onlyyouqj/iStock via Getty Images

Since the beginning of the year, gold miners have suffered from OPEX cost increases combined with lower gold priced, leading to significant margin squeeze. This has led to serious price decreases within the sector and I believe there are good bargains, especially if one believes that the FED pivot is near and gold will shine again as a result. One such opportunity I see in the newly formed Aris Mining (TSX:ARIS:CA)(OTCQX:TPRFF)(TSX:GCM:CA). After the merger of GCM Mining and Aris Gold, the new entity has a larger and very promising, but not fully funded portfolio of development projects. As a result, I expect that share buybacks and dividends will be halted for the foreseeable future and the next two years will bring a bit of uncertainty, while two of the project are being constructed, but the long-term prospects look too good to ignore.

Company overview

Aris Mining is a Canadian gold producer with primary focus on Colombia (3 projects – one fully operational, one in expansion and one mid development stage), one advanced stage project in Guyana and a smaller early-stage project in Canada. The Company was recently formed in September, after the merger of GCM Mining and Aris Gold was finalized, following an approval of the respective shareholders. As a result, the existing shares of Aris Gold, not owned by GCM Mining were converted into shares of the new entity using an exchange ratio of 0.5. Consequently, Aris Mining has around 136.1M shares, which could be increased by 57.5M if all outstanding warrants are exercised. There are also options outstanding, which could boost up the share count by 7.5M and convertible notes that could be transformed into 3.8M shares.

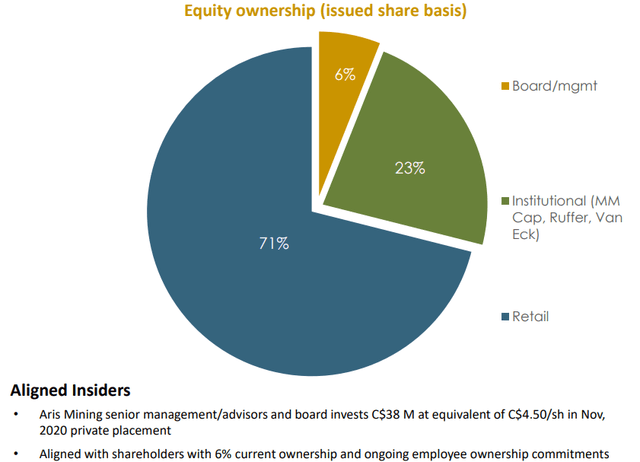

Aris Mining’s ownership structure (Aris Mining)

According to the latest data, 71% of the shares are held by retail, while institutional investors have a combined stake of 23% with the remaining 6% held by management, implying skin in the game. The company is led by an experienced management team with Neil Woodyer as a CEO, who played a key role in the establishment of Endeavour Mining (OTCQX:EDVMF) as a major producer.

Project portfolio

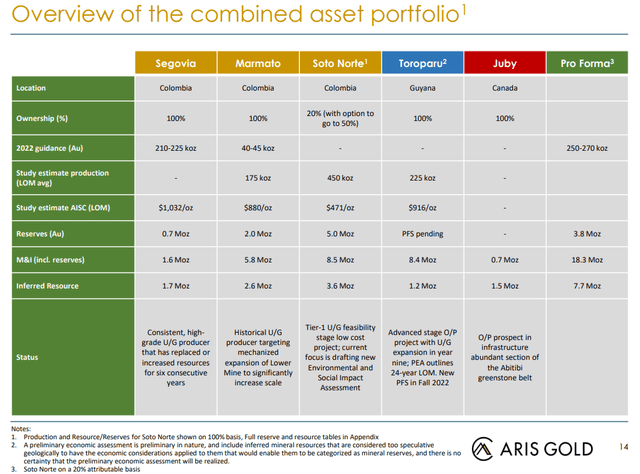

Project portfolio (Aris Mining)

