Nattakorn Maneerat/iStock via Getty Images

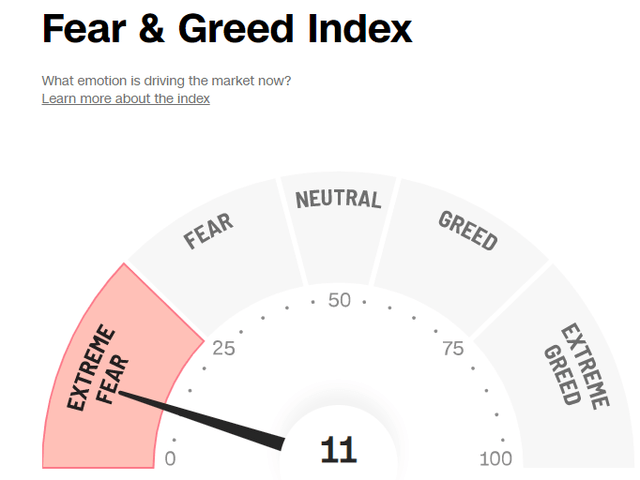

Right now, the market is very fearful.

So fearful that the ‘Fear & Greed’ index is near its lowest level ever recorded at 11, which is deeply in the “Extreme Fear” category:

CNBC Fear & Greed Index (CNBC)

In case you aren’t familiar with this index, it is a compilation of 7 different indicators that measure the behavior of the stock market. These include:

- Momentum

- Stock price breadth

- Stock price strength

- Put and call options

- Junk bond demand

- Safe haven demand

- Volatility

The index gives each indicator an equal weighting, and their average currently tells us that the market is extremely fearful.

This is a good thing because this index is used to gauge whether stocks are fairly valued or not. The logic here is that excessive fear tends to drive share prices below fair value, and too much greed tends to have the opposite effect.

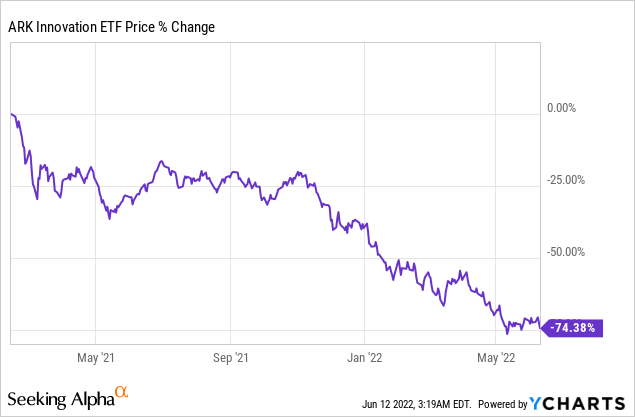

If you spent any time reading the comments of articles covering tech stocks (QQQ) back in late 2020 and early 2021, you would have noted that people were extremely optimistic, despite the fact that valuations were approaching levels last seen during the dot-com bubble. People were so optimistic because share prices seemed to be rising day after day…

… But we, of course, know how that played out in hindsight (ARKK):

Today, it is the opposite.

Investors are convinced that we are headed into a recession… inflation is high… and the declining share prices only fuel more and more pessimism.

These cycles of greed and fear happen largely because investors are excessively focused on short-term results and suffer behavioral biases in the wake of market volatility.

But if you think like a landlord, there really isn’t any major cause for concern. A 1-2 year recession has minimal impact on the true value of properties because valuations should be calculated based on decades of future expected cash flow. 1-2 years really isn’t that meaningful.

