Justin Sullivan/Getty Images News

Arcos Dorados Holdings, Inc. (NYSE: ARCO) remains the largest McDonald’s (NYSE: MCD) franchisee globally. It holds the largest customer base in Latin America and the Caribbean. Two years after the pandemic hit the industry, it has already regained its footing. With its solid rebound, more promising growth catalysts are expected this year. The increased number of internet users may leverage its growth in the digital market. Likewise, the stock price shows a more rosy future for investors. This optimism is in line with its fundamentals and dividend payments.

Company Performance

Arcos Dorados did not avert the unfavorable impact of the pandemic. The restrictions led to massive supply chain disruptions and lower sales. The combination had more problematic results as the operations remained limited. Aside from the restrictions, the surge in unemployment dragged its demand down.

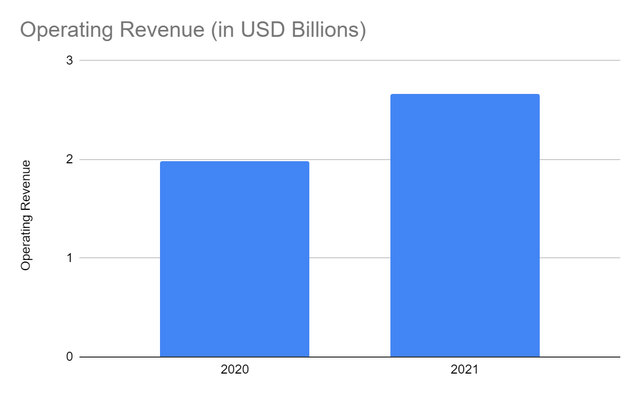

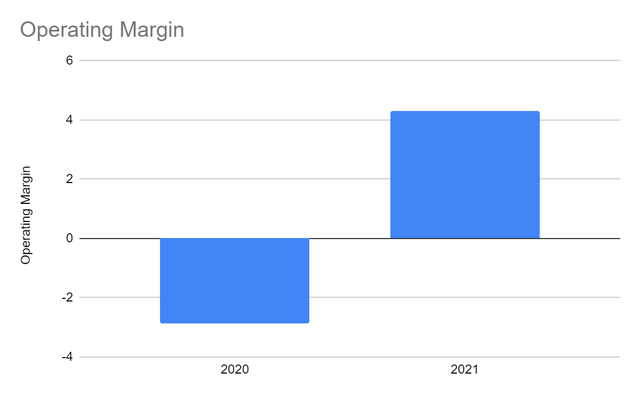

ARCO had to contract its operations, resulting in a 33% decrease in sales. From $2.66 billion, it landed on $1.98 billion. Likewise, costs and expenses were cut to keep the core business stable. Yet, the effort was not enough as the external pressures proved disruptive. The impact of lower demand and limited operations on sales was more substantial. So, reducing the costs and expenses could not offset revenue losses. As a result, the operating profit dropped to -$57 million, or a margin of -2.88%. Nevertheless, the company remained operational throughout the year. Its resiliency helped it cope with the challenging market environment.

