Falcor

It’s been a mixed Q2 Earnings Season thus far for the gold sector, and OceanaGold (OTCPK:OCANF) may have beat on operational performance, but costs certainly didn’t live up to expectations. The company revised its guidance well above its previous outlook, now targeting $1,425/oz costs at the mid-point in FY2022. Combined with a sub-par performance at Waihi, the delayed receipt of the SEIS, and weaker copper prices, the cost outlook provided in its multi-year guidance is looking far too ambitious (FY2023 cost mid-point: $1,225/oz). So, while OceanaGold is a decent story given its organic growth, I think there is far more relative value elsewhere in the sector with this dampened outlook.

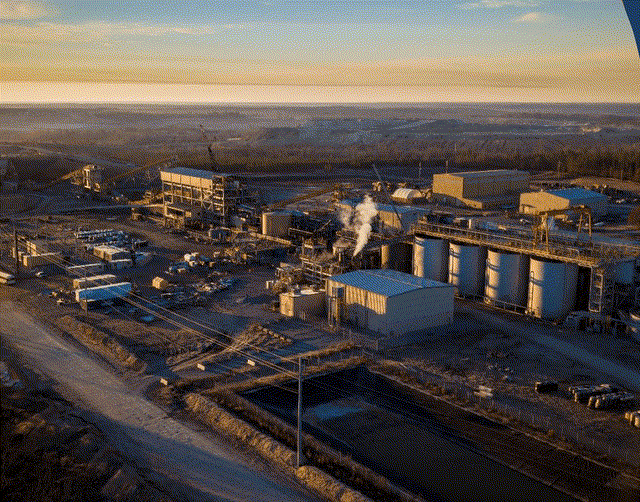

Haile Operations (Company Presentation)

Just over three months ago, I wrote on OceanaGold, noting that the stock was near fully valued heading into its Q1 earnings report. This is because the stock was trading at 1.20x P/NAV heading into earnings, and while Didipio would provide a boost, this was a steep valuation for a turnaround story. Since then, the stock has seen a drawdown of 30% from its highs, impacted by a sharp decline in the gold price and inflationary pressures, which will significantly impact all-in sustaining cost [AISC] margins vs. the previous outlook. Let’s look at the recent report and whether this pullback in OceanaGold (“Oceana”) now offers enough margin of safety to wade back into the stock:

Q2 Production

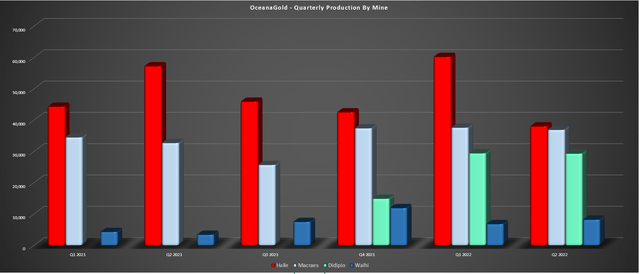

Oceana released its Q2 results last week, reporting quarterly production of ~112,300 ounces, a 20% increase from the year-ago period. This increase was despite a softer quarter from its Haile operation as mining was completed in the high-grade Ledbetter Phase 1 pit, helped by another strong quarter from its restarted Didipio Mine in the Philippines. Meanwhile, Macraes put together a much better quarter with ~36,900 ounces produced, a 13% increase from Q2 2021 levels and at lower costs ($1,476/oz vs. $1,524/oz). Following the solid Q2 performance at its primary operations (Haile, Didipio, Macraes), Oceana is well on track to deliver into its guidance mid-point of 470,000 ounces (~237,000 ounces produced year-to-date).

OceanaGold – Quarterly Production by Mine (Company Filings, Author’s Chart)

While production was solid at Oceana’s main operations, production at Waihi was softer than expected, producing just ~8,200 ounces at all-in sustaining costs of $2,659/oz. Year-to-date, this operation has produced just 15,000 ounces of gold at costs near $2,800/oz, a far cry from the 55,000 to 70,000 ounces at $1,375/oz to $1,475/oz discussed in the 2022 guidance. Although Oceana did note that it’s seen improved mining rates and reconciliation benefiting from the grade control drill program, production guidance was cut to 40,000 ounces at the mid-point – a massive miss. It is worth noting that COVID-19 cases have been an issue, impacting one-third of the workforce.

