Cindy Ord

Sirius XM Holdings Inc. (NASDAQ:SIRI) shares have not performed well over the past month, having fallen about 3.5% at the time of writing.

Recent stock price performance was likely driven by certain metrics related to the company’s radio service subscriptions that may have disappointed the market.

It’s also possible that subscriptions have been impacted by the fact that after two years of lockdowns and various restrictions imposed by Covid-19, it has almost been natural for people to focus less on entertainment via radio and other services in anticipation of the holiday season. If this is the case, a more compelling trend in subscriptions will recover as this holiday season comes to an end. The stock price should then pick up, provided that other headwinds, such as higher inflation and the risk of a recession, will have no impact.

About Sirius XM Holdings Inc. in the US Entertainment Industry

Sirius XM Holdings Inc. is a leader in the US audio entertainment industry and a leading programmer and operator of a platform on which users can subscribe to audio products or benefit from audio products that can live thanks to digital advertising.

Through its platform, Sirius XM Holdings Inc delivers music, talk shows, news, comedy, entertainment and podcasts to paid and free users for an aggregate audience that the company boasts to be approximately 150 million listeners.

Consistent Q2 2022 Results, Full-Year Revenue, Adjusted Earnings and Free Cash Flow Guidance Reaffirmed and Larger Self-Pay Base Expected

Amid consistent financial results, Sirius XM confirmed full-year revenue, adjusted core earnings and free cash flow guidance. It also forecasts a larger self-pay base going forward.

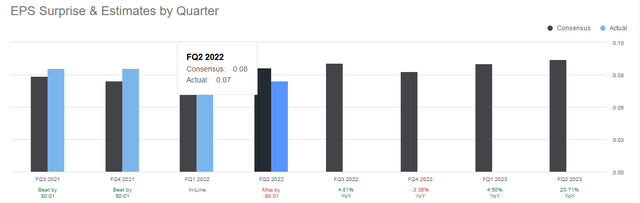

In line with the company’s guidance, revenue for the second quarter of 2022 was $2.25 billion, an increase of more than 4% over the same quarter of 2021. Net income for the second quarter of 2022 was $292 million resulting in diluted earnings per share [EPS] of $0.07, down from $0.10 for the same quarter of 2021. EPS missed the average analyst estimate by a penny.

seekingalpha/symbol/SIRI/earnings

Revenue Analysis

Revenue growth was driven by higher average revenue per user [ARPU], which was $15.62 in Q2 2022 and a higher number of SiriusXM self-payers, which increased by approximately 2% from the prior-year quarter.

As can be seen from the chart below, the number of self-payers was significantly lower than in the corresponding quarters of previous years, which may have recently caused the market to lose some confidence in the stock. However, the slowdown in the number of self-payers may be due to people enthusiastically returning to other activities after a two-year pandemic forced them to spend a lot of time at home. The desire to finally spend a summer vacation without the constraints of restrictions and lockdowns could have magnified the effect.

|

Items |

In Q2 2019 |

In Q2 2020 |

In Q2 2021 |

In Q2 2022 |

|

SiriusXM ARPU |

$13.83 |

$13.96 |

$14.57 |

$15.62 |

|

Number of SiriusXM net self-payers |

+290,000 |

+264,000 |

+355,000 |

+23,000 |

|

Number of Subscribers to paid promotions |

-116,000 |

-780,000 |

-378,000 |

+54,000 |

|

Self-pay monthly churn |

1.7% |

1.6% |

1.5%, |

1.5%. |

The churn rate of 1.5%, the lowest in recent years, keeps the total number of self-paying subscribers afloat at 32 million users. In addition, the number of subscribers to paid promotions is growing again, improving the contribution to ARPU, which continues to show a positive trend.

It is worth noting that the sharp drop in the number of subscribers to paid promotions from 2019 to 2021 was influenced by declining sales in some industries, such as the automotive industry, which offers paid trial subscriptions when selling or renting a car. The trend is on track to improve as the issue of Covid-19 is increasingly behind us.

The ad revenue segment continues to perform well, with podcasts benefiting from the launch of new audio content and from very popular Lyle Forever podcasts.

|

Items |

For Q2 2019 |

For Q2 2020 |

For Q2 2021 |

For Q2 2022 |

|

Advertising revenue |

$358 million |

$236 million |

$429 million |

$452 million |

Consistent results for the second quarter of 2022 contributed to the positive streak in terms of sequential growth in total TTM revenue as shown in the table below.

|

Revenues |

12 Months Jun 2021 |

12 Months Sep 2021 |

12 Months Dec 2021 |

12 Months Mar 2022 |

12 Months Jun 2022 |

|

Total Revenues |

$8.431 billion |

$8.604 billion |

$8.696 billion |

$8.824 billion |

$8.919 billion |

|

YoY Growth |

— |

+2.06% |

+1.07% |

+1.47% |

+1.08% |

Sirius XM Holdings Inc. 2022 Revenue Outlook and Wall Street Estimates:

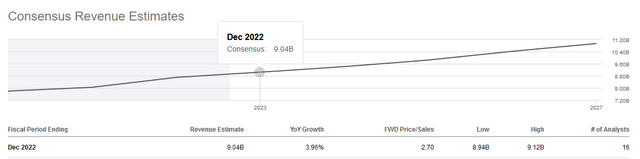

For full-year 2022, Sirius XM expects that another improvement in self-paying subscribers will drive total revenue to $9 billion, representing 0.9% sequential growth and 3.5% year-over-year growth.

