Images we create and what actually happens are always beautiful when we have imagination./iStock via Getty Images

Shares of topical dermatology innovator Arcutis Biotherapeutics (NASDAQ:ARQT) are only slightly in the green since the IPO was priced in January of 2020 at $17, despite recently achieving FDA approval in late July for Zoryve (roflumilast) and thus a meaningful degree of derisking for investors. Year to date, shares sport a roughly 15% loss.

My interest in digging deeper here stems from a Core Biotech mindset, as I want to track initial launch metrics for their newly approved product into the plaque psoriasis space. There seems to be a measure of differentiation here, as Zoryve is the first and only topical phosphodiesterase-4 (PDE4) inhibitor approved for the indication, provides rapid clearance and reduces itch (all via a well-tolerated, steroid-free cream). Additionally, one could make the argument that plaque psoriasis is only the “beachhead” indication, as other opportunities could follow such as atopic dermatitis and seborrheic dermatitis.

My goal today is to delve deeper, better understand the story and determine whether we should enter a position near term or perhaps simply monitor from the sidelines until critical sales milestones are achieved to further derisk the story.

Chart

Figure 1: Weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price top out in the $35 to $40 range over the past couple years. On the other hand, in the past year valuation took a sizeable hit and share price established a bottom at the $15 level (even as the story got further derisked with FDA approval granted in July). My initial take is that investors would do well to establish a pilot position in the near term ahead of accelerating clinical and commercial momentum in 2023, but again I need to dig deeper before gaining greater confidence with such an approach.

Overview

Founded in 2016 with its headquarters in California (147 employees), Arcutis currently sports an enterprise value of ~$600M and Q2 cash position of $570M providing them operational runway for roughly 2 years.

Morgan Stanley Healthcare conference presentation from mid-September provides a helpful overview, with the CEO noting that the balance sheet is strong after August’s secondary offering combined with $125M drawn from the existing loan facility. The current focus is on launching Zoryve in plaque psoriasis as well as expanding applications of this topical cream to additional indications.

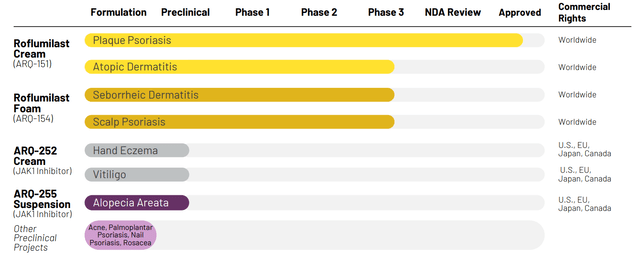

Figure 2: Pipeline (Source: corporate presentation)

Speaking of which, recent phase 3 results for seborrheic dermatitis were quite positive and presented at the European Academy of Dermatology and Venereology (EADV) Congress. From there, phase 3 data for scalp and body psoriasis is expected later this quarter or early Q4 followed by two large phase 3 readouts in atopic dermatitis by year end.

Other pipeline programs continue to advance, with ARQ-255 (novel JAK1 inhibitor cream) to enter the clinic later this year. Arcutis also acquired Ducentis Biotherapeutics recently (has exciting early-stage asset). In sum, we can see that both clinical and commercial momentum appear to be accelerating.

As for launch trends in lead indication of plaque psoriasis, the CEO cautions into overinterpreting scripts and other data as the launch is in very early days. Arcutis is taking a different approach versus peers, as other companies often start out with aggressive offers that generate synthetic demand (giving away drug for free, vouchers, buying co-pays down to zero, etc). The latter method generates many scripts but less dollars and impairs gross-to-net, not to mention what happens when companies have to pull back from such offers over time.

Instead, Arcutis has decided on a co-pay option that is sustainable for the long term and is focused on generating true demand. More formulary decisions should be coming through in the near term and being in a better position with payers could translate to growing demand (and thus rapid improvement in gross to net and profits for shareholders). There are 3 big pharmacy benefits managers (PBMs) in the US- Express Scripts takes on average 4 months to review a new product, while for CVS that’s typically around 9 months and Anthem reviews more frequently but has more unpredictable timelines.