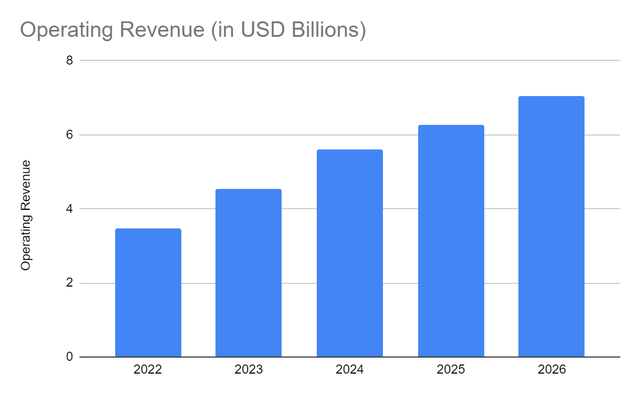

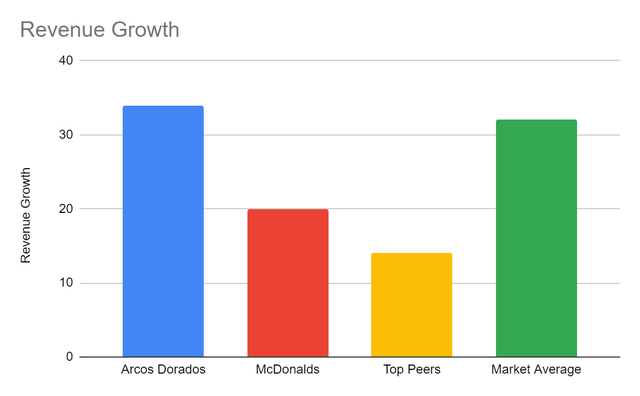

Today, Arcos Dorados shows more stable operations. Its most recent operating revenue is $2.66 billion, a 34% year-over-year growth. Likewise, the operating margin is now 4.3%. Thanks to the reopening of borders and easing of restrictions. Its digital adaptation becomes a growth driver as more people embrace the technology.

Operating Revenue (MarketWatch)

Operating Margin (MarketWatch)

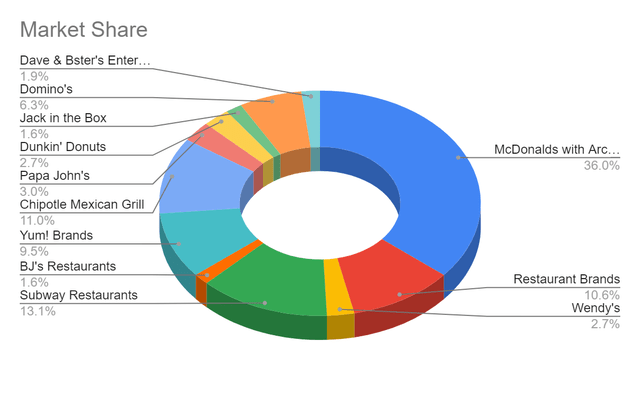

Also, it holds the largest franchise in McDonald’s, giving it the most sales globally. ARCO dominates Latin America and the Caribbean. With over 2,000 stores, it caters to millions of customers daily, making it the largest QSR chain in the region.

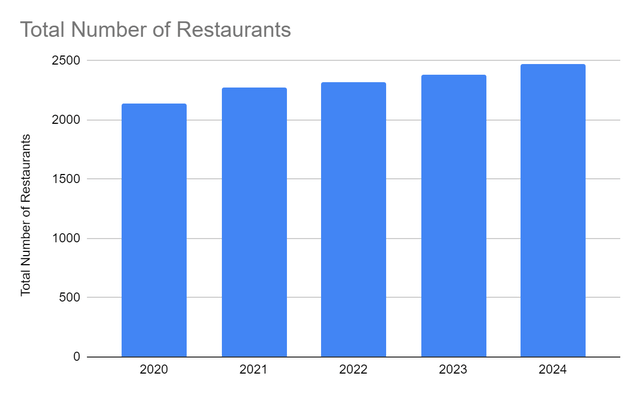

With 46 store openings in 2021, it now has 2,261 operating restaurants, 268 cafes, and 3,265 dessert centers. It is no surprise that revenues and earnings increased last year. The openings of more restaurants may help cater to more customers and capture more demand. It is highly attainable, given the solid customer base and brand loyalty of McDonald’s.

Currently, McDonald’s, including Arcos Dorados, holds 36% of the market share. It is a 1% increase from the 35% market share in the previous year. It shows the maintained popularity and increased market demand. Also, Arcos Dorados shows a 34% year-over-year revenue growth. It is higher than MCD’s top peers and the market average. The data shows its robust performance and ability to go head-to-head with larger QSRs.