The following portfolio updates should provide the sales-making machine of Sirius XM Holdings Inc. with more fuel. These are the introduction of new audio content such as Conan O’Brien’s Team Coco [fan-centric audio entertainment], as well as possible iterations of Black Music Appreciation Month [as June was the annual celebration of African American music in the United States, a custom since 1979]. In addition, the company will show its listeners a more comprehensive offering from the National Football League [NFL].

Regarding total revenue for 2022, analysts estimate a median of $9.04 billion.

seekingalpha/symbol/SIRI/earnings/estimates

Sirius XM Holdings Inc. EBITDA and Free Cash Flow Forecasts

Sirius XM also reported a slight decline in adjusted EBITDA to $679 million, but full-year 2022 should be better, assuming revenue develops as expected. The company forecasts $2.8 billion in 2022 versus an adjusted EBITDA of $2.77 billion in 2021.

While free cash flow is expected to hover around $1.55 billion, which, although less than $1.831 billion in 2021, shouldn’t bother shareholders as the company is still able to raise more than 70% of the amount to be spent on shareholder compensation and investments.

Sirius XM rewarded shareholders by repaying more than $300 million in Q2 2022. Shareholders received $217 million from the implementation of the company’s buyback plan and the rest from dividend payments.

Highly Profitable Business Supports a Significant Balance Sheet

The balance sheet showed a lot of debt at the end of the second quarter of 2022 as total borrowings were $10.25 billion while cash on hand had only $126 million.

However, that doesn’t appear to be a concern, as the company’s high profitability, as evidenced by the TTM EBITDA margin of 28.73% versus the industry median of 18.63%, means that borrowings are easily carried on.

In fact, an interest coverage ratio of 6.24x means the company is perfectly able to pay the interest cost of the debt with the profits it regularly generates from its operations. The interest coverage ratio is calculated as TTM EBITDA of $2.608 billion divided by a TTM interest expense of $418 million.

Another financial leverage metric, Net Debt to adjusted EBITDA, deteriorated, albeit marginally.

|

Item |

As of Q2 2019 |

As of Q2 2020 |

As of Q2 2021 |

As of Q2 2022 |

|

Net debt to adjusted TTM EBITDA |

3.3x |

3.0x |

3.2x |

3.6x |

The metric measures the number of years it takes for the company to pay off all debt using gross profits.

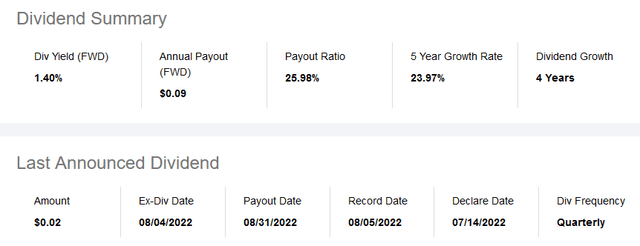

The Dividend Yield Is Below the Market but Could Improve

Currently, Sirius XM awards a forward dividend yield of 1.40%, which is lower than the benchmark S&P500 yield of 1.55% as of this writing. But aided by high margin operations and a stable financial condition, the board of directors may decide to increase the dividend. Should this happen, the share price could potentially receive a significant boost.

The payout ratio of 26% gives ample room to increase the dividend.

The company will pay a quarterly dividend of 2 cents per common share in cash on Aug. 31, reflecting a 33.34% year-over-year increase.

seekingalpha/symbol/SIRI/dividends/scorecard

As the screenshot above shows, Sirius XM has increased its dividend by nearly 24% per annum for the past 5 years.

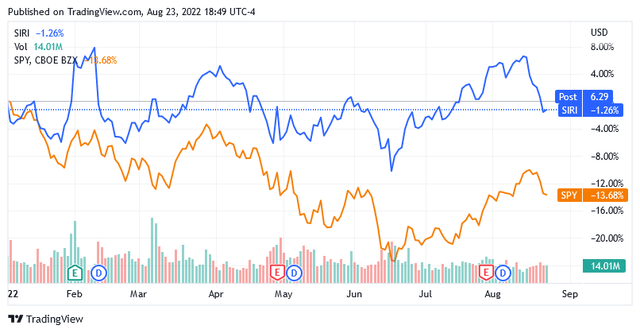

Share Price and Comparison with Recent Market Valuations

Shares of Sirius XM Holdings Inc. were trading at $6.28 a share at the close on August 23, giving it a market capitalization of $24.38 billion.

The stock price does not look expensive given its comparison to the 52-week range of $5.69 to $6.85 and in light of the growth prospects.

Shares are at compelling levels as also indicated by the 200-day moving average of $6.31 as the value of $6.31 is a measure of the long-term trend in the share price.

Risk Section

The stock has a 5-year monthly Beta of 0.94.

The stock is less volatile than the market, so the stock should feel less of the market’s bearish effect if the headwinds, that have fueled them so far, continue. The current headwinds will probably linger as bearish sentiment factors are severe, but this stock proves that it can weather this extremely challenging period well.

In fact, except for the past month when temperatures and vacation plans have distracted many people from radio programming, the stock price has tolerated the negative effects of the war in Ukraine and high inflation well.

This can be seen in the chart below, which shows how Sirius XM Holdings has clearly won the battle against the SPDR S&P 500 ETF Trust (SPY), a benchmark of the market so far, despite a slight decline.

Conclusion – The Stock is Poised to Recover from the Underperformance of the Past 30 Days

The stock will recover from last month’s poor performance as vacationers resume daily activities like listening to radio programs and the main entertainment schedule for many events reopens to the public.

The company has added more audio content to its offerings, which is expected to provide strong support for continued growth in self-pay subscribers.

This, coupled with a high-margin platform, will likely continue to support the balance sheet and increase the likelihood of another quarterly dividend increase.

In the meantime, an innate resilience will likely defend this stock against market headwinds.

Be the first to comment