naphtalina/iStock via Getty Images

Introduction

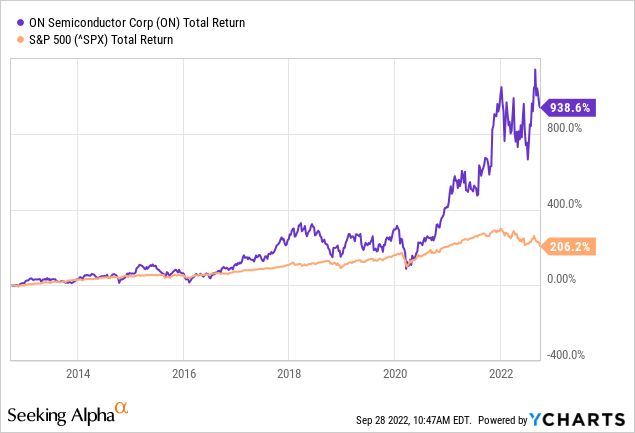

ON Semiconductor (NASDAQ:ON) is in a fast-growing market and sees a bright future ahead. The stock has already proven itself strongly over the past 10 years by showing an average growth of 26% against the growth of the S&P 500 of 12%. Despite the strong rise, the stock is valued attractively, and this may be due in part to the volatile automotive market, which showed mixed results and expectations in the short term.

Nevertheless, in the long term, I expect the automotive market to rise sharply due to the enormous growth of EVs. ON Semiconductor’s recent quarterly figures looked strong, and the outlook is strong. Both the EV/EBITDA and the PE ratio show that the stock is attractively valued. The stock has some risks (volatile automotive market), but the many benefits outweigh this risk.

Quarterly Highlights

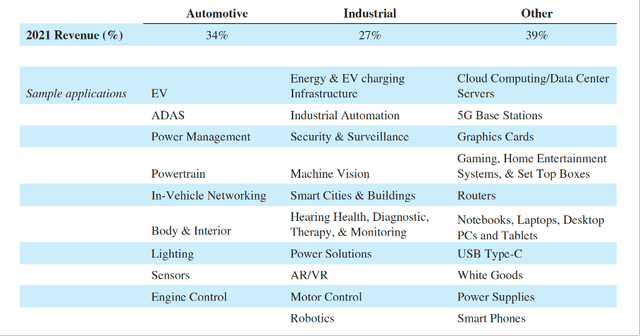

ON Semiconductor provides sensing and power solutions for the automotive, industrial and other (computer). ON Semiconductor sees fast-growing secular trends in the automotive and industrial end markets. Automotive sees a growth spurt due to the rapid growth of EVs, which are equipped with numerous components in which ON Semiconductor specializes. The Automotive end market accounted for 34% of revenue in 2021 and the Industrial business segment for 27%. The remaining business segment accounted for 39% and consisted of power solutions for various end markets in the computer and peripherals markets. In 2021, 58% of sales came from Asia (excluding Japan), 17% from both the US and Europe and 7% from Japan.

Segment Revenue (2021 ON annual report)

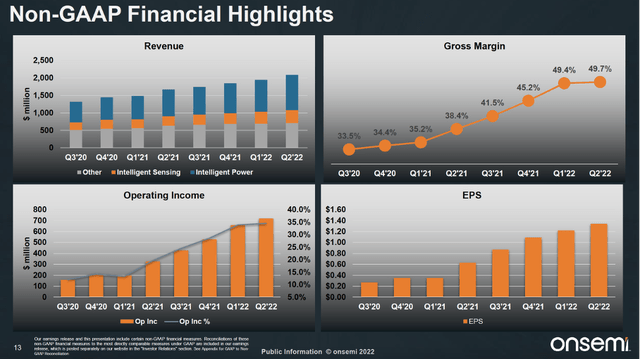

In the second quarter, revenue grew strongly by 25%. Their gross margin has improved significantly in recent quarters. The gross margin grew from 33.5% in the third quarter of 2020 to 49.7% in the second quarter of 2022. Due to the legacy IDM model (fab filler strategy), the flexible production process ensures a low fixed footprint. This ensures minimal gross margin volatility. Both the silicon carbide and power & packaging segments are expanding to meet rising demand. The short-term capital intensity is 12% and is expected to reach 9% in 2025.

