Stanislav Chegleev/iStock via Getty Images

MicroVision (NASDAQ:MVIS) is a meme stock that investors should avoid despite a patent that was issued to the company in March this year. When the news was announced, the stock’s price surged over 30% before shedding the majority of its value. It’s important for investors to realize that communities like WallStreet Bets (WSB) have a proclivity for sending shares of meme stocks like MVIS to new heights primarily out of spite for short sellers and hedge funds. MVIS currently, and for the foreseeable future, lacks the fundamentals to be considered a serious investment – even with promising projects in the works.

Company Overview

In Q4 2021, the company reported that it had a GAAP EPS of -$0.08 and a revenue of $0.56M, which is +40%Y/Y.

The abstract of the company’s most recent patent states the following.

A mechanically resonant system exhibits a resonant mode frequency response. A conductor is included on a resonant member within the mechanically resonant system. A current in the conductor causes a modification of the resonant mode frequency response when in the presence of a magnetic field. The modification of the resonant mode frequency response may include an offset in the natural frequency of the mechanically resonant system.

To me, there is nothing in this patent that suggests that a 30% price increase is logical in terms of increasing the valuation of the company. According to an investor presentation, MVIS has over 430 patents on its books in MEMS-based core technology. The technologies the company develops claims to be used by clients such as the US Military as well as by tech giants like Microsoft (MSFT).

Industry analysis

Despite never turning a profit, a negative revenue growth, and often trading at many, many times its sales, this has not deterred the company from attempting to turn its image around from a meme stock to a profitable and growing company.

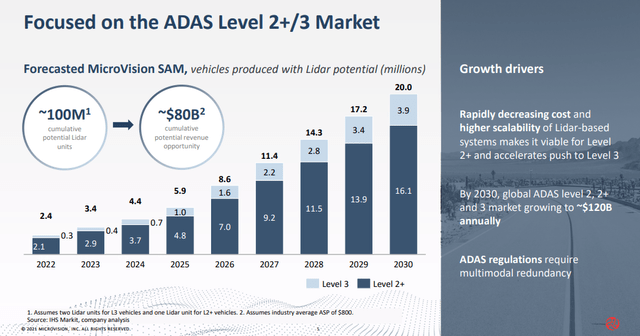

MVIS is clearly focused on the ADAS market, of which there is claimed to be rapid growth drivers in decreasing the cost and increasing scalability of this emergent tech to become more widespread. If this market forecast is correct and the company is able to convert this opportunity, then it could potentially take off sometime after 2025. After 2030 its market is expected to increase ~$120B annually.

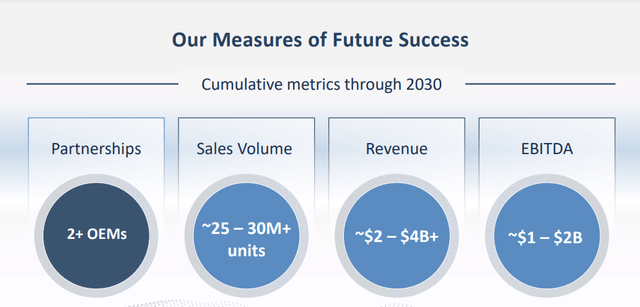

Looking further ahead still through the 2030s, the company claims that it will have an EBITDA of between $1 and $2B and a revenue of $2 to $4B along with a couple of OEM partnerships and a high end of 30M of sales.

This forecast along with MVIS’s accumulation of numerous patents to be suggests that if one is serious in investing in this company it’s going to be a very long term play. Consider that it may take half a decade or even longer before the company breaks even (if ever). I believe investors would need to understand this market very well or be an insider themselves in order to invest in MVIS with any degree of certainty.

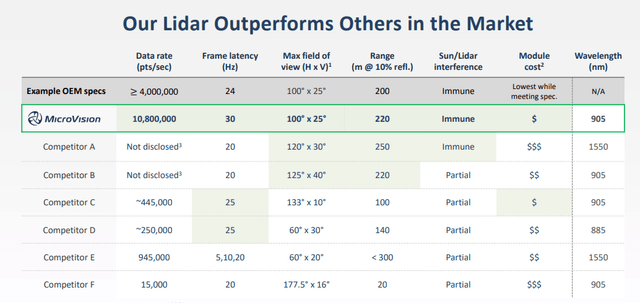

Still, the company claims to have a key competitive advantage in terms of its product, namely that its OEM specs are seemingly less expensive and have a higher data rate transfer.

