Justin Sullivan

I know I just wrote about SoFi (NASDAQ:SOFI) last week and you might be sick of hearing from me about it. Normally I wouldn’t write back-to-back articles so quickly on the same stock, but I did this analysis just after sending that article off and was so enthused by the results that I had to share. SoFi reports earnings on August 2. This article will have you primed and ready for that report. I will start by highlighting some areas of concern that I will be watching closely, followed by my summary of the Key Performance Indicators (KPIs) I am looking at, why I track them, and use historical data to set some expectations. This includes a detailed look into what to expect from personal loan originations, and why the trends there could lead to SoFi beating revenue, EBITDA, and raising guidance. Finally, I will move into the realm of speculation and talk about a few new product announcements SoFi could reveal on the earnings call.

Concerning Trends to Keep an Eye On

Increasing Expenses in Financial Services and Technology Segments

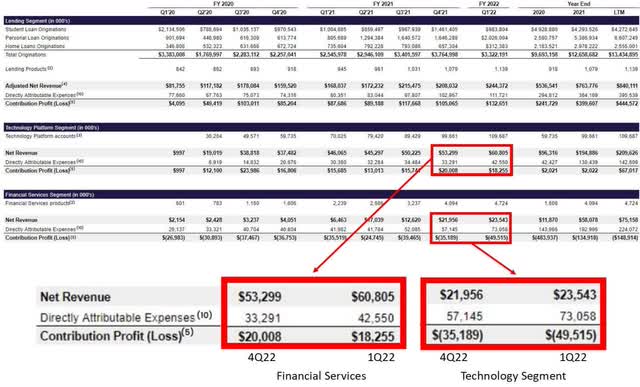

Every stock has risks. SoFi is no different and these are the red flags from last earnings that I am tracking. Directly attributable expenses in both their technology and financial services segments grew at a faster pace than revenues for those segments in 1Q22. Increasing revenue and margins in their lending segment more than made up for these increased expenses, but this is not a positive development. While they do not provide a full breakdown of these expenses, it isn’t hard to see that there was a fairly large jump in their technology and product development expenses (+$15.6M QoQ) as well as their provision for credit losses (+8.3M QoQ).

Increasing Expenses in Financial Services and Technology Segment (SoFi)

The jump in tech expenses is probably due to their acquisition of Technisys, as the total head count for their technology segment increased significantly with the acquisition. Provision for credit losses is money they have to set aside in case of defaults on credit cards, and will continue to grow as they issue more cards. I want to see the Technisys acquisition start to contribute meaningfully to make up for the expenses. Right now I’m alright with financial services expenses rising somewhat as that is the main driver of new members. The cost to acquire new members is low for financial services and as they cross sell those members to use more products, including taking out loans, it will more than pay for itself in the long run.

Credit Card Risk

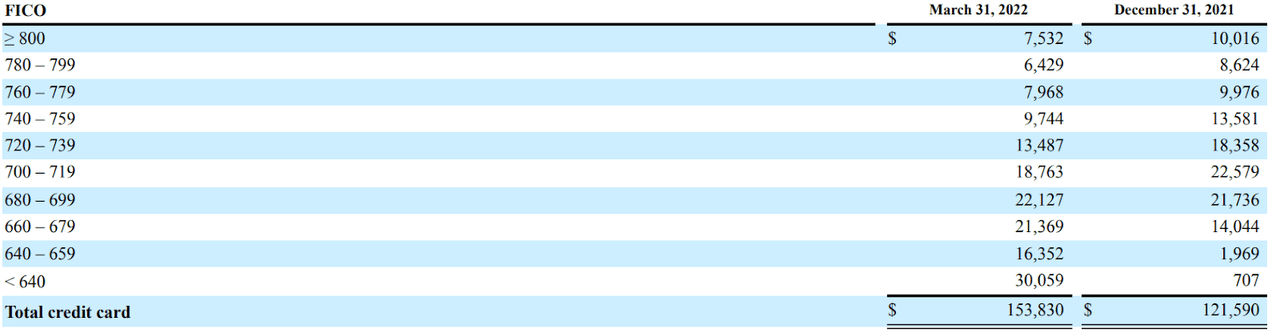

While the quality of SoFi’s loan borrowers is high, the quality of their credit card risk is actually weakening. The following table is found in their most recent 10-Q accompanied by the following explanation:

The following table presents the amortized cost basis of our credit card portfolio (excluding accrued interest and before the allowance for credit losses) as of the dates indicated based on FICO scores, which are obtained at the origination of the account, and are updated as new credit information is available. The pools estimate the likelihood of borrowers with similar FICO scores to pay credit obligations based on aggregate credit performance data.

Amortized cost basis of SoFi credit card portfolio (SoFi)

You’ll notice that high FICO scores decreased their credit utilization in Q1, while those with lower FICO scores significantly increased utilization. Overall, credit cards are a small portion of SoFi’s business ($153M in cost basis of the $7.2B in loans they are carrying), but the risk profile here is trending in the wrong direction. SoFi’s exposure is low, but it is something to keep an eye on.