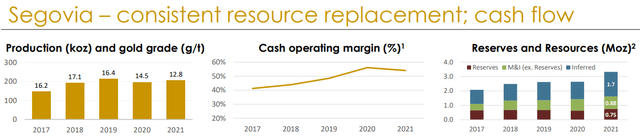

Segovia – Located in Colombia, Segovia is the cash cow of the company, producing north of 200koz of gold per year. In Q2’22, it produced 53,198oz (+1.9% YoY) at AISC of US$1,228/oz (+11.5% YoY). The increase in the latter was mainly due to increases in the cash costs (US$877/oz), related to the inflationary pressures on materials and energy as well as personnel expenses. Despite the increase, I think that going forward Segovia will be able to maintain cash operating margin around 45-50%, assuming gold price north of US$1,700/oz. According to the latest Technical report from 2022, Segovia has proven and probable gold reserves of 745koz, which equates to NPV US$245.6M using 5% discount rate and assuming gold price of US$1,650/oz and AISC of US$1,032. Although AISC probably won’t return to such low figures, I think that the reserves in the Technical report are very conservative, given the fact that in the last 5 years the exploration activities have led to continuous replenishment of those reserves and to an increase in total resources.

Marmato – The Marmato project is also located in Colombia. As of now, only the Upper Mine is operational. However, it’s economics are not very compelling. Production for Q2’22 was 7,411oz of gold (+24.4% YoY) with AISC of US$1,536/oz (-15.5% YoY). The company is expanding the project with the Upper Mine expected to reach yearly production of around 50koz of gold, while the Lower Mine, which is under construction to boost total production of the property north of 175koz of gold. The expansion is expected to be completed towards the end of 2023. According to the Pre-feasibility study of the project from 2020, the estimated NPV of the project is US$256.1M discounted at 5% and assuming gold price of US$1,400/oz and AISC of US$880/oz. The initial investment is estimated at US$269.4M. While from today’s standpoint AISC and CAPEX inflation is very likely, the current gold price is also significantly above the one used in the PFS.

Toroparu – The Toroparu project is located in Guyana and its addition to Aris Mining’s portfolio will provide jurisdictional diversification. According to a Preliminary economic assessment, the project is expected to produce approximately 225koz of gold and has an estimated NPV of US$794M at 5% discount rate, assuming AISC of US$916/oz and gold price of US$1,630/oz. The estimated initial capital needed for the project is US$354.8M. As the report was done towards the end of 2021, I think it’s reasonable to assume that part of the effects of inflation on initial capital and AISC should have been factored in. A pre-feasibility study of the project is expected in Q3’22.

Soto Nortе – This project, located in Colombia, is brought in the newly formed entity by Aris Gold, which entered into JV with the investment company Mudabala, initially acquiring 20% interest in the Soto Norte project for 20%, with the option to bring its stake to 50% in an exchange for additional US$300M. The option expires 10 weeks after the Environmental and Social Impact Assessment (ESIA) approval of the project or 42 months after closing of the agreement, whichever comes first. According to the guidance, provided by Aris, the ESIA approval is expected to come first, within approximately two years. This means, that if the company plans to increase its stake in the project, it must come up with US$300M somewhere towards the end of H1’2024. However, if the options is not exercised, Mudabala may purchase back the 20% stake at price equal to the total amount Aris invested in the project up to that point. According to the Feasibility study from 2021, Soto Norte is expected to produce around 450koz of gold per year (225k attributable to Aris Mining, assuming 50% stake) and has estimated NPV of US$1,486M (US$743M attributable to Aris Mining, assuming 50% stake), discounted at 5% and using gold price of US$1,675/oz and AISC of just US$471/oz. However, the estimated initial capital is high – US$1,177M, which implies that Aris Mining should come up with nearly US$600M, assuming 50% stake.

Juby – Located in Canada, this project is still in exploration stage. It has indicated and inferred resources of 733koz and 1,488koz of gold, respectively. I don’t expect any significant developments related to Juby in the foreseeable future, given that the company will focus on the construction of Toroparu and the Marmato Lower Mine, while securing funding for Soto Norte.

Liquidity and project financing

On the balance sheet Aris Mining has US$352M of cash and equivalents. In addition, there’s committed funding of around US$260M from Wheaton Precious Metals (WPM), regarding streaming agreements for Marmato and Toroparu. This will bump the available liquidity to US$612M. That amount looks sufficient for the completion of the two projects in construction, which have combined initial capital requirement of US$624.2M, given that part of it is already spent. Although the exact amount is not disclosed, from the Q2’22 report of GCM Mining is clear that the company spent US$33.1M in capital expenditures for Toroparu for the first 6 months of the year.

