yangphoto

Clearway Energy Inc. (NYSE:CWEN, NYSE:CWEN.A), owner of a portfolio of operational renewable energy assets, is one of my favorite dividend growth stocks.

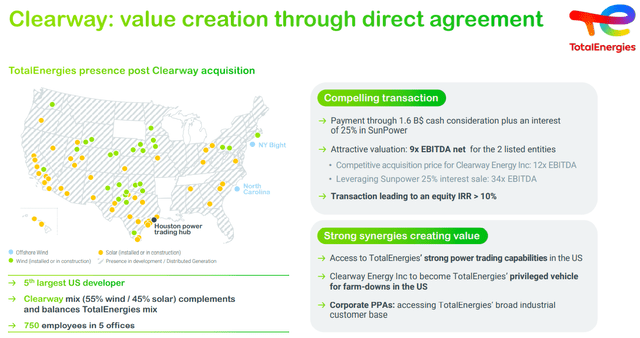

CWEN’s parent company and sponsor, the privately owned Clearway Energy Group (“CEG”), is the 5th largest developer of renewable energy projects in the USA and is now jointly owned by two of the biggest players in renewable energy today: Global Infrastructure Partners (“GIP”) and TotalEnergies (TTE), the French energy supermajor.

That puts CWEN, as the YieldCo of CEG, in a great position to continue rapid portfolio expansion and thus dividend growth in the coming years.

The company has a 7.7 GW operational portfolio (at CWEN) plus a 9 GW pipeline of advanced or intermediate stage projects (at CEG). The majority of these assets are renewable energy, split between wind, solar, and battery storage. But CWEN does also own some conventional energy assets in the form of natural gas plants (mostly in California), 100% of which are contracted through at least 2026.

Lastly, CWEN has a strong balance sheet, with most of its debt in the form of non-recourse, project-attached debt. The company has no corporate debt maturities until 2028, and 99% of its consolidated debt is fixed rate.

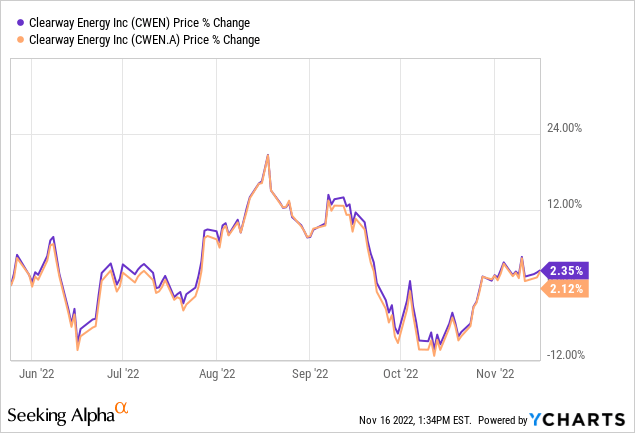

I own a large position in CWEN.A, the Class A shares with superior voting rights and slightly less trading volume, because they tend to trade at a 5-10% discount to CWEN, the Class C shares. Yet both pay the same dividend, and thus CWEN.A offers a higher dividend yield for the same economic ownership.

In what follows, I will explain three reasons why I love CWEN.A as a dividend growth investment and why I’m still buying more, even though it’s around flat year-to-date.

1. Long Growth Runway

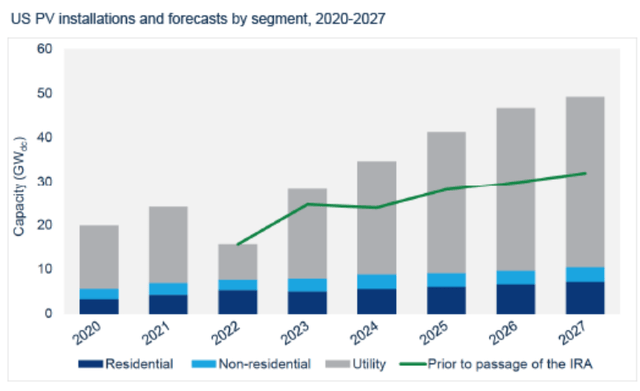

The recently passed Inflation Reduction Act has given a long runway of tax credit incentives to the wind and solar industries. Whereas before the bill was signed into law, renewables would typically get tax credit extensions of a few years, now they have 10 years of federal incentives locked in.