Key Performance Indicators

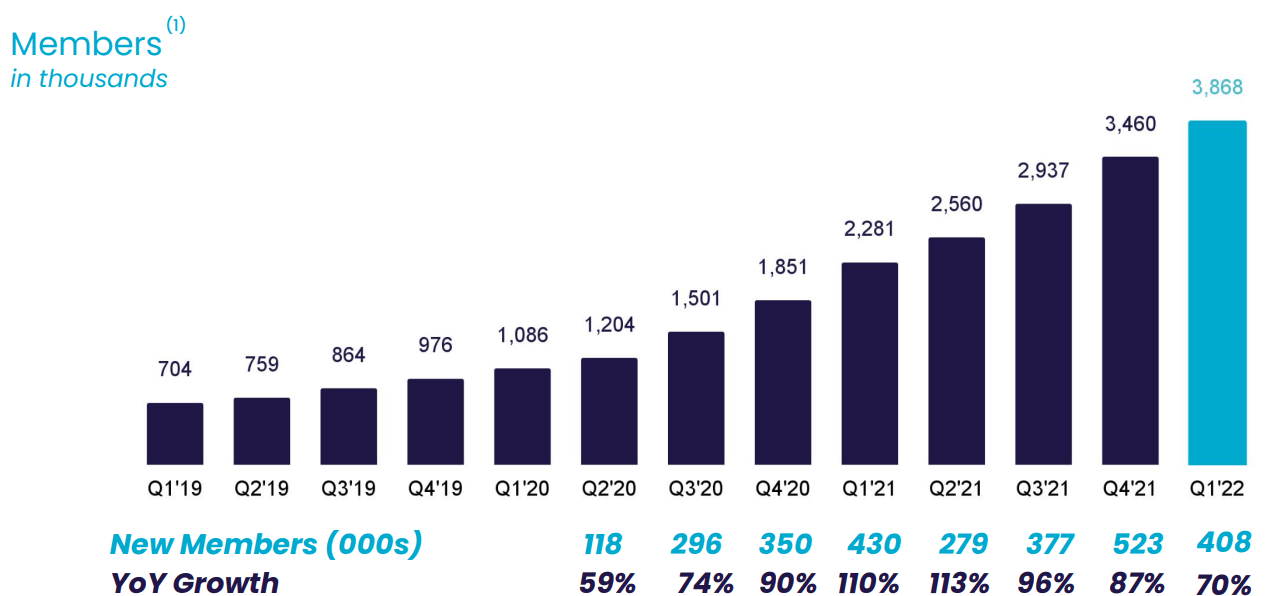

KPI #1 – Members

SoFi added 408k new members in 1Q22 to reach a new total of 3.87M. I am not sure if we will see that same total in the second quarter as it was the weakest quarter for membership growth percentage in both 2020 and 2021. They added 10.9% new members in 2Q20 and 12.2% in 2Q21. Achieving high percentages also becomes much more difficult as the baseline number increases. SoFi traditionally gets a boost in 3Q and 4Q from exposure from their stadium during the NFL season, and this year the Super Bowl was played in SoFi Stadium with the Rams winning on their home turf, probably resulting in a bump to 1Q22 numbers. If this quarter follows previous trends, there will probably be around 350k-400k new members added.

SoFi Membership Growth (SoFi)

The ace that SoFi has up their sleeve for this quarter is that they were offering best-in-class APY on their Checking & Savings accounts for the entire quarter, moving from 1% to 1.25% on April 5, then 1.5% on June 28 (it has since moved to 1.8% on July 26, but that is during Q3). At a time where people are starting to tighten their belts and are looking to save and make money in any way possible, giving that high of an APY on checking & savings accounts could be a key driver for new members. This is also the first full quarter that they have been able to offer rates that high since they now have their bank charter. I know several people who have joined just for the interest. I expect a minimum of 350k new members and it would be a disappointment if it comes in under that number. If SoFi adds more than 400k members, a lot of that growth should be attributed to member referrals, which would be very bullish. Anything above 450k members would be absolutely outstanding and really surprising.