However, there’s the US$300M for the additional 30% of Soto Norte that will have to be paid in approximately two years, if the company decides to exercise the option. I’m assuming that the management intends to do so, unless there’s major deterioration in market conditions for gold miners. I estimate that roughly half of it, could be generated through cash flows from Segovia and the operating portion of Marmato. A potential source of the remaining half could be the outstanding warrants.

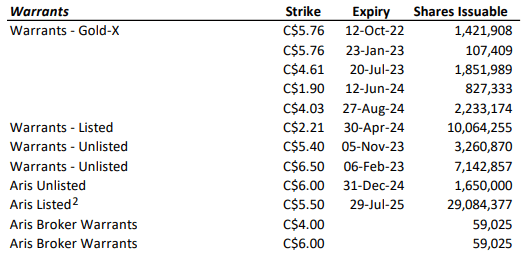

Outstanding warrants (Aris Mining)

Given the current market price of CAD$3.64 I doubt that any of the warrants expiring on 12 Oct 2022 will be exercised, but the rest remain a potential source of total funding of CAD$272M (approximately US$200M), given that the company shows good and timely progress in the construction of its projects and the share price increases as a result. In such scenario, outstanding shares will increase by +56M.

When it comes to the subsequent construction of the Soto Norte, the bill for Aris Mining will likely be north of US$600M. And since the process likely won’t start before the end of 2024, by then the company may have become a +600koz producer, which will allow it to expand its debt financing capacity. Currently, debt outstanding amounts to US$391M, with the majority due in 2026. On the other hand, if there are problems and delays with the construction of Toroparu and Marmato Lower mine, when the Soto Norte related expenses loom, further dilution may be on the cards.

In the meantime, I expect that the shareholder return program of GCM Mining won’t be continued by the new entity. For H1’22, the amount spent on share repurchases by GCM Mining was US$3.1m, while US$6.9M were distributed as dividends. However, at that time the expansion project of GCM – Toruparu was fully funded and the company had the ability to give back some of the profit to shareholders. Now, that the newly formed Aris Mining doesn’t have enough liquidity for all of its capital needs, every dollar is going to be retained within the company. Although the company didn’t explicitly announce the end of its dividend distribution, a tell-tale sign is the lack of monthly dividend announcement in September, which has always been done in the middle of the month.

Share price and valuation

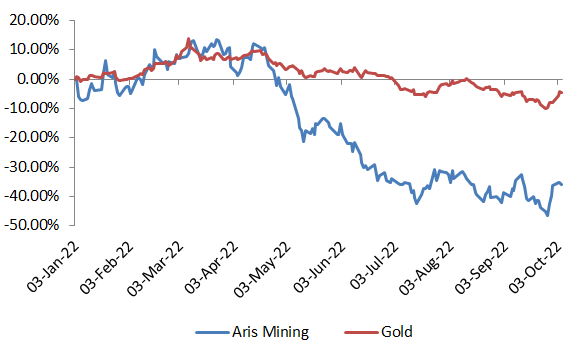

Aris Mining and Gold performance YtD (Investing.com; author’s calculations)

Since the beginning of the year Aris Mining’s price has fallen 36.1%, while gold is down only 4.7%. Up to the middle of April, both were performing in line with each other, but after that as gold prices started falling, the company’s price was falling at a faster pace. The daily prices on an YtD basis have strong correlation of 0.877. This is not surprising, since Aris Mining is a pure play gold miner, as there are very little byproducts in the ore. The inferior performance of the company’s shares was probably also caused by the overall risk-off mode of the markets in the last few months, as the central banks started tightening.

