naphtalina/iStock via Getty Images

Real estate investment services firm, Marcus & Millichap, Inc. (NYSE:MMI) is a small, but fast-growing player in the real estate market. The company has had a great 5-year run, growing revenues, widening profitability, and spitting out free cash flows at ever-rising rates. The company’s business model is built on a robust client base, and wider industry and economic trends support long-term growth. The company’s free cash flows are trading at a yield of nearly 15.7%.

Good But Not Good Enough

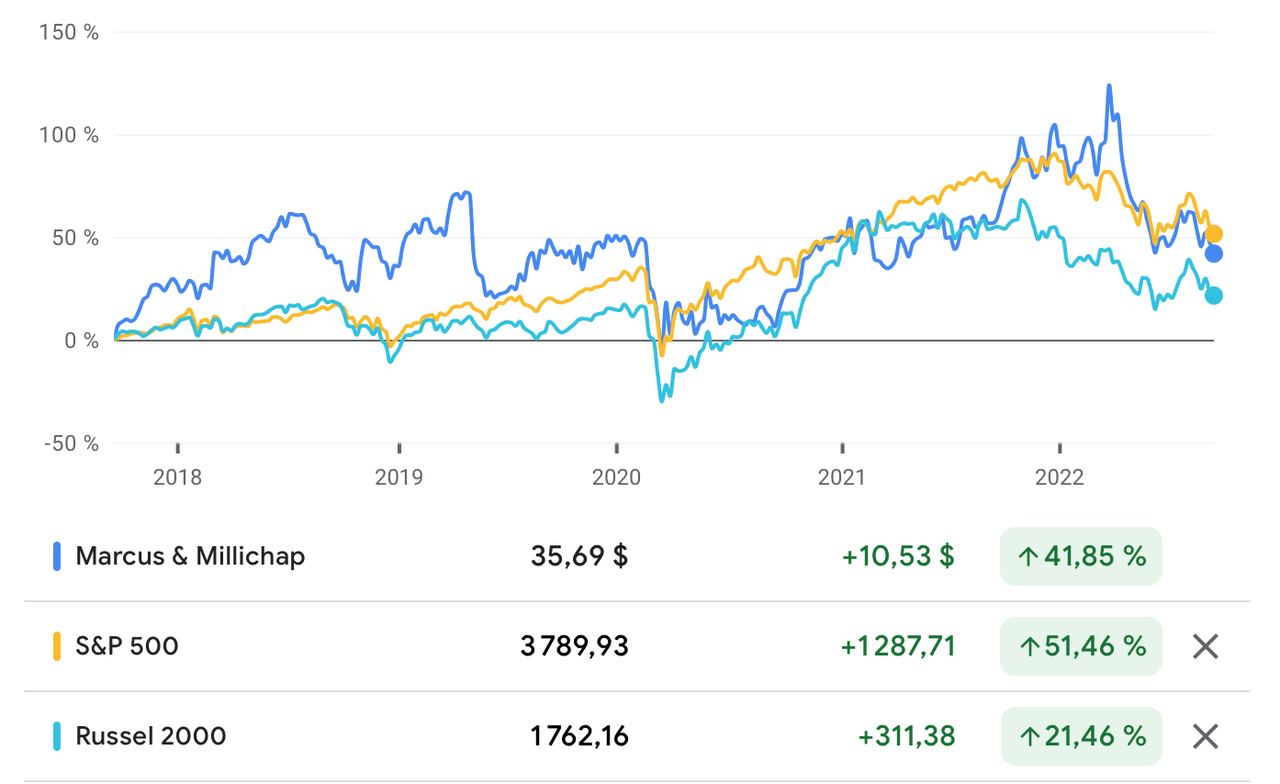

In the last five years, Marcus & Millichap has risen 41.85% (at time of writing), compared to 51.46% for the S&P 500, and 21.46% for the Russell 2000.

Source: Google Finance

In that time, CBRE Group, Inc. (CBRE) has grown 96.37%, Colliers International Group, Inc. (CIGI) has grown 117.72%, Cushman & Wakefield plc (CWK) is down 30.30%, JLL (JLL) is up 28.77%, and the Newmark Group Inc. (NMRK) is down 31.97%. The company has performed well, but not well enough to beat the market, or its peer group.