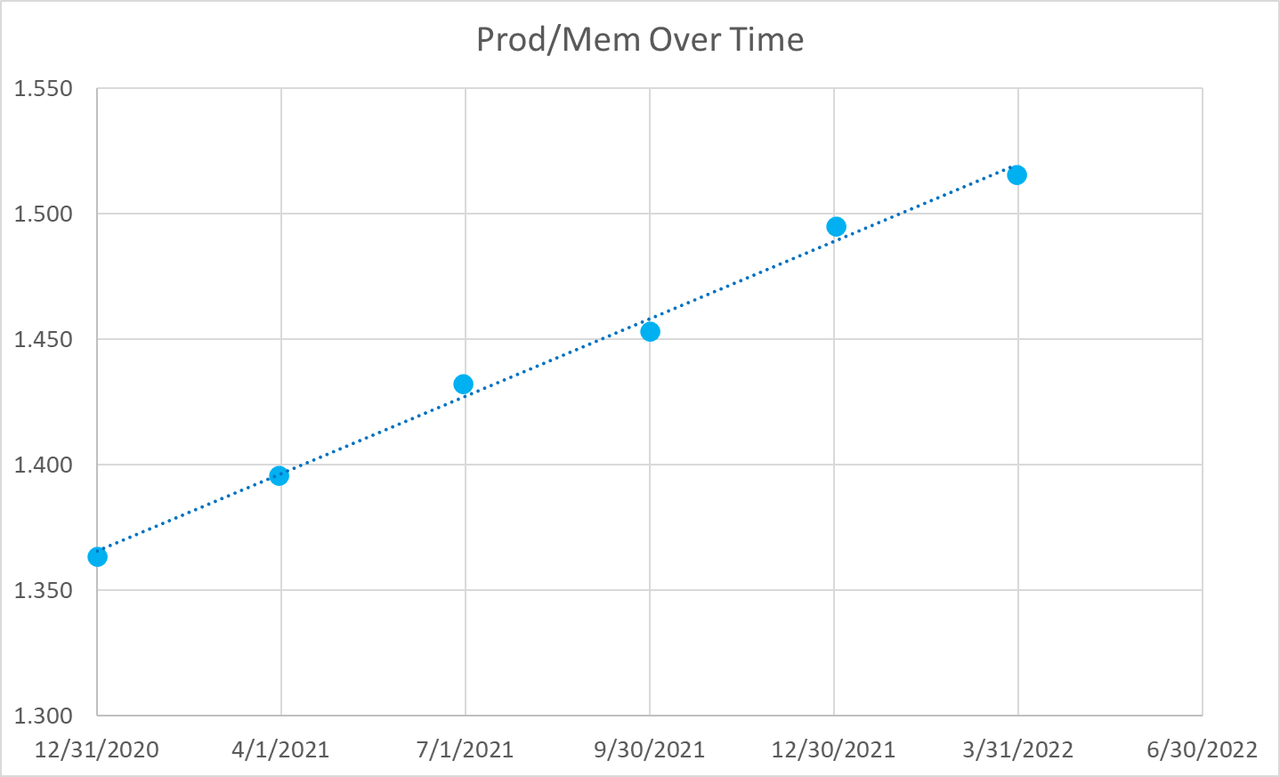

KPI # 2 – Products/Member

This KPI indicates how effectively SoFi is cross selling their products to existing members. This is important for two reasons. First, the more products each member has, the more they interact with SoFi and the relationship gets stickier. Second, new products from existing members means more revenue for no additional customer acquisition costs. So far their growth in cross sell has been fairly linear, which is a great feat considering each new member starts with only one product. I am looking for them to continue this trend and get to 1.55 products per member.

Products per member for SoFi (Data from SoFi, chart by author)

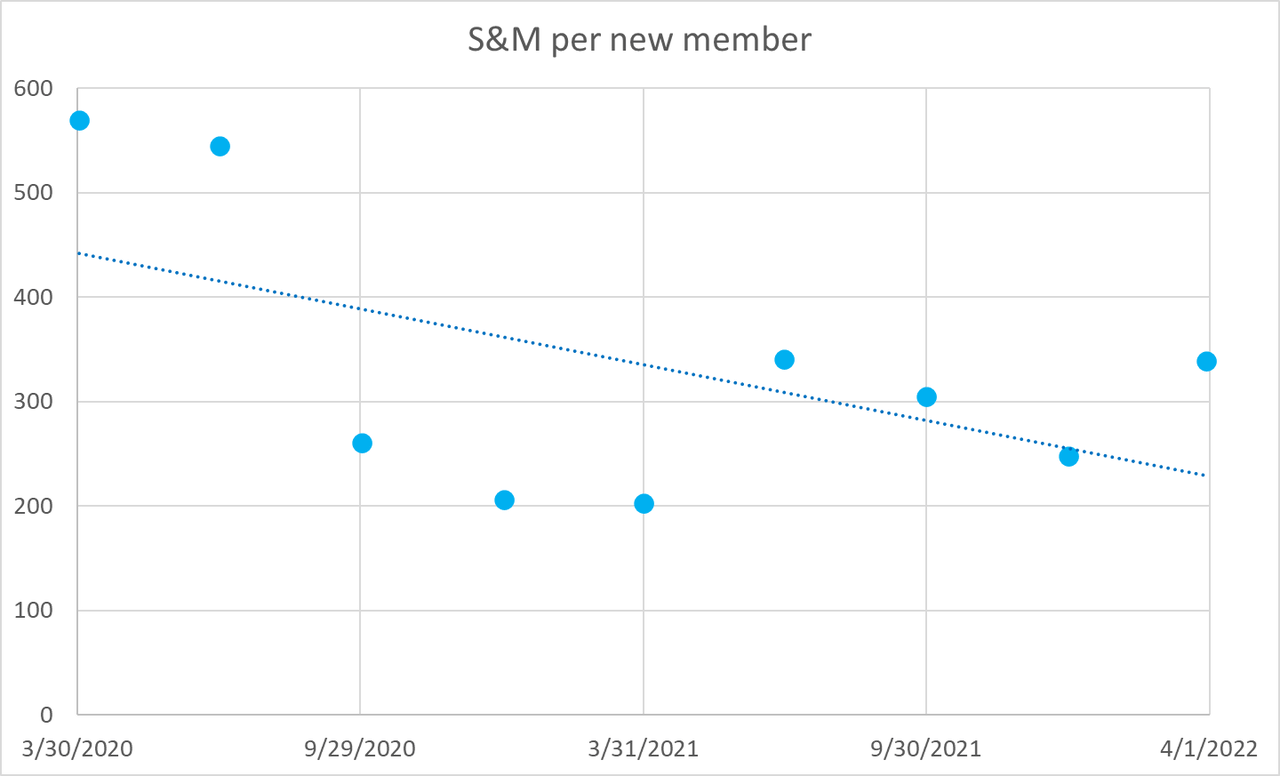

KPI #3 – Sales & Marketing spend per new member

This KPI is more volatile than the others on this list, and it is also the one that I would like to have management speak about directly at some point. Based on the fact that they are willing to give up to $325 to new members who direct deposit with them, I believe that management right now is comfortable with that as a customer acquisition cost (CAC). CFO Chris Lapointe and CEO Anthony Noto are both on the record as saying that their current CAC is in line with what they are targeting and that the lifetime value of their customers justifies their current outlay to acquire those customers. As such, I believe anything less than $350/new member is acceptable. It would be something of a concern if it gets above $400/new member.

Sales & marketing spend per new member (Data from SoFi, chart by author)

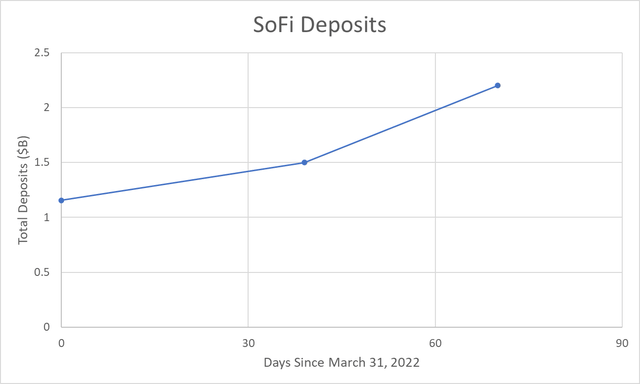

KPI #4 – Deposits

SoFi stated that they are growing deposits at a rate of about $100M per week. We have three data points to judge from. The 1Q22 balance sheet shows $1.16B of deposits on March 31, 2022. Management said that they had around $1.5B in deposits on the 1Q22 earnings call on May 10 and Chris Lapointe said it had increased to $2.2B on June 9 at the Piper Sandler Conference. Those are rounded numbers, but that’s the best we have. This is an average increase of $102M per week between March 31 and June 9. A plot of the data shows accelerating deposits (see below). The average growth between March 31 and May 10 was only $60M/wk but between May 9 and June 9 they grew deposits at $163M/wk.