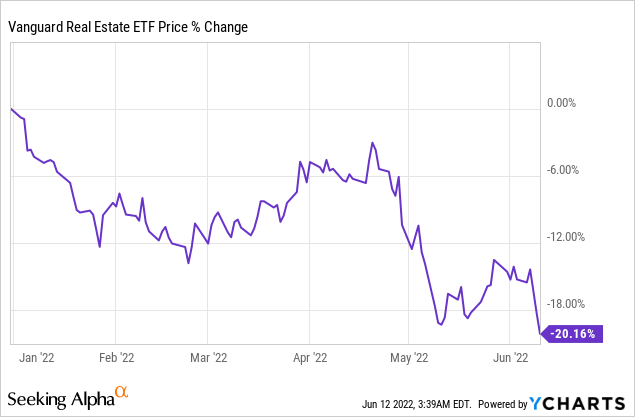

Moreover, most REITs (VNQ) are today well-managed, conservatively financed, and their properties generate cash flows that are at least somewhat resilient to recessions and inflation.

So that leads me to think that the extreme pessimism of short-term oriented investors has driven REIT share prices too low, providing some great opportunities for long-term investors who can think past a few years and truly act like landlords:

Today, we continue to execute our accumulation strategy that we outline in a separate article that you can read by clicking here.

In short, since we cannot time the market, we make small weekly purchases, buying more shares in many phases. This way, we are sure to profit in the long run, and we don’t risk running out of cash early into volatility.

I personally use liquidity from 4 different sources to make these additions. These include: dividend income, new savings, portfolio recycling, and maturing property loans that I reinvest in discounted REITs. You can follow a similar accumulation strategy, take inspiration from my purchases, and adapt it to your cash availability and risk tolerance.

In what follows, I share some of my latest purchases:

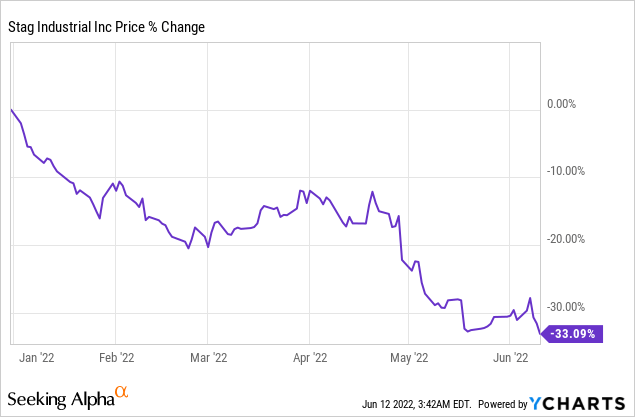

STAG Industrial (STAG)

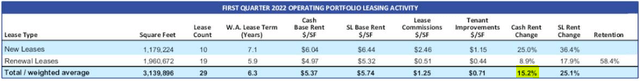

Recently, I bought more shares of STAG Industrial. The company’s share price has dropped 33% since the beginning of the year, and that’s despite the fact that its organic growth has accelerated:

The market fears that we could be approaching a recession, and industrial real estate has been notoriously hard hit in previous down cycles.

But what the market appears to ignore is that STAG’s leases are today deeply below market, and as it renews or signs new leases, it is able to push large rent hikes. In the first quarter of the year, it hiked rents by 15%+:

STAG Industrial rent growth is accelerating (STAG Industrial)

Picture of an industrial property owned by STAG:

STAG Industrial warehouse (STAG Industrial)

That’s some of the fastest growth we have ever seen coming from STAG Industrial. The CEO made the following note:

“We are coming off one of the best years we have had as a public company and our Q1 performance continues that trend.”

He added that:

“The industrial fundamental story is very much intact, with demand drivers, exceeding expectations and supply in check. Peculiar demand drivers including e-commerce, widespread supply chain reconfiguration, and an expected increase in inventory levels continue to be strong tailwinds.”

I think that China’s new lockdowns and Russia’s invasion of Ukraine will only cause more companies to reconsider their supply lines and bring larger portions of them back to the US, creating even more demand for STAG’s properties.

FFO per share rose 8.2% in the first quarter, and that’s unusually rapid growth for a company that’s priced at just 14x FFO. Most industrial peers trade at approx. a 10-turn high multiple, and their future growth prospects are not materially different.

