Ig0rZh/iStock via Getty Images

Investment Thesis

Salesforce, Inc. (NYSE:CRM) will be in the hot seat today, given its upcoming FQ2’23 earnings call post-market closing. For now, we remain optimistic about its performance, mostly attributed to the robust demand and growth in the global cloud market, despite the rising inflation, FX headwinds, and worsening macroeconomics. It would be meaningful to gather more information about its forward execution as well, since these would be highly critical to its stock performance ahead.

Assuming that these levels hold, we expect CRM to perform very well indeed, given the massive growth in the global cloud market from $219B in 2020 to $791.4B in 2028 at a CAGR of 17.9%. However, with a potential deal down-sizing and longer sales cycles ahead, the company could potentially face a weaker YoY comp ahead for its Remaining Performance Obligation by H2’22. We shall see, though these would only be temporary headwinds with recovery visible by mid-2023.

CRM Continues To Exceed Expectations Despite Temporary Headwinds

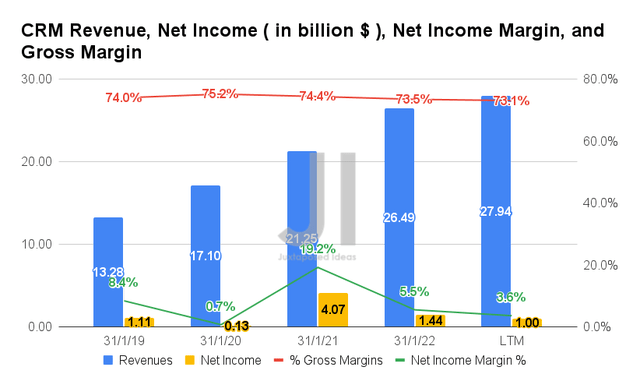

By the last twelve months (LTM), CRM reported revenues of $27.94B and gross margins of 73.1%, representing an increase of 31.4% though a moderation by -1.3 percentage points YoY from FY2021 levels, respectively, with the former attributed prior to its Slack acquisition and the latter attributed to the rising inflation. In the meantime, the company reported net incomes of $1B in the LTM, indicating an unfortunate decrease of -47.2% and -5.3 percentage points YoY, respectively, after certain adjustments.

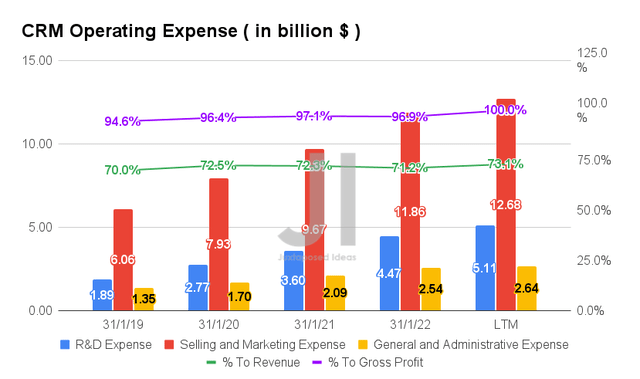

The moderation in its profitability is mainly attributed to CRM’s elevated operating expenses of $20.43B in the LTM, presenting a notable increase of 33% YoY. The rate of growth also accelerated against the company’s growing sales, at a ratio of 73.1% to its revenue and 100% of its gross profits then. Thereby, pointing to CRM’s reduced operating income of $0.26B in the LTM, compared with $0.45B in FY2021, after adjusting for its Stock-Based Compensation (SBC) expenses.

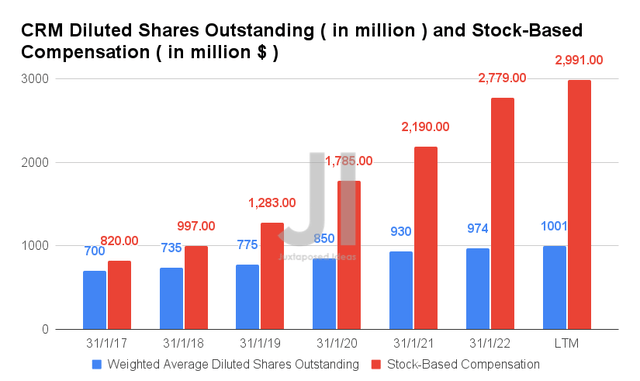

This segment also highlights CRM’s high expenses of $2.99B in SBC expenses in the LTM, representing an increase of 36.5% YoY. This has directly contributed to the company’s continual share dilution, with a total share count of 1001M in FQ1’23, representing an increase of 7.6% YoY. Otherwise, an increase of 1053.6% since its IPO in 2004. Naturally, these are on top of its continuous M&A deals, which fortunately have been top-line accretive by now.

