think4photop/iStock via Getty Images

The high prices of natural gas in the European region present a great opportunity for producers of the substance. One of the entities that stands to benefit is Trillion Energy International (OTCQB:TRLEF). The company is fully funded and already begun drilling wells. At the same time, it is trading at significant discount to the estimated NPV of its main project, offering a potentially high reward to those willing to take the risk.

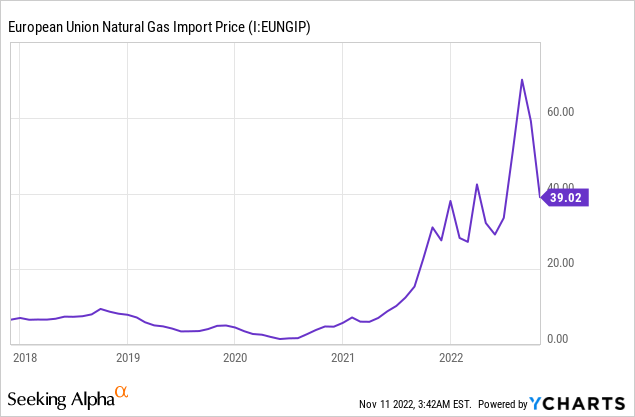

The market opportunity

Natural gas was destined to be at the forefront of Europe’s energy transition. Many European households and industrial facilities were powered primarily by Russian gas. However, following the events of this year, Europe has lost its biggest supplier. As a result, natural gas’ prices went parabolic. Although there’s been decrease in prices lately, a few factors have to be considered. First, the weather in October was unusually hot, reducing energy demand for heating. In addition, Europe’s storage facilities were filled, while flows from Russia were still largely available. Moreover, China has reduced its demand for LNG, compared to last year.

Despite the energy crisis, the anti-fossil fuels agenda of the European politicians continues. In that regard, Netherlands, as one of the most active pushers of the green agenda, in September decided to implement a sharp cut of gas production from the Groningen field, which once was one of the primary natural gas sources for Europe. To make matters worse, the Dutch government plans to end all extraction from that field by 2024. When it comes to relations with Russia, even if the war in Ukraine stops, it’s doubtful that pre-war economic relations will be immediately restored. Not to mention that the serious damage of the Nord Stream pipeline will likely take a long time to be restored, even if there’s a will for it to be done by both sides. Due to all of these factors, I think that the current decline is temporary and higher gas prices will be persistent for the foreseeable future.

Such situation seems ideal for companies producing natural gas in a close proximity to Europe, therefore are exposed to the high pricing environment, but at the same time EU politicians don’t have the power to force their green agenda on those entities.

Company overview

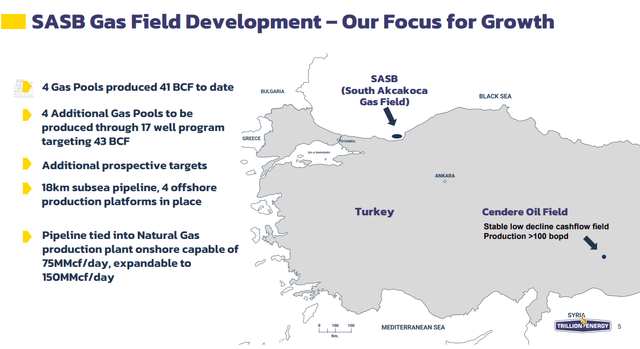

Trillion Energy is a Canadian oil and gas company with assets in Turley and Bulgaria. The flagship asset of the company – the SASB gas field is located in the Black Sea, 18km away from the Coast of Turkey. The Canadian entity has 49% working interest in the field, while the remaining 51% belong to the state-owned Turkish Petroleum Corporation (TPAO). Trillion also has 19.8% WI in the Cendere oil field, which amount brings attributable production to around 100boe/day and 100% interest in the Vranino 1-11 Gas project in Bulgaria.

Trillion’s Turkish assets (Trillion Energy)

As of August 2022, there are 371.4M shares outstanding, 109.5M warrants and 9.5M options. It’s important to note that the vast majority of warrants are exercisable at prices between US$0.35 and US$0.39/share, which is around the current share price, therefore dilution is very likely.

The SASB Gas Field

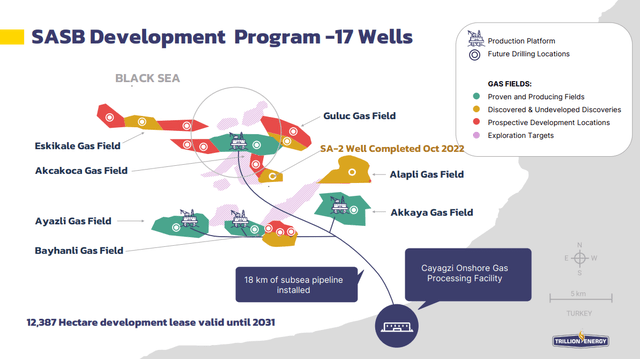

The SASB project includes 17 wells, which are to be drilled in two phases – A and B, focusing first on the Akcakoca area of the project. The transport infrastructure is already in place and all that remains is for the wells to be drilled.