According to the Solar Energy Industries Association (“SEIA”), the IRA should spur 40% more solar panel installations over the next decade than we would have otherwise seen, mostly in the utility sector.

This should significantly increase the number of projects (solar, battery, and wind) that CWEN should be able to secure in the coming decade.

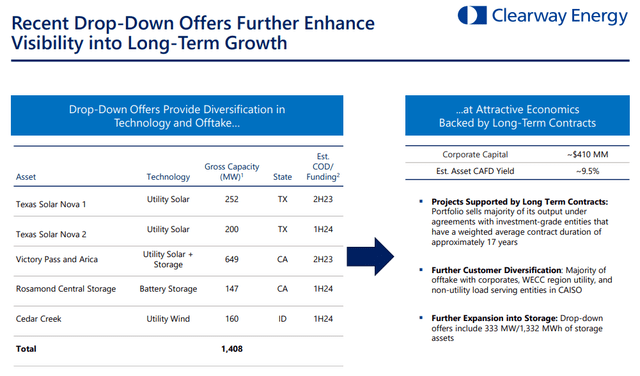

With the recent agreement to purchase some drop-down assets from CEG, CWEN has now identified destinations for all $750 million of excess proceeds from the sale of its thermal energy assets. This will give the company the ability to expand its renewable energy portfolio for years without the need to issue equity.

These projects are being purchased at ~9.5% estimated cash available for distribution (“CAFD”) yields and feature long-lived contract terms averaging 17 years. The customers are mostly corporate utilities.

In the coming quarters, I would expect to see CEG’s pipeline continue to expand with more and more projects, especially solar and solar + battery facilities. This gives CWEN a long runway of future portfolio and dividend growth ahead of it.

2. Strong Sponsorship

Back in May of 2022, TotalEnergies purchased a 50% stake in CEG, offering both cash and a 25% stake in SunPower (SPWR) in exchange. This strikes me as a great partnership for all parties involved, including CWEN.

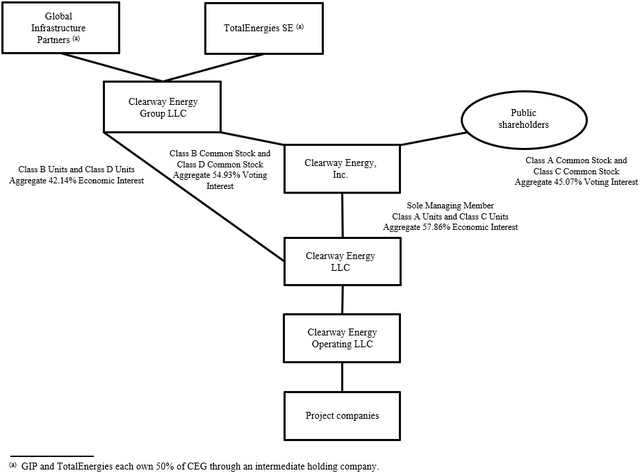

TTE and Global Infrastructure Partners now own CEG 50/50. Here’s how the ownership structure breaks down as far as CWEN shareholders are concerned:

While GIP and TTE now own CEG 50/50, CEG owns 42.14% of the economic interest and 54.93% of the voting interest of CWEN. That leaves public shareholders (you and me) with 45.07% voting power and 57.86% economic interest in the YieldCo.

The reason I think bringing this new partner of TTE into the mix is a good idea is that the French energy giant is rapidly expanding its renewables portfolio, both on the development and the operational side. CWEN will be able to secure more and better projects with TTE now as a sponsor.