Growth Prospects

The pent-up demand in the industry offers more opportunities today. It is finding more ways to meet more customers, whether in physical stores or online. Statistics show that the global fast-food market may reach $998 billion in the next few years. Thankfully, the company keeps up with the evolving market landscape and customer preferences. These are the anticipated growth prospects for Arcos Dorados.

Digital Transformation

Even before the pandemic, digital transformation has been seen across industries. And ARCO was able to catch up. When the pandemic peaked, the fear and health protocols confined many customers at home.

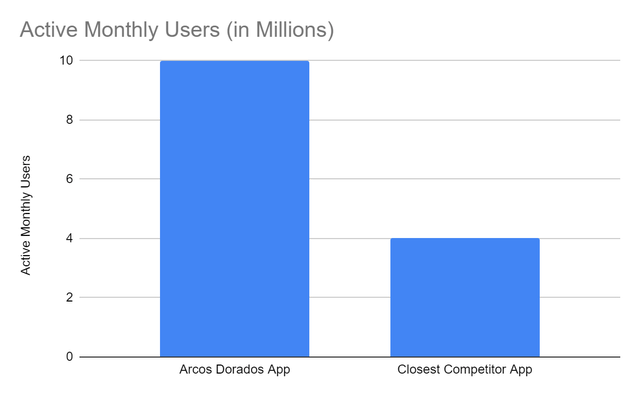

Fortunately, ARCO was able to adapt to consumer trends. It improved Arcos App while its Squad focused on McDelivery. The company expands its e-commerce capabilities to increase digital sales. Also, the app helps it dominate the market with 10 million monthly active users, 60% higher than its closest competitor.

Active Monthly Users (Arcos Dorados Website , Investment Relations, 4Q 2021 Presentation )

Personalization may enhance the customer-tailored experience, leading to more engagement. Recent statistics show that tailored experience increases the probability of purchases by 80%. Today, digital sales account for 36% of its total revenues. It aims to increase it to 40% by 2025.

The digital aspect will not only attract more customers but also improve efficiency. It will lessen the processing time of orders and increase customer satisfaction. So while it captures more demand, it may keep its costs and expenses relatively low. That is why it is strategic for Arcos Dorados to increase its investments in technology.

Competitive Advantage and Store Openings

Store openings are vital in its goal to capture more customers this year. In 2021, it already opened 46 restaurants, 40 free-standing. In 2022-2024, it plans to open at least 200 restaurants with 90% or 180 of which are free-standing. Currently, it has already opened 13 out of 55 target restaurants.

Total Number of Restaurants (Arcos Dorados)

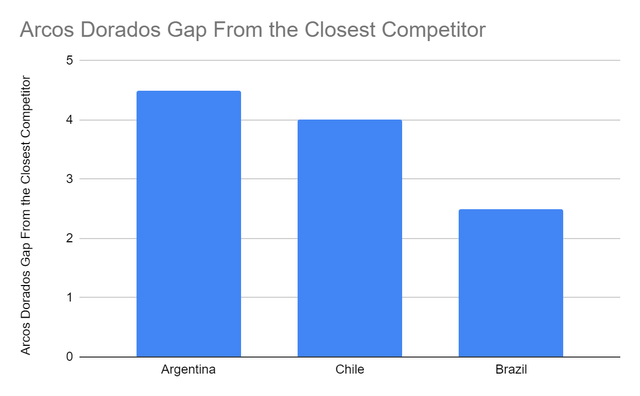

But of course, openings alone are not always enough. It’s a good thing that ARCO knows which types offer a more competitive advantage. So, it keeps opening more free-standing restaurants. The master franchisee holds the largest number of free-standing restaurants in the region. Even better, ARCO continues to generate revenues. It may be fruitful since it has the highest market presence. In Argentina, it is 4.5x more existent than its closest competitor. It is also the most dominant in Chile and Brazil, with 4x and 2.5x increased presence, respectively.

