Design Cells

Shares of up-and-coming heme CAR-T player Arcellx (NASDAQ:ACLX) have risen by 20% since February IPO was priced at $15. After falling as far as the $6 level during Q2, the stock is up 131% over the past 3 months thanks to promising clinical data unveiled at EHA for its CART-ddBCMA therapy in patients with relapsed or refractory myeloma.

While it is true that the field of hematological malignancies and especially the BCMA target are quite crowded, given strength of the results and potential readthrough to the company’s use of a novel binding domain I wanted to dig deeper and see what I can uncover for readers here.

Chart

Figure 1: ACLX weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares slide post IPO to a low of $6 in Q2 followed by a parabolic spike to highs $20s thanks to promising clinical data shared at EHA in June. From there, management wisely took advantage of the post-data move to raise $128M at $16/share and that price level appears to be providing support in the near term. My initial take is that investors interested in this name would do well to accumulate positions in the second half of the year (perhaps we see dips to the $16/level which would offer an attractive opportunity to add further exposure).

Overview

Founded in 2015 with headquarters in Maryland (78 employees), Arcellx seeks to reimagine cell therapy through development of safer, more effective and more broadly accessible programs. Management believes that competitors are constrained to existing biologic structures which in turn ultimately limits impact and opportunity for their drug candidates. A key point of differentiation for Arcellx in this increasingly crowded space is its novel synthetic binding scaffold, the D-Domain, which is designed to overcome limitations of traditional CAR-Ts.

While existing cell therapy products mostly use biologic-based, single chain variable fragment (scFv) binding domain, these tend to be beneficial to a limited segment of patients and result in toxicity challenges (narrow applicability to indications they are pursuing). Arcellx’s D-Domain platform consists of structurally unique binders that are small and stable. They can be consistently manufactured and easily modified to generate diverse libraries of proprietary target-binding domains. In preclinical studies of CARs with D-Domains and scFvs they demonstrated that the D-Domains result in higher transduction efficiency, higher surface expression, and lower tonic signaling relative to scFvs, which could lead to cell therapies with improved therapeutic benefit and reduced toxicity.

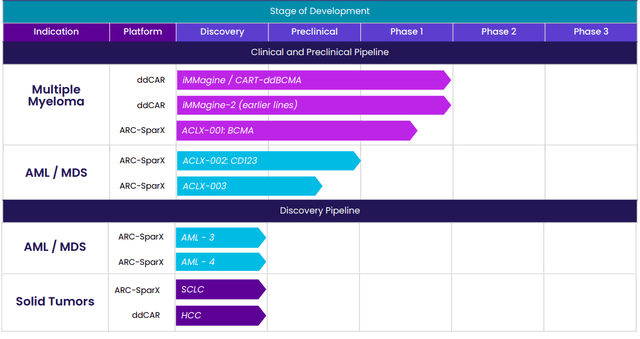

Again, Arcellx aims to overcome competitors’ limitations with its new class of D-Domain powered autologous AND allogeneic CAR-Ts, including classical single infusion CAR-Ts called ddCARs and dosable and controllable universal CAR-Ts called ARC-SparX, to address hematologic cancers, solid tumors, and eventually indications outside of oncology such as autoimmune diseases.

Figure 2: Pipeline (Source: corporate presentation)

