Adrian Vidal

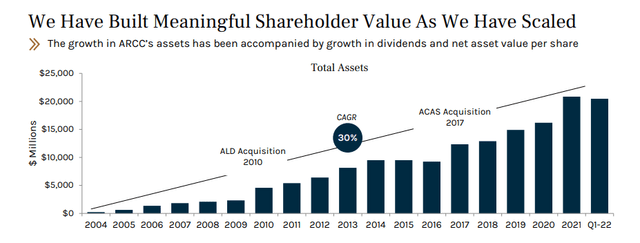

Shares of Ares Capital (NASDAQ:ARCC) slid more than -3% on 7/29 after news broke that ARCC would price 8 million shares in a public offering. The 8 million share offering came several days after ARCC beat Q2 earnings estimates on both EPS and investment income and rewarded shareholders with a 2.4% quarterly dividend increase. ARCC is the largest publicly traded BDC by net assets and market cap, and plays an important role as one of the largest direct lenders in the U.S. to private or public U.S. firms with market caps under $250 million. Is ARCC an investment that’s going to gain tremendous notoriety? Is ARCC going to break out and generate massive amounts of capital appreciation? ARCC isn’t flashy, it’s not going to have the same tailwind potential as some technology companies. From a capital appreciation standpoint, an S&P index fund will probably appreciate more over an extended period. ARCC is an income investment that is probably only interesting to investors looking for larger than average income generation potential. I like ARCC for under $20, and I am looking to buy it as it slides.

The good news from Q2

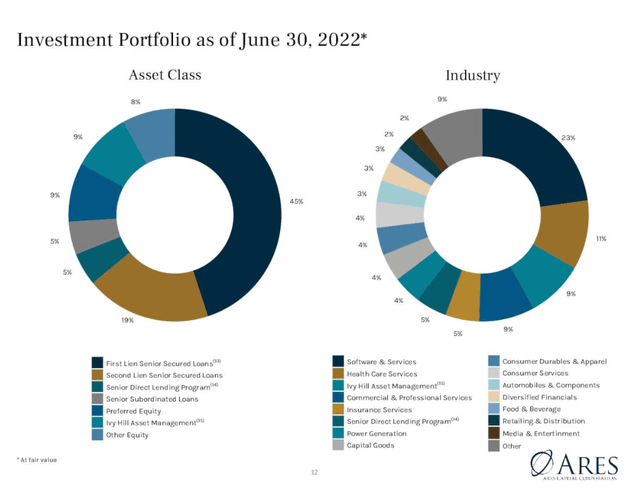

In Q2 of 2022, ARCC committed to roughly $3.1 billion new investments, including $570 million of new investment commitments to IHAM, which have already been funded with $2.9 billion of capital. The $3.1 billion of new investments included 21 new portfolio companies and 31 existing portfolio companies. These additional investments are made up of 71% first lien senior secured loans, 1% second lien senior secured loans, 1% subordinated certificates of the Senior Direct Lending Program (the “SDLP”), 3% senior subordinated loans, 3% preferred equity, 18% IHAM and 3% were in other equity. Of these, 89% were in floating rate debt securities, of which 94% contained interest rate floors.

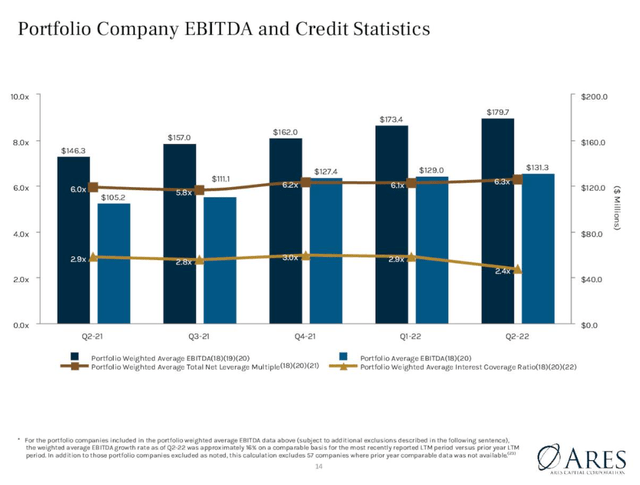

In Q2, ARCC generated $0.46 of EPS which was a $0.02 beat and produced $479 million of investment income which was a beat of $12.79 million, up by 4.4% YoY. ARCC focused on doing deals with larger companies over the past several years, which helped during the downturn, as the weighted average EBITDA of ARCC’s portfolio reached $179 million. This is more than 2x from 2017. ARCC believes that the continued increase in market interest rates presents a potential opportunity for the growth of its core earnings. This is due to the large floating rate loan portfolio, which is financed by mostly low-cost, fixed-rate, unsecured sources of financing. ARCC is anticipating that additional rate hikes should drive its quarterly core earnings well past its Q2 level.

ARCC’s total portfolio at fair value at the end of Q2 was $21.2 billion, and its total assets amounted to $21.8 billion. The weighted average yield on ARCC’s debt and other income-producing securities at amortized cost was 9.5%, and the weighted average yield on total investments at amortized cost was 8.7%. The total investment yield at the end of Q2 increased approximately 60 basis points from Q1. These numbers are enticing to me because ARCC should benefit from the rising rate environment as it theoretically will correlate to positive impacts on net interest earnings in Q3.