SoFi total deposits (Data from SoFi, chart by author)

Why do deposits matter? They can use deposits as collateral for their lending business, and their deposits are lower cost than the warehouse facilities they would otherwise be using. In that same conference, Chris Lapointe explained that “the cost of capital savings that you’re seeing between our deposits and the warehouse facilities today is north of 150 basis points.” So every dollar of direct deposits is worth 1.5 cents in extra revenue on their loans. That may not seem like much, but 1.5% extra interest on the $7.2B of loans they have translates to an extra $108M of revenue per year. That’s a 10% jump in revenue that’s essentially free just for using deposits. The faster they grow deposits, the faster they ramp their margins. Assuming $100M in deposits per week, they will consistently be growing their lending margins every week for at least the next year.

We should get another data point or two on total deposits from earnings. I expect them to have continued growing deposits at least at the $100M/wk rate, resulting in a minimum of $2.5B in deposits. If they continued the accelerated rate seen in May and June, they would have $2.7B on the 2Q balance sheet.

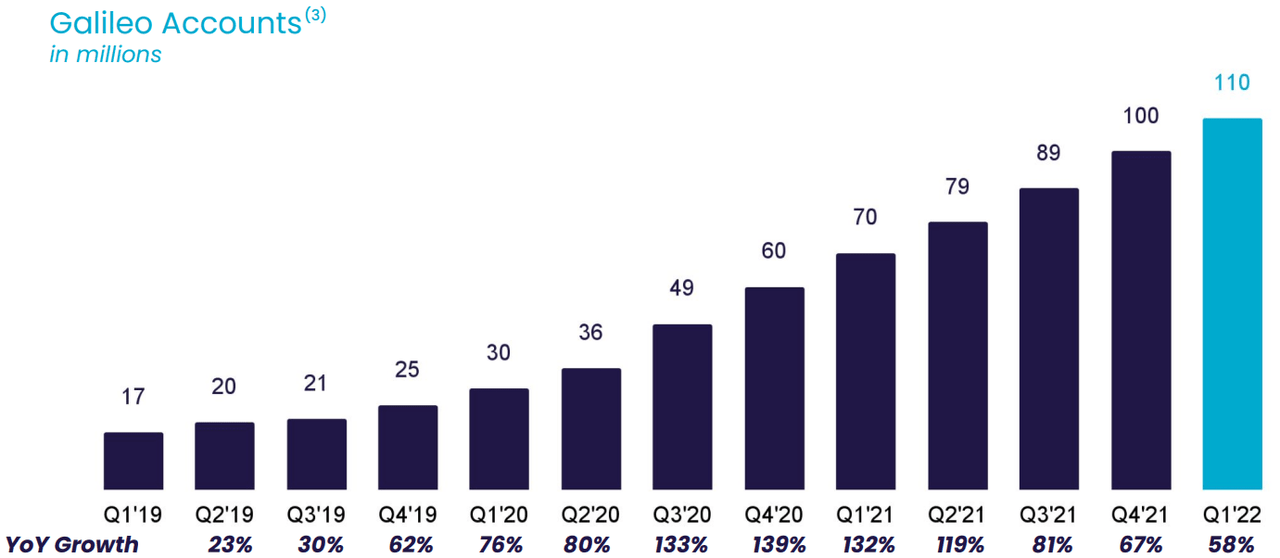

KPI #5 – Galileo Accounts

Galileo accounts have been extremely linear as well, adding about 10M accounts per quarter like clockwork for the last 6 quarters. This is a disappointment to me as I would like to see this number ramping. 10M new accounts is excellent growth when you are at 50M accounts, but it’s hardly impressive at 110M accounts. I fully expect them to have about 120M accounts for this quarter.

Galileo accounts (SoFi)

I am hoping that the acquisition of Technisys will help bring more accounts over time as they cross sell Galileo to existing Technisys customers. I do expect that integration and cross selling to take time and do not expect to see any effect on 2Q22 numbers.

KPI #6 – Personal Loan Lending Originations

All the above numbers are key to understanding the health of the overall business, but nothing drives SoFi’s top and bottom line like their lending segment. And for now, lending revenues and profits are dependent on personal loans. This is where the rubber meets the road and where the meat of my analysis lies.

There are two competing macro factors in the current environment that affect borrower demand for personal loans. On the one hand, a rising rate environment incentivizes people to move from variable rate debt like credit cards into fixed debt like personal loans. On the other hand, rising rates raise the cost of the loans which should decrease demand. Scott Sanborn, CEO of LendingClub (LC), a major provider of personal loans, made it pretty clear which of these two factors is winning out. On their 2Q22 earnings call on July 27 he said:

We are seeing, and you see it in the results, very strong borrower response rates, very strong borrower take rates. And as I talked about in my prepared remarks, we are leveraging that. In addition to moving on coupons as credit cards rates move, we’re also being selective with our credit to get more yield to investors by really kind of top grading the overall base we’re pulling through. And we’re able to do that while still seeing improvements in our efficiency in the marketing. So that is working in our favor.

Borrower demand was so strong that LendingClub was able to simultaneously:

-

Raise rates on their loans (this is what is meant by “moving on coupons”)

-

Be selective in who they could originate loans to, only funding the most creditworthy borrowers (“top grading the overall base”)

-

Decrease their marketing spend

-

Increase total originations (setting a new record high for the company)

SoFi operates in the same space with the same benefits to leverage as LendingClub and should see the same strength in demand.

