eyegelb/iStock via Getty Images

Investment Thesis

Most listed companies involved in the business of cannabis cultivation and distribution, whether for recreational or medicinal purposes, trading on the Nasdaq, have seen their share prices nosedive over the past 12 months, and Cronos Group (NASDAQ:CRON) is no exception.

The Toronto, Canada based company was the first “Pot Stock” to uplist from the Toronto stock exchange (TSX) to the Nasdaq, in March 2018. Early investors would have been delighted with the initial rise in the company’ stock price, from ~$7 shortly after the uplisting, to a “high” of nearly $22 in February 2019, but sadly, the gains were short-lived.

Barring a brief spike to $10 in January 2021, it has been all downhill for the stock price, which currently trades at a value of $3.15 – down 58% across the past 12 months.

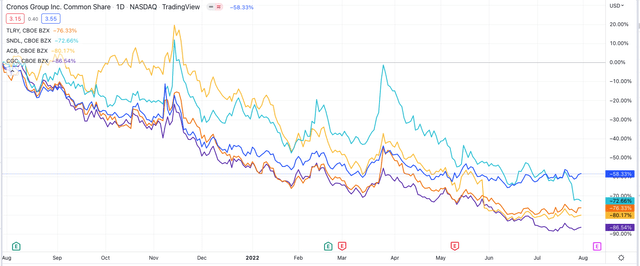

Share price performance of Canadian Cannabis companies – past 12 months. (TradingView)

As we can see below, rival Canada based cannabis stocks Tilray (TLRY), SNDL (SNDL), Aurora Cannabis (ACB), and Canopy Growth (CGC) have fared even worse. Of these companies, Aurora and Sundial Growers are relative minnow, with market caps of $320m and $535m respectively, Canopy Growth and Cronos are both valued ~$1.2bn, and Tilray is the largest, with a market cap of $1.6bn.

Whilst Cronos, Canopy and Tilray boast impressively high cash positions of ~$1bn, $1.4bn, and $803m, the trouble is the companies are reluctant to deploy capital when the market opportunity is so small, and that is chiefly down to the US’ refusal to legalise marijuana at the Federal level. A statement in Cronos 2021 10-K submission to the SEC explains:

Though a number of states in the U.S. have authorized the cultivation, distribution or possession of U.S. Schedule I cannabis and U.S. Schedule I cannabis containing products to various degrees and subject to various requirements or conditions, U.S. Schedule I cannabis continues to be a Schedule I controlled substance under the CSA. Therefore, the cultivation, manufacture, distribution and possession of U.S. Schedule I cannabis violates federal law in the U.S. unless a U.S. federal agency, such as the DEA, grants a registration for a specific activity, such as research, with U.S. Schedule I cannabis.

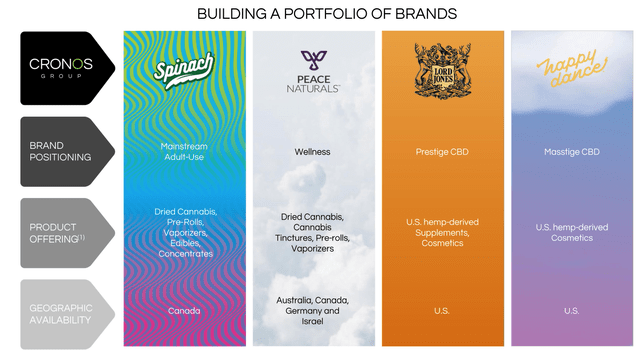

Cronos Group’s Portfolio of Brands. (Cronos investor presentation)

The US does permit trade in hemp related products, and as we can see above, Cronos is able to sell its Spinach cannabis brand in Canada, for mainstream adult use thanks to Canada’s legalisation of marijuana, and also sells cannabis products for “Wellness” i.e. medicinal use in Australia, Canada, Germany and Israel, and 2 hemp-derived product portfolios in the US, under the Lord Jones and Happy Dance brands.

These products don’t generate strong revenue streams however – Cronos earned just $25m of revenues in Q122 – which is admittedly up 123% year-on-year – but posted a loss of $32.6m, and earned just $2.3m of revenues from the US. In FY21, 3 major customers – Ontario Cannabis Retail Corporation, Société Québécoise du Cannabis (the “SQDC”), and Alberta Gaming, Liquor and Cannabis Commission – accounted for 26%, 15%, and 15% of the company’s revenues of $74.4m. The company’s net loss in 2021 was $395.6m.

With >600 employees on its payroll, and markets stubbornly refusing to open up, with only limited opportunities internationally in countries authorising cannabis for medicinal use, it’s easy to make the bear case for Cronos, given its funds look likely to be exhausted by the end of 2023 at the current burn rate.

The only thing likely to save the company is if the US legalises marijuana at the federal level – it is already decriminalised, but that is of no use to companies attempting to ship a schedule I product – defined by the FDA and DEA as having “no therapeutic value” meaning it “therefore cannot be lawfully possessed or prescribed”.

With all that said, however, in the event that the US does change the classification of marijuana, shareholders in companies like Cronos are likely to realise substantial triple digit gains, positioned as they are to capitalise on any positive developments, and these companies are trading at historical lows.

In the rest of this post, I will take a closer look at the situation that Cronos currently finds itself in, and try to discuss whether there is a rewarding opportunity in investing in Cronos stock at a historically low price.

Recent Developments in US

There are many and persuasive reasons why the US may want to decriminalise cannabis, and these were discussed at a Senate Judiciary Committee Subcommittee on Criminal Justice and Counterterrorism hearing as recently as last week.

The Cannabis Administration and Opportunity Act was also introduced by Senate Majority Leader Chuck Schumer last week, which, if passed, would deschedule marijuana as a Schedule I controlled substance. Senator Cory Booker chaired the discussion, highlighting issues such as social injustice, and the amount of police time that may be wasted on hunting down cannabis smokers – he told the senate that in 2019, there were more arrests for cannabis than for all violent crimes combined. Booker also noted that 91% of Americans are in favour of medical marijuana, and 68% support adult use.

Despite some persuasive arguments, the “COAC” is unlikely to become because, apparently, it is viewed as too far reaching, and faces strong Republican opposition, whilst President Biden is not thought to favour legalisation at the federal level, preferring an “incremental” approach.

The COAC certainly seems to represent praiseworthy progress, but it would be a stretch to claim that it is going to benefit a company like Cronos, firstly because it is unlikely to be passed, and secondly because its main thrust is towards providing social justice, rather than commercial opportunities. COAC may represent progress, but probably not fast enough to stem the flow of losses at Cronos.

The Altria Question

Meanwhile, Cronos reveals in its 2021 10-K submission that it is ~42% owned by Altria (MO), which made a $1.8bn investment into Cronos back in 2018. Altria is a $79bn market cap holding company, which engages in the manufacture and sale of cigarettes in the United States, and clearly the company saw an opportunity in the cannabis market that it sought to exploit by investing in Cronos.

Altria also has the option to increase its stake in Cronos above 50%, at which point the company would effectively own Cronos and have the right to appoint an entirely new board, sell the business, or sell a significant amount of its shares in Cronos, resulting in further share price losses or issue more shares, resulting in investor dilution.

Altria and Cronos initially felt there may have been an opportunity in the cannabis vaping market, but no such opportunity has arisen (to the best of my knowledge) and it’s tempting to wonder if the much larger Altria intends to cut its losses in Cronos. As such, investors believing that it is only a matter of time before Cronos is in a position to exploit changes in cannabis legislation may be disappointed.

Conclusion – Cronos’ Bet On Cannabis Markets May Have Come Too Early

Cronos’ current business would actually look reasonably well organised and successful, based on its differentiated product offering, tailored to suit different markets, most notably Israel and Canada, were it not for the outrageous – for a company of its size – cash burn and meagre return of just $25m in Q122.

You can argue that many companies made massive losses in their early years only to recover those losses when markets finally opened up, but in the case of the cannabis market, you can understand Cronos’ position. The company could buy up plantations all over the world, but what would it do with the product? The market opportunity is simply not there at present, and may not be in 5 years, or even in 10 years’ time.

Local cannabis producers can potentially thrive in the US where most states permit selling and the introduction of the SAFE Banking Act, which has circulated around the senate no fewer than 6 times, may help them to legitimise themselves.

Cronos would have to alter its entire business model to join them, however, and once again, the market opportunity may prove to be too small. It’s hard to believe that Altria doesn’t regret its investment into Cronos, since there is no way to successfully or strategically deploy capital at the present time.

My feeling is that Cronos’ market cap valuation is likely to diminish at the same pace as its cash pile, so if the company can find some way to stem its losses, then it ought to stabilise the share price. But simply watching and waiting for the US, or European markets to open themselves up to the full legalisation of cannabis is not a convincing strategy, in my view.

Cronos may have been set up to exploit changing cannabis laws in Canada, but arguably, the Altria investment has proven detrimental, since there is no correspondingly large market opportunity.

It all adds up to the likelihood of Cronos’ share price continuing to fall, and my belief is that Cronos is not a viable investment opportunity at the present time, mainly because it became cash rich too soon, which swelled its share price beyond what could be considered reasonable. The company may end up playing a valuable role in the fight to fully legalise cannabis, but that may be of scant consolation to investors who find themselves out of pocket.

Be the first to comment