Finally, while Haile continues to perform well under Chief Operating Officer David Londono, the company has yet to receive the Supplemental Environmental Impact Statement [SEIS]. However, it appears close to being published. While this doesn’t affect 2022 production and may only have a slight impact on 2023 production, any further delay could impact 2024 production, which was expected to be a transformational year for Haile as mining heads underground and costs drop off significantly. Per the technical report, Haile was forecasted to produce over 250,000 ounces in 2024 at all-in sustaining costs below $1,000/oz.

Costs & Margins

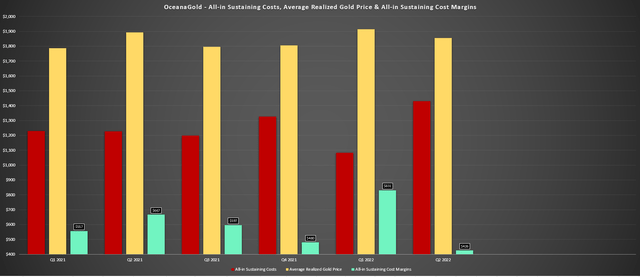

Unfortunately, while production was solid in Q2, we saw a significant decline in margin performance. This was related to inflationary pressures (diesel, consumables, materials) and the impact of lower by-product credits at Didipio (declining copper price). The result was all-in sustaining costs of $1,430/oz in Q2 2022, which were up more than 16% year-over-year despite the restart of the high-margin Didipio Mine. It’s worth noting that Waihi’s sub-par performance didn’t help, nor did the lower grade quarter from Haile (mine sequencing). However, combined with a dip in the gold price, margins slid 34% to $426/oz.

OceanaGold – Costs, Gold Price & Margins (Company Filings, Author’s Chart)

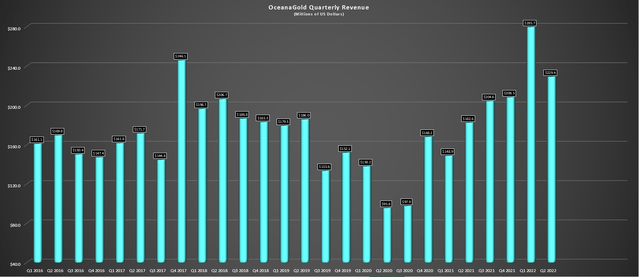

Given the sharp decline in margins and weaker copper price, OceanaGold revised its cost guidance 7% higher to $1,425/oz at the mid-point (a $100/oz increase). So, while H1 revenue was a record at $515.1 million and free cash flow generation has improved considerably ($72 million in H1 2022 vs. negative $81 million in H2 2021), the FY2022 outlook is nowhere near as robust as it previously looked. The key will be whether the company can receive its SEIS and turn around operations at Waihi, and a recovery in the copper price would certainly help to return to margin expansion in 2023. However, the 2023 cost outlook looks far too ambitious, in my view ($1,150/oz to $1,300/oz).

OceanaGold – Quarterly Revenue (Company Filings, Author’s Chart)

Medium-Term Outlook

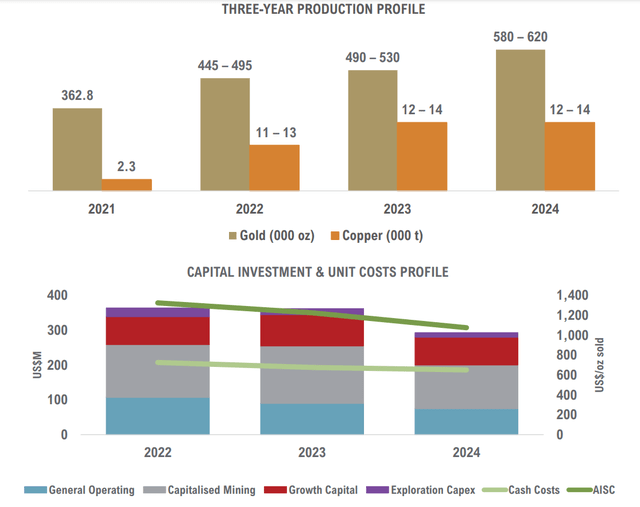

OceanaGold published an updated multi-year outlook earlier this year, targeting production of up to 530,000 ounces in FY2023 at all-in sustaining costs below $1,225/oz. This was projected to improve even further in 2024 as Haile headed underground, producing 580,000+ ounces consolidated at all-in sustaining costs of $1,075/oz. These were very aggressive assumptions, which don’t appear to have factored in the following:

- a decline in copper prices despite what looked to be risks of a recession

- the immediate receipt of the Haile SEIS

- minimal impact from inflationary pressures despite even major gold companies guiding for meaningful increases in operating costs in their Q4 2021 results

