skynesher/E+ via Getty Images

Ares Commercial Real Estate Corporation (NYSE:ACRE) is a well-priced senior loan mortgage trust with a sizable origination operation. Because of its extensive assets in floating rate senior commercial mortgage loans, the trust has a well-covered dividend and interest rate upside.

The stock is trading at a discount, and the company benefits from its partnership with Ares Management Corporation.

Senior-Loan Focused Origination Business

Ares Commercial specializes in senior loan origination in the commercial real estate market in the United States. The trust benefits from its partnership with Ares Management Corporation, a worldwide investment manager with $325 billion in assets under management and a $46 billion global real estate asset platform. Ares Management Corporation sponsored Ares Commercial.

Assets Under Management (Ares Commercial R/E Corp)

The trust generally originates commercial senior loans in the industrial, multi-family, hotel, office, and self-storage sectors, but it also has exposure to the less transparent student housing and residential sectors. Ares Commercial typically invests in senior (secured) loans with a target investment size of $10-250 million, with loans having a short duration (3 years) and floating rates that alter as interest rates change.

Target Investments And Property Type (Ares Commercial R/E Corp)

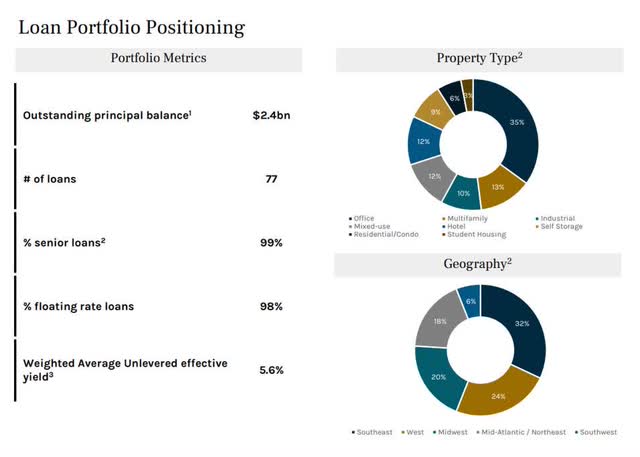

The trust has amassed a $2.4 billion loan portfolio comprised of 77 significant loans. Furthermore, 99% of all loans have senior features, which means they are heavily backed by cash-flowing assets.

Offices are Ares Commercial’s largest investment category, accounting for 35% of the trust’s portfolio. Multifamily loans account for 13% of the trust’s loan exposure, while mixed-use loans account for 12%, hotels account for 12%, industrial accounts for 10%, self-storage accounts for 9%, residential accounts for 6%, and student housing accounts for 3%.

Loan Portfolio Positioning (Ares Commercial R/E Corp)

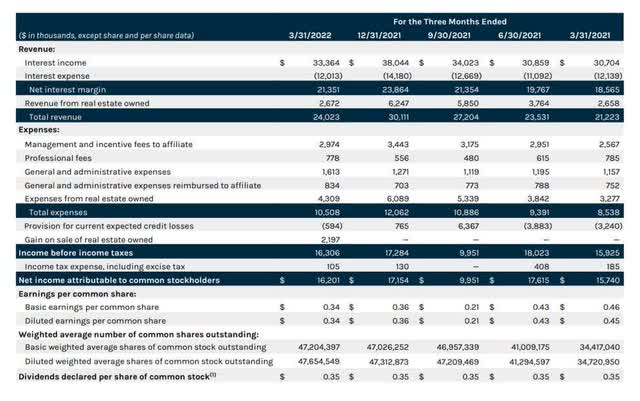

Ares Commercial’s net interest margin generates the majority of their revenue, with the remaining coming from owned real estate. The net interest margin reflects interest revenue from Ares Commercial’s significant senior loan portfolio, which serves as the trust’s primary activity.

Net Interest Margin (Ares Commercial R/E Corp)

Interest Rate Upside

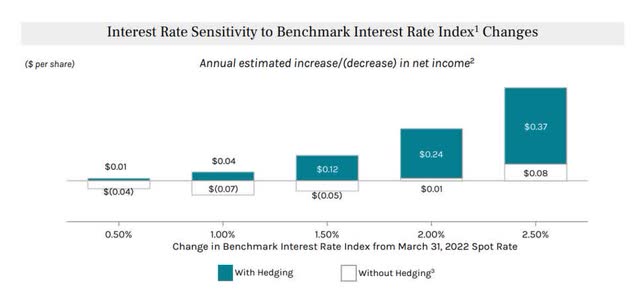

Ares Commercial originates senior loans, the majority of which are floating rate. With floating rates on 98% of generated loans, the trust is well-positioned for increased interest rates.

According to management predictions, a 2% increase in benchmark interest rates will result in an annual increase in net income of $0.24 per share.

Since the central bank has indicated that it intends to begin on an aggressive interest rate hike cycle in order to manage inflation, Ares Commercial’s earnings are expected to rise as interest rates rise. Because of Ares Commercial’s interest rate sensitivity, an investment in the trust may also operate as an inflation hedge.

Interest Rate Sensitivity (Ares Commercial R/E Corp)

The Dividend Is Well-Covered

Ares Commercial pays a quarterly base dividend of $0.33 per share, which is currently supplemented with a special dividend of $0.02 per share.

Over the last year, the total quarterly dividend pay-out has been $0.35 per share, and Ares Commercial covers its dividend with distributable earnings. In reality, Ares Capital has regularly covered its dividend payments with distributable earnings for the last five years. Ares Commercial’s most recent dividend coverage ratio, based on the last twelve months, was 1.1x.

Full Dividend Coverage (Ares Commercial R/E Corp)

Selling At A Discount To Book Value

Ares Commercial’s stock trades at a 3% discount to book value, whilst other trusts in the sector, such as Starwood Property Trust (STWD) and Blackstone Mortgage Trust (BXMT), trade at P/B multiples greater than 1x, implying premiums. I don’t think there’s a clear reason why Ares Commercial is selling at a discount, especially when Ares Commercial’s portfolio is heavy on senior (secured) loans.

Why Ares Commercial Could See A Lower Stock Price

Ares Commercial’s capacity to expand revenues is dependent on the health of its origination business, which is dependent on the strength of the commercial real estate market in the United States.

Ares Commercial faces risks from declining demand for new originations during a recession, as well as debtors failing on their financial responsibilities. The trust’s heavy exposure to office properties could be a concern for Ares Commercial, as this industry is notoriously cyclical.

My Conclusion

Ares Commercial’s strong 9.3% yield is covered by distributable earnings, and it has continuously covered its dividend pay-out over the last five years.

Because loss ratios on highly secured loans are relatively low, focusing on senior loans protects shareholders in the event of a real estate recession.

Furthermore, Ares Commercial’s high 98% variable rate percentage provides interest rate upside, implying that the trust is poised for increased income when interest rates rise.

Dividend investors seeking substantial dividend income should examine Ares Commercial, which trades at a discount to book value.

Be the first to comment