JuSun

Skillz (NYSE:SKLZ) once promised an appealing platform for mobile skill-based competitions, but the business model hasn’t worked. The mobile gaming platform is now in the process of adjusting the model to not rely as much on engagement marketing. My investment thesis remains ultra Bearish on the stock, even at $1, due to no proof the model works.

Restructuring Pain

Skillz just reported Q2’22 revenues fell an amazing 22% QoQ and the company lost $61 million in the quarter. Skillz cut the net loss by 59% from the prior quarter, but revenues at $73 million still struggle to top the excessive spending ongoing at Skillz.

For the quarter, revenues actually missed targets by a whopping $19 million. The miss was amazing for a $93 million target entering the quarter and due in large part to a cheating issue with platform participants abusing system discounts and friend referrals, amongst other issues.

The whole problem is that the game quality doesn’t apparently sell itself causing Skillz to spend aggressively on marketing to acquire and retain customers. The whole premise of the investment was an appealing mobile skill-based gaming platform that should attract players with limited marketing.

For Q2, Skillz spent $73 million on total sales and marketing while only generating $73 million in revenues. The company still can’t generate revenues in excess of the marketing spend, even with cuts to marketing.

The problem is that paying users fell during the quarter. Paying MAUs (monthly active users) declined 26% QoQ to only 0.42 million. The platform remains extremely small limiting any potential scale of the business.

The company promotes a new metric (always a bad sign) of RAEM (revenue after engagement marketing), but investors are cautioned to not be misguided by this number. This metric dipped to just $43 million in the quarter, down another 16% from $51 million in the prior quarter.

Such a small amount limits the ability to achieve profits despite having a business with nearly 90% gross margins. The combined costs for R&D and G&A top the total of the new RAEM metric. As long as RAEM continues to dip along with cutting marketing, Skillz is in a race to the bottom, as retention and monetization just declines with less money spent on marketing.

The guidance for 2022 has revenues plunging to $275 million, down from a prior internal goal of $400 million. The goal is for engagement marketing to stay an unsustainable high of 42% of revenues causing RAEM to only hit $160 million for the year.

Considering Skillz hit RAEM of $94 million in the 1H of the year, the company is projecting a dip to only $66 million in the 2H of the year. The goal is to average a quarterly RAEM of $33 million for the rest of the year. Such a low amount of their won revenue metric isn’t encouraging for the company reaching probability next year.

Product Development Questions

Skillz ended the June quarter with cash of $590 million and net cash of $290 million. The strong financial position does provide the company with a couple of years to straighten out the business.

The company has a promising NFL game challenge entering soft launch phase and a multi-year partnership with the UFC for a mixed martial arts branded mobile game. Any successful game launch for a game with high appeal could provide the player interest to drive engagement without needing a high level of marketing.

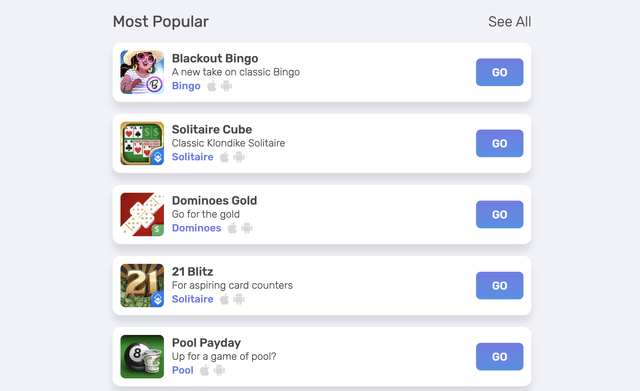

The biggest question remains the quality level of the games on the mobile platform. The most popular games listed on the website still appear very basic games clearly unappealing to the average player based on the constant weak financials.

Per the CEO on the Q2’22 earnings call, Skillz has major problems with product development as follows:

In fact, we’ve had slower product development velocity than we would have liked or anticipated. We’ve had too many new product features that aren’t driving LTV and sometimes are even detrimental. We’ve had too many new experiments split tested that didn’t yield LTV growth and also have sometimes been detrimental.

Takeaway

The key investor takeaway is that Skillz remains in a downward spiral. The company has long promised higher quality games, but the end result is product development issues and retention engagement cheating. The mobile skills-based gaming opportunity remains interesting, but Skillz doesn’t appear to have the talent to deliver on a promising business plan.

Be the first to comment