ON Semi Non-GAAP Financial Highlights (2Q22 Investor Presentation)

ON Semiconductor Is Expected To Grow With A CAGR of 7% To 9%

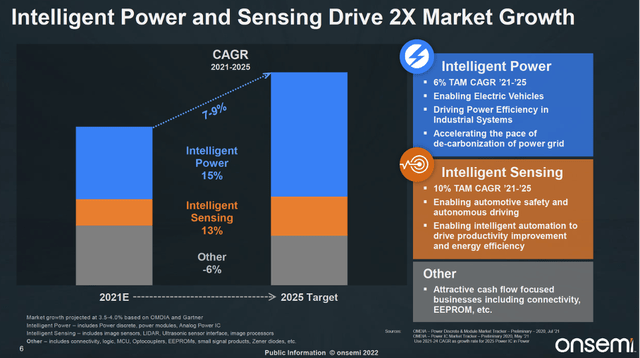

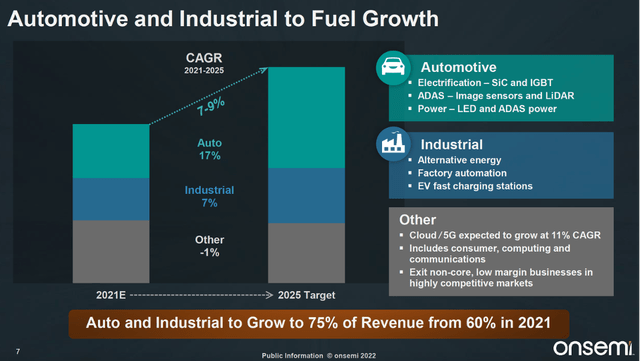

ON Semiconductor expects the total addressable market (TAM) for Intelligent Sensing and Intelligent Power to grow strongly. Intelligent sensing solutions are expected to grow at a CAGR of 13% and Intelligent Power at a CAGR of 15% through 2025. Consolidated, ON Semiconductor is expected to grow at a CAGR of 7-9% through 2025.

Intelligent Power and Sensing Drive 2x Market Growth (2Q22 ON Semi investor presentation)

Automotive segment is expected to grow strongly at a CAGR of 17%. Industrial segment comes second with an expected CAGR of 7%. HP and other computer manufacturers lowered their expectations, and this is also reflected in ON Semiconductors’ CAGR forecast through 2025. ON Semiconductor expects a CARG of -1% in this segment. Consolidated, the company will grow strongly to 7 to 9% CAGR.

Automotive and Industrial to Fuel Growth (2Q22 ON Semi investor presentation)

As the automotive market is expected to grow strongly, I will elaborate further in the next section.

Current Automotive Market Is Mixed, But 5 Year CAGR Is Expected To Be 18%

In the long term, ON Semiconductor expects strong growth in their automotive segment due to the rise of EVs. Currently, different ON Semiconductor customers have a different short-term outlook.

The revenue of Continental (OTCPK:CTTAF) (maker of car parts, stability systems, braking systems and tires) grew by 8% year-on-year in the past quarter. They see strong order intake in excess of $6 billion and expect their 2022 outlook in the automotive segment to be between $17.8 billion and $18.8 billion (up 16% to 22% from 2021).

Aptiv (APTV), a maker of vehicle components, signal and power solutions, and advanced safety and user experience components, grew 9% year-over-year revenue in the recent quarter. They see a continuous impact from the shortage of semiconductors on production volumes, but still manage to realize strong sales growth. Total gross program bookings are at an all-time high at $20.3 billion in the first half of the year, as full year 2021 bookings totaled $24 billion. In the Signal & Power Solutions business segment, revenue grew 22% in the second quarter. Aptiv is expected to achieve ~30% revenue growth in FY2022.

Sales of automotive components manufacturers and their outlook were strong. These components eventually are installed into different automotive brands. However, these brands show a different picture of their sales expectations. Toyota (TM) posted strong year-over-year revenue growth of 7% in the quarter, while consolidated auto sales declined 6%. The company recently announced that Toyota sales in the US fell by 10% yoy in August and by 21% yoy in July. The picture also looks less rosy for Honda (HMC). Honda cuts production by 40% at two Japanese plants due to supply chain problems. Honda sales in the US fell 38%. General Motors (GM) saw quarterly sales rise 3% year-on-year, and U.S. dealer inventory rose 17%. The segment excluding China JV performed particularly well, with sales up 36% and wholesale up 31%. I cite from CEO Mary T.Barra:

Our outlook for the second half is strong, and we are reaffirming our full-year earnings guidance that includes EBIT-adjusted of between $13 billion and $15 billion. This confidence comes from our expectation that GM global production and wholesale deliveries will be up sharply in the second half.

