Uriel Eichenbaum/iStock via Getty Images

A lot has happened since my last article on silver. The inflation readings got much hotter, whilst the Fed got much more hawkish than it used to be. I predicted this might happen. But my fundamental thesis that the grey metal is undervalued remains intact.

Silver is often used as a hedge against inflation, it is also a metal useful in energy transition. Surely, the fact many central banks, especially the Fed, are getting hawkish is bearish for the precious metals and for manufacturing activity. But if we see a recession soon enough, many countries’ central banks would be forced to print more money again. This will make the prices of both gold and silver soar. Although this is true of gold, this is even truer of silver since the prices of the latter are more volatile. Let me explain all this in some more detail.

Industrial uses of silver

As many of you know, silver is used to produce cutlery and jewelry. It is also irreplaceable in batteries, dentistry, glass coatings, LED chips, medicine, nuclear reactors, photography, RFID chips (for tracking parcels or shipments worldwide), semiconductors, touch screens, water purification and wood preservatives. So, we can see that it is used in producing items that are very important these days, especially batteries, microchips and semiconductors. The demand for these only keeps rising. But the greatest demand growth potential is due to alternative energy sources, in my opinion. Silver is used in the production of EV accumulators and solar batteries. EVs need energy, normally coming from traditional sources like oil and gas, to power them. This could be a problem these days. But it does not mean the demand for electric vehicles will not grow. In fact, EV production might keep rising. This means the demand for silver to produce such batteries will grow as well.

The same is true of solar panels. Lots of economies nowadays are trying to solve the biggest energy crisis since the 1970s. That means that all energy sources are here to gain. The demand for solar panels is growing, whilst the producers are using much more silver to manufacture these than they used to. For example, according to Jeffrey Christian, one of the leading experts in the field, solar power has risen from almost no silver use 25 years ago to around 120 million ounces per year now. It is highly likely the trend will continue. So, all other factors equal, the demand for industrial silver should rise.

The Fed is hawkish and a recession is on the horizon

Everyone knows the Fed, the ECB and the Bank of England are getting increasingly hawkish. The inflation readings are hovering near multi-decade highs. At the same time, the employment rates right now seem to be acceptable for central bankers. This obviously makes the central banks get very hawkish. For example, the Fed has already raised the interest rates several times and more tightening would likely follow. The more the Fed tightens, the harder it is for anyone with USD-nominated borrowings to pay back the debt, whilst many businesses and consumers would be unable to borrow more. This will make the existing production and consumption levels fall significantly. As a result of tightening, many economies will enter recession.

But the problems do not end here. The Chinese economy is shrinking, which means the levels of manufacturing activity are quite low and are getting lower. This is important since China is the largest importer of raw materials and the largest exporter of manufactured goods. So, any slowdown of the Chinese economy substantially affects the supply of manufactured goods and the demand for commodities.

All these factors are quite threatening for the global economy. They are also bearish for silver demand. However, recessions stimulate central banks to eventually get dovish and ease the monetary conditions, i.e. print more money. This will make the prices of silver soar since the grey shiny metal serves as both a hedge against inflation and the industrial metal.

Energy supply

Right now there is one further argument against higher silver demand – namely higher energy costs. As I have mentioned before, silver is an industrial metal. The energy costs all over the world, especially Europe are near multi-decade highs. So, the production levels are falling since manufacturers are unable to make sound profits due to higher energy expenses. That is why the demand for industrial metals, including silver is falling.

At the same time, the energy crisis is also a bullish factor for the silver prices. That is because silver mining requires plenty of energy consumption. Since the energy prices are so high, miners are forced to cut their activity levels. Obviously, low mining levels mean decreased silver supply, which is bullish for the prices of this precious metal. So, the energy crisis can play both ways for silver. It can be a good upward catalyst and it can be a bearish factor.

Undervaluation of silver

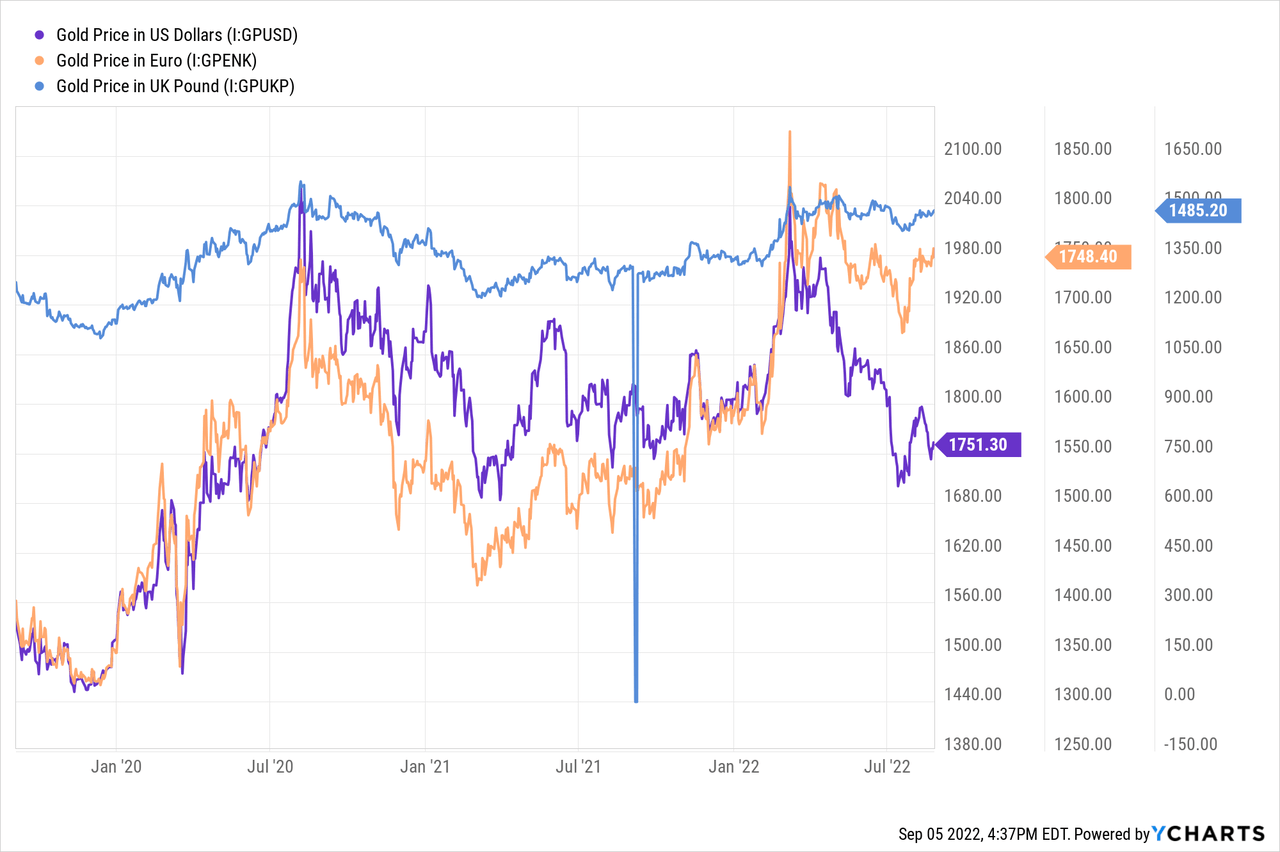

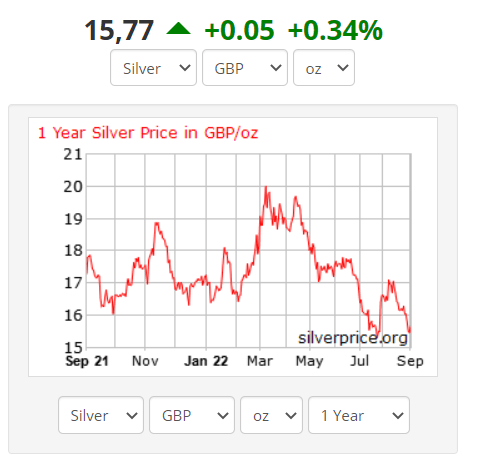

Quite recently we have seen high volatility on the silver market. Due to the bearish Fed, the ECB and the Bank of England, the prices of both gold and silver have stayed under significant pressure.

Gold prices in GPB, EUR and USD

Silver prices in GPB

Silverprice

Silver prices in EUR

Silverprice

Silver prices in USD

Silverprice

We can see that the gold prices are much less volatile than the silver prices. But the grey metal’s volatility really helps investors benefit from it, provided they buy low enough.

Silver is very cheap if we compare it to gold, the money mass and the stock market.

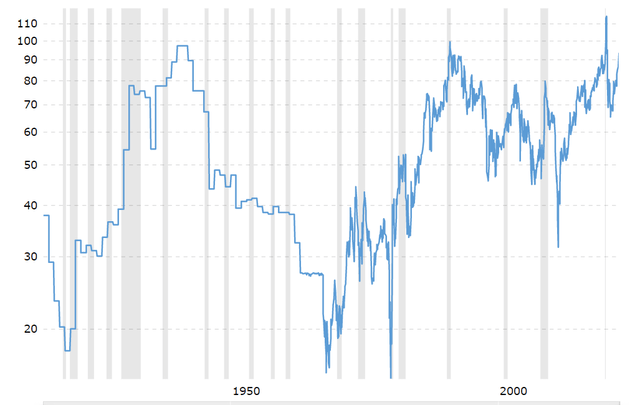

Gold to silver ratio

The gold-to-silver ratio is not at its all-time high of 110 but it is still very high, currently lingering near 90. The higher the gold/silver ratio is, the more undervalued the grey metal is.

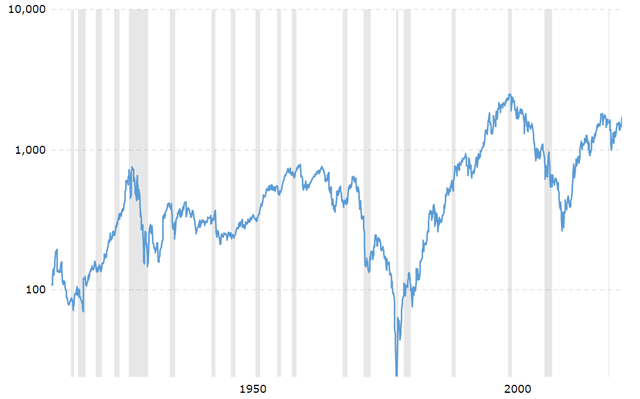

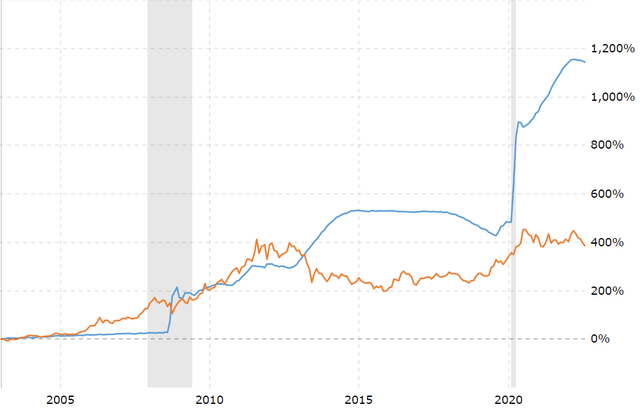

As all of you know, Dow Jones is a blue chip index, only including 30 largest U.S. companies. It might not, therefore, be representative of the whole U.S. stock market. But it is still useful to compare Dow Jones to the silver prices to see where the grey metal is compared to the stock market.

In spite of the stock market’s correction, the Dow is still extremely high compared to the silver prices.

Dow to silver ratio

You might be wondering why I have used the gold to monetary base ratio. After all, the article is about silver. But the prices of the two metals move in the same direction even though the gold prices are more stable than the silver prices. Both gold and silver serve as hedges against currency devaluation since both of the metals have historically been used as money. Gold still plays an important role in the monetary system.

As I have mentioned in my other articles, the money mass in the U.S. is at its all-time highs. The situation is similar in the EU and Japan. But we can see from the graph below the gold prices have remained quite moderate compared to the money mass in the U.S. economy. It is a clear sign that gold is undervalued. But silver is even more undervalued compared to gold.

Gold to Monetary Base Ratio

Conclusion

In my view, the prices of silver are highly undervalued right now. Do not get me wrong: I totally agree the silver prices will fall further in the short run. But time is investors’ best friend. Silver will benefit from the production of solar batteries and the green energy trend in general. But it is also a way to play currency devaluation. This way is much more volatile and risky than investing in gold though. But silver can make its investors make a far better profit than its gold.

Be the first to comment