gremlin

Introduction

I have covered Viatris (NASDAQ:VTRS) on several occasions in the past. My original investment case was outlined back in 2021 when the company still traded at around $14. On a total return basis, the stock has “performed” roughly in line with the S&P 500 – evidently a sobering result.

I originally bought Viatris as a well-positioned manufacturer of branded, generic and biosimilar products with a promising pipeline. In a later analysis, I outlined why I remained loyal to the company despite its decision to sell its only growth asset, its biosimilars business. I argued that the company’s still-strong free cash flow and the proceeds from the Biocon transaction will provide a solid foundation for Viatris’ dividend and future share repurchases and support debt reduction, respectively. I welcomed the company’s minority ownership in what will become a vertically integrated biosimilars company and viewed Viatris’ reduced complexity going forward in a positive light. In a May 2022 addendum, I described why I still believed in Viatris as a company that should be able to return generous amounts of free cash flow to shareholders through dividends and buybacks while focusing on debt reduction rather than expensive and potentially unprofitable acquisitions – arguably the activity largely responsible for the share price demise of its predecessor, Mylan.

Those who have been following Viatris since management unveiled its updated plan in early 2022 know that the company intends to stave off the erosion of its generics and branded drugs businesses by focusing on three therapeutic areas – ophthalmology, gastrointestinal and dermatology – where it plans to grow organically, but also through smaller acquisitions. During the third quarter earnings conference call, management announced the acquisitions of Oyster Point Pharma (NASDAQ:OYST) and Famy Life Sciences, which I will discuss in this follow up analysis as they represent an inflection point in my investment case.

Viatris’ Acquisition of Oyster Point Pharma: Tyrvaya, And The Value Of The CVR

At first glance, it makes perfect sense for Viatris to acquire an ophthalmology company. Viatris has agreed to acquire Oyster Point Pharma for $11 per share in cash plus a contingent value right [CVR] entitling holders to receive up to $2 per CVR if certain commercial milestones related to the company’s treatment of signs and symptoms of dry eye disease – Tyrvaya (varenicline) – are achieved. The treatment attracted attention due to its innovative method of use as a nasal spray. It activates the trigeminal parasympathetic pathway, thereby increasing the production of the patient’s natural tear film. Dry eye disease is widespread, affecting between 5% and 34% of people to some degree, with older people appearing to be affected comparatively more frequently. In his prepared remarks, Viatris’ CEO Goettler said the disease affects about 17 million patients in the U.S. alone.

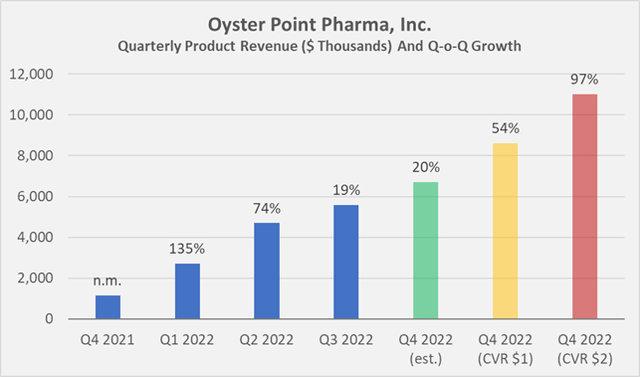

Given those numbers, and the fact that most people in the developed world are spending more and more time in front of screens, such a treatment appears to be a jackpot. Indeed, Goettler described the acquisition of Oyster as an important step for Viatris on its way to becoming the next global leader in ophthalmology. For such a groundbreaking asset, however, Tyrvaya’s product sales are ramping up relatively slowly. Tyrvaya is Oyster Point’s only FDA-approved drug (press release dated October 18, 2021) and therefore represents the company’s so far exclusive source of product revenue. In the first nine months of 2022, OYST generated $13 million in product-related revenue, with quarter-over-quarter growth rates of 135%, 74%, and 19% in Q1, Q2, and Q3, respectively.

If management is to be believed, it could be that Oyster Point, as a relatively small company (current market cap of $295 million, enterprise value of $321 million), lacks execution capabilities. That sounds like a lazy excuse, of course, but it fits with Oyster’s Chief Executive Jeff Nau’s statement that Oyster will now benefit from Viatris’ global scale:

“Viatris could propel Oyster Point with its global commercial footprint, R&D and regulatory capabilities, supply chain as well as the multiple additional ophthalmic assets.“

Jeff Nau – President and CEO of Oyster Point Pharma

While the argument is not entirely without merit, it is nevertheless difficult to believe that Tyrvaya’s U.S. sales will benefit materially from the merger with Viatris, given the company’s continued effort to diversify its capabilities away from the United States.