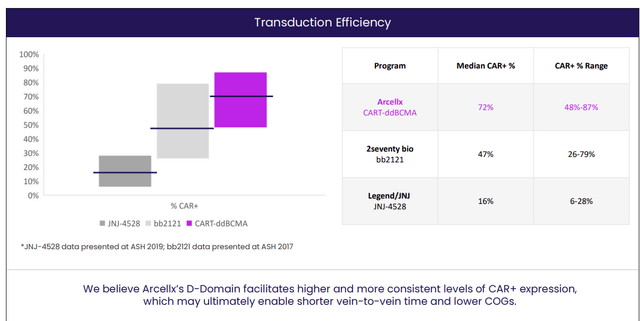

Delving into specifics of the company’s proprietary platforms starting with ddCAR, it is composed of an intracellular T cell signaling domain similar to traditional CARs fused to the D-Domain, which functions as the extracellular antigen binding region. Differentiating attributes of the D-Domains include small size (8kDa versus other antigen binding domains used in CAR constructs at 25kDa). The idea here is that a smaller antigen binding domain will decrease the overall lentiviral construct size which may improve transduction efficiency. The small antigen binding domain may also function to improve the immunological synapse formation and thus CAR-T cell killing. Stability is also superior as D-Domains are highly stable proteins compared to scFvs (facilitates expression of CARs on T cells and manufacturing of SparX proteins). Such structural properties could translate into high transduction rates, high cell surface expression and low tonic signaling. In the context of ddCARs, they believe the D-Domain structure creates an efficient and scalable cell manufacturing process. Specifically, for CART-ddBCMA they have achieved transduction rates ranging from 60% to 85% in over 20 lots tested. This could result in improved product consistency and reduce number of untransduced T cells (which contribute to toxicity but not efficacy).

Figure 3: Superior transduction efficiency for CART-ddBCMA (Source: corporate presentation)

High transduction rate compared favorably to previously published data for Abecma and Carvykti, as seen above. Management believes this suggests CART-ddBCMA has a meaningful advantage over the leaders in BCMA CAR-T space. Along with higher transduction rates, expression of CAR on the surface of T cell is higher with CARs employing a D-Domain compared with an scFv (could drive activation against low antigen-expressing target cells). Also, low tonic signaling (above background in only 3 of 42 D-Domains tested) of D-Domain CARs is important as this leads to lower T cell exhaustion.

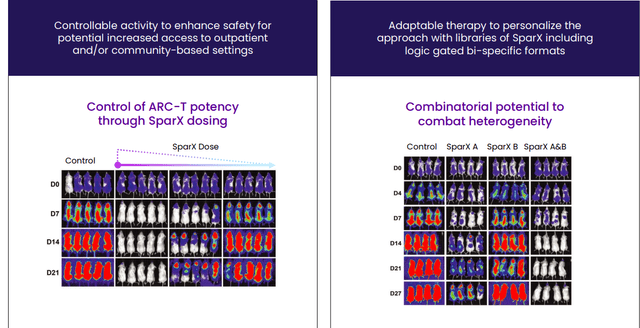

Moving on to the ARC-SparX platform, this is a controllable and adaptable modular therapy that builds on ddCARs by replacing the antigen binding domain of the T cell with a novel synthetic binding domain that recognizes only SparX proteins, which contain the antigen binding domain. Simply put, when the SparX proteins antigen binding domain recognizes and binds to the antigen on a diseased cell, it recruits the ARC-T cell to kill the diseased cell. ARC-T cells are designed to remain inactive (silenced) and only activate when combined with a SparX protein (effectively separates the antigen-recognition and killing functions, rendering them dependent on antigen specificity and dose rather than uncontrolled CAR-T proliferation as is the case with leaders in the space). We shouldn’t skip over this advantage, as unregulated killing is responsible for the severe toxicities such as high grade CRS we see in some cases and this can be addressed by adjusting dose and schedule of SparX protein administration. Lastly, stopping the dose of the SparX protein periodically can allow the ARC-T cells to rest after activation lowering the risk of T-cell exhaustion, which is a common cause of rapid decline of genetically modified T cells.

Figure 4: ARC-SparX advantage (Source: corporate presentation)

Small size of the SparX protein allows it to penetrate complex tumor microenvironments with a half-life short enough (estimated to be several hours in humans) that physicians could manage an emerging toxicity by withholding or decreasing the next SparX protein dose thereby causing the ARC-T cells to deactivate (much more flexible than is the case for approved CAR-Ts due to half-life of several weeks).

Manufacturing has been a key bottleneck for approved CAR-Ts, so it’s an important attribute that manufacturing of ARC-T is more scalable than in conventional CAR-T therapies in that ARC-Ts comprise the same drug product irrespective of clinical indication. The same lentiviral vector comprising the universal ARC and a similar T-cell transduction process can be used for every patient regardless of disease or target antigen. Conventional CAR-T therapy requires different viral vectors (each with a different T-cell transduction process) to be used to make new CAR-T cells when physicians want to target a new antigen (this is clearly a manufacturing and regulatory advantage for Arcellx, one that I believe is underappreciated).