The Business Case

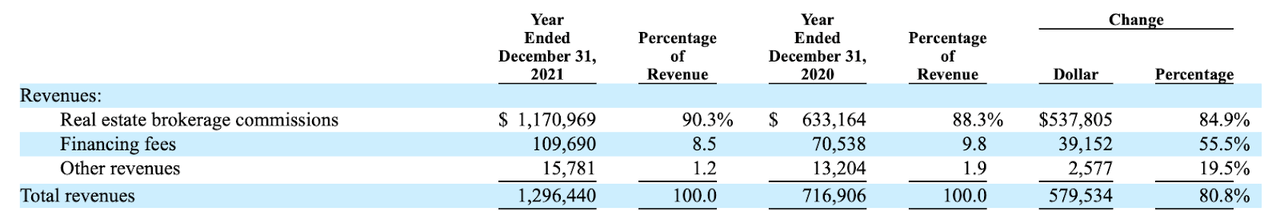

Marcus & Millichap earns its revenue through real estate brokerage commissions, and financing fees from commercial properties, and the provision of a variety of services. As of 2021, over 90% of the company’s revenue was derived from real estate brokerage commissions.

Source: 2021 Annual Report

The company has four market segments: properties priced at under $1 million; the private client market with properties priced at between $1 million and $10 million; the middle market with properties of between $10 million and $20 million; and the larger transaction market with properties worth over $20 million. The private client market is the firm’s most important segment, accounting for around 59% of the company’s revenue.

Source: 2021 Annual Report

Asset turnover rates in the segment are high. Private clients are less prone to make real estate decisions because of macroeconomic factors, and are more driven by changes in personal circumstance. This is an important differentiator between the firm, and its peer group, who are focused on larger investors, or lack a national platform, or are focused on leasing or property management. So, Marcus & Millichap has a degree of robustness in its business model that its competitors do not.

The question for long-term investors is: are the supply factors in commercial real estate such that investors will continue to invest there in search of rental income?

