Parradee Kietsirikul Aveo

There is no better teacher than history in determining the future… There are answers worth billions of dollars in $30 history book. – Charlie Munger (Warren Buffett’s co-manager at Berkshire)

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 22, 2022.

In biotech investing, it’s an exciting time when you see your stocks getting bought out. After all, a stock usually gaps up more than 40% when news of an acquisition hits the market. Now, you should not invest in any company based on buyout speculation. No one legally knows when a company will get acquired. And, trying to forecast such an event is low yielding. Nevertheless, there are certain factors that I observed over the years that can position a company to get bought out. In this article, I’ll analyze the current biotech market environment while focusing on the latest deal with AVEO Oncology (NASDAQ:AVEO).

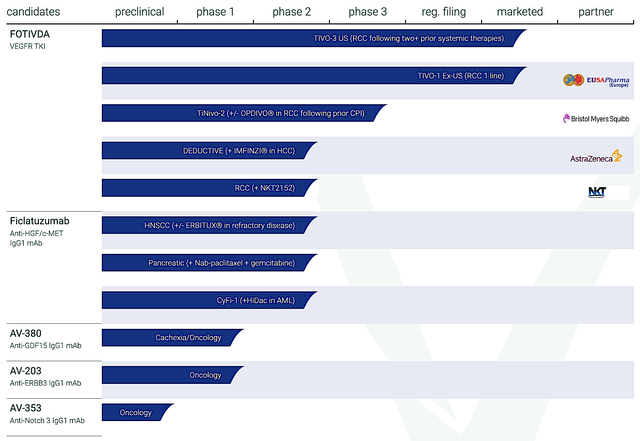

Figure 1: AVEO chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you’re familiar with the firm, I suggest that you skip to the next section. I noted in the prior article,

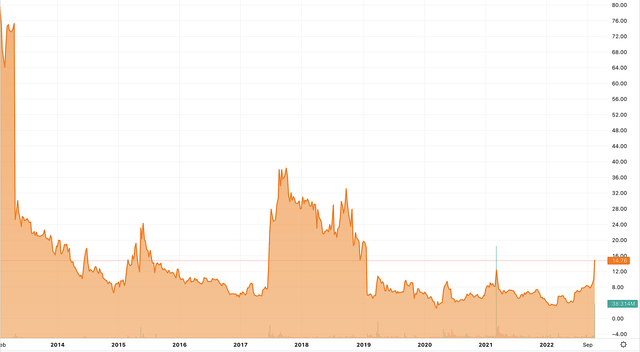

Headquartered in Cambridge MA, AVEO is focused on the innovation and commercialization of therapeutics to service different cancers. As a potent and selective inhibitor of vascular endothelial growth factor, i.e. VEGF (1, 2, and 3) receptors having a long half-life, the lead molecule (tivozanib) is being developed for the treatment of renal cell carcinoma (“RCC”) in North America. Back in August 2017, tivozanib is approved for advanced RCC. It is currently marketed by EUSA Pharma under the brand Fotivda.

Figure 2: Aveo’s pipeline

Factors Favoring Mergers & Acquisitions

Shifting gears, let us analyze the first factor that is important for mergers & acquisitions (i.e., M&A). That is to say, an M&A environment has to be “favorable.” Precisely speaking, a bearish (i.e., down) market is a prime-time acquisition environment for larger players.

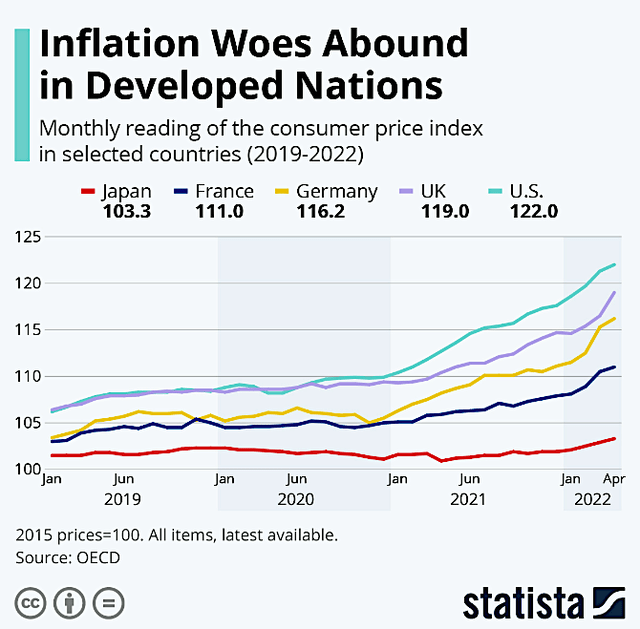

In 2022, you’ve been witnessing different macroeconomic factors clobbering the stock market. They include supply chain constraints relating to the pandemic, rising interest rates, falling home prices, looming recession, and hyperinflation. As you can see, the common denominator here (i.e., the underlying culprit) for the market decline is COVID-19.

