Chinnapong/iStock Editorial via Getty Images

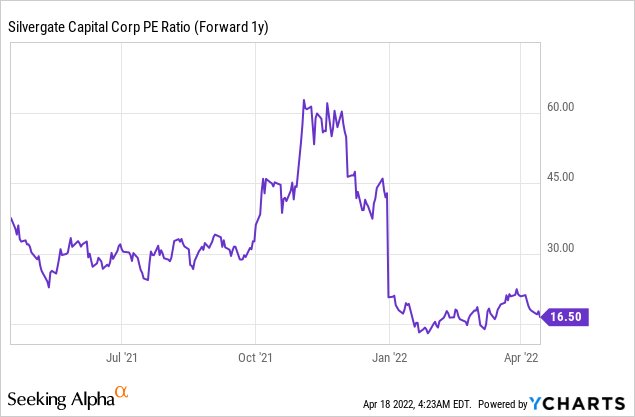

Silvergate Capital’s (NYSE:SI) acquisition of Diem earlier this year is a game-changer. Yet, the market has not priced this in – the stock is down ~21% YTD and trades largely in-line with pre-announcement levels. To be fair, the deal did cost a significant % of SI’s market cap, and guidance on the revenue potential of Diem IP has been lacking. If SI successfully replicates the Circle playbook, however, the path toward breakeven is relatively undemanding at ~$3bn in incremental deposits. Plus, SI is the only regulated banking institution that has successfully taken a step forward within the private stablecoin space, and thus, it stands to benefit massively as a first mover in a future where stables become the dominant source of payments. Given the growing interest in digital currencies by institutional investors, payment service providers, and retailers, a move toward stablecoins does not sound far-fetched at all. With SI also positioned for earnings upside through levers such as SEN Leverage and its rate-sensitive portfolio, SI shares at ~17x fwd P/E represent one of the cheapest crypto disruption plays on the market.

Diem Acquisition Paves the Way for a New Payment Rail

The Diem acquisition came as little surprise following the President’s Working Group report outlining regulators’ preference for stablecoins issued by banks. The net effect is that it places SI in a unique competitive position within the industry as the only Federal Reserve regulated bank participant in the crypto ecosystem. The acquisition is a clear strategic win for SI – replicating Diem on its own would have entailed a range of complexities, including building out a team of top-tier software engineers and an ecosystem of partners. Thus, federal regulators pushing Diem’s hand for a relatively undemanding ~$182m price tag (~$50m in cash) is to Silvergate’s benefit, in my view.

A key part of the deal is the heavy share-based consideration – it keeps skin in the game for Meta (FB) and the other Diem Association members. In effect, FB still participates in the upside from a SI stablecoin, while SI could also gain preferential access to the FB user base (e.g., Facebook, Instagram, and WhatsApp). The value proposition of stablecoins as a lower fee payment rail, as well as its integration within the Diem member platforms (e.g., Spotify (SPOT), Uber (UBER), and Shopify (SHOP)), makes SI a potential long term disruptor of the trillions in payment volume transacted by card networks.

One Step Forward, Two Steps Back

The headline numbers suggest the deal is dilutive to fwd EPS in the mid-teens. Now, management did not disclose the extent to which the $30m in guided expenses is recurring vs. one-time but sensitizing a 50-70% range yields a 16-19% 2023E EPS dilution scenario. I suspect these numbers could prove conservative, though, given that much of the cost is likely attributable to the transaction/due diligence and software development buckets, with the remainder due to recurring operational costs. Plus, SI did not provide any revenue guidance post-integration of the Diem assets, so future revenue benefits represent additional upside from here (Street estimates likely won’t account for Diem benefits pending guidance).

|

Base Case |

Bear Case |

|

|

Annualized incremental expense |

30 |

30 |

|

% Recurring |

50 |

70 |

|

Recurring expenses |

15 |

21 |

|

Intangible amortization (Straight line over 10-year useful life) |

18 |

18 |

|

Total incremental Expense |

33 |

39 |

|

Net Income 2023E (pre-Diem) |

210 |

210 |

|

EPS Dilution |

16% |

19% |

Source: Author, SI Disclosures

Yet, the stock has not re-rated on the acquisition, creating a mispricing in SI stock, in my view. Post-Diem, SI will not only be issuing a stablecoin but also running its own blockchain. This creates the opportunity to build out multiple revenue growth levers over time – from minting and burning to charging on-chain transaction fees as well as generating yield income on its stablecoin reserves. Thus, the Diem price tag is more than justified by the long-term opportunity, in my view – assuming a fee rate and margins in-line with USDC stablecoin issuer Circle (CND), the company only needs $40-50m in incremental revenue (or ~$3bn in deposits) to offset the mid-teens EPS dilution.

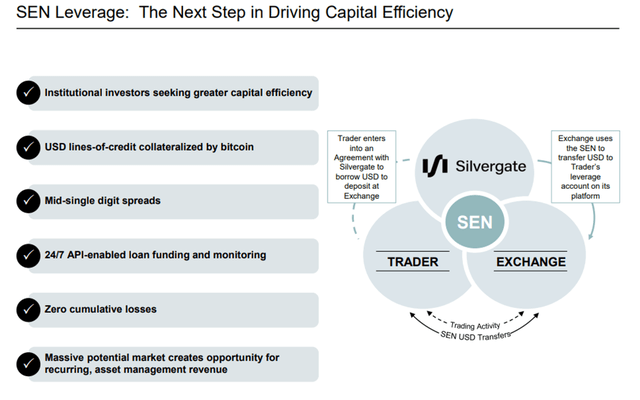

Optionality from SEN Leverage and Short Duration Bias

Through its collateralized lending product, SEN Leverage, SI could also tap into a significantly underserved growth avenue – only ~10% of its institutional customer base uses SEN Leverage, so further penetration should drive a ramp-up in earnings contribution going forward. A shift in mindset by Bitcoin (BTC-USD) miners towards holding Bitcoin on balance sheet (vs. selling it) represents a huge market opportunity. Marathon Digital’s (MARA) recent ~$100m line of credit is likely just the start, and going forward, I suspect BTC collateralized financing could be the go-to option (vs. equity issuance and unsecured debt) for miners to pay for their capex needs. While the self-imposed cap on SEN Leverage loans at 100% of capital could deter growth in the short run, SI’s plans to move future loans off the balance sheet (mainly via partnerships with other financial institutions) should mitigate much of the risk. If successful, the SI model would be more akin to an asset manager deriving origination and servicing fee income (vs. spread income) – effectively, a capital-light model. In the meantime, scaling at mid to high single yields should drive upside to the current SEN earnings outlook.

Silvergate Capital Investor Deck 2022

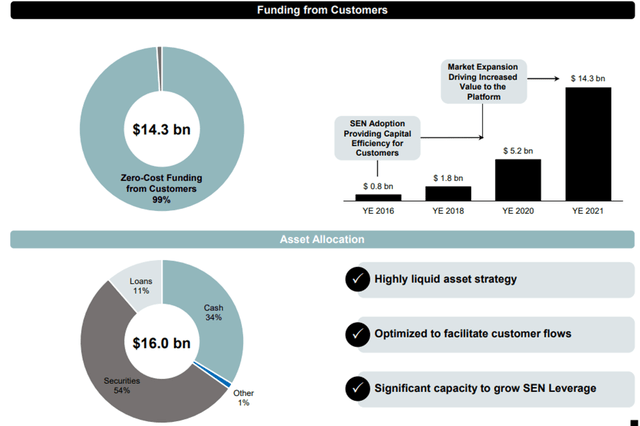

SI’s conservative management of its securities portfolio places it in a unique position to capitalize on rising rates (and volatility) in the coming quarters. For one, SI’s crypto focus allows it to maintain a deposit base that pays near-zero interest (i.e., a near-zero cost of funding). Contrast this with its securities portfolio, which at >50% of assets, is significant and, most importantly, has a short duration, floating rate structure. As a result, SI’s net interest income is guided to increase 52% for every 100bps shock in interest rates, although portfolio shifts post-Q3 2021 (when the guidance was issued) suggest an even bigger impact. SI has gone even more defensive in its latest quarter by selling $1bn of long duration, fixed-rate securities and purchasing $2.7bn of shorter duration, fixed and variable rate securities, so the portfolio sensitivity has likely increased. With the Fed dot plot now implying seven rate hikes for 2022, SI should emerge as a prime beneficiary.

Silvergate Capital Investor Deck 2022

Building a Crypto Champion

At ~17x P/E, there is a lot to like about Silvergate Capital. The Diem deal is likely just the start, as the company has built a unique regulatory moat, which should allow it to bring in meaningful crypto-related deposits over time. SI’s stablecoin rollout will differ slightly in that the initial focus will be on specific payment use cases (commerce and cross-border remittances) as it looks to capitalize on its head start with Diem Association members (most have already integrated the Diem architecture with their platforms). That said, running a blockchain opens up new economic models, including stablecoins for other use-cases, NFTs, and smart contracts, driving a massively expanded TAM. For now, the Diem deal will be dilutive to 2022/2023 earnings given the one-time and recurring costs added to the business, but against the potential benefits, I believe the recent weakness in the stock price presents a great buying opportunity for long-term investors.

Be the first to comment