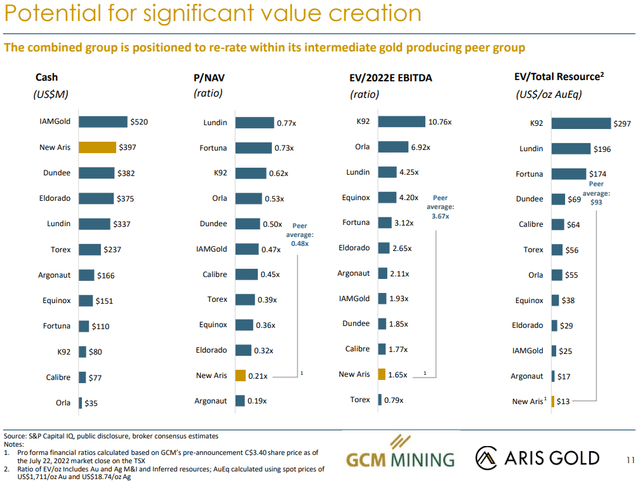

Peers comparison (Aris Mining)

When it comes to comparison with peers, Aris Mining looks very undervalued in terms of EV/Total Resources, P/NAV and EV/2022E EBITDA. In order to be conservative, I’ll take only the estimated NPV’s of Segovia and the two assets in construction – Marmato Lower mine and Toroparu, which totals US$1,295.7M. At the same time, the current EV of the company is around US$404M, or just 31.2% of the combined estimated NAV of the three projects.

So how this discount could be reduced or even eliminated? First of all, I think that the news for the merger and the high likelihood of dividend halt has made some investors sell their stock. This process is an example of the dividend clientele effect, as a company is drastically changing its shareholder return policy. But looking at the long-term, prospects for Aris Mining look very good. Led by a team of proven mine builders and with sufficient funding to finish its two projects in construction it has a clear path towards becoming a +600koz gold producer in a few years. Later on, the addition of Soto Norte could push the production further towards the strategic goal of +1moz of annual production. I think that during the following years, news about timely progress of the projects should have a positive effect on the price and eventually reduce the valuation gap.

Risks

Interest rate risk – Although the current debt of the company is fixed, it affects the discount rate of the future cash flows. Also, historically interest rates and gold prices have somewhat of an inverse relationship. I think that it’s unlikely that the tightening will continue for long and also won’t be surprised if we see rate cuts and more stimulus in 2023, given the high indebtedness of the world economy and its fragility.

Gold prices risk – As the company’s main product is gold, its price has a major impact on the financial results. Gold has been under pressure by rising interest rates, but geopolitical tensions and economic uncertainty have curtailed that effect. As mentioned above, I don’t think that tightening will continue for long and even expect looser monetary policy in 2023, which could be beneficial for the gold price.

Political risk – the newly elected president of Colombia – Gustavo Petro has shown hostility towards open-pit mining even promised to stop the construction of such assets. In the case of Aris Mining, this is not that big of a treat, given the fact that the expansion of Marmato is underground and the Soto Norte project is entirely and underground mine with outstanding ESG profile. However, the Colombian government has already started to soften its stance on some pre-election statements. For example, the idea for 10% duty on gold exports was abandoned. The addition of Toroparu in Guyana diversifies the political risk as it is based in another jurisdiction.

Cost inflation risk – Aris Mining is already suffering from higher operating costs, as evident from the yearly increase in AISC. Unfortunately, there’s little that the company could do to mitigate that risk, besides early purchases of some of the equipment for Marmato and Toroparu.

Construction delay – This is also a significant risk, since there’s going to be a major difference of weather the company has put into operation the Marmato Lower mine and Toroparu when it’s time to make payments for the Soto Norte project. Here I believe that the experience of the management team could be beneficial in minimizing this risk.

Dilution risk – The outstanding warrants and options could lead to significant increase in the number of shares. The good thing is that the bulk of them are exercisable at considerable higher than current prices. Further down the road, the funding of Soro Norte could also cause some dilution, but if by that time annual production is +600koz and the market environment is favorable, the project could be financed by debt or debt + streaming agreement.

Conclusion

The newly formed Aris Mining offers investors exposure to potentially very significant production growth in the coming two years. Led by an experienced management team and sufficient liquidity for the two projects in construction it has a clear timeline towards +600koz of production. The expected cash outflows to the Soto Norte project bring uncertainty and risk in the picture, but the company is currently trading at significant discount to peers and the combined estimated NPVs of Segovia, Toroparu and Marmato. For this reason, I’m bullish.

Be the first to comment