We believe that as STAG continues to positively surprise the market with rent increases in the coming quarters, the market will regain some optimism and reprice the company at closer to 20x FFO, which would still be very reasonable for a REIT of this quality. While you wait for the upside, you also earn a monthly 4.5% dividend yield. We are upgrading STAG to a ‘Strong Buy’ rating.

Outfront Media (OUT)

Billboards can be great investments because they require relatively little investment and can generate an extraordinarily high return on the capital invested. Moreover, they also require little maintenance capex and technology isn’t a great threat to them. On the contrary, studies have shown that social media marketing such as ads on Facebook (META) combines really well with out-of-home advertising formats, which reinforce the message and add credibility to them:

Outfront Media billboards (Outfront Media)

But the one downside of billboards is that they are some of the most cyclical investment properties.

During good times, everyone wants to invest heavily in advertising. But when times get tough, companies cut their ad spend, and with that, landlords of billboards also experience declining cash flow.

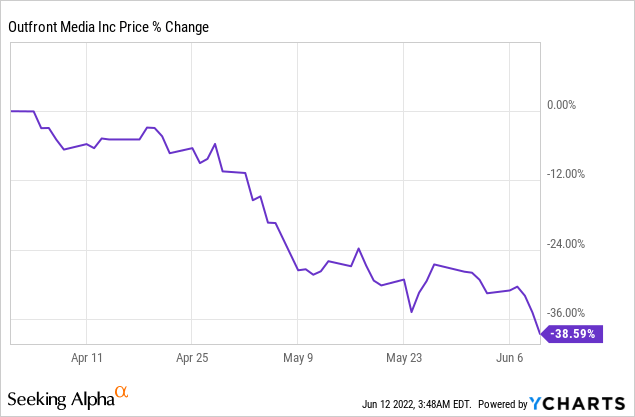

With that in mind, it is not surprising that Outfront’s stock declined when the market became fearful of a potential near-term recession.

Does OUT deserve to trade at a lower share price if we go into a recession? Yes, it probably does. But does it deserve to drop by nearly 40% in just two months?

Absolutely not.

As we explain in the introduction of this article, companies commonly get undervalued/overvalued because the market is excessively focused on short-term results.

The next 1-2 years could be tougher for OUT, if we go into a recession, but as we noted earlier, the impact of 1-2 years on the fair value of a company is not that significant.

If you have a 5+ year investment horizon, this is a great opportunity because you get to buy great assets at a steep discount due to near-term concerns that will eventually disappear and let place to more optimism.

Right now, OUT is priced at 7.5x normalized cash flow, a 6.8% current dividend yield, and an 8.5% dividend yield based on its pre-Covid payout rate.

Beyond that, if you ignore the recent stock price performance, OUT is actually doing really well at this moment. Its revenue recovered to pre-Covid levels in the last quarter, and the CEO noted on the conference call that the “Demand for our billboards has never been hotter”. He added that they continue to expect strong revenue growth in “virtually all regions for both billboards and transit.”

He said this in early May, so perhaps he spoke too soon, not knowing about the recession fears that were about to spread like wildfire.

But it just shows you that the drop in share price was fully driven by a change in narrative and market sentiment, not a deterioration in its fundamentals.

Moreover, OUT’s closest peer, Lamar (LAMR), just announced a 9% dividend hike:

Lamar hikes its rent (Seeking Alpha)

This provides further evidence that the outlook for billboards is likely stronger than what OUT’s share price performance may be implying.

Closing Note

The best time to invest is when fear is at its peak.

But that’s also the hardest time for most people to actually take action.

It is against our nature to be contrarian, and there are always good reasons for people to be fearful.

We don’t mean to deny the near-term risks that we are facing, but we are much more optimistic, especially at these lowered prices, because we think that long-term oriented landlords, and not like short-term oriented traders.

That seemingly small distinction makes all the difference.

We buy real estate at pennies on the dollar from investors who fail to see past the near-term challenges and miss the long-term opportunity.

Be the first to comment