CreativaStudio

Investment Thesis

While most Consumer Discretionary companies are reporting lower demand amid monetary tightening and shrinking margins due to supply chain issues, rising material and labor costs, Arhaus (NASDAQ:ARHS) is demonstrating strong revenue growth and improved operating leverage. Management notes continued strong demand despite macro headwinds. The company is expected to open 5-7 new stores in the coming years, and the new distribution center will be a springboard for growth in California and Texas, two of the most promising markets. Arhaus has the potential to grow profitably. First, maintaining high demand and relative pricing power allow the company to successfully pass costs to its customers. Secondly, Arhaus is a growth company and has not fully realized economies of scale yet. According to our valuation, ARHS trades at a discount to its fair market value. We rate shares as a Buy.

Company Profile

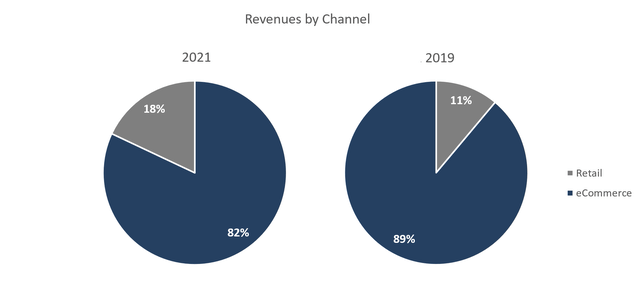

Arhaus Inc. designs and markets premium home products. The range of goods is presented in such categories as furniture, lighting, textiles, and decor. The company sells products through 80 retail stores located in 28 states, as well as through its own website. The revenue structure is shown below:

In November 2021, Arhaus held an IPO in which the company sold 12.9 million shares at $13 each and raised $168 million. Proceeds were used to repay the loan, as well as for general corporate purposes.

Industry Opportunities

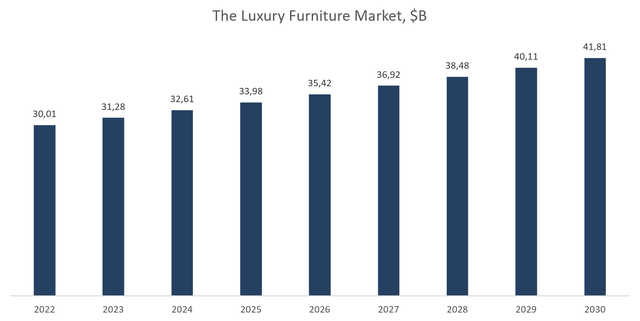

Arhaus operates in the luxury furniture market, which is valued at $30 billion and is expected to grow at a CAGR of 4.23%. Thus, the market will have been valued at approximately $41.8 billion by 2030. With expected revenue for the year in the range of $1.173-1.193 billion, the company’s share is 3-4%. At the same time, the furniture market is highly fragmented, which provides the company with significant room for growth.

In the middle of the forecast range, management expects revenue of $1.18 billion with 83 open stores, which projects $14.31 million per store. Arhaus plans to open five stores annually. Thus, while maintaining same-store sales at the current level, the revenue will be growing at an average annual rate of 5.3% and it will have reached $1.61 billion by 2028.

Competitive Advantages

The Arhaus business model has several advantages over its competitors. About half of the company’s products are made in the United States. This factor is an important competitive advantage in the face of problems in the supply chain. While competitors struggle with logistics, ARHS can sell and deliver products faster and cheaper. In addition, due to the focus on the premium segment, Arhaus has more room for price growth.

In late 2021, Arhaus announced its intention to open a third distribution center in Dallas, Texas. In the second quarter of 2022, the company has already begun to put it into operation and plans to increase its cargo turnover quarterly. We see significant potential in this since the old distribution centers are located in the eastern United States, in Ohio and North Carolina, while in the west there are two large and solvent states – Texas and California, each of which has six Arhaus showrooms. (more only in Ohio and Florida). California is one of the top five states with the highest income every year, while Texas is one of the fastest-growing regions in the country. Thus, the distribution center in Dallas will create a solid foundation for further expansion to the west.

Financial Performance

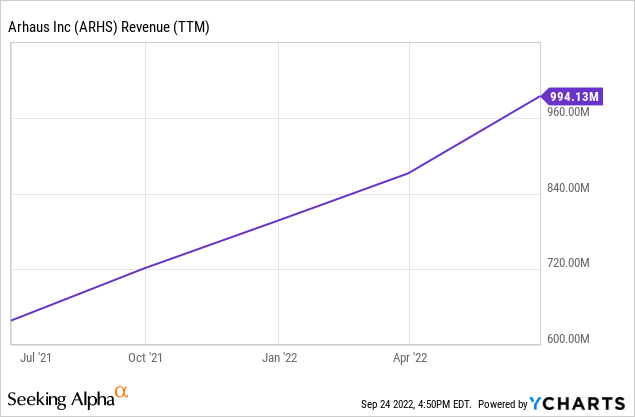

Although Arhaus was founded way back in 1986, the company has a short history on the public market. At the end of 2021, the company’s revenue grew by an astronomical 57.2% to $796.9 million. It is expected that the revenue will be from $1.173 billion to $1.193 billion by the end of 2022, which implies growth in the range of 47.2-49.7% year-over-year.

Arhaus still has the potential for further growth. First, the company faced a large demand for its furniture. The management estimated the time frame for covering the accumulated demand until mid-2023 at maximum productivity. Secondly, as noted above, only due to the planned opening of stores with the current same-store sales, the company can grow by more than five percent annually. Same-store sales are likely to grow as Arhaus actively develops eCommerce.

