SAND555

Trilogy Metals (NYSE:TMQ) is doing a good job of reducing its cash burn rate and should be able to avoid needing to raise additional funds (unless an opportunity presents itself before then) until after the draft Supplemental Environmental Impact Statement (SEIS) is published (currently expected in Q2 2023). However, it will likely need to raise additional funds before the final SEIS is published.

Compared to when I last looked at Trilogy, its situation has improved a bit due to its reduced cash burn as well as there being an announced date for when the draft SEIS is expected to be published.

Trilogy’s market capitalization is down to around $100 million now, which makes it a reasonable speculative bet given the potential value of the Arctic Project and the other Upper Kobuk Mineral Projects. There will likely be a lengthy wait for further progress though, with the final SEIS and Record of Decision likely coming in 2024. There may also be a change in federal administration with the 2024 elections that would benefit those projects.

This report uses US dollars unless otherwise stated.

Potential Timeline

The Bureau of Land Management currently anticipates publishing a draft SEIS during Q2 2023, after which it will accept public comments (typically a 45 day comment period).

This would likely result in the final SEIS and the Record of Decision being published in 2024. For comparison, it took seven months from the draft EIS to the final EIS for the Ambler Access Project, and then another four months after that for the Record of Decision. A similar timeline would result in the final EIS being published in Q1 2024 and the Record of Decision coming in Q2 2024.

Cash Burn Rate

Trilogy had $3.5 million in cash at the end of May 2022, which was reduced to $3.1 million in cash at the end of August 2022. Trilogy’s cash balance declined by $0.36 million during that three month interval, while its working capital declined by $0.45 million.

Trilogy is attempting to minimize cash expenditures as much as possible. It mentioned that it has reduced marketing and office expenses, while Trilogy’s Board of Directors is also taking all of their fees in shares rather than cash now. Trilogy’s senior management team is also taking part of their base salaries in shares to help reduce cash burn as well.

Trilogy noted that cash preservation strategies resulted in overall cash savings of $0.5 million in the-three month period ending August 2022. It believes that its current $3.1 million (as of the end of August 2022) cash balance with $2.9 million in working capital is sufficient to fund at least 12 months of head office operations (from the start of September 2022 onwards) with its reduced cash burn run rate.

The Ambler Metals joint venture is well funded with approximately $93.5 million in cash on hand as of the end of August 2022. The joint venture previously planned to spend around $44 million in 2022, so a continuation of that run rate it would give it enough funds until late 2024. Ambler Metals’ spending will likely slow as long as the Ambler Access Project remains in limbo, so I don’t expect Trilogy to be required to add funds to the joint venture until after the Record of Decision for the SEIS.

Potential Equity Raise

While Trilogy is carefully managing its cash balance, it seems likely that it will need to raise additional funds between the publication of the draft SEIS and the final SEIS. If working capital continues to go down by $0.45 million per quarter, it would have $1.1 million in working capital left at the end of August 2023. There are also annual listing, insurance and regulatory fees to consider, which would increase its costs slightly when those become due.

Trilogy probably does not have enough cash to last until the final SEIS or Record of Decision without raising additional funds. However, if the draft SEIS is positive (or at least more positive than expectations) that could give Trilogy a window for an equity raise at an improved share price.

Notes On Valuation

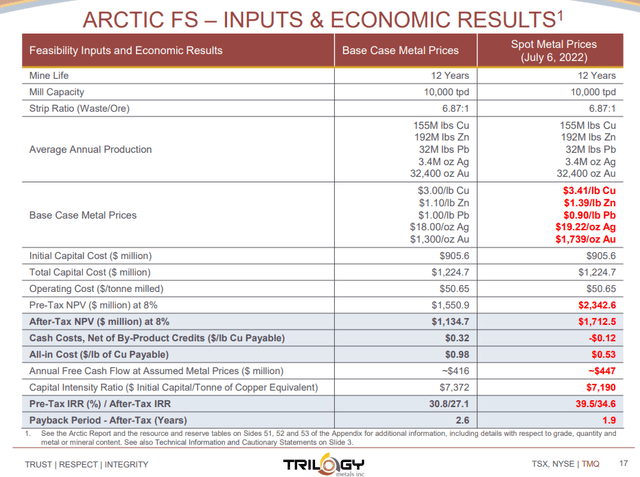

Copper spot prices declined significantly between March 2022 and July 2022 (Trilogy’s most recent presentation). Copper was at $4.62 per pound on March 21, but had declined to $3.41 per pound on July 6. The current price of copper (at $3.43) is around that level as well.

This reduces the estimated value of Trilogy’s share of Arctic (after adjusting for NANA’s potential NRI or direct interest) to an after-tax NPV8 of approximately $0.7 billion at current (and July) spot prices.

Arctic FS at July Spot Prices (trilogymetals.com) This was down from around $1.2 billion at March spot prices. I believe that March spot prices are closer to what metal prices will be when Arctic gets into production (assuming the various approvals eventually get worked out) though.

Trilogy’s current market capitalization of approximately $100 million (at $0.69 per share) is thus potentially less than 0.1x after-tax NPV8 for Arctic, while there would be potential additional value from Bornite and other Upper Kobuk Mineral Projects.

Conclusion

Trilogy is doing a good job in conserving its cash and thus may be able to avoid an equity raise until after the draft SEIS is published (currently scheduled for Q2 2023). It seems likely to need to raise funds before the final SEIS or Record of Decision though.

Trilogy is a highly speculative stock due to the uncertainty around the Ambler Access Project and the potential lengthy timeline before that could progress. However, the Arctic deposit is also quite valuable and if the road gets completed it would open up access to other valuable deposits.

Be the first to comment