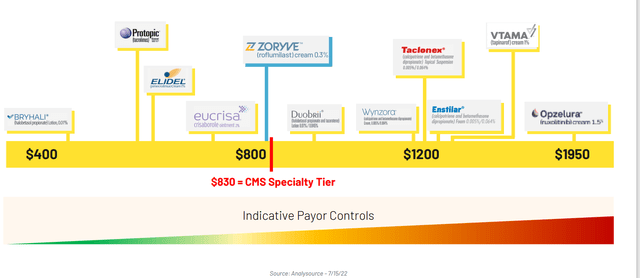

Figure 3: Prices of select branded topicals shows Zoryve in the mid to lower range (Source: corporate presentation)

Previous history in the branded topical space shows insurers have put considerable barriers in front of such products (multiple prior authorizations, etc) which dermatologists don’t want to do. While Arcutis’ management is admirably trying to minimize such barriers and make the drug as easy to get as possible, I still worry that these types of issues that peers have suffered from will affect them too (at least in the next few quarters out of the gate). Regarding cost of drug (Figure 3 above), the goal was to achieve a price point that allows them to secure the desired level of access from payers with minimal restrictions.

As for the product profile for Zoryve, inclusion of intertriginous patients has been sought after by doctors (one of the more difficult patients to treat). Tolerability profile is another positive attribute of the drug (sounds like the good news is no push back so far on profile, but at the same time I am left wondering what makes it stick out given how competitive the field is).

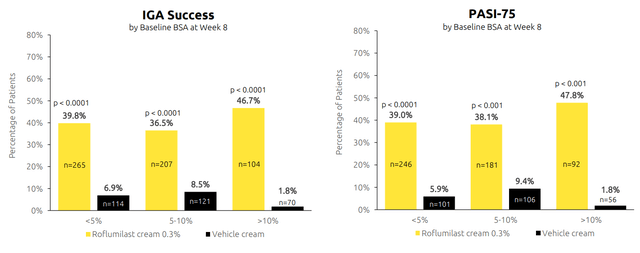

Figure 4: New data presented at AAD for Zoryve shows consistent clearance regardless of baseline disease severity (Source: corporate presentation)

The CEO states that while doctors can use steroids for short periods of time, they are looking for efficacy that can be used chronically for this chronic disease.

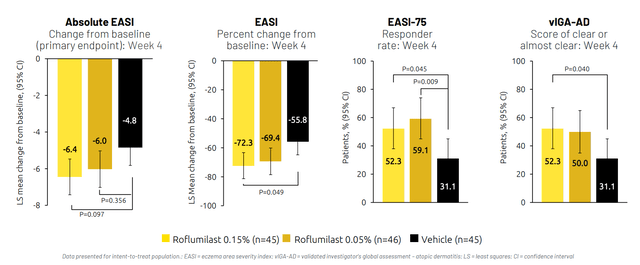

Moving on to atopic dermatitis phase 3 readouts by the end of the year, the CEO clarifies that will only be the topline results and full extent of data won’t come until later. For a novel non-steroidal treatment to be successful, they need to be comparable to SOC (standard of care) mid-potency steroid in terms of efficacy (versus psoriasis which uses higher potency steroids). 50% reduction in EASI without the safety concerns of a steroid should be a winning profile and appears to be the goalpost set by management.

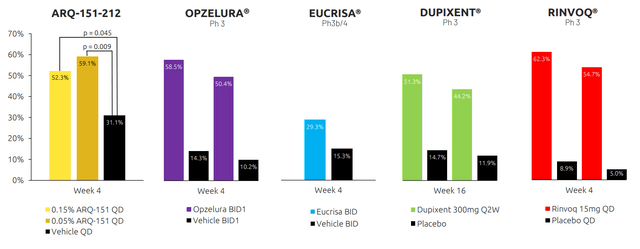

Figure 5: Roflumilast cream versus approved treatments in AD as reflected in EASI-75 responders (Source: corporate presentation)

Roflumilast phase 2 data showed something substantially better than the “goalpost numbers” (72% reduction in EASI), which leaves some margin for a win in the upcoming readout even if that number comes down (would be a grand slam for efficacy if comes in that high). Playing devil’s advocate, phase 2 study did not quite hit statistical significance on primary endpoint but management reminds us it was just a POC (proof of concept study) with 136 patients and current phase 3 trials are enrolling 650 patients.

Per the CEO, data in the phase 2a study was so strong that they skipped phase 2b and went straight to phase 3 (not sure I buy that). They did hit statistical significance on multiple secondary endpoints (% change from baseline in EASI, EASI 75, IGA clear or most clear). They narrowly missed statistical significance on primary endpoint of absolute change from baseline in EASI (again, only 45 to 46 patients per arm though). Drug clearly works when looking at full data snapshot.

