Spencer Platt

Robinhood (NASDAQ:HOOD) is an American financial services company with a market capitalization of around $10 billion. The company’s earnings were pummeled by the market; however, the market rewarded the company for less than expected weakness in the losses. As we’ll see throughout this article, the company remains overvalued as users continue to flee.

Robinhood and FTX

Although Robinhood has no direct interest with FTX, FTX’s now disgraced owner Sam Bankman-Fried purchased an almost 8% stake in the company with almost 60 million shares. That stake is worth more than $500 million, and there’s a good chance that at this point with FTX, at minimum, it’ll need to be liquidated.

If nothing else, that’ll put immediate short-term pressure on the company’s stock.

Robinhood Financial Results

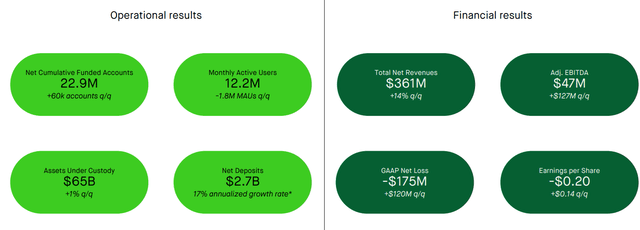

The company had financial results in the most recent quarter that indicate it’s still struggling.

Robinhood Investor Presentation

The company has almost 23 million funded accounts, however, that growth rate has slowed down to almost 0. The annualized growth rate of user accounts in the most recent quarter was <1% showing a continued lack of demand for users to the company’s operations. The company’s AUC increased slightly more than funded accounts, but not by much.

However, the bigger loss was that inactive users grew significantly as MAU declined. The company reported $361 million in net revenues which it turned into -$175 million in losses, although its losses decreased substantially quarter-over-quarter. Layoffs were a cheap way for the company to reduce costs, but we expect it doesn’t have substantial room for new layoffs.

The company does have a $6 billion net cash position which means that it can sustain losses for the long-term but there’s still a limit here to what can be handled. More than $600 million in annual losses before dilution is not sustainable.

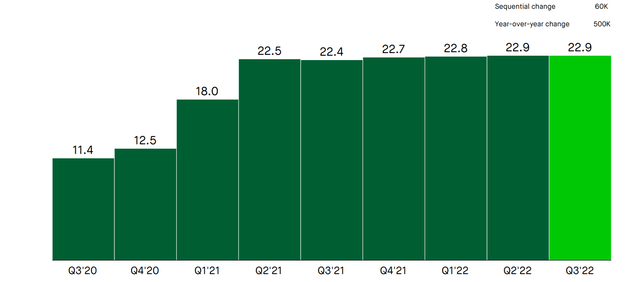

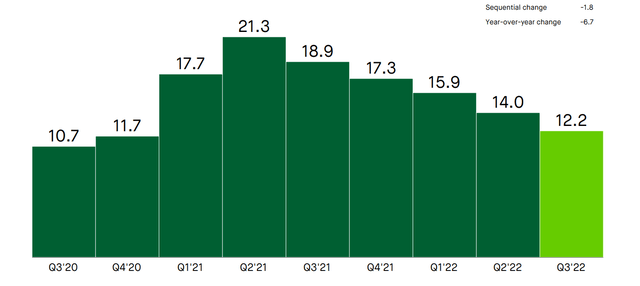

Robinhood Stagnation

The company has continued to stagnate substantially from a user perspective, indicating its difficulties.

Robinhood Investor Presentation Robinhood Investor Presentation

The company’s stagnation is clearly evident through its available user accounts. The company’s total funded user accounts have flattened out and the company’s MAU accounts have decreased substantially QoQ. Given these continued declines, we expect that the company’s inactive accounts will continue increasing.

That stagnation will hurt the company’s ability to recover and move from massive losses to a point where it can make gains.

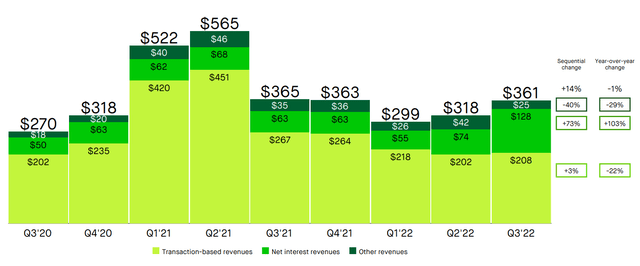

Robinhood Interest vs. Losses

The company has continued to have reasonable revenue and cash flow but loses money every day.

Robinhood Investor Presentation

The company’s revenue managed to increase QoQ supported by increasing interest expenses as other revenue slowed down. We see this more as a delayed response, in higher interest rate environments, investors will be reluctant to leave money behind on the table, but they might be slow to withdraw their money.

However, the other thing to keep in mind is this revenue appears wholly unsustainable to generate a $10 billion valuation without growth. The company’s annualized revenue is barely crossing $1.5 billion, the ability to generate almost $1 billion in annualized profits from such a valuation would be difficult.

Unless the company can switch to a portfolio of substantial revenue growth or customers choose to leave substantial cash behind even in a high interest environment, the company doesn’t appear to have a simple path forward.

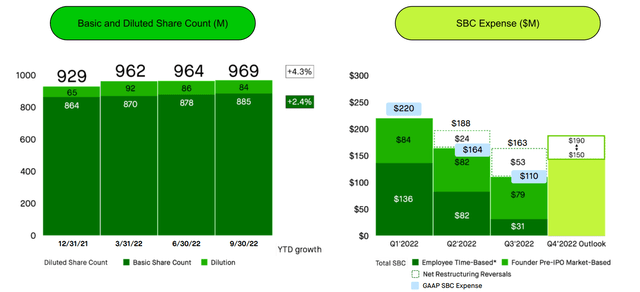

Robinhood Dilution and Cash

The company has continued to have sizable dilution that will hurt its ability to drive returns.

Robinhood Investor Presentation

One of the big costs with tech employees, one that’s not readily available to investors, is the cost of RSUs. The company’s outstanding RSUs that will contribute to dilution is a massive 84 million shares (almost 10% of outstanding shares). The company’s outlook for stock-based compensation expense gives a better picture at ~$170 million in 4Q 2022.

That expense is substantial, it’s equivalent to roughly 50% of the company’s revenue. That continued expense will continue to hurt investors even if it doesn’t touch the cash pile, hurting the company’s ability to generate shareholder returns.

Our View

In our opinion, Robinhood is a slowly dying company.

The company does have a substantial cash position that’s protecting it and it has a platform that users continue to remain interested in. However, the company’s revenue is declining when you don’t account from the interest-rate boost, something that we view as both more temporary and more transitory for the company.

Additionally the company continues to have major hidden expenses through stock-based compensation etc. Until that turns around, and it’s showing no sign of doing so, we expect the company to continue underperforming.

Thesis Risk

The largest risk to our thesis is that Robinhood was once the darling of young new investors. The company’s reputation was tarnished by the GameStop fiasco, but it still has the ability to become popular once again, supported by a substantial cash position. The company doesn’t need a major turn in the winds to return to its previous positioning.

Conclusion

Robinhood has continued to suffer substantially. The company has a market cap of almost $10 billion and a cash position of roughly $6 billion meaning there’s not a lot of market capitalization that’s left in the company. That’s not surprising given the company continues to have substantial losses to the tune more than $500 million annualized.

Going forward, the company also has stock-based compensation as a major expense that’s not being accounted for. As long as those struggles continue, without the company turning around its luck, we expect the company to generate no noticeable shareholder rewards, making it a poor investment for any portfolio.

Be the first to comment