- less than flawless execution from Waihi, which has been anything but this since production began at GPUG (Q2 AISC: $2,659/oz)

OceanaGold – Multi-Year Outlook Q1 2022 (Company Presentation)

While the increase in throughput has still kept the 2023 production profile on the table, I don’t see any way that OceanaGold will meet its FY2023 cost guidance mid-point of $1,225/oz, and I would not be surprised to see costs come in above $1,330/oz next year, barring a surge in copper prices. Meanwhile, the 2024 outlook (~600,000 ounces at $1,125/oz) is looking shaky as well, with the possibility that the first underground ore production moves into 2024, potentially reducing the robust 2024 outlook for Haile (sub $1,000/oz costs), and this was before the onset of inflationary pressures. So, while I would expect further margin improvement in FY2024, I don’t see a $1,125/oz cost profile as doable and would expect $1,200/oz+ costs.

Some investors will argue that this isn’t a huge deal, and growth to ~600,000 ounces in FY2024 at $1,200/oz is still a huge improvement from ~470,000 ounces at $1,425/oz at the mid-point of guidance this year. While a fair point, much of the stock’s outperformance (in my view) was related to this aggressive growth/margin outlook, with the margin outlook now looking extremely difficult to achieve. So, the premium that OceanaGold traded at after unveiling this growth plan (1.0x P/NAV to 1.20x P/NAV) is more difficult to justify at lower gold/copper prices and with this margin outlook now seemingly out of reach. Let’s look at the valuation below:

Valuation

Based on ~720 million fully diluted shares and a share price of US$1.82, OceanaGold currently trades at a market cap of ~$1.31 billion or an enterprise value of just over ~$1.5 billion. If we compare this market cap figure to an estimated net asset value of $1.38 billion, OceanaGold trades at 0.95x P/NAV, a large premium to its peer group of mid-tier producers. In fact, OceanaGold is trading at a more significant premium to net asset value than Agnico Eagle (AEM) despite a less diversified production profile, a much higher-cost profile (~$1,400/oz vs. $1,000/oz), and the fact that Agnico is a much larger producer, with 2.5+ million-ounce producers typically commanding a premium valuation.

Lastly, it’s worth noting that Agnico Eagle is benefiting from cost synergies of up to $40/oz over the next couple of years due to its merger, which erases most of the impact from inflationary pressures on unit costs. Obviously, OceanaGold benefits from organic growth; it has one phenomenal operation in Didipio (sub $700/oz AISC) and is one of the better small-cap stories in the sector if it can execute successfully. That said, from a relative value standpoint, I think there are far better options than OceanaGold when senior producers can be bought near 1.0x P/NAV and mid-tiers at below 0.75x P/NAV in many cases (OceanaGold: ~0.95x P/NAV).

Summary

OceanaGold had a solid H1 report, enjoying record revenue despite the sharp pullback in gold/copper prices. However, this was partially overshadowed by the upward revision to cost guidance and the delayed receipt of the Haile SEIS. Assuming a full year of higher throughput rates at Didipio and recovery in copper prices, Oceana should have a better 2023 (sub $1,375/oz costs) and surpass the 500,000-ounce mark from a production standpoint. Still, with the rest of the sector significantly underperforming, OceanaGold does not stack up great from a P/NAV standpoint vs. peers.

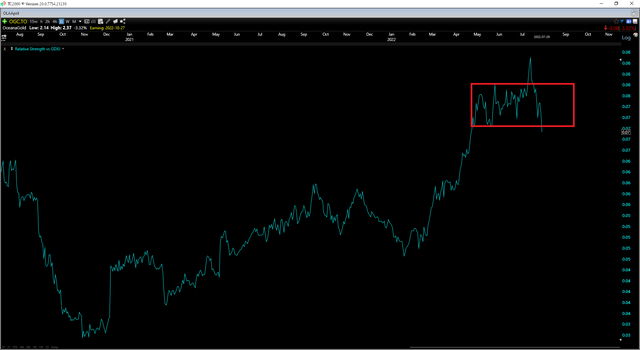

OceanaGold vs. GDXJ (TC2000.com)

This view of buying the dip in other names is reinforced by the fact that OceanaGold looks like it may have topped out short-term vs. the Gold Juniors Index (GDXJ) and also some senior producers. The above chart displays this breakdown, which could lead to some underperformance going forward. So, while I think Oceana is a name to keep an eye on if this correction worsens, I think there are far more attractive opportunities elsewhere in the sector.

Be the first to comment