Focusing on the only clinical-stage program ddCAR (targeting BCMA), it’s currently in a phase 1 study for treatment of patients with relapsed or refractory multiple myeloma. Early data showed promising clinical benefit and the company has plans to move into a pivotal phase 2 study for late-line patients as well as expansion studies in earlier lines of therapy.

Select Recent Developments

On May 10th the company announced dosing of the first patient in the open-label phase 1 study evaluating ARC-SparX program in patients with relapsed or refractory multiple myeloma. Again, key points of differentiation here versus conventional CAR-T therapies include addressing antigen heterogeneity and dose limiting toxicities (allow physician to better manage side-effect profile and thus increase patient access and overall market opportunity).

On May 23rd the company announced appointment of Michell Gilson as CFO (served prior at Canaccord Genuity as Managing Director and Senior Equity Research Analyst).

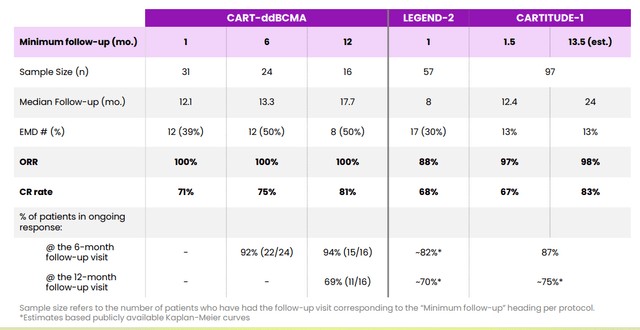

From there, the key catalyst for rebound in share price was June’s data update from the phase 1 expansion study of CART-ddBCMA in patients with relapsed or refractory multiple myeloma. 31 patients were evaluable for efficacy and safety consisting of doses 1 (100M CAR+ T cells), dose level 2 (300M CAR+ T cells) and dose expansion cohort at recommended phase 2 dose. All patients had poor prognostic factors including 21 of 31 (68%) being penta-refractory, 12 of 31 (39%) with extramedullary disease (EMD), and all 31 patients having had at least three prior treatments. Interim data with May 3 cutoff date showed deep and durable responses including 100% ORR in all patients, 71% of patients achieving complete response or stringent complete response, 94% of patients achieved > very good partial response and 6% of patients with partial response. As for signs of durability, 13 of 16 patients (81%) dosed more than 12 months ago reached CR/sCR, 50% with EMD and 56% remain in ongoing response with median follow up of 17.7 months. Interestingly, conversions to sCR have occurred as early as 1 month and also at ≥12 months.

Figure 5: Comparison of response over time versus Legend Carvykti (Source: corporate presentation)

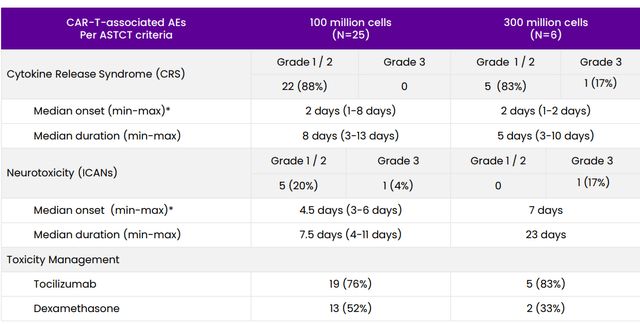

As for the highly important topic of safety profile at recommended phase 2 dose, there were no cases of delayed neurotoxicity events, parkinsonian symptoms or grade 3 or greater CRS. There was only one case (4%) of grade 3 ICANS and all toxicities including CRS and ICANS were manageable (resolved with standard management at both dose levels). Again, the plan from here is to initiate enrollment in pivotal phase 2 study by the end of the year and it’s encouraging to see clinical momentum accelerating here (I don’t take that for granted, as many BCMA players appear to be stagnating in early to mid-stage studies).