The SASB Gas Field (Trillion Energy)

Drilling has already began, as in the beginning of November, Trillion reported successful flow test at a rate of 7.0-8.2 MMcf per day at the South Akcakoca-2 well, which is the first to be completed out of 17 planned. The company intends to complete and put into production a new well every 45 days, while reentry in the past producing wells should take 15 days on average.

Strong balance sheet and cash flow generating potential

As of the end of Q2’22, Trillion has more than US$23.5M of cash and equivalents, which are more than enough for the spudding of the first wells to be completed. In addition, as most warrants are on the money, they could be exercised and bring additional US$35M.

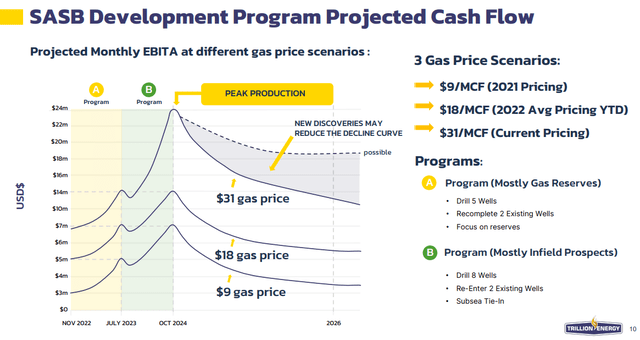

SASB cash flow generating potential (Trillion Energy)

However, as wells are being put into production, they’ll start generating cash flows, which at current price environment are expected to be massive for the size of the company. Therefore, the spudding of the latter wells is going to be self-funded. Peak production is projected to be reached in H2’24, when at current prices, the company could be generating US$24M EBITDA per month.

Note, that Trillion will sell its production entirely in Turkey, therefore supplying the EU market is not part of the plan as of now. However, gas prices in Turkey follow those on the EU market, and were hiked significantly throughout the year.

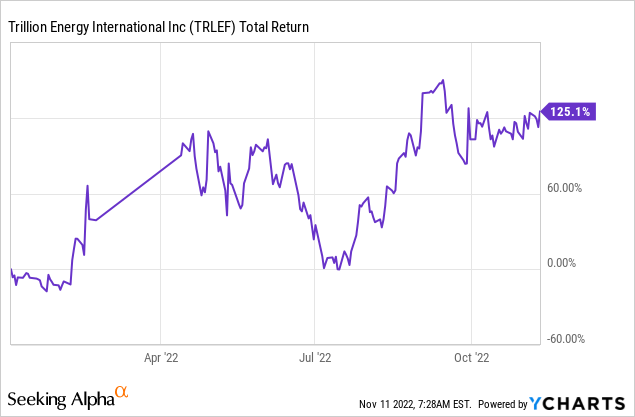

Share price and valuation

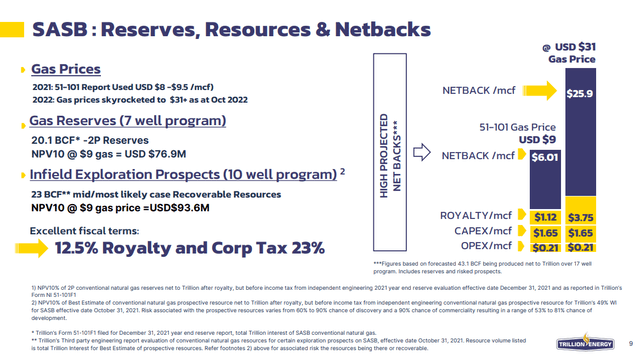

YtD, the shares of Trillion have risen an impressive 125.1%. However, I think there’s more room for expansion. Currently, the EV of the company is around US$107M, while the estimated NPV of the SASB at natural gas prices around US$9/Mcf is north of US$170M. However, at current market prices, which are slightly below US$31/Mcf, the estimated NPV jumps more than 4 times.

SASB estimated NPV (Trillion Energy)

Besides further exploration successes, I think that as wells go into production and the company starts to generate serious cash flow as a result, it may end up on investors’ radar. So news about putting wells into operations and releasing of the Q4’22 statements could act as near-term upside triggers. Obviously, moves of the natural gas prices to the upside could also lead to share price appreciation.

Risks

Political risk – The company operates in Turkey, which is notorious for its unconventional economic policies – interest rates are being aggressively lowered amidst record inflation. However, political interference in Turkey seems to be limited to domestic economic affairs only. The country is an importer of energy, therefore developing potential own energy resources is critical. The last thing that a government should do in such cases is to be hostile towards foreign investors, who are willing to participate in the development of these resources. So I don’t expect any political interference in Trillion’s business nor price caps on natural gas.

Natural gas prices risk – The short-sighted energy policy of the EU countries and the restricted economic relations with Russia have led to constrained natural gas supply in the region. As those two factors are likely to be persistent, natural gas prices should remain elevated.

Conclusion

Trillion Energy stands to benefit from elevated natural gas prices in the European region. Currently, the company is trading well-below the indicated NPV of its SASB project, which is becoming cash flow generating as we speak. Any news about wells going into production, therefore reaffirming the cash flow generation could act as near-term upside triggers. Given the current and prospective situation in Europe, natural gas prices will likely remain high, therefore benefiting Trillion’s shareholders.

Be the first to comment