Figure 6: Consistent evidence of efficacy across endpoints in phase 2a (Source: corporate presentation)

The phase 3 endpoint is vIGA-AD success at week 4 (only endpoint the FDA will accept) and phase 2a data showed 37% vs. 22% (robust delta between active and vehicle). Phase 3 then is simply a matter of powering up (roughly 650 patients per study in 2 to 1 randomization, or 10x as many patients in each arm versus phase 2). Timeline to filing for approval would be 6 to 9 months post data readout (sounds like end of Q3 2023 filing and 10-month review for sNDA). As for where the drug candidate would fit in the treatment landscape, if the product profile is similar to phase 2 they could potentially compete head to head with topical steroids and topical calcineurin inhibitors (parents don’t like using drugs with boxed warnings on their kids). Dupixent is generally a 2nd line agent for more severe cases, while Opzelura is reserved for 3rd line with their label. Roflumilast will be competing for the first line patients.

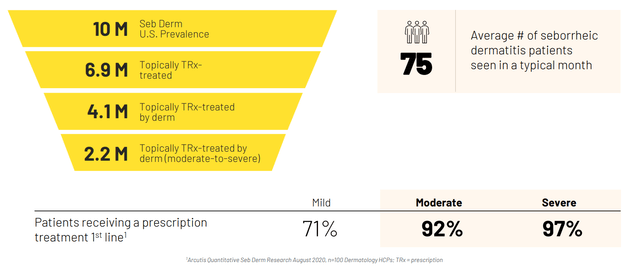

Moving on to seborrheic dermatitis, the CEO calls the data spectacular noting that they achieved an 80% IGA success rate with half of the patients completely clear at 8 weeks. Foam is something patients can integrate into their daily lives which is a challenge with existing therapies (like ketoconazole shampoo). This market is nearly as big as the psoriasis market and there has not been any innovation for decades in this space.

Figure 7: Market opportunity for seborrheic dermatitis (Source: corporate presentation)

The fact that the phase 3 study was easy to enroll (“patients coming out of the woodwork”) bodes well for launch prospects in this indication (potential indicator of demand out of the gate).

Scalp and body psoriasis indication reported positive phase 3 data on September 26th. Specifically, 67.3% of patients treated with roflumilast foam achieved S-IGA Success compared to 28.1% for vehicle at week 8 (P<0.0001), and 46.5% of individuals treated with roflumilast foam achieved B-IGA Success compared to 20.8% for vehicle foam at week 8 (P<0.0001). Roflumilast foam also demonstrated statistically significant improvements compared to vehicle on ALL secondary endpoints, including scalp itch and overall itch at week eight.

The goal is to get approved for treating all over the body including the scalp (staggered NDAs starting with seborrheic dermatitis in Q1 2023 then follow with scalp after the initial indication is approved). A key unknown for seborrheic dermatitis is after stopping treatment, how long clearance lasts before it restarts again. Annual utilization will likely be less for these patients (2 cans/tubes per year versus 3 to 4 cans per year for plaque psoriasis).

As for the Ducentis Biotherapeutics acquisition ($16M upfront cash payment, $14M stock payment plus future milestones), the company’s lead asset is still in preclinical stage (fusion protein highly selective for CD200 receptor, thought to be an important immunological checkpoint with a pivotal role in the maintenance of immune tolerance). CEO states they are a medical dermatology company (not necessarily restricted just to topicals), there is still big unmet need in atopic dermatitis and CD200 has been clinically validated (exciting durability of effect off drug once patients respond).

Ducentis’ candidate DS-234 looks to offer potential differentiation through an improved ability to modulate the CD200 pathway, a longer half-life, and a higher steady state volume of distribution. It was a logical deal as Ducentis is an early-stage discovery company and Arcutis has the development capabilities to efficiently take the asset into the clinic.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $283M (plus $162M net proceeds from August secondary offering and $125M drawn from existing loan facility brings it to a total of $570M). Net loss rose by over 50% to $67.4M, while research and development expenses increased to $38.2M. G&A more than doubled to $27.6M, a consequence of higher headcount as they prepare for commercialization. Even with a seemingly robust balance sheet, I continue to think a key risk is seeing a slow launch out of the gate for a few quarters in which case they will need to further dilute shareholders (perhaps another financing by 2H 23).

As for prior financings, keep in mind that August secondary offering took place at $20 per share and current stock price is a bit below that (not necessarily a good sign).

As for institutional investors of note, Orbimed Advisors owns a 4.7% stake (sold a bit recently) and Frazier Life Sciences owns a 14.6% stake. As relates to insider behavior, over the past year I see mainly selling which does not inspire confidence in near term prospects. President and CEO Frank Watanabe owns 381,000 shares (some skin in the game but again has been selling for some time).