Using Data to Predict Originations

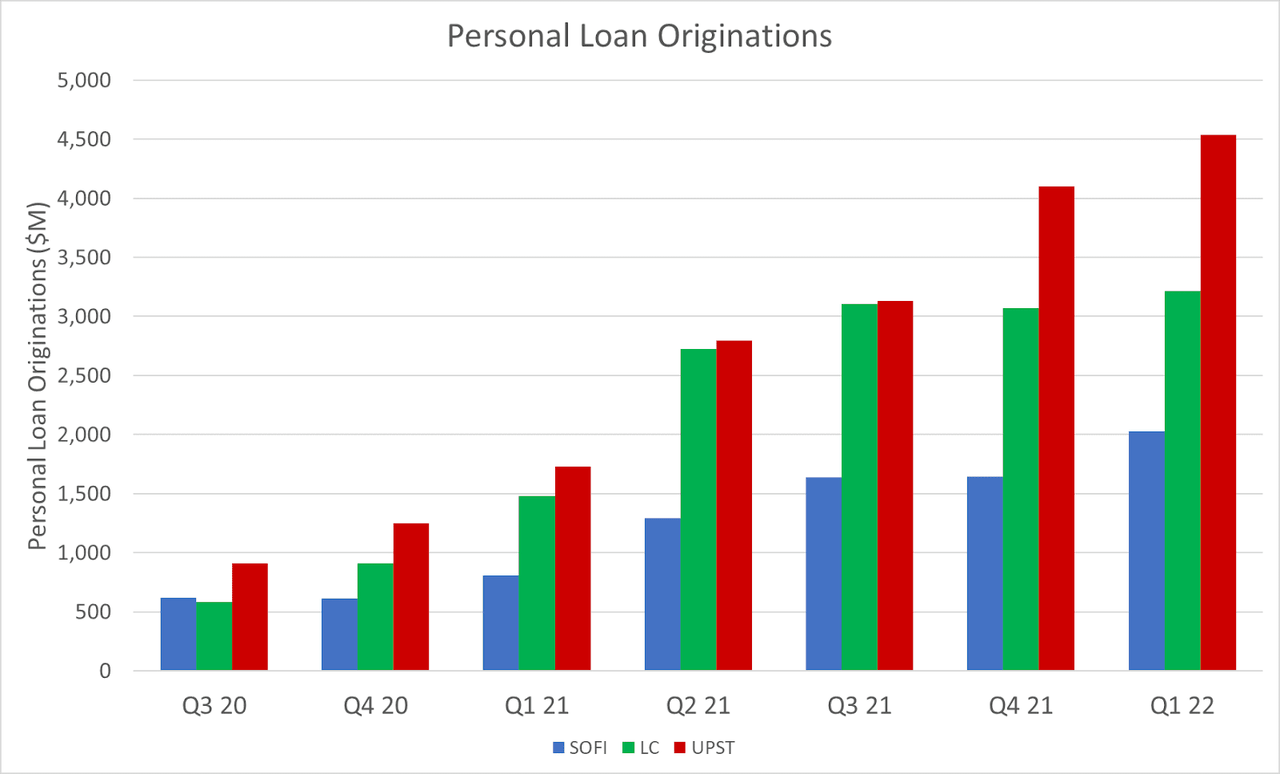

The three largest fintech players in the personal loan space are SoFi, LendingClub, and Upstart (UPST). Each caters to a different clientele. SoFi targets higher earners that have prime plus and super prime credit ratings. LendingClub targets prime and prime plus customers who are serial users of credit that often return for multiple loans over time. Upstart targets near prime and subprime customers, seeking to identify credit-worthy individuals who are not well served by traditional lenders.

Personal loan originations for SoFi, LendingClub, and Upstart (Author)

Over the course of the last two years, all three companies have seen originations grow. While they all started on relatively equal footing, LendingClub and Upstart saw significant growth in the second half of 2020 and first half of 2021. SoFi lagged during those quarters but started making up ground in the second half of 2021 and into 2022.

