Natalia_Grabovskaya/iStock via Getty Images

I like bear markets far more than bull markets for the obvious reason of buying high quality dividend-paying companies on the cheap. While it’s tempting for investors to keep buying high dividend BDCs that yield in the 10 – 12% range, it’s also important not go overboard and diversify one’s portfolio for who knows what may come next.

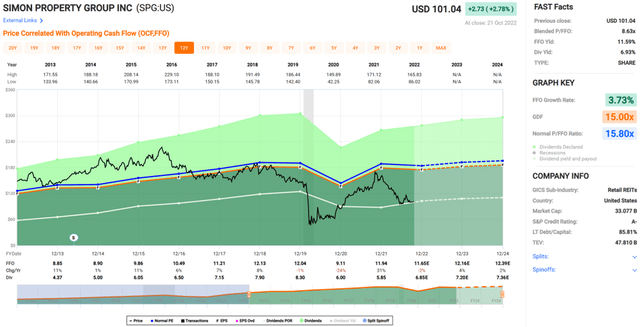

That’s why it pays to also focus one’s attention what I would consider mid-range dividend yields in the 4 to 7% range. Simon Property Group (NYSE:SPG) fits the profile of one such stock with durable attributes that sits at the top of this range. This article highlights why SPG is too cheap for its quality and long-term total return potential.

Why SPG?

Simon Property Group is an S&P 100 company and is the largest retail-focused REIT in the U.S. It owns over 200 properties, about half of which are primarily Class A U.S. Malls with the rest comprising of Premium Outlets and International/Mills/Lifestyle Centers. In addition, SPG owns an 80% interest in Taubman, which carries a premier portfolio of malls and outlet centers across the U.S.

SPG continues to trade rather cheaply at the current price of $101. As shown below, it sits well below its 52-week high of $171 and its bear market peak of $116 achieved in August.

Of course, economic uncertainty and the potential for a recession is weighing on the stock. However, many economists predict that a recession will be mild. Recently, Goldman Sachs (GS) predicted about a one-in-three chance of the US economy slipping into a recession by the middle of next year, and for the unemployment rate to tick up by just 1 percentage point.

If that’s the case, then consumers should still have plenty of money in their pockets to make discretionary purchases, and therefore doesn’t warrant such a big sell off in America’s biggest retail landlord.

While SPG hasn’t yet reported its third quarter results, any indication of weakness would be a U-turn from second quarter results, during which domestic property NOI increased by 3.6%, and total portfolio NOI rose by 4.6%. Plus, occupancy remained strong at 93.9%, up 210 basis points from the prior year period, driven in part by record tenant sales per square foot reaching a record $746. Plus, occupancy costs sit at just 12% of revenue, the lowest in 7 years, and is a reflection of a more efficient enterprise.

Looking forward, I see SPG as being more than just a mall operator, with smart investments in brands with the aim of turning them around. This is reflected by its SPARC investment with Authentic brands now worth over $1 billion. SPG also recently partnered with fintech Cardless to introduce a credit card that gives users up to 3% cash back on eligible purchases made at Simon’s shopping malls. In addition, the Simon American Express (AXP) credit card that will offer up to 5% back on eligible purchases at participating Simon destination retailers.

Also encouraging, SPG recently announced a 50% stake in Jamestown, a global REIT with a 39-year track record and over $13 billion in assets under management. This partnership has the potential to accelerate SPG’s future mixed use projects, as noted in the press release:

The partnership will unlock new value creation opportunities and create a platform for future growth in the investment management sector. With Simon, Jamestown will gain a partner with a deep platform of resources and operational tools that will enhance the firm’s ability to scale and grow. With Jamestown, Simon will gain an opportunity to capitalize on the growing asset and investment management businesses with an experienced fund manager and mixed-use operator and developer, utilizing the Jamestown platform to accelerate Simon’s future densification projects.

Lastly, SPG carries a strong A- rated balance sheet and pays a well-covered 6.9% dividend yield protected by a 60% payout ratio. The stock remains cheap at the current price of $101 with a forward P/FFO of 8.7, sitting well below its normal P/FFO of 15.8 over the past 10 years. A reversion to mean valuation sets up SPG for potentially strong double-digit annual returns going forward.

Investor Takeaway

Simon Property Group owns some of the best malls and outlet centers in America and internationally. The stock has been hammered due to concerns over the potential for a recession, but that appears to be an overreaction, especially considering its avenues for growth. Meanwhile, SPG maintains a strong balance sheet and pays a well-covered dividend yielding 6.9%. The stock appears cheap at the current price and has the potential to generate strong returns for investors going forward.

Be the first to comment