health Inc.

- Venergy Group LLC

- Burlington Industries LLC

- Plc Defense Inc

- Jl Kaya Inc.

- Dow Chemical Company

- Products-R-Us LLC

- Gray Enterprises Plus Inc

- American Vet Works Inc.

- Innovative Federal Operations Group L.L.C.

- Fairfield Chair Company

Even if AirBoss were to win some portion of these contracts, the gowns are being procured for the SNS (stored for use in event of “public health emergency”). Hence, we believe any (unlikely) contract wins would be largely one-time in nature.

We believe AirBoss is overvalued and may soon have a precarious balance sheet.

Pre-COVID AirBoss earned ~$20-30M of EBITA. 22Q2 is the first quarter since the pandemic without any contributions from government PPE contracts. In 22Q2, AirBoss reported $15M of run-rate OSS-adj. EBITA1.

We estimate normalized EBITA is ~$25M. Street is currently projecting ~$65M of EBITA in 2023 and ~$80M in 20242. This implies a potential miss of ~60-70%.

$25M of normalized EBITA and a 10x multiple (in-line with last 10Y average) equates to ~$250M of enterprise value. $107M of net debt and ~$11.5M (could be more) related to the FedEx lawsuit implies a market cap of ~$133M or ~CAD$6.3 per share. This equates to ~50% downside from the market close price of CAD$12.90 per share on September 7th, 2022.

Public Filings: AirBoss Financials (SEDAR)

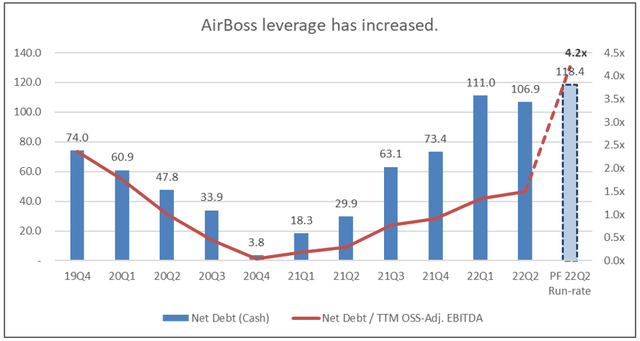

Lastly, without any large government contract wins, we think AirBoss could break their financial covenants in the coming quarters. Net debt now exceeds pre COVID peaks. If we use FY22Q2 run-rate adj. EBITDA, we get to net debt / adj. EBITDA of ~4.2x2. This exceeds AirBoss’ financial covenant of 3.75x net debt / adj. EBITDA. Detailed calculations and adjustments here.

Public Filings: AirBoss Financials (SEDAR)

Conclusion:

AirBoss benefited from large non-competitive government PPE contracts during the pandemic. We believe these no-bid contracts are non-recurring in nature. AirBoss’ current pipeline contracts are highly competitive. Given the FedEx lawsuit and WRO, AirBoss has a spotty track record that we believe will likely adversely impact their chances on winning other contracts and lead to potential legal settlements and inventory write-downs. We see 50%+ downside in the stock and potential financial covenant issues.

(1) In 22Q2, AirBoss reported $10.5M of EBITDA, $3.2M of depreciation, $4.0M of “cost recoveries” associated with stock options/PSUs/DSUs of ~$4M and $0.6M of unrealized FX losses. Adjusting for these leads to ~$7.1M of EBITDA and ~$3.9M of EBITA in the quarter or annualized figures of ~$28M and ~$15M respectively.

(2) On CAPIQ, Consensus show $78M of EBITDA in 2023 and $93M in 2024. We assume full year depreciation is $13M based on annualizing 22Q2 depreciation expense of $3.2M. $3.2M * 4 = ~$13M.

(3) CAPEX (depreciation as a proxy) is a real cash expense. Net debt / 2022 Q2 run-rate EBITA of 7.7x is even more concerning.

Disclosures: The author of this report has a short position in AirBoss of America (Company) and stands to profit if the share price of AirBoss of America (Company) declines. The author may buy or sell the Company’s securities or any derivatives thereof at any time. This report is for informational purposes only. Under no circumstances should this report or any information herein be construed as investment advice, or as an offer to sell or the solicitation of an offer to buy any securities or other financial instruments. This report is based on publicly available information and the author’s due diligence and analytical processes. To the best of the author’s belief, all information contained herein is accurate and reliable, and has been obtained from public sources. However, such information is presented “as is,” without warranty of any kind, whether express or implied. The author makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. This report expresses the opinion of the author and forward-looking statements. All expressions of opinion are subject to change without notice, and the author does not undertake to update or supplement this report or any of the information, analysis and opinion contained in it.

Be the first to comment