Oyster’s November 10 press release outlines the terms under which the CVR entitles the holder to a cash payment. $1 per CVR will be paid if Oyster (i.e., Tyrvaya, as the company currently has no other marketable therapeutics) generates at least $21.6 million in net product revenue and records approximately 132,000 prescriptions for Tyrvaya in the U.S. in 2022. An additional $1 will be paid if at least $24 million in product-related revenue is generated and at least 145.5k prescriptions are recorded in 2022. Let us take a closer look at how likely Oyster is to reach these milestones.

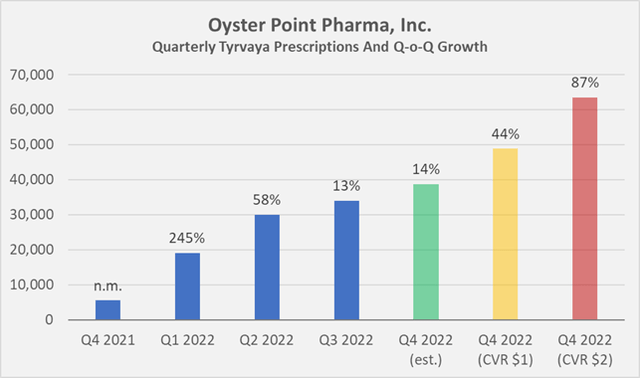

With about 8,500 prescriptions between September 1 and October 21, 2022, Oyster is likely to report less than 40,000 prescriptions in the fourth quarter of 2022 using linear extrapolation. I believe this is a realistic assumption given that synergies between OYST and VTRS in the U.S. are not achievable that quickly, and might as well be not that significant after all, considering Viatris’ emphasis on international markets. An expected slowdown during the holiday season will likely further dampen results. For the first nine months of 2022, Oyster reported approximately 83,000 prescriptions. To meet the CVR’s lower quantitative target, the company would need to report about 49,000 prescriptions for the fourth quarter (44% quarter-over-quarter growth), or more than 63,000 to meet the higher target (87% quarter-over-quarter growth, Figure 1). Such growth hardly seems realistic.

Figure 1: Quarterly Tyrvaya prescriptions, estimated Q4 2022 prescriptions using linear extrapolation of the data for the period September 1 to October 21, 2022, as well as necessary prescriptions to meet the quantitative targets of the CVR (own work, based on Oyster Point Pharma’s quarterly and full-year 2021 earnings releases)

In terms of product-related revenue, Oyster generated about $13 million with Tyrvaya in the first nine months of 2022, which means the company would need to generate more than $8.5 million in the fourth quarter to meet the lower revenue-related target of the CVR (Figure 2). Achieving the higher target would represent a near doubling of quarterly revenue. Given the slow growth in prescriptions since Tyrvaya was approved, and especially the comparatively weak performance so far in the fourth quarter, I am very pessimistic about the value of the CVR.

The market is obviously very efficient in this regard, with Oyster trading at $11 at the time of writing. Mr. Market certainly takes into account currently available treatments for dry eye disease, such as Restasis (ciclosporin, AbbVie, ex Allergan) and Xiidra (lifitegrast, Novartis, ex Takeda/Shire). According to AbbVie’s (ABBV) 2021 10-K, Restasis’ global sales were approximately $1.3 billion that year. In addition, it should not be forgotten that generics of Restasis are increasingly available and Viatris also has such a product in the pipeline, as reported in the February 28, 2022 Investor Event presentation (slide 32). All of this makes the previously discussed slow sales growth of Tyrvaya somewhat more understandable, but at the same time contradicts the growth story so enthusiastically told by Dr. Nau of Oyster Point during Viatris’ Q3 earnings call.

Figure 2: Quarterly product revenue of Tyrvaya, estimated Q4 2022 sales based on the aforementioned prescription data, as well as necessary revenues to meet the targets of the CVR (own work, based on Oyster Point Pharma’s quarterly and full-year 2021 earnings releases)

My Take On The Transactions As a Viatris Shareholder

The management of Viatris is obviously very excited about the Oyster Point and Famy transactions and expects the combined company to become the next global leader in ophthalmology.

I bought Viatris as a well-positioned manufacturer of branded, generic and biosimilar products with a promising pipeline, and I expected the company to grow mostly organically and focus on developing generics for current blockbusters. I saw the investment in Viatris as a welcome diversification from companies developing original compounds.