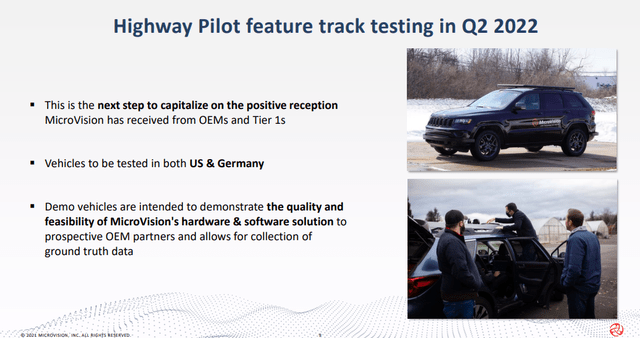

MVIS plans to test its components in this quarter, with them being deployed in vehicles in both the US and Germany.

Financials

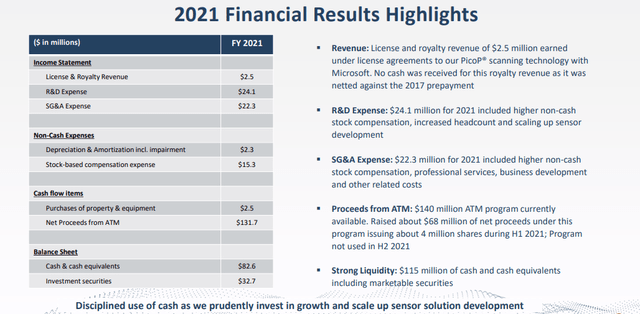

Many analysts who are not part of the WSB community have criticized the company’s lack of strength in terms of revenues, profitability, and product. The results from FY 2021 mirrored these criticisms as it only recorded $2.5m in revenue on its income statement from licensing and royalties. Meanwhile, the company’s expenses continue to swell while it works on developing its products for the future. One positive of the company is the strength of its balance sheet with $115.37M in cash or cash equivalents. This gives the company a current ratio of 9.58 as it is fundamentally a decade-long or longer investment before it should be expected to deliver returns for investors.

Something else to be noted about the company’s financial position is that it’s asset-light. The company in the past has been criticized in the past that it only has $119.43M in assets, but I think people overlook that this is part of its business model.

Valuation

MVIS is still a work in progress, and what we have to go by are estimates by the company of how much it will be worth a decade or so into the future. This makes valuating such a company difficult and risky. To me, no traditional valuation technique makes sense for this stock since it will always be seen as overvalued due to having abysmal revenues and no product. The company’s intrinsic value and therefore its logical valuation should be 0. I believe one needs to really speculate and gamble on the company’s prospects if they’re serious about investing in its future.

However, if one finds the company’s prospects attractive and has more industry knowledge than the average investor then I would invest today as it’s trading near its 52-week low of 2.61. However, for the majority of people out there I would advise against it as one needs to fully understand what they are committing to in terms of how likely their speculation is to pay off.

Risks

The riskiest part of MVIS to me is the sheer length of time it will take for this company to start delivering real value to investors. A decade can rightfully be seen as too long for most people to wait to see if they’re right at all about their investment. The markets and technology can easily change by the time MVIS is ready to deliver their work in progress.

Another problem MVIS must overcome is that it has been branded as a meme stock and thus not taken seriously by many investors. This stigma may damage its long-term prospects even if it manages to capitalize on its stated advantages.

Conclusion

I think MVIS should be avoided by the majority of people who lack expert knowledge of the company’s industry and its prospects for growth due to the horizon for this investment to pay off and the company’s current lack of fundamentals. However, if one does believe they can accurately estimate, and not purely guess, where the market is heading this pick could hold a lot of potential value due to its share price. For this reason, I’m rating this company as a hold until it can prove it has the ability to make its business model work.

Be the first to comment