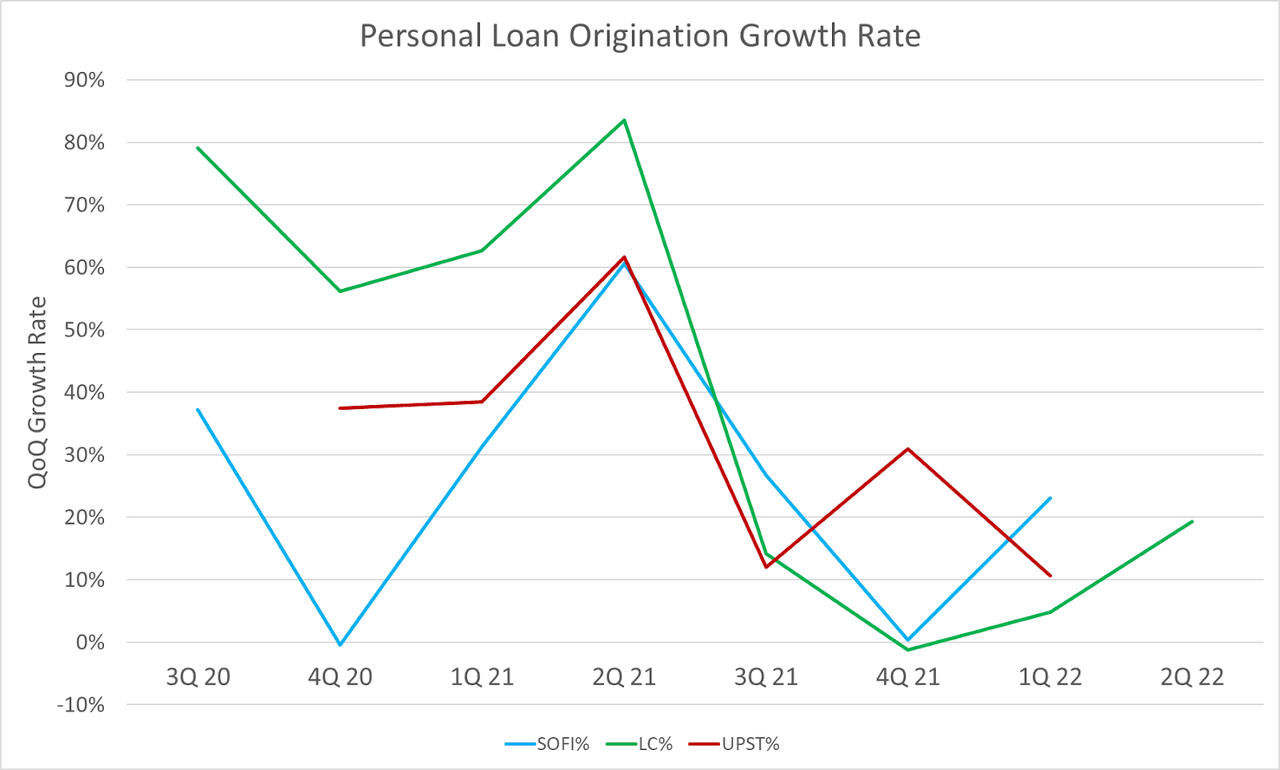

This becomes even more apparent when you look at the QoQ origination growth rate. SoFi has had the highest growth rate in two of the last three quarters (see below). The chart also highlights that with very limited exceptions, the QoQ growth rates trend in the same direction for all three companies. This demonstrates the seasonality of demand for loans and the uniformity of demand across different FICO scores.

Personal loan origination growth for SoFi, LendingClub, and Upstart (Author)

LendingClub already reported earnings and saw a 19% QoQ increase in originations in 2Q22, which is why they have one more data point than either SoFi or Upstart. This is very bullish for SoFi. In fact, I actually expect to see a divergence in this chart moving forward where SoFi’s origination growth rate outpaces their competitors due to three key differentiation factors.

Differentiator #1 – Access to Funding

The first reason is because they control their own funding, which will separate them from Upstart. Demand for Upstart loans began to dry up in the capital markets as rates began to rise. As a result, they chose to supplement origination volume by funding loans with their own cash in 1Q22. The market didn’t like that decision and Upstart reversed course in the second quarter, abandoning that practice and selling the loans they had accumulated up to that point. The results were so bad that they released Preliminary Unaudited Q2’22 Financial Results early because they would significantly miss projections for the quarter. They did not report origination volumes, but in their own words, “our marketplace is funding constrained, largely driven by concerns about the macroeconomy among lenders and capital market participants.” Upstart originations will be down significantly in 2Q22 because of funding constraints.

SoFi faces no such limitation to their funding. They have excess capacity in their warehouse facilities, extra cash on hand, and they can lend against their growing deposits. Between those three funding sources, SoFi has access to $6B+ of funds in addition to the $7.2B in loans they already hold on their balance sheet. That is more than enough to meet demand. SoFi still has to be cognizant of debt markets. They will sell these loans in 6 months and cannot originate more than markets are willing to buy. If they do, they will lose money by decreasing the value of their securitizations (the packages of loans that they sell to debt market participants). It is still a balancing act, but for reasons discussed below, SoFi still has an advantage.

Differentiator #2 – Member Growth

The second key reason why SoFi will outpace its competitors, and LendingClub specifically, is that they are growing members at a much faster pace. Each quarter SoFi has a rapidly expanding pool of potential borrowers. LendingClub does not report its member numbers with as much granularity as SoFi, but their recent investor presentations have given us the following data.

|

Members |

|

|

3Q21 |

3.8M+ |

|

4Q21 |

3.9M+ |

|

1Q22 |

4M+ |

|

2Q22 |

4M+ |

SoFi adds more new members in 3 weeks than LendingClub adds in 3 months. I think this is the main reason that SoFi has outperformed LendingClub in origination growth for the last three quarters and why they will continue to do so going forward.

Differentiator #3 – Quality of Borrower

The third key reason that SoFi will outperform is that SoFi’s average borrower is the highest quality of all three companies. Upstart has been seeing appetite for their loans decrease for over six months at this point because they cater to lower quality borrowers. LendingClub just stated that, “Our core consumer has an average income of $112,000 and a FICO score of 721.” As a result of the higher quality borrowers, LendingClub has not yet seen degradation in the appetite for their loans, but they do expect to see some softening demand from the marketplace in the third quarter. This is why they lowered guidance for Q3 even though they maintained full-year guidance.

SoFi’s personal loan borrower has a weighted average income of $140,000 and FICO score of 746. As a result, demand for SoFi’s personal loan securitizations on debt markets is even more robust in a rising rate environment and in a recession. SoFi has the lowest risk of degradation of demand and value of their loans, giving them more flexibility to ramp originations with some security in knowing their securitizations are in higher demand than their competitors.

The Bottom Line for Originations

Based on these differentiators and in light of LendingClub’s comments on borrower demand, I fully expect at least 20% growth in personal loan originations, would not be surprised to see 30% growth, and think 40% growth is in the realm of possibility. This would put quarterly personal loan originations in a range between $2.43B-$2.84B.

This also suggests that SoFi are likely to beat expectations for revenue and EBITDA, since personal loans are their biggest revenue driver and highest margin revenue. Remember also that SoFi will keep collecting revenue on each loan they originated for 6 months before selling them. Significant growth here would not only help them beat on revenue and EBITDA, but also could lead to increased guidance for the rest of the year.

Even if that happens there is no guarantee, however, that the stock will go up. LendingClub posted a significant double beat (a 10.4% beat on revenue and 12.5% beat on EPS) and reiterated their full-year guidance. The stock peaked at +7.8% after hours only to give back all their gains in the first minute of trading the next morning and close the next day down -8.8%.

