Diego Thomazini

The strategy of selling calls on U.S. stocks to achieve regular income at the cost of capital gains has been a losing one over the past decade, but that is likely to change over the coming years. The Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) tracks the performance of the CBOE S&P 500 BuyWrite Index, which holds the S&P 500 and writes calls against it in order to earn the option premium. The fund holds the underlying stock positions and writes one-month, at-the-money call options on the Index. The ETF is for investors who are happy to miss out on potential upside in favor of generating regular income. The attractive thing about the XYLD, and other ETFs following a similar strategy, is the tendency to outperform during periods of market weakness.

The XYLD tends to underperform the S&P500 when the returns it received from option sales underperforms the combined returns of the dividend yield, the growth in dividends, and the impact of rising valuations (or falling dividend yield). The main reason for the underperformance has been the significant increase in U.S. dividend payments as well as the rise in equity valuations which has more than outweighed the impact of higher income on the XYLD. As dividend growth slows and equity valuations decline, the XYLD should outperform, particularly if implied volatility rises as I expect.

Understanding The Historical Underperformance

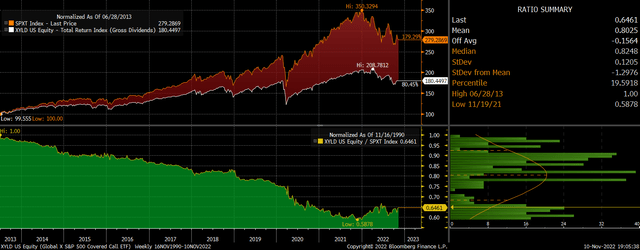

The XYLD has underperformed the SPX for the vast majority of the time since its inception in 2013 despite generating 6.7% annual returns after expenses largely from selling options. Over the same period the S&P500 has returned 11.6% over this period. Anyone looking at the performance of the S&P500 over the past 9 years as a gauge to future performance is likely to be misled, as the market’s returns have been driven by a number of unsustainable factors that are likely to reverse over the coming years.

XYLD Vs S&P500 Total Return (Bloomberg)

The first one is the rise in dividend payments, which have grown by 7.3% annualized, significantly outpacing corporate sales and nominal GDP. As a result, dividend payments on the S&P500 are currently elevated relative to most other corporate fundamentals and should be expected to grow more slowly going forward. Even if they were to grow by the pace of nominal GDP growth, this is likely to be below 3% based on long-term potential real GDP and long-term inflation expectations.

The second driver of XYLD underperformance has been the decline in the dividend yield, which has contributed another 2% annually to the S&P500 relative to the XYLD. With the dividend yield now at just 1.8% there is little room for falling yields to provide support to S&P500 returns, particularly with the risk-free rate continuing to rise.

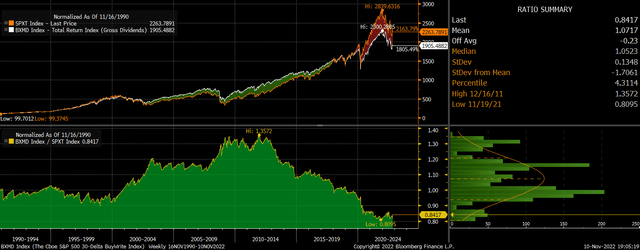

S&P500 BuyWrite Index Vs SPX Total Return (Bloomberg)

Over the coming years we should see the XYLD continue to generate high single-digit income returns that far outstrip the impact of dividend growth and valuation changes on the S&P500. As we saw during the 10-year period following the bull market peak of 2000, we should see the XYLD outperform the S&P500 significantly.

Can The XYLD Generate Positive Returns In A Bear Market?

As mentioned above, the XYLD has generate income returns of 6.7% annually since 2013. If this were to continue going forward then the ETF would generate positive returns as long as the S&P500 does not fall by an equivalent amount. While I still believe that there is further downside for the S&P500 before the ultimate low is in, from a long-term perspective, future returns have improved significantly and are now finally positive from a 10-year perspective. Furthermore, if we see a sharp fall in equity prices, we are also likely to see a sharp rise in the VIX, which should lead to stronger income returns for the XYLD. The 6.7% annual income returns seen since 2013 have occurred over a period where the VIX volatility index has averaged just 18, whereas it is now up at 27.

Summary

The XYLD is ideal for investors looking for exposure to U.S. stocks but with additional income, and who are willing to forego some upside in the event of a resumption in the S&P500 bull market. The historical underperformance of the XYLD has been driven by an unsustainable rise in S&P500 dividend payments and rising valuations, which will not be repeated over the coming years. Furthermore, higher implied volatility should also help the XYLD to achieve higher income returns than in the past.

Be the first to comment