Figure 6: CART-ddBCMA adverse event profile (Source: corporate presentation)

Finally, on June 21st the company closed upsized secondary offering to raise $128M via sale of over 9 million shares at price point of $16/share.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $307M as contrasted to net loss doubling to $32M. Research and development expenses doubled to $23M, while G&A nearly tripled to $9M. While that cash position might sound high at nearly 40% of market cap, management is guiding for it to take the company through “at least the next 12 months”.

As for the landscape and opportunity in treating multiple myeloma (MM), multiple myeloma is the third most common hematological malignancy in the US and EU with 35,000 new cases diagnosed per year in US alone. Keep in mind that while new treatments have very high rates of response along with excellent depth & durability, there is still no cure and patients typically have life expectancy of 5 years. In 2020 size of global MM market was $18 billion and company estimates that the addressable CAR-T market for r/r MM is $10 billion based on number of patients receiving third line treatments and beyond. Currently there are six FDA approved CAR-T cell therapies and that number is set to grow in coming years. Specific to the MM market, Johnson & Johnson’s (JNJ) Carvykti has been approved for adult patients with r/r MM after four or more prior lines of therapy and Bristol-Myers Squibb’s (BMY) Abecma has been approved similarly for patients with 4 or more prior lines. BMY is guiding for $250M to $300M of Abecma US revenues this year and launch certainly seems to be getting off to a good start (demand exceeding supply). Versus Carvykti there is a point of differentiation in manufacturing failure rate (1.5% for Abecma versus 18% for Carvykti). Projected sales for Carvykti by 2026 are thought to be in excess of $1.5 billion and I imagine Abecma can do similar. Again, I think Arcellx’s (ACLX) CART-ddBCMA appears to be the “best-in-class” BCMA-targeted CART in multiple myeloma, but they are a number of years behind in the race.

As of March 24, 2022, the two CAR-T therapies targeting BCMA that have been approved by the FDA are Abecma and Carvykti. Bristol Myers Squib is currently enrolling clinical trials targeting expansion of Abecma, currently approved only as a fifth line of therapy, into earlier lines of treatment. Carvykti, developed by Legend/Johnson & Johnson, also currently approved only as a fifth line of therapy, has demonstrated a sCR rate of 78.4% and mPFS that will exceed 20 months. The BCMA-targeting ADC, Blenrep is also an approved product and has reported an ORR of 31%, which is considerably lower than the 72% and 97.9% ORR for Abecma and Carvykti, respectively. Additionally, the PFS observed after Abecma and Carvykti (median 11.1 months and >20 months, respectively) appear to be longer than that observed with Blenrep (median PFS ~3 months). Although Abecma and Carvykti responses are a step forward, there remains a need for improved overall response and durability. Across the clinical trials of Abecma and Carvykti, the presence of EMD has been a poor prognostic factor. In these clinical trials, patients with EMD have had lower CR rate, shorter DOR, and shorter PFS. In the Phase 1 trial of Carvykti (LEGEND-2), for instance, the CR rate was approximately 60% in patients with EMD (compared with approximately 80% in non-EMD patients) and mPFS was 8.1 months for patients with EMD (versus 25 months in non-EMD patients).

Also, we should not forget competition from many next generation aspiring BCMA players (too many to name). One that comes to mind is Gracell Biotechnologies (GRCL) which reported 89% ORR and MRD negative/stringent CR in 21 of 28 patients for its CD19/BCMA fast Car candidate. Safety profile was favorable and duration of response was a promising 15.7 months in mostly high-risk heavily pretreated patients.

Also, Oricell’s GPRC5D CAR-T achieved 100% ORR (albeit in low N of 8 patients) including 3 patients who failed prior treatment with BCMA CAR-T. Complete Response (CR)/ stringent Complete Response (sCR) rate was 60%. Multiple bispecific candidates such as Janssen’s talquetamab are also pursuing this novel target of GPRC5D.

As for institutional investors of note, Suvretta Capital owns a 5.8% stake and New Enterprise Associates owns 19.2% of the company. Novo Holdings also owns an 11.4% stake and Perceptive Advisors upped its position to 1.1M shares. Cormorant Capital owns 1.5M share stake and on the whole it appears there’s a decent bit of institutional clustering here (green flag). I also thought it quite telling that NEA bought $5M in shares (adding to its position) AFTER new data was unveiled at EHA and share price/valuation was higher (shows conviction).