The latest dividend increase is a continuation of a longstanding practice from ARCC

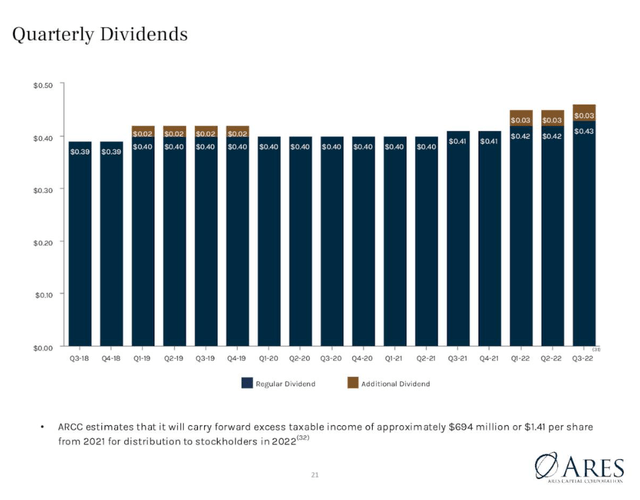

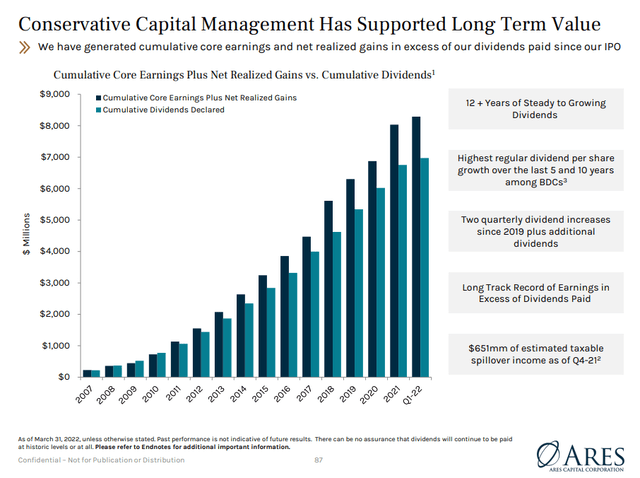

ARCC has a long history of paying dividends, with 2005 being its first full year of dividend payments. Since its inception, ARCC has increased its quarterly dividend by 48.28%. ARCC’s core earnings and net realized gains have driven its dividend growth, and the rising rate environment has helped ARCC deliver another dividend increase. ARCC’s dividend track record is unique, and income investors should take these statistics into consideration. ARCC just provided its 2nd quarterly dividend increase over the past 12 months, which is its 3rd increase in the past 6 quarters and its 53rd consecutive quarter of unchanged or growing dividends.

The chart above illustrates all of ARCC’s dividends since Q3 2018. Throughout 2019, ARCC paid 4 special dividends in addition to its regular quarterly dividend. This is another aspect that sets ARCC apart from other BDCs as they continuously generate spillover income. ARCC has estimated that its spillover income from 2021 into 2022 will be approximately $694 million, or $1.41 per share. Generating undistributed spillover income helps support ARCC’s dividend throughout fluctuating economic and market cycles. Q3 will now be the 3rd consecutive quarter where a special dividend has been declared in addition to the regular quarterly dividend.

ARCC went public through an IPO at $15 per share since the fall of 2004 has appreciated by 29.27%. If this statistic was told to investors looking for capital appreciation, they would look at you as if you had lost your mind. As I indicated at the beginning of this article, I look at ARCC as an income vehicle. Including the Q3 2022 dividend, ARCC will have paid $27.39 in dividends since it went public, which is 182.6% of its initial value. When I look at income investments, I just want them to trade sideways, and if they generate a small amount of capital appreciation, it’s an added bonus for me. The main focus is income, and ARCC generates income in spades. Its next ex-dividend date is 9/14/22 with a 9/30/22 payout date. ARCC’s dividend track record is hard to replicate, and the special dividends are an added bonus on top of the 53 consecutive quarters of unchanged or growing dividends.

How the 8 million share offering could be used

The market didn’t seem to like the 8 million shares ARCC is selling in the public offering. ARCC has granted the underwriters an option to purchase up to an additional 1,200,000 shares of common stock, and the offering is expected to close on 8/2/22. ARCC is expecting to utilize the proceeds to repay certain outstanding indebtedness under its credit facilities. ARCC can reborrow under its credit facilities for general corporate purposes, which include investing in portfolio companies per its investment objective.

Here is my take on the offering. I hate share dilution because it decreases the equity my shares of an equity represent. When public offerings arise, investors should investigate what the proceeds are being used for and determine if the management team has a good track record of creating shareholder value.

My opinion on this is that ARCC’s management team has generated value for shareholders and has a longstanding track record of driving core earnings and net realized gain growth from its portfolio. Due to the track record, I am more than willing to put aside my personal feeling about dilution, as ARCC has demonstrated fiscal responsibility throughout the years. Every investor should look into the offering and see if they agree with how the proceeds will be allocated.

Conclusion

ARCC is a pure income investment for me that I will be adding to. I don’t expect ARCC to generate large amounts of capital appreciation, but I do expect it to continue generating large amounts of income from its quarterly dividend. It’s hard to argue with its track record of dividend payments, and the 3rd consecutive special dividend is icing on the cake. The 8 million share offering created a sell-off, which could be extended in the next trading session. If you’re an income investor, I believe ARCC is the crème de la crème of BDCs, and this is an 8% yield that can be counted on. Investors should look into the public offering and see if they agree with how the proceeds will be allocated. I think ARCC has done a fantastic job creating value in the past, and the rising rate environment could help drive additional growth throughout its portfolio.

Be the first to comment