Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ:AAPL) submitted its earnings sheet for the fourth fiscal quarter a little more than one week ago which resulted in two beats on earnings and revenues for the technology company. Although the company is still growing its core hardware business and the Services segment continues to ramp up nicely, I believe Apple’s shares are still overvalued and, due to the firm’s dependency on consumer spending, have very little recession value for investors. Since inflation remains a major problem with consumers as well, investors must expect a continual slowdown in Apple’s top line growth as well as continual pressure on the valuation factor!

Very little recession value

In my work comparing Alphabet (GOOG) to Apple — “Alphabet’s Google Vs. Apple: Better Recession Pick?” — I indicated that Google offers investors higher recession value due to the presence of the Cloud business which is growing extremely quickly and offers the digital advertising giant some protection against the current down-turn in the PC market.

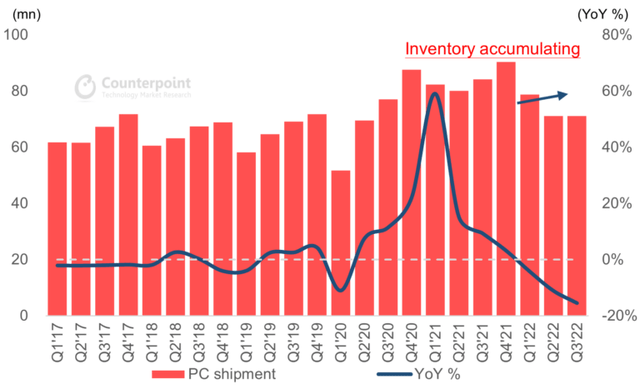

According to consulting firm Gartner, the decline in PC shipments actually accelerated in the third-quarter, to approximately 20% year over year, which severely impacts companies whose revenue mix is dominated by hardware sales. An acceleration of the current down-turn in the coming quarters is therefore a big risk for Apple since the company continues to generate the majority of its revenues from hardware and not software sales.

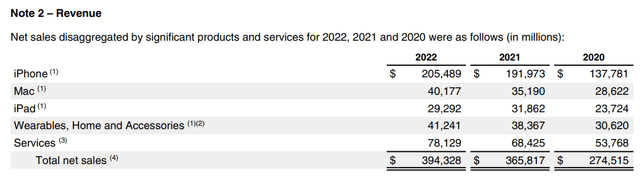

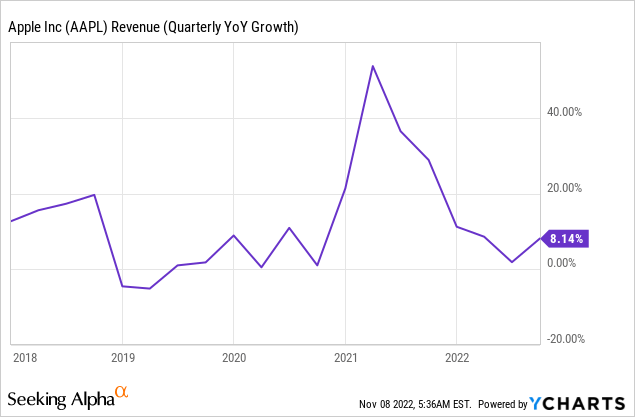

For the financial year that ended September 24, 2022 for Apple, the technology company revealed total revenues of $394.3B, showing an 8% year over year increase. Apple’s hardware revenues — which come from sales of the iPhone, Mac, iPad, Wearables and other accessories — accounted for 80% of all revenues in FY 2022. Apple’s combined hardware revenues grew only 6% in the last quarter, however, while the Services business grew its top line 14% year over year to $78.1B… which is on par with the growth rate in the fastest-growing hardware segment: Mac computers.

The Service segment has been Apple’s growth engine for a while now, but growth even in this segment — which includes revenues from the sale of advertising, AppleCare, cloud, digital content, payment and other services — has decelerated by about half from the 27% growth rate Apple enjoyed in FY 2021.

Source: Apple Segment Revenues

The problem with the hardware business is that it is highly dependent on consumer spending and a deterioration in consumer spending poses a big challenge for Apple going forward. Consumer spending is still holding up relatively well, but a down-turn in the economy paired with persistently high inflation could become a major challenge for Apple in FY 2023.

Another problem is that weak demand for consumer electronics has led to a build-up in inventories in FY 2021 and FY 2022, according to Counterpoint Research data. High inventory levels in the device market indicate not only weaker volume shipments but also pressure on product prices… both of which would be bad for hardware-reliant technology companies like Apple.

Revenue growth and valuation

The expectation is for Apple to have revenues of $407.9B in FY 2023 and $430.2B in FY 2024 which translates to expected top line growth rates of 3.4% and 5.5%. These growth rates are clearly not great and Apple may see a continual slowdown in its revenue growth in next year.

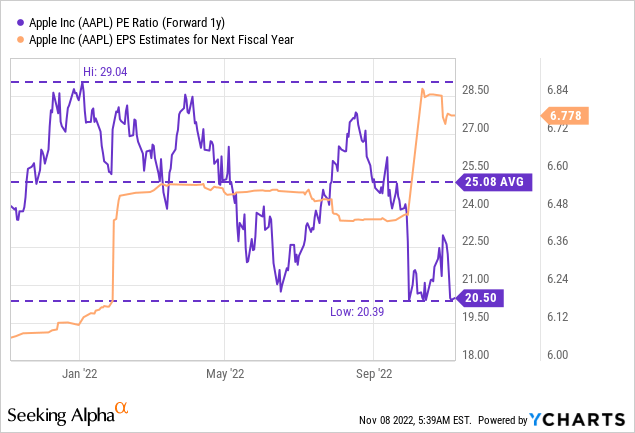

Based off of EPS expectations of $6.78 for FY 2023, shares of Apple are currently valued at a P-E ratio of 20.5 X… which is substantially below the 1-year average P-E ratio of 25.1 X. I believe shares of Apple are expensive considering that Apple has no real protection against a continual down-turn in the PC market which is made worse by its over-reliance on hardware products.

Risks with Apple

The big commercial risk with Apple is that despite growing importance and a higher revenue share of the Services business, the technology company remains overly reliant on hardware sales – PCs, notebooks, tables and mobile phones — whose sales in turn depend on healthy consumer spending. Therefore, I believe Apple is far more exposed to the down-turn in the PC market than other technology companies such as Google… which I like a lot more than Apple. Growing top line pressure, weaker margins and a lower valuation factor may be what investors have to expect going forward with Apple if the down-turn in the PC markets accelerates in the fourth-quarter.

Upside Risks

I would abandon my bearish-leaning sentiment if the PC market showed signs of stabilization and consumer spending remained resilient. A recovery in top line growth, new innovative product launches or more aggressive stock buybacks would also be very good reasons to change over to the bullish side.

Final thoughts

I still believe that Apple offers investors very little recession value, despite the company obviously having a great product line-up and incredible brand strength that has translated to premium pricing for all of its consumer electronics products and services. However, Apple continues to be super-exposed to the down-turn in the PC market with little offsets provided by the business. Services growth has also slowed down as inflation and slower economic growth hurt consumers. With shares continuing to sell at a relatively high P-E ratio, given the risks to revenue growth, I believe the stock has further to fall in the near future!

Be the first to comment