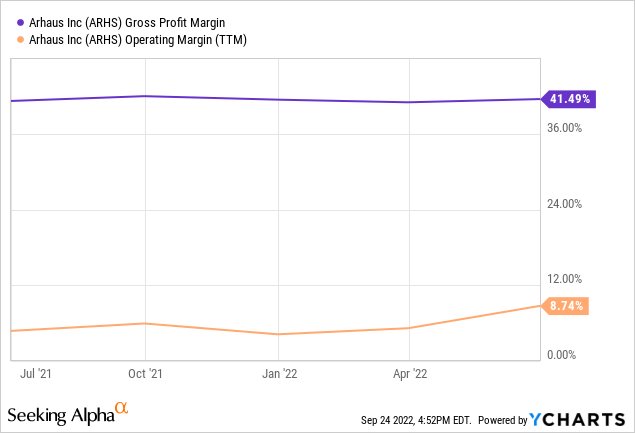

The operating margin for 2021 was 4.1% versus 6.0% a year earlier. ARHS completed its IPO last year and incurred one-off costs, including $9.7 million in underwriting fees of $26.6 million. The operating margin, adjusted for these one-off costs, is 10.2%. In the first half of 2022, the operating margin increased by 7.6 percentage points and reached 13.2%. Arhaus has the potential to further improve operating leverage. First, the company can pass on rising costs to customers, as it focuses on a secured price category. Secondly, top-line growth naturally allows you to reduce costs as a percentage of revenue. Thirdly, the opening of a new distribution center will reduce the cost and time of delivery.

Arhaus has a strong balance sheet with total debt of $358.2 million and total cash & short-term investments of $144.6 million. Thus, net debt is $213.6 million, which is 146% of cash from operations for 2021. A strong balance sheet provides Arhaus with a solid foundation for sustainable development and enables it to successfully navigate difficult market conditions.

Valuation

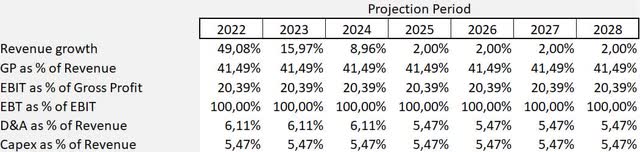

The DCF model is built on several assumptions. Year-end sales are expected to be $1,183 million in the middle of the forecast range with 83 stores open, implying $14.3 million per store. Our revenue forecast is based on the assumption that sales per store will remain at current levels and increase by five units per year, in line with management’s expectations.

Although the last 12-month gross margin is 44.9%, we assume that the gross margin will remain at the 2021 level until the end of the forecast period – 32.6%, which is quite conservative given the development of eCommerce and the opening of a new distribution center.

Management expects adjusted EBITDA for the year to be $173-180 million, which projects approximately 8.5% of the operating margin for the year. We assume that the operating margin will increase by one percentage point in 2023 and remain at this level until the end of the forecast period.

Management forecasts capital expenditures in the range of $55-65 mn for the year, which corresponds to 5.5% of revenue at the upper end of the range. We assume that CapEx as a percentage of revenue will remain at 5.5% until the end of the forecast period.

The assumptions are presented below:

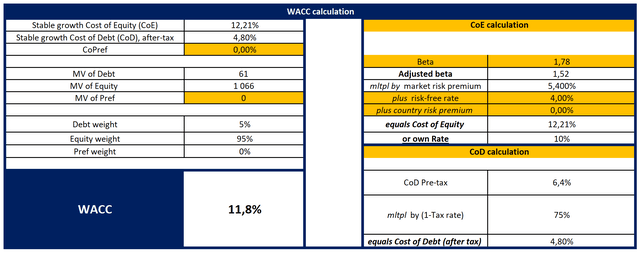

With the cost of equity equal to 12.21%, the Weighted Average Cost of Capital [WACC] is 11.8%.

With a Terminal EV/EBITDA of 8.45x (the median value of the Consumer Discretionary sector), the model projects a fair market value of $1.410 million, or $10.2 per share, below the Wall Street consensus estimate of $11.3. The upside potential we see is about 32%.

You can see the model here.

Key Risks

- While Arhaus is not currently facing a slowdown in demand, a deep and prolonged recession will negatively impact real estate activity, which in turn will hurt furniture companies’ bottom line. In 2009, the company had a negative comp of 13% and then came out strong in 2010 with a 20% comp growth. It is worth considering that the average duration of recessions is 17 months.

- On Yelp, you can see negative comments about poor customer service. They are mainly related to delivery delays, failure to notify consumers about the postponement of the delivery date, as well as warranty repair of furniture. Perhaps the negative consumer experience is due to the abnormal growth of the eCommerce channel amid the pandemic. However, it is necessary to take into account that poor quality of service can create problems for further growth.

Conclusion

Arhaus is a small company in a large and stable premium furniture market. Due to excess demand in the past two years, ARHS has significantly increased its revenue and improved profitability. Management plans to open 5 to 7 showrooms in the long term, and the new distribution center in Texas will provide a solid foundation for expansion in the western US. Despite inflation, in the last reporting period, the company significantly improved its margins, which impressed Wall Street. We expect Arhaus to continue to improve its profitability. According to our estimates, the company trades at a discount to its fair market value. Despite the risks, we are bullish on ARHS.

Be the first to comment