TTE September 2022 Presentation

In the bottom right corner, you can see TTE’s explanation of why this deal creates valuable synergies. The main benefit to CWEN, in my view, is becoming TTE’s “privileged vehicle for farm-downs in the US.”

As CWEN’s President & CEO Christopher Sotos commented in the Q3 2022 earnings report:

With the closing of TotalEnergies’ investment for 50% ownership of Clearway Group, our sponsor has further enhanced its ability to grow its renewable development pipeline.

And yet, since the announcement of TTE’s partnership with GIP in the ownership of CEG, CWEN’s stock price has gone practically nowhere.

TTE’s involvement in Clearway (both CEG and CWEN) makes them both materially more valuable, and yet CWEN’s stock price has risen only ~2%! That strikes me as a buying opportunity.

3. Rapid Dividend Growth

CWEN asserts that it remains on track to raise its dividend at the upper end of its target of 5-8% per year through 2026.

In the first nine months of 2022, CWEN’s adjusted EBITDA grew 5.3%, while total CAFD grew 9.0% and CAFD per share (including both Class C and Class A) increased 9.3%. Meanwhile, from 2022 to 2023, as the proceeds of the thermal energy sale begin to be reinvested, total CAFD is expected to grow by ~17%. Since CWEN should not need to raise capital via equity issuance in the next year, I would expect CAFD per share to rise about 17% YoY as well.

In the first nine months of 2022, CWEN’s CAFD per share has been around $2.83, although Class A & C shareholders’ economic interest in that is $1.64 (57.86% of the company). Compare that to declared dividends of $1.08 in the first nine months and we get a 2022 YTD payout ratio of ~66%.

But that doesn’t really cast an accurate depiction of dividend coverage, because Q2 and Q3 are cyclically stronger for power producers like CWEN for multiple reasons:

- The wind blows more in the spring and summer months

- Insolation from sunny days is stronger during the summer months

- Hotter temperatures lead to more electricity usage, which increases reliance on conventional power plants

For the full year of 2022, using CWEN’s total CAFD guidance of $350 million gets us to CAFD per share of $3.02, or $1.75 per share for public shareholders. Assuming another 2% quarterly dividend bump puts the annual dividends paid at $1.45, which would work out to a payout ratio of ~83%.

For 2023, however, CAFD per share is expected to jump to $3.53, or $2.05 for public shareholders. Assuming dividends rise another 8% in 2023, dividends paid will jump to $1.57, and the payout ratio will fall to ~76%.

As of this writing, CWEN.A’s dividend yield sits at 4.44%. That’s respectable enough in itself, but if the dividend grows at a 7.5% average annual rate through 2026, then buying today will result in a yield-on-cost of 5.9% in just four years. Not bad!

Now assuming CWEN.A’s dividend grows at an average annual pace of 6% thereafter, buying the stock today would result in a yield-on-cost of 8.4% in 10 years.

That would be a dividend growth investment homerun, in my opinion.

Bottom Line

The massive decarbonization of the utility sector is a once-in-a-lifetime growth megatrend. In my estimation, the best way for income-oriented and dividend growth investors to participate in this megatrend is through renewable energy YieldCos. And among YieldCos, CWEN.A is one of the best, alongside Brookfield Renewable (BEP, BEPC) and NextEra Energy Partners (NEP).

With a well-constructed balance sheet, long contract terms, a largely investment grade customer base, plenty of investment opportunities from its sponsors (as well as third parties), and no need to raise equity for the foreseeable future, CWEN.A is in a fantastic position to continue growing its dividend at a 7-8% annual rate through at least 2026.

What’s more, given the degree to which the IRA’s tax credits are expected to ramp up utility-scale solar and wind installations in the next decade, it would not surprise me if this pace of growth continued for the next decade, rather than just the next four years.

This is why I as a dividend growth investor have built CWEN.A into one of my top holdings and continue to accumulate more shares even today.

Be the first to comment