Ryan Fletcher/iStock Editorial via Getty Images

Bombardier (OTCQX:BDRBD) has been one of the names that I have been covering for years. Bombardier as we know it today is not the Bombardier that I wrote about years ago. Years ago, Bombardier was a company with a huge debt load and a lot of disappointment built into it. The company saw some unsatisfying performance in its rail business and proceeds from commercial aircraft were under pressure due to an aging product line while the C Series project was essentially locked in a position where Bombardier could never reap the rewards of its investments. That left Bombardier with a tough choice to make: Leave the business jet side or the rail business. It became the latter leaving the company as a business jet maker. A decision that haven’t been a bad one it seems as I show in an earnings analysis.

New Bombardier, New Ticker

With its refocus from transportation in a very broad sense to business jet, I do see Bombardier as a new a company or as reborn company. Bombardier must have felt reborn as well as it changed its ticker to BBD.A:CA and underwent a 1-to-25 reverse stock split turning 25 shares into 1 share bringing the number of shares in line with that of companies with similar market caps. The reverse split also means that shares are traded in higher dollar increment values, so in some sense people will think twice about selling shares but also about buying shares. So, this move is not necessarily good for the number of shares that are being traded each trading day but could provide a bit of stability as investors are not shaving their positions due to the low prices nor is there a low share price that attracts traders to make a quick buck driven by the psychologically low pricing level.

It was observed that Bombardier shares have a rather limited trading volume of several thousand shares per day which for me is a reason to provide a word of caution on the volume: Due to the low volume there might be a lack of liquidity, which makes quick buying and selling and constant prices more challenging and could possibly result in higher volatility when buying or selling occurs. This provides opportunity for investors, but associated risks should also be kept in mind.

Bombardier Revenues Contract, Earnings Improve

Bombardier Q1 2022 revenues (Bombardier )

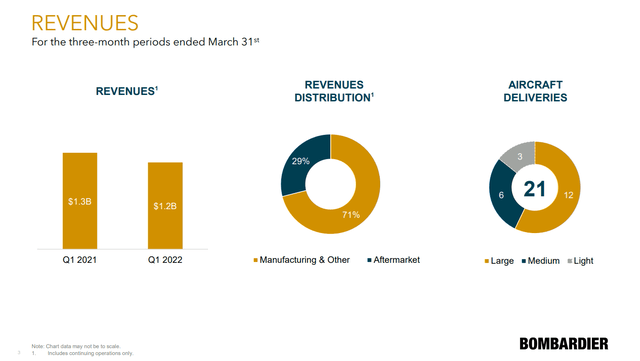

Bombardier revenues actually contracted from $1.3 billion last year to $1.2 billion this year. Services accounted for 29% or $361 million of the revenues and $885 million for Manufacturing & Others. The decline was due to the delivery of five fewer business jets during the quarter which had a $182 million impact resulting in a 7% reduction in revenues. Absent of the volume reduction, revenues would have grown 22% but a reduction in volume is not something I want to account for as the reduction in volume is a business reality. Viewed by segment, there was a 15.6% reduction in manufacturing revenues, a 34.2% increase in services revenues and a 22.7% decrease in other revenues. The strong uptick in services revenues is driven by increased flight activity. Overall, despite geopolitical tensions and a slight decrease in deliveries the revenues looked strong.

Bombardier Q1 2022 earnings (Bombardier )

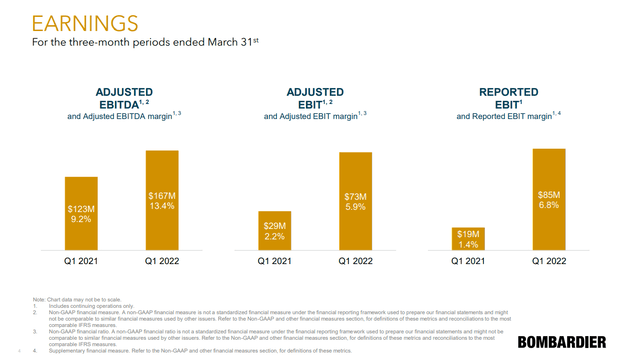

Despite lower revenues, earnings trended up which is a very good sign as it shows there’s strong margin improvement. This margin expansion was driven by strong revenues in the aftersales market which tends to have strong margins, an improving cost structure and margin improvement on the Global 7500 program.