The biggest risk here for guidance is that SoFi is still beholden to the debt markets. Their borrower quality does separate them from the pack and makes them more resilient, but they are certainly not immune to softening demand. It is feasible that they outperform in Q2 but guide conservatively for Q3, Q4, and the full year. At the Piper Sandler Conference on June 9, CFO Chris Lapointe said that “the demand that we’ve had for our paper, both on the personal loans and student loan refinancing side has been extremely strong and robust, so we’re not seeing any degradation.” As recently as two months ago their securitizations were still in high demand but a lot can change in two months.

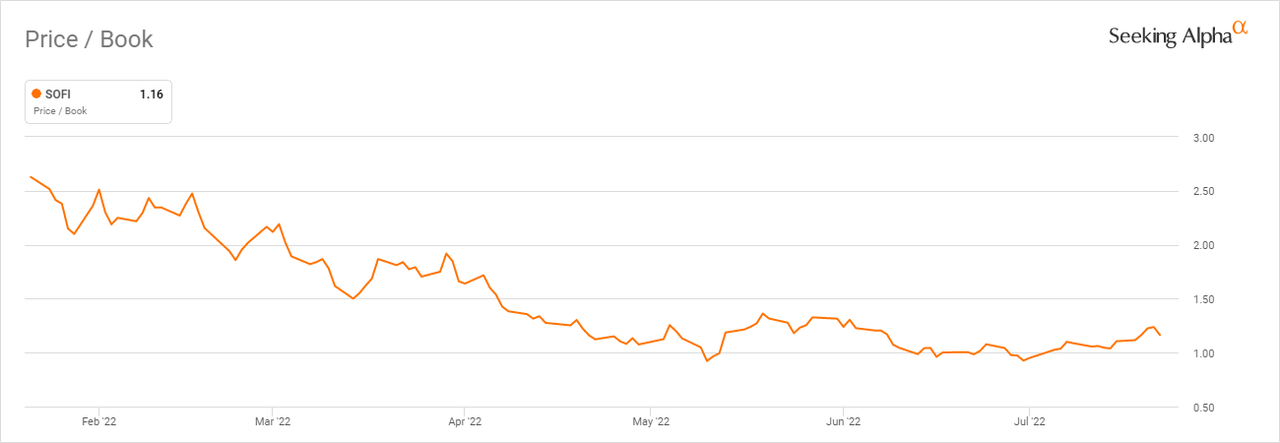

KPI # 7 – Book Value

SoFi’s book value has provided extremely solid support to the stock. Both times its P/B dipped under 1 it bounced significantly, resulting in 20%+ returns in the next few weeks. It makes sense for book value to provide support as anywhere under this value you are effectively buying a company with 50% YoY revenue growth for less than the fair market value of its current assets minus its current liabilities.

Price/Book for SoFi (Seeking Alpha)

Book value should continue to remain a good floor for the stock as long as the growth story continues. Yes, there might be swings underneath, but as long as SoFi continues to meet or beat projections, I don’t see it falling below a P/B of 1 for long. SoFi’s book value per share increased from $5.27 in 3Q21 to $5.29 in 4Q21 and then jumped to $5.69 in 1Q22, mostly on the strength of their loan book and the acquisition of Technisys.

As long as SoFi continues to grow members, their originations and assets will continue to grow. As long as those assets maintain their value, their book value will continue to grow. It bears repeating that their average personal loan borrower has a weighted average income of $140,000 and FICO of 746 while their average student loan borrower has a weighted average income of $170,000 and FICO of 775. Their book value should continue to increase every quarter and thus raise the stock’s floor.

Will We See New Products?

This is the fun part of the article. This is highly speculative, so please take it with a grain of salt and realize that the most likely scenario is that none of this is even mentioned on the earnings call. That doesn’t make these developments any less exciting.

SoFi is already the best fully-digital one-stop banking solution. They may not be the best solution for each product individually, but collectively there is nothing better. They are not sitting on their laurels and still have more products in the pipeline. There may have been no fanfare, but SoFi actually just launched branded Certificates of Deposit (CDs) to further their deposit base. That isn’t exciting because CDs are boring by nature. There are, however, other exciting new products that should launch this year and could be launched any time. These include new Galileo products, SoFi Plus, Pay-in-4, and options trading for SoFi Invest.

Galileo products

Galileo is due for some new products, on December 1 of last year, CFO Chris Lapointe said the following when asked about the possibility of offering credit card issuing through Galileo:

We haven’t publicly talked too much about the roadmap for credit processing, it’s certainly on the roadmap. And one of the things that we want to do is address the needs of all of our customers. We’re getting a lot of demand, not only for credit processing but also for things like our reward capabilities that we’ve built at SoFi, our fraud capabilities that we’ve built at SoFi, lending as a service given everything that we have at SoFi. So you’ll expect — you can expect to start seeing us roll out these new products and features, like I said, in 2022. We’re not going to provide a specific timeline on when we expect to see that. But there is significant demand not only for the credit card but all of the products and services that we offer at SoFi.

2022 is halfway done and none of the products mentioned has been announced. We are overdue for an update on them.

SoFi Plus

SoFi Plus is currently in beta and there are members who have access to it and have been using it. Not too much is known, but the program was publicly announced by CEO Anthony Noto at the Morgan Stanley Conference. This is how he described it:

You’ll see us launch something called SoFi Plus, which brings everything together. SoFi Plus will be like a subscription service where you get a whole host of member benefits if you direct deposit with us. So we won’t charge for it, but we’ll give you all these value added services. When you do SoFi Plus with us, which is triggered off of doing direct deposit, there’ll be benefits in loans, benefits in Invest, benefits in rewards and a number of other areas.

