xijian

Rithm Capital Corp. (NYSE:RITM), formerly known as New Residential Investment Corporation, reported strong distributable earnings this week that easily covered the company’s $0.25 per share dividend pay-out.

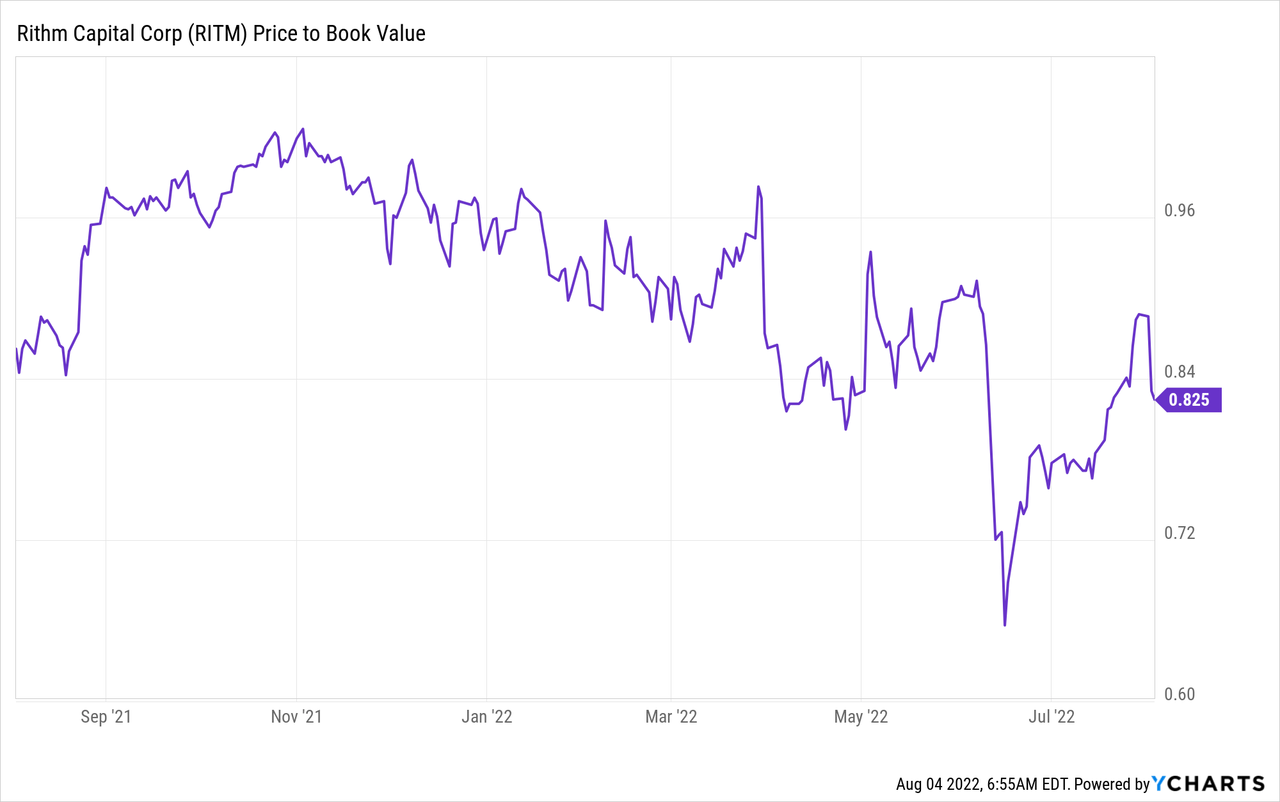

Rithm Capital, a real estate investment trust (“REIT”), benefits from higher interest rates through its mortgage servicing rights portfolio, and the stock trades at a discount to book value. Since the trust’s internalization is complete, a larger portion of earnings will be available for distribution in the future.

When New Residential’s 11.6% yield was on the market in June, I advised investors to acquire it.

Favorable Tailwinds For Mortgage Servicing Rights

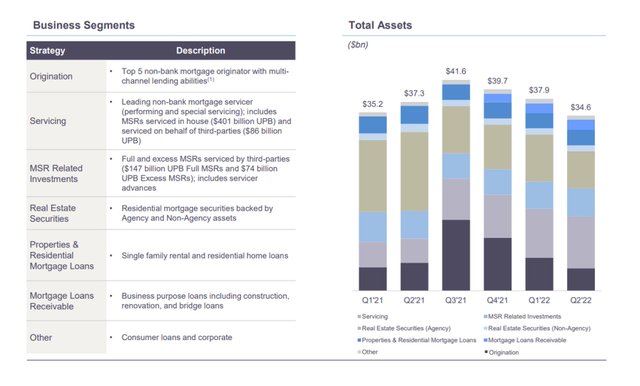

Rithm Capital invests in a variety of mortgage assets, including Mortgage Servicing Rights (MSR), servicer advances, agency and non-agency residential mortgage securities, and single-family residential loans and properties. The trust’s primary investment areas include MSR, real estate securities, and held-for-sale residential mortgage loans.

At the end of the second quarter, the trust’s portfolio was worth $34.6 billion. Rithm Capital is a significant mortgage servicer and one of the country’s top non-bank mortgage originators.