As for management team, CEO Rami Elghandour served prior as CEO & President at Nevro (took it from small private company to $400M in revenue) and was an investor in Johnson & Johnson Development Corporation. Chief Medical Officer Christopher Heery served prior in same role at Precision BioSciences and Bavarian Nordic. Several other members of management including Chief Business Officer Aileen Fernandes also hail from Nevro (nice to see leadership has experience successfully working together in past). Chief Scientific Officer David Tice served prior as VP Research & Translational Sciences at MedImmune.

On the board of directors, we find Ali Behbahani (general partner at shareholder New Enterprise Associates) and David Lubner (prior EVP and CFO at Ra Pharma until it was acquired by UCB for $2.1 billion). Also, board member Olivia Ware served prior as SVB BTK franchise at Principia Biopharma before it was acquired by Sanofi for $3.7 billion.

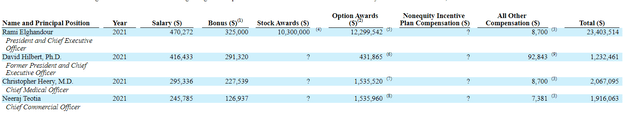

As for executive compensation, cash portion of salaries is on the low end below the $500,000 mark. On the other hand, while stock and option awards are quite reasonable for most of leadership, CEO’s stock awards of over 10 million shares and option awards of over 12 million shares are on the high side.

Figure 7: Executive compensation table (Source: 10-K filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for IP, patent portfolio consists of 14 U.S. and international patents and over 50 U.S. and international pending applications. 3 patent families are directed toward the proprietary D-Domain binding technology. Two patent families are directed toward proprietary ARC-SparX technology. D-Domain related patents expire in the 2036 to 2038 range, while ARC-SparX patents expire between 2038 and 2042 (like seeing the long-lived protection here).

Final Thoughts

To conclude, despite fierce and increasing competition in the BCMA and multiple myeloma space, I am a fan of differentiation observed in features of Arcellx’s novel platform technologies especially in terms of potential benefits for safety, efficacy and scalable manufacturing. It’s quite neat (and an underappreciated attribute) that ARC-T cells express the same anti-TAG binding receptor to be used in every patient, regardless of disease or the target-specificity of the SparX protein. Streamlined manufacturing process is applicable to EVERY patient across ALL programs, and this will have advantages during regulatory review as well (shared requirements across platforms).

While in the near term the stock may have found its ideal trading range and there could be a lack of material catalysts, long term over 3-to-5 year period I see multi-fold upside as lead candidate CART-ddBCMA moves into late stage studies as well as expands into earlier lines of therapy. The AML/MDS indication is a notoriously tough one to tackle and I’m less optimistic about the company’s efforts there given new competition on the horizon and novel agents likely to move into first line setting, such as menin inhibitors. I would love to see the company’s early-stage solid tumor programs experience success as these indications have less competition and greater market potential, in my opinion.

For readers who are interested in the story and have done their due diligence, ACLX is a Buy and I suggest initiating a pilot position at current levels and then adopting a “buy the dips” strategy for the second half of this year.

From a Core Biotech perspective (emphasis on next 3 to 5 years), I do appreciate the company’s long term prospects and think shareholders will be rewarded in such a timeframe. However, as they are still several years away from possible regulatory approval and commercialization, ACLX is not an appropriate selection for our Core Biotech portfolio.

As for risk rating (1=low, 5= high), I assign this one a 4 as I believe clinical data to date has greatly derisked the lead program and showcased potential benefits & points of differentiation versus competition in the BCMA space. On the other hand, the BCMA target and multiple myeloma indication are getting increasingly crowded and I won’t pretend to have as much long term visibility here as I would like to be reassured of ultimate market potential and where CART-ddBCMA is sure to fit in the treatment landscape. With current cash burn and resources, I expect the company to dilute shareholders again via secondary offering in 2023.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the Comments section below.

Be the first to comment