However, management’s bold statement about becoming the next global leader in ophthalmology seem to me to be somewhat at odds with the outlook that the company will grow mostly organically by developing new generics. Oyster Point and Famy are just two first steps, and it increasingly appears that the Mylan successor is returning to its roots – growth through acquisitions. Viatris’ focus on inorganic growth in ophthalmology is underscored by a look at its weak pipeline in this field, which, as noted earlier, shows a Restasis generic as the only significant asset in that context.

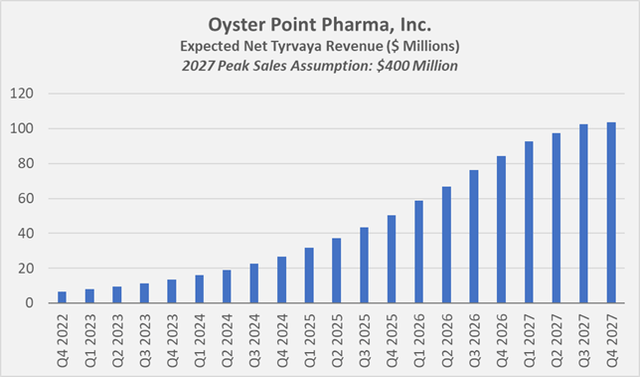

If management is to be believed and the team is assumed to have appropriate M&A capabilities (former Mylan shareholders take notice!), Viatris will generate $1 billion in sales by 2028 with the assets from Oyster Point and Famy Life Sciences. According to one analyst (Q&A session, VTRS Q3 2022 earnings call), Tyrvaya could achieve peak sales of $400 million. For example, to reach such a figure, sales would need to grow at the current quarterly rate of 19% through the end of 2024, followed by a decline to 17%-18% in 2025, a further decline to about 15% in 2026, and a flattening of the curve in 2027 (Figure 3). Such growth does not seem unrealistically aggressive, even if Tyrvaya is for now slow to ramp up in the United States. Finally, Viatris’ focus on international markets should benefit product sales, keeping in mind, of course, that international regulators must approve the use of Tyrvaya as a dry eye treatment. At the same time, peak sales of $400 million mean that Viatris acquired Oyster Point at a price to peak sales multiple of 1 (assigning a value of zero to the CVR), which can hardly be considered expensive and raises the question of whether Oyster’s management and board of directors acted in the best interest of shareholders. Conversely, this could be another sign that Tyrvaya is not the breakthrough therapeutic that management is so excited about, especially considering Restasis’ 2021 sales of $1.3 billion.

Figure 3: Growth model for Tyrvaya-related revenue to reach 2027 peak sales of $400 million (own work, based on analyst Elliot Wilbur’s 2027 peak sales estimate)

Of course, the successes of Restasis and Xiidra beg the question of why neither AbbVie nor Novartis (NVS) bought Oyster Point. After all, the company was trading at a market cap of only $100 million not too long ago. Either the two companies did not see the value that Viatris’ management sees now, or, more likely, they were less enthusiastic about Tyrvaya’s prospects.

In addition to Oyster Point Pharma, Viatris also acquired the apparent remainder of Famy Life Sciences (Mylan apparently already owned a 13.5% stake in the company) for about $281 million, according to Viatris CFO Sanjeev Narula. As an aside, I noticed a discrepancy when evaluating the price tag for Oyster Point. Using the number of diluted weighted average shares outstanding of OYST in Q3 2022 (26.8 million), a cash payment per share of $11, an implied valuation of $0 to $54 million for the CVR (up to $2 for each of the 26.8 million shares) and a total payment for both companies of $700 million to $750 million (according to Robert Coury, Executive Chairman of VTRS), one arrives at $295 million to $349 million for Oyster Point and consequently $400 million for Famy.