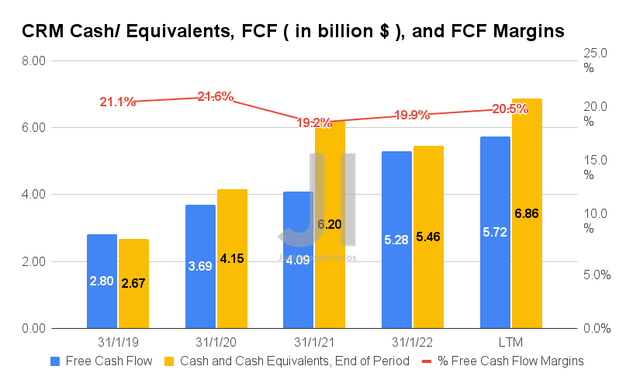

Nonetheless, it is evident that CRM is able to report positive Free Cash Flow (FCF) thus far, with an FCF of $5.72B and an FCF margin of 20.5% in the LTM. It represents an excellent increase of 39.8% and 1.3 percentage points YoY, respectively. Thereby, strengthening its cash and equivalents to $6.86B by FQ1’23.

CRM Credit and Debt Maturities

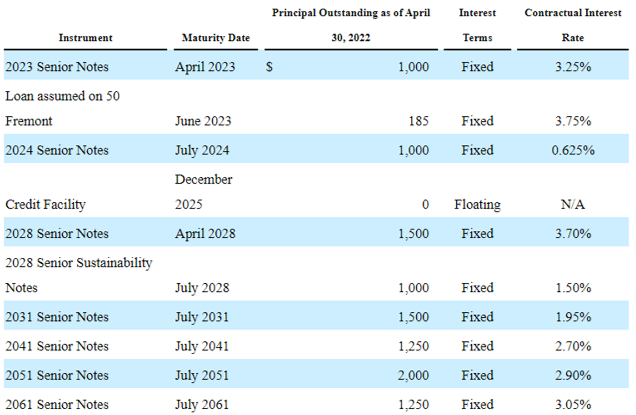

S&P Capital IQ

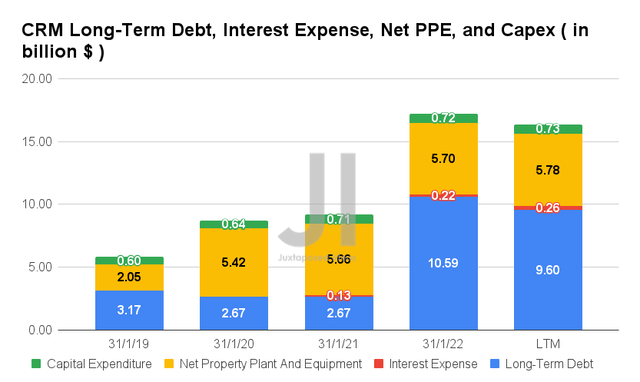

Though CRM reported total debts of $10.68B in FQ1’23, it is essential to note that only $1.18B is maturing in 2023. In addition, with a minimal $0.26B of interest expenses in the LTM, the company remains well poised for growth and expansion ahead, given its expanding war chest of capital on its balance sheet thus far.

