bjdlzx

Buying into high-quality companies may seem simple enough. But the fact of the matter is that many of these firms tend to be rather expensive from a valuation perspective. Add on top of that the volatility of what is currently a very different market than what we have experienced for much of the past few years, and it should not be surprising to see shares of even the highest quality companies experience some pressure relative to the broader market. One really great example of this can be seen by looking at American Tower (NYSE:AMT). As one of the largest global REITs, the company owns a massive portfolio of communications sites that host telecommunications equipment. It also owns other telecommunications infrastructure, fiber, and property interests. On top of that, it has a rather small but growing data center business that, as of the end of the latest quarter, totaled 28 facilities in all. Unfortunately, the market has not appreciated how pricey shares are. On top of this, there’s also the fact that financial performance achieved by the business has been a bit mixed recently. Even with these issues, though, I do think that the company makes for a solid long-term opportunity. As such, I have no problem keeping it at the ‘buy’ rating I had it at previously.

Bad signals from Mr. Market

In early September of this year, I wrote my most recent article discussing the investment worthiness of American Tower. Even though shares of the company are far from cheap, I found myself impressed by the strong financial performance achieved by management. This was driven largely by acquisitions and continued site development. I also found myself lured in by the consistency of the enterprise and the potential that would have for long-term investors who don’t like volatility. At the end of the day, this all led me to rate the business a ‘buy’ to reflect my view that shares should outperform their broader market for the foreseeable future. So far, the market has not exactly appreciated my stance on the matter. While the S&P 500 is down 5.7%, shares of American Tower have generated a loss for investors of 18%.

Given this return disparity, you would be forgiven for thinking that the company is suffering from a fundamental perspective. But that couldn’t be further from the truth. Or, at a minimum, the picture is more nuanced than that. Consider revenue for the third quarter of its 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the enterprise. Sales during that time came in at $2.67 billion. That’s 8.9% higher than the $2.45 billion generated at the same time one year earlier. Although the company’s core operations reported sales increases across every region in which the business operates except for the Asia-Pacific region, the biggest growth for the company came from its data center business. Overall revenue in the third quarter of this year totaled $193.7 million. That dwarfs the $2.7 million generated at the same time last year and it can be attributed largely to the company’s acquisition of CoreSite back in the final quarter of 2021.

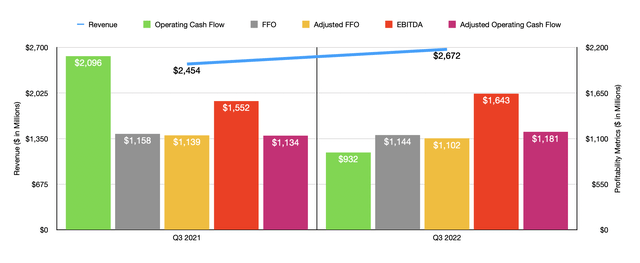

With revenue rising, profits for the company also improved. In the latest quarter, the company generated net income of $839.7 million. That stacks up favorably against the $723 million in profits generated at the same time last year. Other profitability metrics have been somewhat mixed. For instance, FFO, or funds from operations, managed to fall from $1.16 billion to $1.14 billion. On an adjusted basis, this metric fell from $1.14 billion to $1.10 billion. The most significant pain involved operating cash flow. This totaled $932.1 million in the latest quarter. That’s down from the roughly $2.10 billion reported at the same time last year. If we adjust for changes in working capital, though, the metric actually would have risen from $1.13 billion to $1.18 billion. Meanwhile, EBITDA for the company also improved, climbing from $1.55 billion to $1.64 billion.

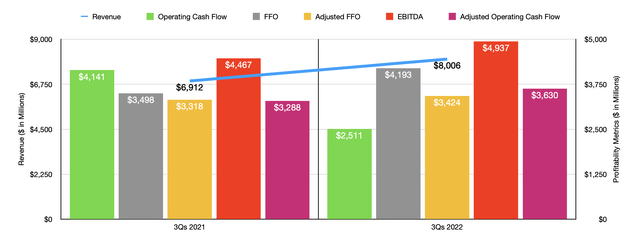

As you can see in the chart above, financial results for the first nine months of 2022 as a whole relative to the same time last year look far better than what data for the third quarter alone looked like. Year over year, every profitability metric for the company is up, as is revenue. The one exception would be operating cash flow itself, which fell from $4.14 billion to $2.51 billion. But if we adjust for changes in working capital, it would have risen from $3.29 billion to $3.63 billion. When it comes to 2022 as a whole, management expects revenue to come in at between $10.40 billion and $10.49 billion. At the midpoint, that would translate to a 14.6% increase year over year. Net income should be between $2.93 billion and $3.01 billion. Management has also said that FFO should be between $4.60 billion and $4.68 billion, while the adjusted figure for this should be between $4.43 billion and $4.51 billion. And finally, EBITDA is forecasted to be between $6.58 billion and $6.66 billion.

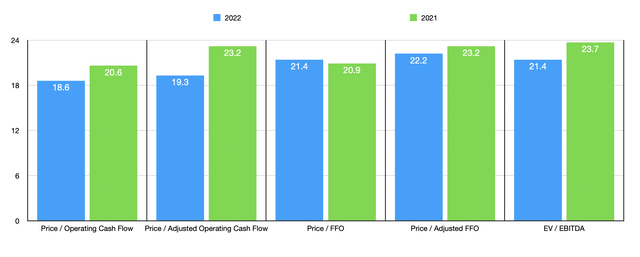

Truth be told, I don’t believe that net income is the most important metric for us to pay attention to. For that purpose, I have left it out of this valuation. But in the chart above, you can see the other multiples for the company. As an example, using data from 2022, the company is trading at a price to operating cash flow multiple of 18.6. This climbs slightly to 19.3 on an adjusted basis. The price to FFO multiple of 21.4 is slightly lower than the 22.2 reading we get using adjusted results. And finally, the EV to EBITDA multiple with the company should come in at 21.4. With the exception of the price to FFO multiple, all of these are lower than if we were to utilize data from the 2021 fiscal year, which is also shown in the aforementioned chart. I do recognize that, on an absolute basis, these shares might look a bit lofty. But relative to similar firms, the company does not seem to be unrealistically priced. As part of my analysis, I compared it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 17.9 to a high of 25. In this case, only one of the companies was cheaper than American Tower. Meanwhile, using the EV to EBITDA approach, the range was from 14.4 to 28.9. In this case, three of the five companies were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| American Tower | 19.3 | 21.4 |

| Crown Castle (CCI) | 21.3 | 20.2 |

| Equinix (EQIX) | 19.4 | 24.6 |

| Digital Realty Trust (DLR) | 19.5 | 15.1 |

| SBA Communications Corporation (SBAC) | 25.0 | 28.9 |

| Iron Mountain (IRM) | 17.9 | 14.4 |

Takeaway

From all the data presented, it seems to me as though American Tower continues to chug along nicely. Keep in mind that this is not a rapidly growing enterprise that will generate significant near-term upside. Rather, this is the kind of stable industry leader that you go to for consistent and steadily growing cash flows. Yes, the market has beaten the stock down a bit as of late. But ultimately, I do think that shares will rise at a rate that outperforms the broader market as the company continues to expand by means of acquisition and through organic means. Because of these factors, I have decided to keep the ‘buy’ rating I assigned to the company previously.

Be the first to comment