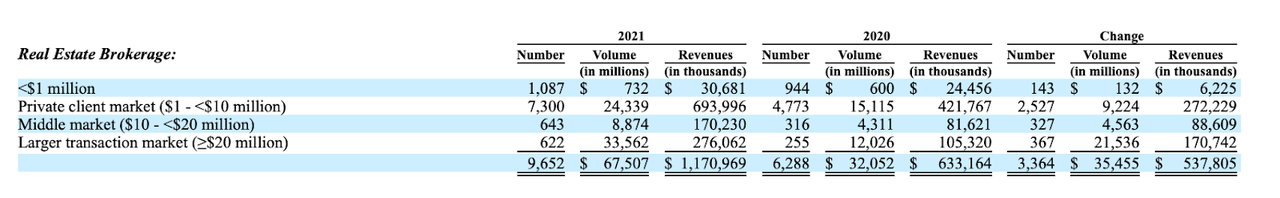

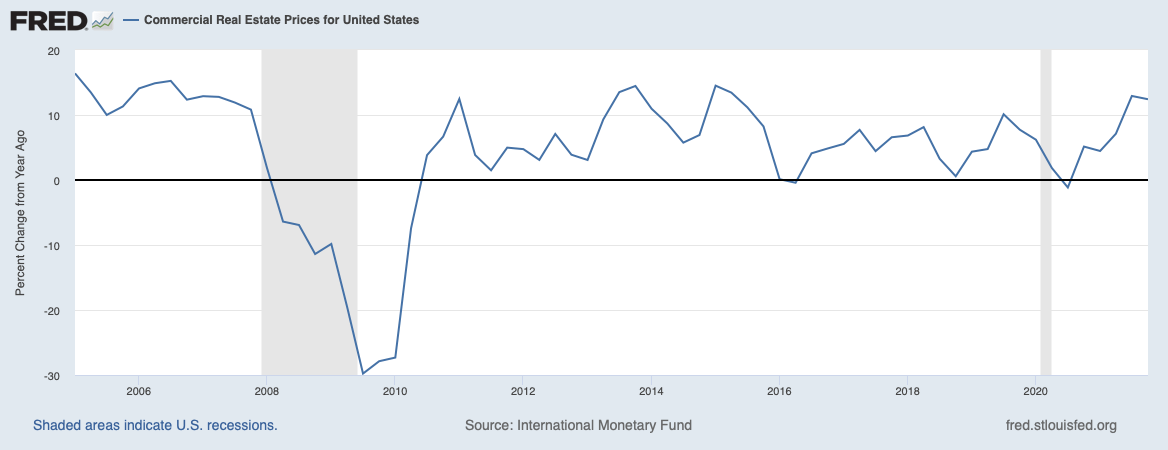

The Value of Commercial Property Has Kept Growing

Despite the doomsday talk about the death of brick-and-mortar, commercial properties have remained robust. The value of commercial property has kept on rising in the United States, with the Bank of International Settlements [BIS] commercial price index rising from 126.6 in Q1 2014 to 212.17 in Q4 2021.

Source: Statista

While a recession may dent the value of commercial properties, for a long-term investor, that should not be cause for concern, because in the long run, the United States needs commercial property.