Arcos Dorados Gap From The Closest Competitor (Arcos Dorados)

Suppose we divide the operating revenue by all restaurants, the average revenue increases from $616,000 to $815,000. That is the difference before and after the 46 restaurant openings. So as more restaurants open, ARCO can cater to more customers and capture more demand. On average, it shows marginal revenue of $14,783,000 per restaurant. Hence, ARCO continues to penetrate more markets while expanding its capacity.

If we use the amount for the additional 55 restaurants, it will increase by 31%, reaching $3.48 billion. We may divide the remaining 145 target stores for 2023 and 2024 into 72 and 73, respectively. Given these, the operating revenue in 2023 and 2024 may amount to $4.54 billion and $5.61. These are still in line with my 30-32% revenue growth projection in 2022-2023 and 23-24% for the next five years. Meanwhile, the operating margin may reach 8-12% since costs and expenses are more manageable.

Operating Revenue (Author Estimation)

More Stable Financials

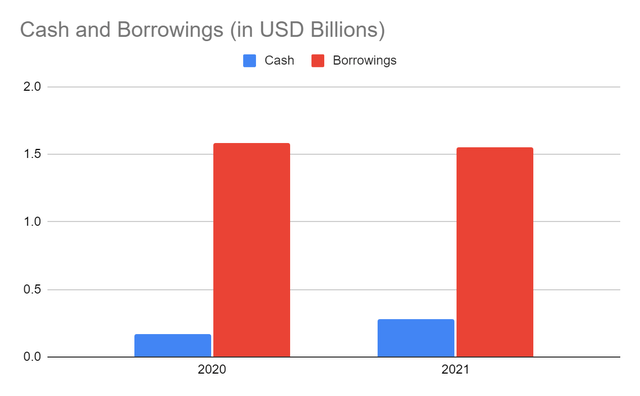

The company shows more stable financials today. The borrowings skyrocketed in 2019, but now, they have become manageable. It decreased by 2%, while cash and equivalents rose from $170 million to $280 million. So, cash relative to borrowings increased from 10% to 18%. Given this, we can see that the company continues to reap the benefits of its recovery and expansion.

Cash and Borrowings (MarketWatch)