Figure 3: Hyperinflation

Due to the aforesaid macros, many public companies are valued much lower than they were a couple of years ago. And if we proceed to a full-blown recession, you can pick up the same company even lower than a fraction of its intrinsic value (i.e., true worth). As such, you can imagine how M&A activity would pick up when there are many bargain issues being presented to well-capitalized/large operators. According to a report by the Big Four Accounting firm (PWC),

All of the stars are aligned for there to be a flurry of deals activity across all areas of the sector despite the slow start to the year so far. Many large pharma players are flush with cash (particularly those that have COVID-19 treatments in their arsenal), biotech valuations have been normalizing after years of a boom market and the 2025 patent cliff is rapidly approaching, all making for a strong deal environment.

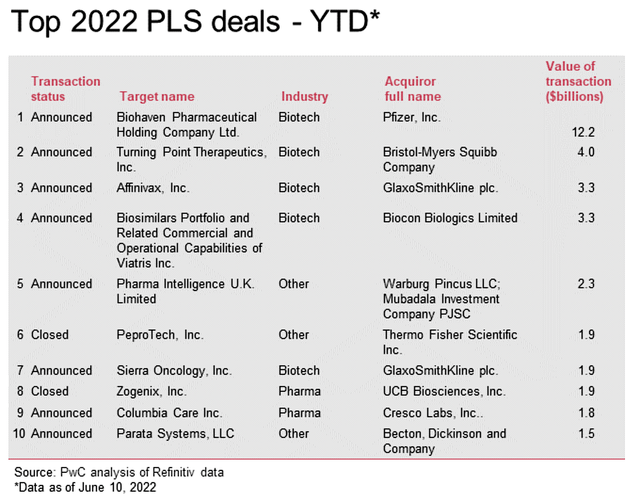

Figure 4: Notable Deals in 2022

As PwC stated, it’s quite important that larger pharmaceutical companies are adequately capitalized to execute the deals. In other words, they have to be flushed with cash. Else, they’d need to have the financial strengths to execute an acquisition via either commercial debt or equity financing.

Another caveat is that companies seeking to acquire other operators typically want to replace their flagship products that are falling off “the patent cliff.” Moreover, some companies simply want to deepen/broaden their pipeline of therapeutic offerings. Furthermore, certain firms can leverage M&A to penetrate foreign markets.

LG Chem To Acquire Aveo

In expanding its commercial footprint in America, LG Chem is poised to acquire Aveo for $566M. At that price, LG chem would buy out Aveo for $15.00 per share, or my estimate of 5X forward revenues. As Aveo disclosed, the transaction would be executed in an all-cash deal.

At such a price, you can see that the deal is at a 43% premium to Aveo’s market valuation on October 17. On a 30-day moving average basis, that would be 71% higher. Even at that premium, you can see from the figure below that Aveo shares are still much lower than their former highs.

Figure 5: Aveo’s long-term share price

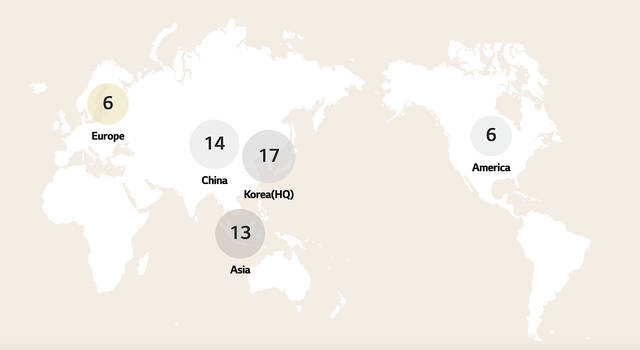

Beyond a favorable market environment, bigger companies are also looking to acquire smaller ones to expand their pipeline as well as gain a presence in new markets. Companies wanting to penetrate into additional geography tend to be foreign operators like LG Chem that are already operating outside their country.