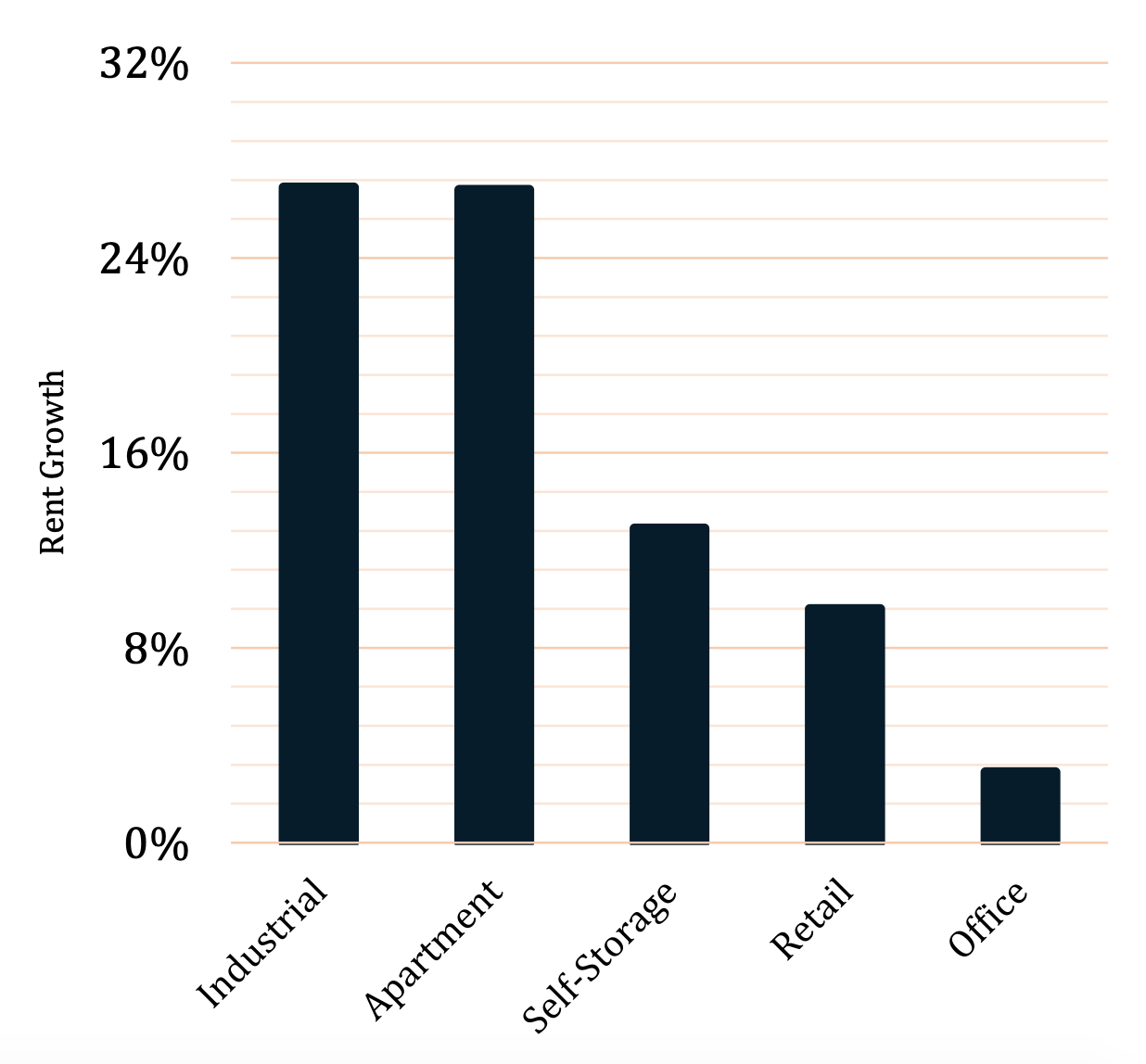

Rental Growth Remains Strong

Rental growth accelerated in the last three years and was extremely good. According to Marcus & Millichap’s August 2022 Investor Presentation, rental growth has been strong across commercial properties.

Source: August 2022 Investor Relations

Considering that we are still in a low-interest rate environment, the attractiveness of this growth will keep the market stable.

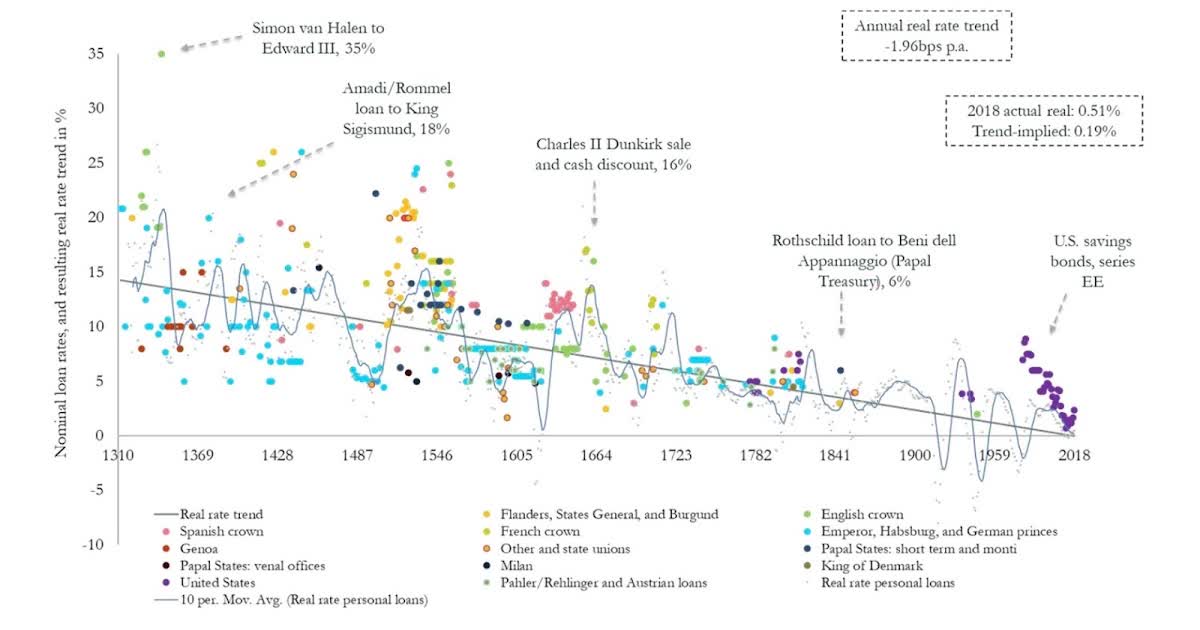

We Remain in a Low Interest Rate Environment

While interest rate hikes will dampen the market, it must be emphasized that the United States and the West as a whole, remain in a low interest rate environment. In fact, research by the Bank of England shows that, across the last eight centuries, interest rates have been steadily declining. While in the near term, nominal interest rates may decline, given the forces of globalization, and the growth of capital, in the medium term, real interest rates will revert to a downward trajectory. In other words, it will continue to become progressively cheaper to buy commercial properties.