I plan to do a deeper dive on SoFi Plus when I write about SoFi’s moat, but as a teaser, there is some indication that it might include the first ever credit card with no annual fee that gives 3% cash back on every purchase.

Pay-in-4

SoFi also looks to be getting into the Buy Now Pay Later (BNPL) space. While this product has not been publicly announced or even hinted at, it looks like they are in the final stages of releasing a BNPL product for members with a Checking and Savings account. Pay-in-4 terms and conditions were recently added to SoFi’s official website. According to those terms and conditions site, this is a 0% APR loan that allows members to pay off a purchase greater than $50 in four installments over six weeks.

Options Trading

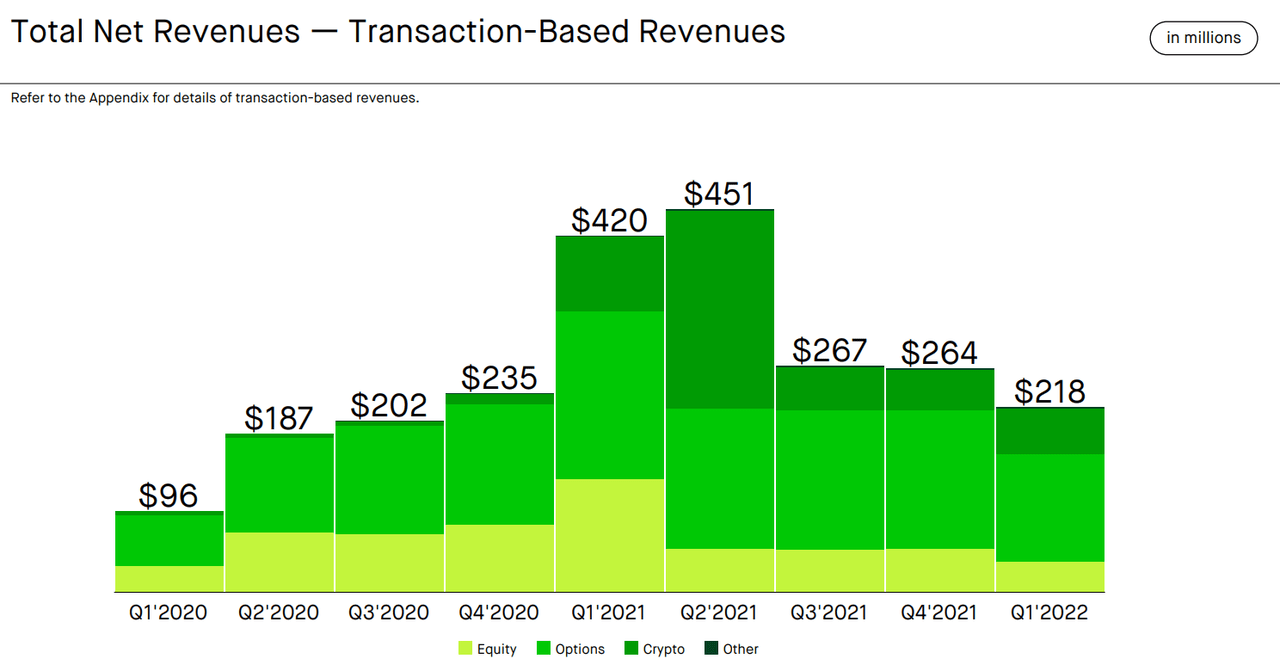

Options trading has been in the works for SoFi for well over a year now. The last official word on the subject was from Anthony Noto during the 1Q22 earnings call, and he said that “we are targeting introducing [options] by year-end.” Personally, I want them to release options so I can move my own trading account to SoFi Invest. As an investor, there is another graphic that illustrates why options are a big deal.

Breakdown of the total net revenues of Robinhood’s transaction-based revenues (Robinhood)

This slide is taken from Robinhood’s (HOOD) 1Q22 earnings presentation. Options trading made up the bulk of their revenues every quarter shown except 2Q21 during the dogecoin craze. Options trading made up 65%, 61%, and 49% of transaction-based revenue for Robinhood in 2019, 2020, and 2021, respectively. If you just look at the second half of 2021, it again accounted for 61% of transaction-based revenue.

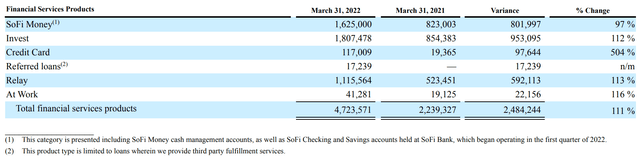

Options is clearly the most consistent source of Robinhood’s revenue, and SoFi’s revenue from their SoFi Invest product will most likely double or more as soon as options launch. Investors who trade options also trade with much higher frequency, giving them more interaction with the app and website and more chance to cross sell other products. It also bears mentioning that SoFi Invest is the most used of all the financial services products.

Breakdown of products in SoFi’s financial services (SoFi)

The first clue that options may be coming soon is that options trading is already in beta and there are members who are testing it. Second, SoFi added an options trading guide to their website in the first week of July. The final clue is that the most recent SoFi app update added urls to support pages related to options trading. This mirrors the rollout of past SoFi features where support page urls appear in app data before the official product launch. For example, support page urls for extended hours trading first appeared in the app on May 23, 2022, which was less than two weeks before it was launched on June 2, 2022.

Conclusion

There are a plethora of indicators to track when SoFi reports earnings that will give insight into the health of the business. I am optimistically looking forward to seeing the direction those indicators point. SoFi has a penchant for under promising and over delivering as they have posted a double beat in each of the last three quarters. Given the results and commentary we saw from LendingClub and SoFi’s three key lending differentiators described above, I think they are set up to beat expectations on the strength of a growing personal loan portfolio and increasing margins from their deposits. I expect excellent results from SoFi’s second quarter with the possibility of added fireworks on the earnings call from new product launches. We will know soon if my analysis proves correct.

Be the first to comment