Chinnapong/iStock via Getty Images

Market prognostication is especially hard to do in the short run, as reflected by an analyst on a popular financial news site recently proclaiming a bottom in the market, only to see the S&P 500 (SPY) reach bear market territory after being thumped for two consecutive days. That’s why I don’t try to time a bottom, rather opting to layer in capital when quality companies take a nosedive.

This brings me to Kimco Realty (NYSE:KIM), which has returned to value territory after material price drops since the start of this month. In this article, I highlight what makes KIM a solid quality buy for long-term income and capital appreciation at the current price, so let’s get started.

Why KIM?

Kimco Realty is the largest owner and operator of open air shopping centers in North America, with 537 centers spread across the U.S. covering 93 million square feet of gross leasable space. It has a long track record in this industry, having been around for more than 60 years, and having been publicly traded since 1991.

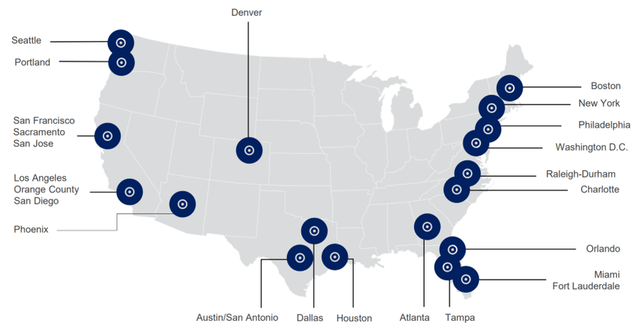

KIM has made great strides in up-leveling its portfolio to primarily growing Tier 1 markets with high population density. As shown below, KIM’s properties are well-located in large MSAs on the two costs, with additional exposure to growing cities in Texas, Denver, and Phoenix.

KIM Locations (Investor Presentation)

Moreover, KIM’s properties serve as essential community centers, as the company bills itself as “First In Last Mile”. This is reflected by the fact that a high number of its properties (80%) are grocery anchored, thereby making them economically essential to its surrounding communities, and e-commerce resistant.

KIM maximizes its last mile advantage, as it offers over 300 sites with curbside pickup following its merger with Weingarten Realty. This makes KIM’s sites attractive for those retailers wanting to expand their omnichannel strategy of shop online and pick-up in store. This is perhaps best exemplified by comments from the CEO during the recent conference call:

When retailers evaluate the real estate, they no longer separate their warehouse and distribution needs from their sales requirements. Today, leading retailers are taking a holistic approach to determine the best locations to ultimately serve their customers. Indeed, this integrative approach is the dominant recurring theme during our portfolio reviews with retailers and is creating more demand for optimal location.

We are seeing renewal and new deal demand for well-located space that is not only suitable for generating in store sales, but it’s also conducive to last mile distribution and fulfillment. Target stores is a bellwether for this new approach, with more than 95% of their total sales, physical and online being fulfilled through their store base. The result is a tremendous Halo in value as their existing and growing store fleet. This trend of increased capital spending by retailers and the renewed focus on and demand for quality locations is good news for Kimco.

Retailers are also keen in knowing that the increased foot traffic from in-store pickups result in higher sales. Notably, Amazon (AMZN) has imposed a 5% fuel and inflation surcharge on sellers, thereby making pure e-commerce less competitive against an omnichannel strategy.

Meanwhile, KIM appears to be executing well, growing FFO per share by 18% YoY to $0.39 and same-property NOI by 8.9% YoY. This was driven by strong demand for its spaces, with a blended rental spread of 7.2%, comprised of 18.6% spread on new leases, and 6.4% of renewals. Furthermore, KIM grew occupancy by 30 basis points sequentially to 94.7% in the first quarter. Notably, this represents the highest sequential occupancy growth during a first quarter for Kimco in over a decade.

Risks to KIM include macroeconomic headwinds, which could hurt tenant profitability and higher interest rates, which could raise KIM’s cost of debt. This is mitigated by the fact that KIM maintains strong Baa1/BBB+ credit ratings from S&P and Fitch, enabling it to tap relatively cheaper sources of capital. I also find the net debt to EBITDA ratio of 6.4x to be fair, considering the long 9-year weighted average debt term and the redevelopments underway.

Meanwhile, KIM’s shares have taken a beating as of late, having fallen from their 52-week high of $26.57 achieved recently in late April to just $19.48 at present. It currently carries an RSI score of 28, indicating that it’s solidly in oversold territory. The dividend is also well-covered with a 51% payout ratio (based on Q1 FFO/share of $0.39), leaving the potential for more raises down the line as it heads towards the pre-pandemic rate and beyond.

I see value in the shares, which currently sit at a forward P/FFO of 12.7. While it’s not as cheap as peers such as Brixmor Property Group (BRX) and Kite Realty Group (KRG), I believe it deserves its slightly higher multiple given its higher exposure to Tier 1 markets. Morningstar has a $26.50 fair value estimate and sell-side analysts have an average price target of $27.41, implying a potential one-year 45% total return including dividends.

Investor Takeaway

KIM’s strong performance indicates that it is well-positioned to weather near-term headwinds. It has substantially grown its profitability over the past year, and maintains strong portfolio occupancy. The stock is down significantly from its 52-week highs, making it an attractive value play at current levels.

Be the first to comment