Source: Bank of England

Remote Work Will Drive Demand for Smaller Offices

The market for properties between $1 million and $10 million is likely to grow as a result of the Covid-19 pandemic, and the emergence of remote work. As businesses are forced to adapt to remote and hybrid work models, the era of large corporate headquarters will fade, and demand for smaller satellite offices will rise. Remote work has not only become ingrained in the consciousness of the worker, it has real benefits for many types of businesses that do not rely heavily on worker in-person collaboration to build value. This may lead to a rise in rents even during the recession, as companies transition away from traditional models.

Exceptional Financial Performance

Between 2017 and 2021 (financial results here), Marcus & Millichap’s revenue has grown from nearly $720 million to nearly $1.3 billion, at a 5-year compound annual growth rate [CAGR] of 12.49%. According to Credit Suisse’s The Base Rate Book, just 12.6% of firms achieve that rate of growth over a 5-year period. In the trailing twelve months [TTM], revenue has risen to nearly $1.543 billion.

Gross profitability in 2017 was 0.59, declining to 0.43 in 2021. Although the company’s gross profitability has declined in that period, it is still greater than the 0.33 threshold that Robert Novy-Marx showed makes a stock attractive. In the TTM period, gross profitability has risen to 0.55.

Marcus & Millichap’s operating profit margin has risen from 13.4% in 2017 to 14.6% in 2021. Operating profit margin has risen to 14.8% in the TTM period. This shows that the company’s competitive positioning has improved in that 5-year period.

Revenue growth, gross profitability and operating profit margin, are all persistent across 1-, 3-, and 5-year periods.

The company’s net income has risen from more than $51 million in 2017, to over $142 million in 2021, at a 5-year net income CAGR of nearly 23%. In the TTM period, net income is over $170 million. Just 8.8% of firms have achieved a similar growth rate over a 5-year period. Diluted earnings per share [EPS] has risen from $1.32 in 2017 to $4.24 in the TTM period. There is a link between earnings, especially if that growth is unexpected. Given the company’s undervaluation, I expect future returns to be good. Nevertheless, EPS growth is not very persistent.

Return on invested capital [ROIC] has declined from 54.2% in 2017 to 43.9% in the present period. This reflects a combination of natural decay, the acquisitions of Metropolitan Capital Advisors, Mission Capital and LMI Capital, and market trends.

Free cash flow [FCF] has grown sharply from nearly $60 million in 2017, to just over $249 million in 2021, for a 5-year CAGR of nearly 33%. That is a phenomenal return. In the TTM period, FCF has declined to nearly $161.5 million.

Interest Rates May Hurt Demand

While the commercial real estate market has shown strength in recent years, the commercial real estate boom ended in Q3 2021. In a climate of rising near-term real interest rates, there is a strong possibility that demand for commercial property will, overall, go down. This will impact prices, and therefore real estate brokerage commissions earned by Marcus & Millichap, even if they retain the same volume of business given the resilience of its clients.

Source: FRED

If the present economic crisis deepens, forcing the Federal Reserve into a prolonged cycle of interest rate hikes, that may materially undermine the company’s business.

Valuation

With $161.5 million in FCF in the TTM period, and an enterprise value of just over $1 billion, Marcus & Millichap has an FCF yield (FCF/enterprise yield) of nearly 15.7%. This is higher than the FCF yield of the largest 2,000 companies listed in the United States, as measured by financial services firm, New Constructs: 1.7%. The company’s fast-growing FCF are, then, trading at a very attractive rate.

Conclusion

Marcus & Millichap has a proven record of growth, profitability, and strong competitive positioning. The company’s financial performance has improved across all metrics in the last five years. In addition, the general market trends indicate that there is a stable base for long-term growth that can overcome any disruptions caused by the recession. Finally, the company’s fast-growing FCF are trading at very attractive levels.

Be the first to comment