The outlook for GM for FY2022 is strong as sales, global manufacturing and wholesale deliveries are set to rise sharply. This is in contrast to the Japanese car manufacturers.

Ford is also having trouble delivering cars due to supply chain issues. Specifically, it concerns problems with the delivery of their brand name badges. This was very negatively reflected in the news report. I see this as an issue that can be addressed quickly.

The car market therefore presents a mixed picture. US sales grew for GM but fell in China, while Toyota and Honda saw US sales fall. The automotive market is very volatile and dependent on different subsystem suppliers, a disruption in the supply chain affects the end segment. The automotive market is a growth market for ON Semi, mainly due to the rise of EVs. From 2022 to 2027, electric vehicle sales are expected to grow at a CAGR of 18%. These are positive developments for ON Semiconductor.

EV/EBITDA And PE Ratio Valuation Metrics Are Favorable

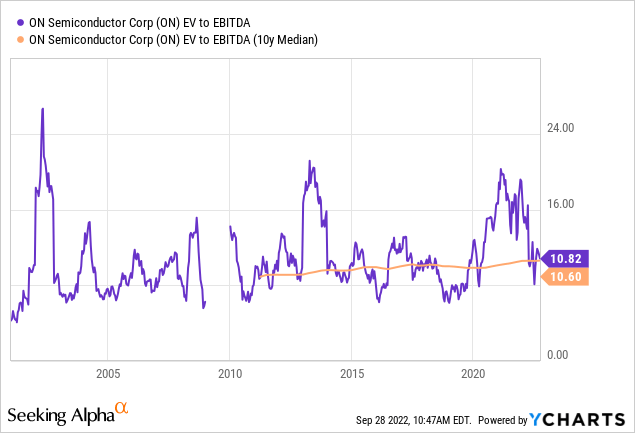

Investor enthusiasm for EV-related stocks has waned, and ON Semiconductor also fell. To gain insight into the valuation, I choose the EV to EBITDA ratio and compare it with the 10-year median.

What we can see from the chart is that the stock price is favorably valued compared to the 10-year median EV to EBITDA ratio.

A favorable stock valuation is only one condition for the purchase decision of the stocks. The outlook is the second condition. The short-term outlook for automotive is mixed, but electric car sales are in high demand over the next 5 years.

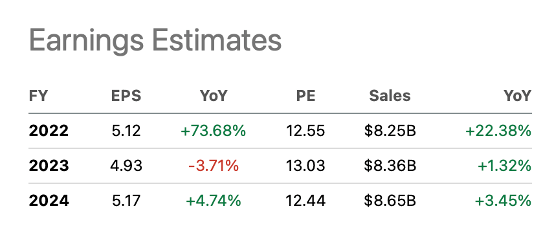

The 5-year median of the PE ratio is 22.8 and with a future PE ratio of 12.4 in 2024, the stock also seems undervalued here.

ON Semi earnings estimates (SA ON Ticker Page)

Key Takeaway

I have summarized the pros and cons of this article in the following list.

Pros:

- Both quarterly results and outlook were strong.

- From 2022 to 2027, EV sales are expected to grow at a CAGR of 18%. This also means positive developments for ON Semiconductor.

- ON Semiconductor is expected to grow at a CAGR of 7-9% through 2025.

- The gross margin has improved significantly over the years. The legacy IDM (fab filler strategy) model ensures minimal gross margin volatility.

- The valuation metrics EV/EBITDA and PE ratio look attractive at current levels.

Cons:

- The current automotive market shows a mixed picture, and the automotive market in general is very volatile.

- Supply chain issues in the automotive market could also lower the growth forecast for ON Semiconductor.

Based on the tradeoffs between the pros and cons, I think ON Semiconductor is worth buying, investors will have to keep an eye on the automotive market as it still accounts for over 34% of revenue.

Be the first to comment