marrio31

Investment Thesis

Owl Rock Capital Corporation (NYSE:ORCC) posted solid Q2 results last month, highlighted by strong Net Investment Income “NII” figures. Management’s bullish outlook for the remainder of the year assuaged fears over macroeconomic challenges’ impact on its portfolio, mainly consisting of leveraged small and medium enterprises “SMEs.” Management’s message was consistent with its peers, reporting portfolio resilience in the face of macroeconomic disruptions during Q2.

However, despite the strong quarter, the company suffers from systematic flaws, exacerbated by conflicts of interest inherent in its management structure, leverage, and excessive risk-taking, making it difficult to lean on ORCC to preserve capital.

Revenue Trends

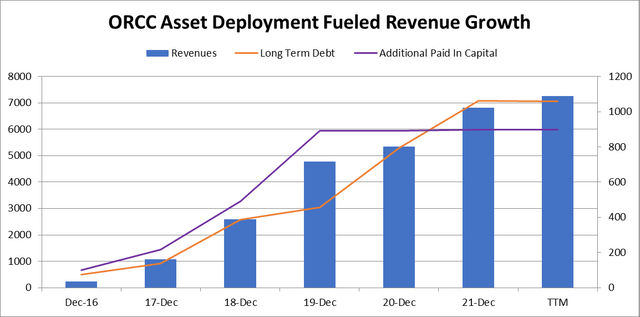

ORCC’s NII is a function of its fixed-income portfolio size and coupon rates (interest paid) on these investments. The company has been gradually and consistently increasing the size of its fixed-income portfolio over the last few years to meet demand from its borrowers. This is why it enjoys one of the highest revenue growth rates in the Business Development Company “BDC” sector.

ORCC Revenue, LT Debt and Equity (Graph created by the author based on SA data)

With the debt-to-equity ratio approaching the upper limit of management’s target range of 0.9x-1.25x, revenue, and dividend growth will likely normalize in the coming quarters.

Beyond asset expansion, ORCC revenue is inherently stable, derived from a fixed-income portfolio constituting 93% of its revenue. This figure increases when including ORCC’s equity investment in Wingspire, the company’s Private Credit lending subsidy, whose income is recorded as a dividend.

The market was quick to brush off the company’s net income loss, its first since Q1 2020, mainly attributed to widening credit spreads instead of a change in the credit quality of its portfolio.

When it comes to Q2 earnings, no news is good news, and what stood out was the encouraging outlook of the company’s performance despite challenging macroeconomic conditions. There were no defaults, and only one company is on non-accrual status, representing 0.5% of the total NAV.

Systematic Risk

Beyond ORCC’s solid performance lies systematic risk stemming from its legal framework as a BDC, exacerbated by an external management structure underpinning a conflict of interest between management and shareholders, amplified by the recent SPAC deal that brought its advisor, Blue Owl (OWL) to public markets.

ORCC management has dual responsibilities, one to ORCC and another for OWL shareholders. OWL shareholders receive a fixed fee over assets under management “AUM” and have an invested interest in seeing AUM expand regardless of performance. ORCC shareholders, on the other hand, have an interest in minimizing fees, maintaining share price, and receiving a stable dividend.

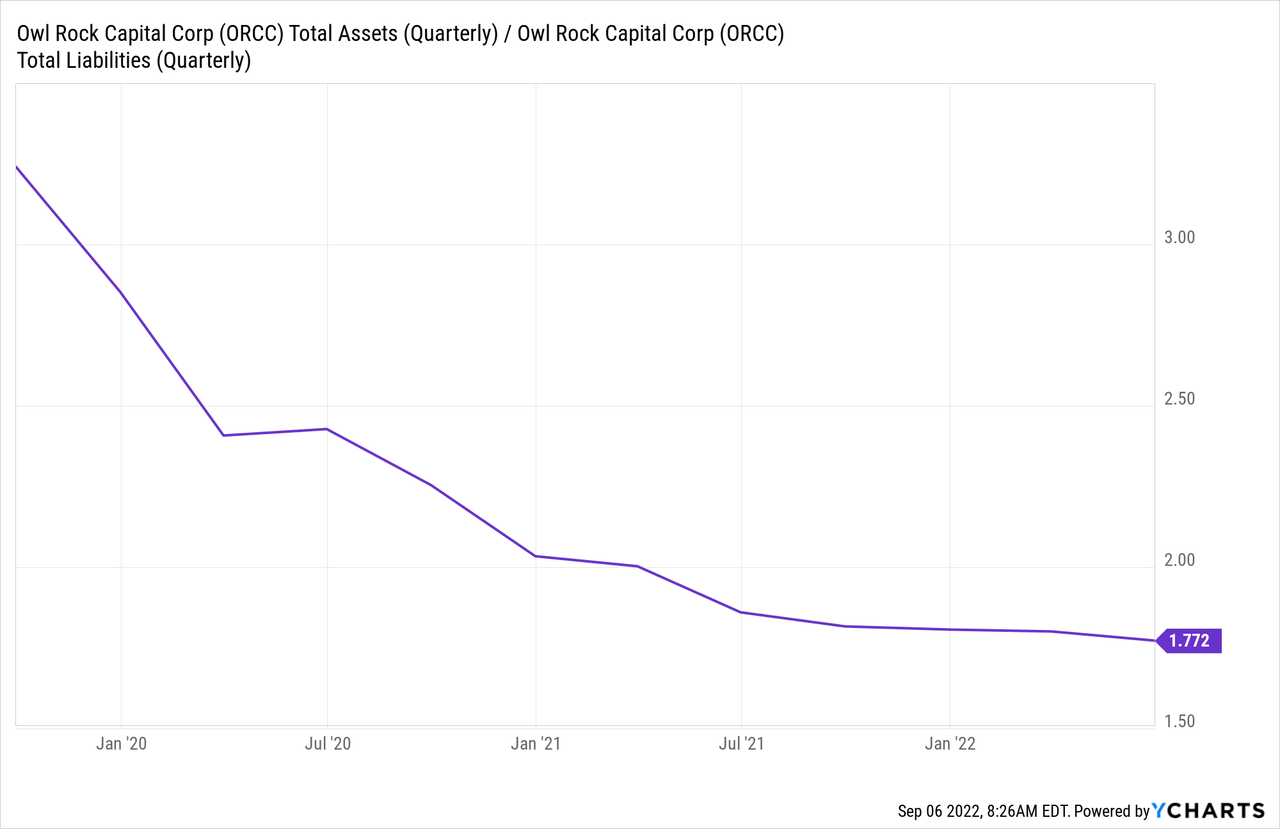

This conflict of interest underpins the industry’s continuous quest to expand portfolio size, diluting equity and increasing leverage. Since 2019, ORCC has been busy deploying cash raised from the 2019 IPO, and, more recently, leveraging up and enhancing base management fees satisfies its obligation towards Blue Owl shareholders, who also take a cut from base management fees without diluting ORCC shareholders. However, now that ORCC’s leverage is reaching regulatory limits, management will need to raise equity to deliver its growth promise for OWL shareholders. This greed and conflict of interest are the main reasons over 80% of publicly-traded BDCs have lost NAV/share value since inception.

Another systematic risk lies in BDC tax regulations requiring ORCC to distribute at least 90% of its investment income to shareholders, leaving a narrow window to recover capital losses. This drawback of the BDC structure is exacerbated by ORCC’s high leverage, management fees, and conflict of interest that encourages risk-taking.

These challenges are promoting slow change in the BDC industry. For example, Apollo Investment (dba MidCap Financial) (MFIC) decreased its management fees earlier last month. Gladstone Investment (GAIN) has long adopted a conservative capital-raising policy to combat the aforementioned systematic risks. Other BDCs adopted an internal management structure and fixed compensation, such as Hercules Capital (HTGC). Still, it remains uncertain whether the Lehman Brothers Alumni in charge of ORCC and OWL will follow this path.

Balance Sheet

In previous articles, I highlighted shortcomings in how many BDCs calculate asset fair values, undermining the usefulness of NAV. ORCC differentiates itself by hiring a third party to calculate the figure, utilizing “market data and spreads” to derive fair values.

However, this “market data” is not disclosed, and, therefore, the NAV calculation may be susceptible to manipulation – especially given the moral hazard of the third-party evaluator, who has the incentive to keep ORCC management happy by inflating fair values. Remember, management and OWL shareholders’ income depends on the fair values of assets under management “AUM.”

Last quarter, ORCC reported a NAV of $14.48, a 4% decline YTD, mainly attributed to market disruptions rather than portfolio credit risk change. Nonetheless, ORCC is highly leveraged and now has its asset coverage ratio near the regulatory limit of 150%. Suppose market disruptions persist or intensify, and fair values fall below regulatory limits. In that case, ORCC might need to issue equity or equity-linked securities to deleverage. One can imagine how hard it would be for a troubled company to raise capital during economic disruptions. For this reason, I don’t believe ORCC is a reliable source of income during market slowdowns.

Summary

ORCC management often touts its low non-performing loan ratio, revenue, and dividend growth. However, I don’t believe these figures say anything about management’s talent or a competitive advantage. Although it has been operating for more than five years, ORCC only went public in 2019 and adjusted its bylaws to allow for higher leverage in 2020, deploying fresh capital in new loan originations that haven’t stood the test of time. Management has a short public track record in the BDC space, having come from the collapsed Lehman Brothers. For now, the company’s NAV per share is holding up against its peers with longer operating histories, but only time will tell if ORCC is as special as management (and some investors) believe. Statistically, the odds are against it, so I’m out.

Be the first to comment