As for relevant leadership experience, Chief Commercial Officer Ken Lock served prior as executive director of sales and marketing at Gilead Sciences (led inflammation and pulmonary hypertension US commercial franchises). VP Clinical Development David Berk served prior as head for medical dermatology at Allergan.

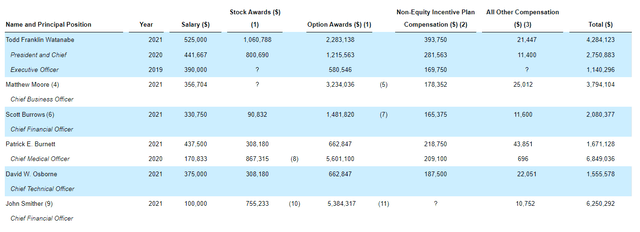

Moving on to leadership compensation, the cash portion of salary is reasonable at $525k or under. Likewise for stock and options awards, I’m not seeing anything that strikes me as excessive though the CFO is certainly getting well compensated at 5.3M in options awards.

Figure 8: Executive compensation table (Source: corporate presentation)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Moving onto useful nuggets from members of the ROTY community, TwoJ noted the following back in 2020:

Arcutis has a powerful topical small molecule inhibitor of phosphodiesterase, formulation for psoriasis and atopic dermatitis. The pipeline appears to be de-risked with a phase 2B showing statistically significant results for psoriasis and another POC study in atopic dermatitis showing a trend toward significance (the study wasn’t powered for significance). Weaker versions of the drug have been used effectively in the dermatology space; their version is much more powerful and has been licensed from AZN who developed it for COPD. It has been used for many years in COPD without safety issues. Management is very experienced in the dermatology space. They seem very savvy about positioning their product in the treatment landscape at a competitive price. Their presentation at Goldman Sachs conference is worthy of a listen.

As for IP, Arcutis has exclusive license to 13 issued US patents and 15 foreign patents (11 pending US applications and 43 pending foreign patent applications). While it is a fair point to note that the issued U.S. patent that they licensed from AstraZeneca (composition of matter encompassing roflumilast) expired in 2020 and data exclusivity for oral roflumilast expired in 2021, the company’s issued patents for roflumilast foam and cream contains claims directed to, among other things, formulating roflumilast in combination with hexylene glycol, methods of making such formulations, and methods of treatment using such formulations, and a method for improving treatment adherence by improving delivery and extending the plasma half-life of a roflumilast composition. These issued U.S. patents will expire no earlier than June 2037.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), terms of the agreement with AstraZeneca by which the company came to own its lead asset merit being reviewed. This exclusive worldwide license deal was inked in July 2018 when Arcutis paid AstraZeneca $1M cash upfront and issued them 484,388 shares of Series B convertible preferred stock (valued at $3M on date of the deal). Subsequently, they paid AstraZeneca $2M for a clinical milestone and are on the hook for up to $12.5M in regulatory milestones and $15M in sales milestones (not to mention high single-digit royalty rate on net sales).

Final Thoughts

To conclude, it’s readily apparent that this dermatology play offers investors multiple shots on goal and a potentially profitable combination of accelerating sales growth and clinical momentum. I appreciate that management’s approach to launch is quite different than that of peers (not trying to generate false demand and instead focusing on improving gross to nets). Playing devil’s advocate, it will take them time to deliver in terms of market access and reimbursement that ultimately translates into the sales growth we seek.

In the meantime, they will burn considerable cash resources and likely need to dilute investors again by 2H 23. Leadership is trying to minimize barriers to uptake and make Zoryve as easy to get as possible, but again I believe issues that predecessors have faced will adversely affect them as well at least in the near term.

For readers who are interested in the story and have done their due diligence, ARQT is a Buy (only appropriate for those with a long-term timeframe).

From a Core Biotech perspective (emphasis on next 3 to 5 years), I will continue to monitor from the sidelines. My plan is to wait for the next few quarters until I see accelerating sales and sufficiently positive launch trends to convince me that the required derisking has taken place.

Key risks include another round of dilution by 2H 23 and heavy competition in spaces targeted such as atopic dermatitis (from generic steroids I might add as well as big pharmaceutical companies with greater amount of resources). Slow launch out of the gate (the first few quarters) would be looked on negatively by Wall Street but seems quite possible to my eyes, in which case the share price would suffer and aforementioned dilution would take place at lows.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment