gorodenkoff

Investment Thesis

Aptiv PLC (NYSE:APTV) is a global technology and mobility architecture company mainly focusing on developing solutions for the automotive industry. The company has recently announced the acquisition of an 85% equity stake in Intercable Automotive Solution, which deals in automotive power distribution and connection technologies. I believe this acquisition can act as a primary catalyst to accelerate the company’s growth by enhancing its capabilities and creating a solid presence in the competitive market.

About APTV

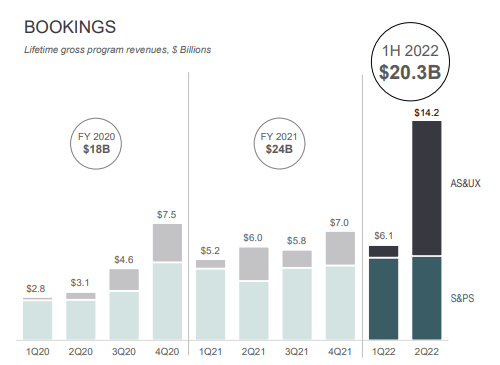

APTV is primarily an automotive-focused global technology and mobility architecture company. The company designs and manufactures parts of vehicles and provides electronic and active safety technology solutions for the automotive & commercial vehicle markets. The company’s customer base comprises the 25 largest global automotive original equipment manufacturers or OEMs. Its global network includes 127 manufacturing facilities and 12 technical centers to serve customers globally. It operates in 46 countries and has 18900 engineers, scientists, and technicians who develop market-relevant products. The company’s core product line includes Signal & Power Solutions and Advance Safety & User Experience. The Signal & Power Solutions segment designs and manufactures all components of the vehicle’s electrical architecture, including connectors, wiring assemblies and harnesses, cable management, electrical centers, and hybrid high voltage and safety distribution systems. This segment earns 74% of the company’s total revenue. The Advanced Safety & User Experience segment offers system integration tools, critical technologies, and advanced software development for security, safety, convenience, and comfort in vehicles, including sensor systems, multi-domain controllers, electronic control units, vehicle connectivity systems, and application development. The Advanced Safety & User Experience segment generates 26% of total revenue. The company is experiencing strong growth in both segments, as it has recorded a revenue of $20.3 billion in the first half of FY2022 which is 81.2% higher compared to the first half of FY2021.

Revenue Trend (Investor Presentation: Slide No.: 7)

Acquisition of Interconnect Solutions

The Electrical Vehicle market is becoming very competitive due to its various benefits, such as fewer emissions, growth of charging infrastructure, and low battery costs. This Automotive revolution can create strong momentum for industry growth in the coming years and provide a wide range of opportunities for the companies operating in this industry. It has already led to increasing demand for EVs due to government regulations and policies in many countries, which has intensified market competition. Identifying this opportunity, the company has recently signed a definitive agreement for acquiring an 85% equity stake in Intercable Automotive Solutions for $595 million. Intercable Automotive Solution deals in high-voltage power distribution and high-precision connection technologies. Intercable Automotive is considered an industry leader, with estimated sales of over $250 million in 2022. It focuses on manufacturing innovative solutions required to address the challenges in vehicle electrification. Its product line consists of solid-state electrical centers, battery-cell interconnects systems, high-voltage busbar technology, and other high-voltage power distribution solutions. Intercable’s technological and manufacturing capabilities will provide customers with an efficient and cost-effective vehicle assembly option, which can attract new customers for APTV. Its highly innovative product designs and relationships with prime European automotive OEMs can significantly enhance the company’s position as a full system supplier for electric vehicle manufacturers and help it gain a competitive advantage in the industry. By being highly competitive in the industry and expanding its customer base, I believe the company can increase its market share in the coming years, which can ultimately expand its profit margins. Observing the current market trends and growing demand for EVs, I think the company’s growth can sustain for a longer period of time as the automotive revolution can cause drastic changes in the automobile industry in this decade. After considering all these factors, I believe this acquisition can act as a primary catalyst to accelerate the company’s growth by enhancing its capabilities in the competitive market.

What is the Main Risk Faced by APTV?

Availability of Raw Material

The company uses various raw materials for production, such as electronic components, semiconductors, petroleum-based resins, chemicals, copper, and other materials. Reasons such as mechanical breakdowns, strikes, fires, explosions, electrical outages, or logistical complications due to climate change, weather, delayed customs processing, and natural disasters can cause disruptions in the supply of such raw materials and increase the raw material prices. Also, this disruption can lead to decreased production and shipping levels, which could increase its operating cost and further stress the company’s profit margins. Additionally, if there is a delay in delivery, the customers can seek to recoup all of their expenses from the company, which can lead to a reduction in profit margins.

Valuation

Recently, the company acquired Interconnect Solutions which can enhance the capabilities of the company in the coming years. I think this acquisition can drive growth and strengthen APTV’s position in a competitive market. After considering all these factors, I estimate the company’s EPS for FY2023 to be $5.08, giving the forward P/E ratio of 17.82x. The forward P/E ratio of the company is higher compared to its sector median of 12.98x. However, the company has always shown a tendency to trade above the sector median, as APTV’s 5-year average P/E ratio is 32.95x. The rising demand in the market for the automotive market can lead to a rise in raw material costs and put pressure on profit margins. Hence, I think the company might trade below its 5-year average in the coming years. After considering all these factors, I estimate the company might trade at a P/E ratio of 27.5x, giving the price target of $139.70, representing a 54.3% upside from the current share price of $90.54.

Conclusion

The electric vehicle market is expected to grow to a large extent in this decade which has intensified competition in the industry. Identifying the need to compete in the market, the company has recently announced the acquisition of an 85% equity stake in Intercable Automotive Solutions. Its capabilities can benefit the company to gain a competitive advantage and further accelerate its growth. The company is exposed to the risk of supply chain disruptions which can further increase raw material prices and decrease production levels. The forward P/E ratio of the company is higher compared to its sector median of 12.98x. However, the company has always shown a tendency to trade above the sector median, as APTV’s 5-year average P/E ratio is 32.95x. After analyzing all the above factors, I assign a buy for APTV.

Be the first to comment