Considering that management discussed at length the breakthrough qualities of OYST’s Tyrvaya, the team discussed the at least similarly priced Famy assets in a surprisingly superficial manner. According to Viatris’ CEO Goettler, the acquisition adds five Phase III or Phase III-ready programs in dry eye disease, blepharitis, presbyopia, mydriasis, and night vision. To my taste, this is very little transparency on the part of management, especially given the plethora of missteps by former Mylan executives. Almost flippantly, Coury responded to an analyst’s question about what motivated the valuation of Famy Life Sciences:

“We helped set up this company originally. We have a small 13.5% stake. And we’ve watched the development of what this company has done. So we’re very, very familiar with these assets.“

Robert Coury – Executive Chairman of Viatris

Finally, it also seems worth noting that Coury’s statement is somewhat at odds with the information on Famy Life Sciences’ website, which itself is very superficially laid out. There are no indications that Mylan “helped set up this company” – instead, it says that Mylan acquired Famy Care Ltd, a women’s health franchise, from Taparia Group in 2015 (see also Mylan’s press release). Mylan’s 2015 10-K (p. 54) confirms this transaction, but I found no reference to Viatris holding a minority stake in Famy Life Sciences, which appears to be a separate company owned by Taparia Group. At the very least, this is a topic that deserves further investigation.

Conclusion – What To Do As An Owner Of Oyster Pharma Or Viatris?

I bought Viatris as a company focused on generics and biosimilars, benefiting from declining but still strong cash flows from legacy branded drugs. I expected the company to grow mostly organically, with little reliance on acquisitions. I did not buy Viatris because of management’s M&A skills (or lack thereof, which are a major reason for Mylan’s share price demise), but it appears that Coury et al. could be returning to their roots of trying to grow the company inorganically. The acquisitions of Oyster Point Pharma and Famy Life Sciences came as no surprise, but management’s communication regarding the only approved therapeutic was overly optimistic for my taste, especially after reviewing Oyster Point’s financial statements. At the same time, the similarly priced acquisition of Famy Life Sciences was discussed only very superficially, leaving more questions than answers.

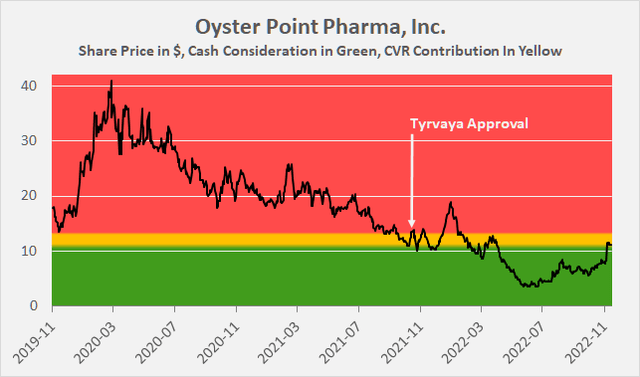

Long-term shareholders of Oyster Point Pharma will suffer a capital loss upon closing of the transaction (Figure 4), and it seems very unrealistic that the CVR received in the transaction will be worth anything. Only those who have speculated on a turnaround in recent months can enjoy handsome capital gains, as OYST traded for as little as $4 in May and June 2022.

Figure 4: Oyster Point Pharma’s historical share price (own work, based on OYST’s daily closing share price, the consideration paid by Viatris and the potential value of the CVR)

I do not own OYST, but if I did, I would probably settle for the $11 and sell my shares as it seems unlikely that the company will reach the milestones associated with the CVR.

I own a small position in VTRS and have been enthusiastic about the company’s direction in the past. However, due to the ambiguities surrounding the transactions and the not unlikely return to the previous management style, I am toying with the idea of selling my position in Viatris. I dislike the fact that Viatris intends to become a combined generic and novel product pharmaceutical company. This is one reason why I never invested in Novartis.

According to the updated plan from February 2022, a continued focus on acquisitions is likely – and understandable – but I had originally expected the company to target only smaller transactions. During the third quarter earnings conference call, management remained relatively opaque about what to do with the 50% of free cash flow that is not earmarked for share repurchases and dividends. After reviewing the earnings call transcript, it is safe to assume that the company will focus more on acquisitions – arguably not a strength of management and the main reason for Mylan’s share price debacle. If Viatris returns to buying up other non-generic drug makers for billions of dollars – trying to play the “big pharma” game – I think that is a recipe for disaster. In addition, as a dividend growth investor, I did not receive Coury’s comments related to the increasing emphasis on share buybacks in a positive light. It may be an over-interpretation of his prepared remarks, but I did listen up when he mentioned “continuation of [the] dividend“. However, perhaps the dividend really will be frozen at the expense of pronounced share buybacks, which of course would help the company’s per-share metrics.

What is holding me back for now from selling is that the company’s free cash flow is very strong (I expect it to remain strong for the foreseeable future) and its valuation is cheap (18% free cash flow yield), while its recent acquisitions are still relatively modest. However, my enthusiasm for Viatris has waned. I would be very interested in your opinion on the situation in the comments below.

Be the first to comment