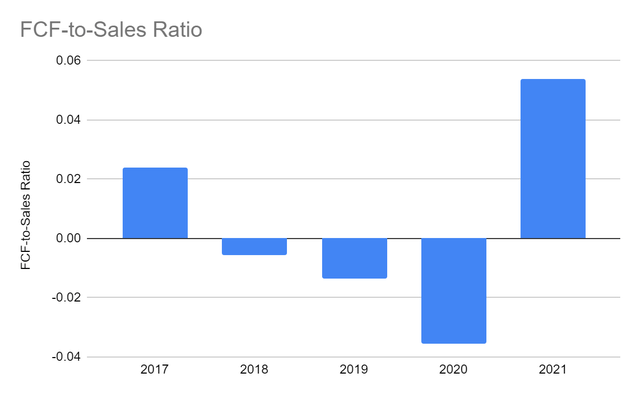

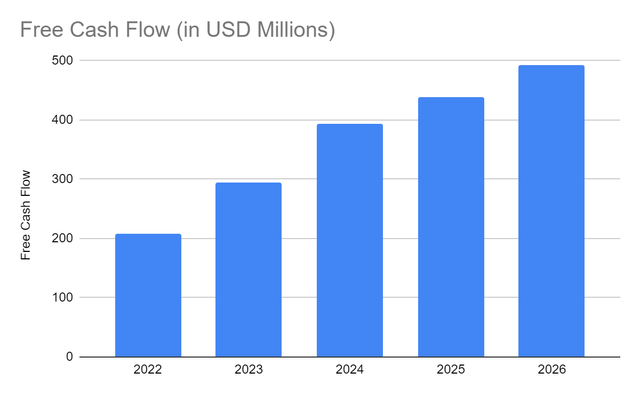

Moreover, it may still sustain its operations while remaining profitable. The company generates more cash, which also helps cover its financial obligations. We can confirm the increasing profitability and sustainability through its Free Cash Flow ((FCF)) of $143 million. The FCF-to-Sales Ratio is now 5.4% despite a higher CapEx of $115 million. It is also the highest for the last five years. So as the company tries to expand, it keeps its costs and expenses lower. It now has more means to cover its expansion and obligations to its stakeholders. For the next five years, I estimate the FCF-to-Sales Ratio to increase to only 6-7% because cause of the increase in CapEx due to more restaurant openings. So, the value may go up from $203 to $490 million.

FCF-to-Sales Ratio (MarketWatch)

Free Cash Flow (Author Estimation)

Price Valuation

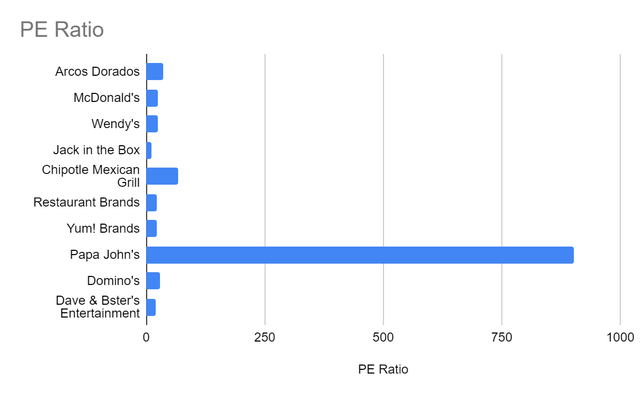

ARCO remains in an uptrend despite the slight decrease since March 25. I was in a buy position at $5.50 in my previous article. Today, it has already paid off by over 50%. At $7.80, the price shows an upward momentum, which may increase further. Although the PE Ratio of 36.20 suggests overvaluation, it remains lower than some of its peers.

Also, if we use the estimated EPS of NASDAQ at $0.39 and $0.47, the PE Ratio will decrease to 20 and 16, respectively. Meanwhile, the PS Ratio of 0.64 suggests that it is indeed a desirable stock. To value the price better, I tried to use the DCF Model using FCFF.

|

FCFF |

$48,000,000 |

|

Cash |

$384,000,000 |

|

Borrowings Outstanding |

$150,000,000 |

|

Perpetuity Growth |

4.40-4.80 |

|

WACC |

6.40-6.80 |

|

Common Shares Outstanding |

210,000,000 |

|

Stock Price |

$7.80 |

|

Derived Value |

$$9.24-$9.82 |

There is a potential upside of 16-20% for the next twelve to twenty-four months. It may be challenging since it’s been four years since ARCO last reached the range. But, given its continued expansion and better fundamentals, the price may keep increasing. Its store openings and digital transformation adaptation keep it on the right path. It may flourish more or maintain its stable financials, sustaining the uptrend.

Moreover, it has resumed its dividend payments at $0.04 per share or $0.16 per year. The payment does not seem to stop again since it has already recovered. The Dividend Payout Ratio is only 18%, so it still has 82% to sustain the operations, expansion, and payments to its stakeholders. Indeed, it remains capable of financing its restaurant openings while satisfying its investors. ARCO may still increase its capacity while maintaining its adequacy.

Bottom Line

Arcos Dorados Holdings, Inc. has already rebounded from its decline in recent years. Its digital adaptation and restaurant openings show its larger capacity to generate earnings. With its fruitful performance, its growth prospects have become more promising. Also, cash and borrowings are more stable, allowing it to maintain its liquidity. The potential stock price upside and dividend payments are other factors to consider. The recommendation is that Arcos Dorados is still a buy.

Be the first to comment