The strong execution on top and bottom line also positively impacted the free cash flow which was $173 million marking a $578 million improvement. Those who have followed my Bombardier coverage might remember that one of my concerns was that absence of positive free cash flow, there was no sustainable path ahead for Bombardier to reduce its debt levels. We’re now seeing that the company is using the proceeds from its divestures to reduce the debt load and subsequently reduce the interest due on its debt providing some relief on its cash flow. During the quarter $400 million in debt was repaid resulting in $30 million in annual interest savings. Over the past twelve, debt was reduced by $3.4 billion reducing the annual interest expenses by over $250 million. One thing to keep in mind is that while free cash flow improvement was attributed to lower interest expenses, free cash flow excludes debt repayment and interest expenses. So, the $173 million is a measure of how much is available for debt repayment, shareholders and interest payments from operations. Overall, there are cash savings but in the way free cash flow is defined you won’t see it in the free cash flow metric.

Bombardier currently has no debt maturing until 2024. That’s quite a difference from 2019 when there was $5.42 billion in debt maturing until 2024. Bombardier has $2.7 billion of debt maturing in the coming five years (2022 included) compared to $4.42 billion in 2019. So, things are improving. There is $6.65 billion in long-term debt, $1.4 billion in cash and cash equivalents and $0.4 billion in restricted cash putting Bombardier in a $4.8 billion net debt position. So, the business jet maker is on the right track but does require continued strong cash flows to reduce its debt. For 2022, the free cash flow is expected to be $500 million which would mean that the company would need around 10 years to pay off the debt using its free cash flows excluding interest expenses. Most of the company’s debt is set to mature in the coming five years showing that the company has some steps to make in expanding the free cash flow in order to be able to pay off debt. Of course, it should be noted that it’s not realistic to assume that the company will reduce its debt level to zero so there will be some relief in refinancing debt though with rising interest rates refinancing debt is going to increase interest expenses for most companies. At the same time it should be noted that with Bombardier becoming a healthier company with better prospects, interest due to increases risk of loaning money should come down.

Things Are Looking Good For Bombardier

Bombardier Global 7500 business jet (Bombardier)

Looking at maturing debt, Bombardier is not there yet but things are looking very promising. The company has guided for $500 million in free cash flow this year and realized $173 million in the first quarter showing that it’s slightly ahead of the plan on an equal-weighted scale. Furthermore, the company is expanding its aftersales footprint around the globe with expansions in Singapore having come online, planned expansions in the UK and new sites in Miami and Melbourne to be opened later this year. As efficiency in new facilities needs to ramp up, we’re going to see most of that addition to company results going to come in 2023 and beyond and provide support to the $2 billion in targeted aftersales revenues by 2025 up from approximately $1.2 billion this year.

Bombardier expects Q2 and Q3 deliveries to be flat year-over-year with an uptick in Q4. This does not necessarily provide a lead for stable revenue of profit assumptions as lower deliveries of small business jet is going to be offset by more deliveries of the medium and large jets which have a higher price tag. The EBITDA margins will be a bit under pressure as newer aircraft with margins that are ramping up are going to be more dominant in the delivery mix where Bombardier is transitioning from Challenger 350 to Challenger 3500 production and increasing the output of Global 5500 and the Global 6500 while the Global 7500 is going through a margin ramp up.

Overall, the company is expecting $7.5 billion in revenues by 2025 and cash flow higher than $500 million which provides the company with significant space to keep the debt runway clear for two years as targeted.

Conclusion

Previously I haven’t been bullish on Bombardier’s prospects. This was driven by the company executing badly in some of its segments. Most notably this resulted in a weak commercial aircraft line up and a C Series agreement with Airbus which due to the conditions of the joint venture agreement could never provide Bombardier with the value it deserved.

Things are looking differently now. Bombardier has made the painful cuts and is successfully turning the company around with a focus on aftermarket sales expansion. Previously, I wasn’t really enthusiastic about Bombardier’s turnaround plans as they were plans that assumed perfect execution. The current plans are ambitious as well, but Bombardier is now focusing on doing one thing well which is building and supporting business jets and the results are already showing while the company for instance for 2022 has been conservative with is guidance expecting stable flying hours while hours are actually increasing. So, the company might positively surprise in the best case and in the worst case it has built in sufficient buffers in its assumptions. I believe that with the significant expansion into services as well as the focus on business jets, if you want to own shares of a business jet manufacturer Bombardier is a promising name.

Be the first to comment