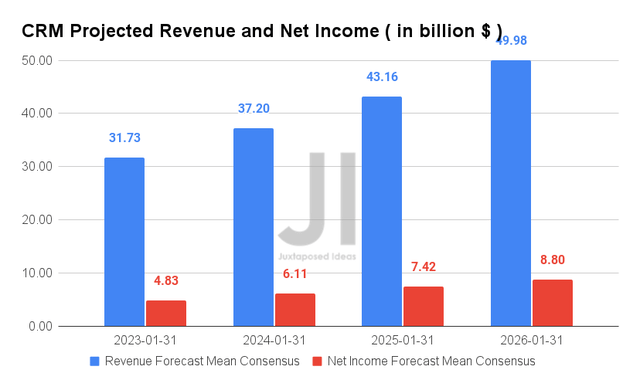

CRM Will Likely Smash Estimates – Triggering A Meaningful Short Term Recovery

Over the next four years, CRM is expected to report revenue and net income growth at a CAGR of 16.91% and 57.23%, respectively. It is evident that the company is expected to report excellent profitability ahead, given the acceleration in its net income growth compared to the previous CAGR of 41.52% between FY2018 to FY2022. These are mostly attributed to its aggressive M&A activities and the global movement toward digital transformation post-reopening cadence. In addition, consensus estimates expect CRM to reporting tremendous growth in its net income margins, from 8.4% in FY2019, to 5.5% in FY2022, and finally to 17.6% in FY2026.

For FY2023, CRM is expected to report revenues of $31.73B and net incomes of $4.83B, representing a massive increase of 19.7% and 335.4% YoY, respectively. All eyes will be on its upcoming FQ2’23 earnings call on 24 August 2022 post-market close, where analysts expect to see EPS of $1.03 and revenues of $7.7B. These will indicate a YoY decline of -30.53 % though an increase of 21.4%, respectively.

Given its exemplary historical performance for the past 16 consecutive quarters, we believe CRM will continue to smash estimates ahead. Especially given the sustained growth reported by its peer, Microsoft (MSFT), in its SaaS segment. The latter reported an excellent increase of 9.7% QoQ and 20.3% YoY in Q2’22. Though not directly related, other global cloud providers, such as Amazon (AMZN), also reported a 6.9% QoQ and 33.3% YoY growth in its AWS revenues for the latest quarter, with Google Cloud (GOOG, GOOGL) reporting an increase of 7.7% QoQ and 35.7% YoY, respectively. Thereby, triggering a meaningful recovery for CRM in the next two weeks, if not more, as similarly seen with these big tech companies post-earnings.

However, we must also mention the fact that much of these companies’ stock gains have also been digested by now, pointing to a mixed signal ahead. Beware of a potential disconnect in CRM’s fundamental performance and stock prices ahead, especially given the Fed’s upcoming interest hike in September 2022. However, early signs are already showing an easing in the rate hike – speculatively pointing to greener days ahead.

So, Is CRM Stock A Buy, Sell, or Hold?

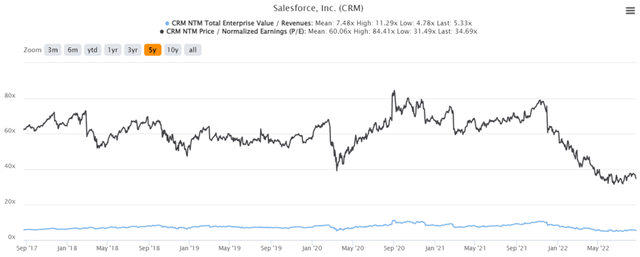

CRM 5Y EV/Revenue and P/E Valuations

CRM is currently trading at an EV/NTM Revenue of 5.33x and NTM P/E of 34.69x, lower than its 5Y mean of 7.48x and 60.06x, respectively. The stock is also trading at $176, down 43.5% from its 52 weeks high of $311.75, though at a premium of 13.8% from its 52 weeks low of $154.55. The stock has also been relatively volatile for the past three months, leading its long-term investors on a rollercoaster ride indeed.

CRM 5Y Stock Price

Nonetheless, consensus estimates continue to rate CRM as an attractive buy with a price target of $237.68 and a 35.05% upside from current prices. Investors with a higher tolerance for risk and looking for a quick buck may potentially add before its upcoming earnings call, given the potential pop afterward. However, we prefer to exercise caution, as always, before advising anyone to play the earnings game. As a result, we rate CRM stock as a Hold for now, while waiting for more clarity on its FQ2’23 performance and forward guidance from its upcoming call. Good luck all.

Be the first to comment