Figure 6: LG Chem’s geographic presence

As you can imagine, LG Chem is getting a great deal here. In other words, Fotivda is already launched in the USA as well as in other countries. In the US, it is commercialized as a second/third-line (2/3L) treatment for renal cell carcinoma (i.e., RCC). Outside the USA, Fotivda is marketed as a first-line (1L) drug for RCC. Notably, a first-choice (1L) drug is one that tends to deliver blockbuster sales. Nevertheless, sales also depend on the market. As you know, the US market has the best reimbursement and thereby boosts the profit margin.

Given that Fotivda does not have 1L status in North America, it’s unlikely to become a blockbuster. In my opinion, an approved drug like Fotivda with multiple ongoing label expansions should be worth a couple hundred million dollars. That aside, I believe that LG Chem also sized up the other four molecules in the pipeline. If ficlatuzumab can become a blockbuster, it alone should be worth roughly a billion dollars. Commenting on the deal, the CEO of LG Chem (Hak-Cheol) noted,

With its track record of clinical success, deep pipeline of innovative therapies and continued growth trajectory following the successful commercialization of Fotivda, Aveo is the perfect partner for LG Chem Life Sciences. This transaction represents the next step in our portfolio transformation towards higher growth markets and provides a strong commercial foundation in oncology as we continue to develop our anti-cancer offerings …

Figure 7: CEO Hak-Cheol

Financial Assessment

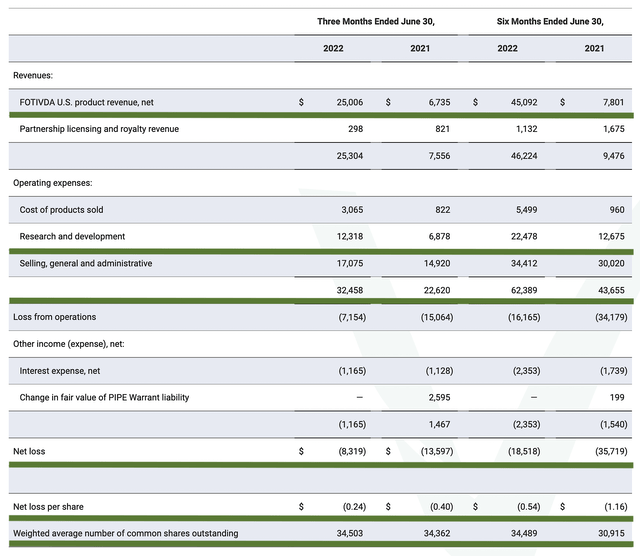

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, you should assess the 2Q2022 earnings report for the period that ended on June 30.

As follows, Aveo procured $25.0M in Fotivda US product sales compared to $6.7M for the same period a year prior. The 273.1% year-over-year (YOY) sales increase signifies that Fotivda is a promising drug that is gaining strong market traction.

That aside, the research and development (R&D) for the respective periods registered at $12.3M and $6.8M. I viewed the 80.8% R&D increase positively because the money invested today can turn into blockbuster results. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $8.3M ($0.24 per share) net losses compared to $13.5M ($0.40 per share) decline for the same comparison. On a per-share basis, the bottom line is improved by 50%.

Figure 8: Key financial metrics

About the balance sheet, there were $77.2M in cash, equivalents, and investments. On top of the $25.3M in quarterly revenue (and against the $32.4M quarterly OpEx), there should be adequate capital to fund operations into yearend 2025. Simply put, the cash position is robust relative to the burn rate that is adjusted with the revenue.

While on the balance sheet, you should check to see if Aveo is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding remain relatively the same at 34.5M, Aveo easily cleared my 30% annual dilution cut-off for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern relating to Aveo for you (as an investor) is that the deal might not be consummated. That is to say, the shareholders might not vote to approve the deal.

The risk for LG Chem is that Fotivda sales might disappoint. In that situation, it won’t generate enough revenue to justify the acquisition price. Moreover, the additional pipeline advancement might not bear fruits. Furthermore, the therapeutic innovation process is lengthy and highly capital-intensive. Therefore, Aveo might burn through significant cash.

Final Remarks

In all, LG Chem took prudent steps as it acquires Aveo in a highly favorable market environment. LG Chem can now take ownership of the same company Aveo that was trading several folds higher in the previous few years. With LG Chem’s robust financial resources and expertise, Aveo can now embark on a more aggressive launch to send Fotivda to many more patients. In addition, there are other pipeline drugs that are likely to generate positive advanced data, gain regulatory approval, and perhaps become blockbusters. Looking ahead, it seems like the favorable market environment is likely to generate more deals.

Be the first to comment