Business Segments (Rithm Capital)

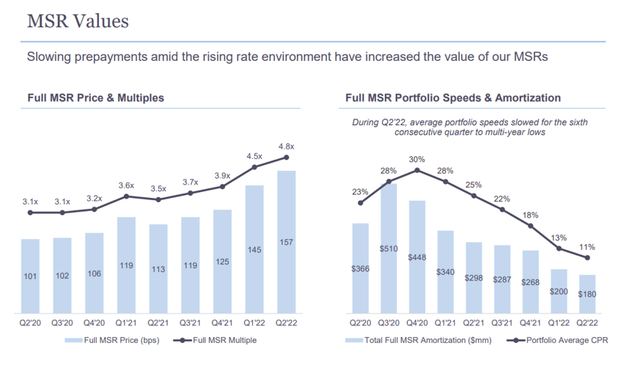

MSR are a particularly appealing investment category in the mortgage industry due to their favorable correlation with interest rates. MSR become more valuable to the investor who holds them when interest rates rise.

The increase in value for MSR is due to increased interest rates slowing down mortgage prepayments, which enhances the servicing value of the underlying MSR. MSR have a longer life and so generate a bigger stream of servicing income with smaller prepayments.

The value of MSR surged considerably for Rithm Capital in 1Q-22 and 2Q-22, as seen in the chart below, thanks to two 75-basis-point interest rate increases by the central bank. Rithm Capital recorded a $515 million unrealized valuation gain on its entire MSR portfolio in the second quarter as rates rose.

Based on the trust’s unpaid principal balance, Rithm Capital’s MSR portfolio was valued at $623 billion as of June 30, 2022. The entire cash amount of debt that the borrower has not yet repaid to the lender is known as the unpaid principal balance, and it is commonly used to calculate MSR exposure.

Single Family Business Is Growing Quickly

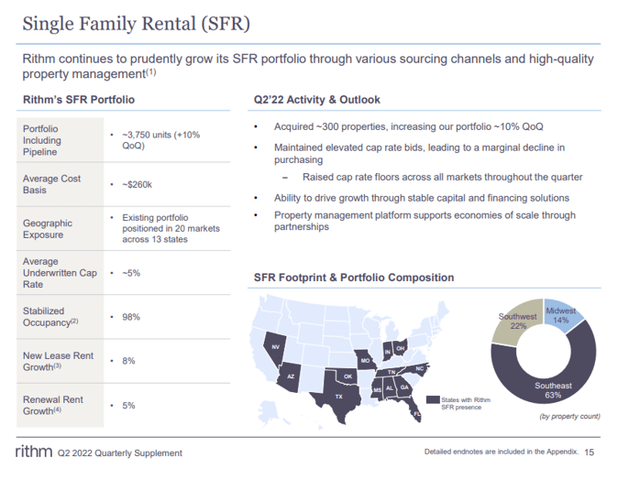

Rithm Capital began by investing in residential loans and mortgages, servicer advances, and MSR, but the trust is now expanding into other areas of the real estate market, such as the purchase and rental of single-family houses.

Rithm Capital acquired 324 SF-homes across the country in the second quarter, increasing its single-family home portfolio by 10% QoQ to 3.75K units. Rithm Capital purchases single-family houses in order to rent them to tenants and generate a consistent stream of rental income for its firm. Rithm Capital’s expansion into single-family homes makes sense since it offers an auxiliary business that complements its mortgage origination and servicing platform.

Single Family Rental (Rithm Capital)

Rithm Capital Has A Very Solid Margin Of Safety

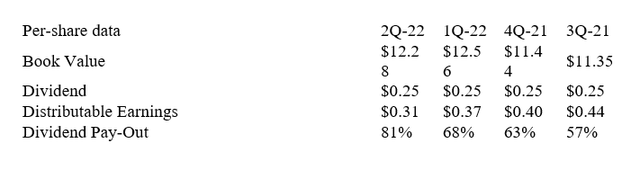

The trust’s low dividend payout ratio is its main selling point. Rithm Capital’s distributable earnings have consistently covered the trust’s quarterly distribution of $0.25 per share. Rithm Capital paid out $1.00 per share in dividends last year but earned $1.52 per share in distributable earnings, resulting in a dividend payout ratio of 66%.

Dividend Pay-Out Ratio (Author Created Table Using Company Supplement Records)

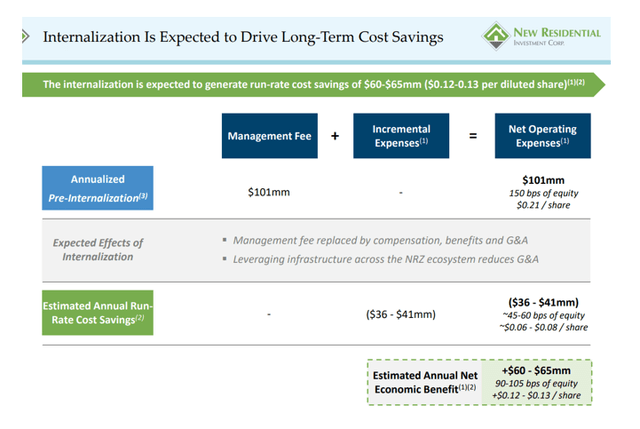

Rithm Capital completed its internalization in the second quarter and anticipates $0.12-0.13 per share in economic advantages from the transaction, so New Residential’s payout ratio might fall to 55-60% in the future.

Internalization (Rithm Capital)

Discount To Book Value

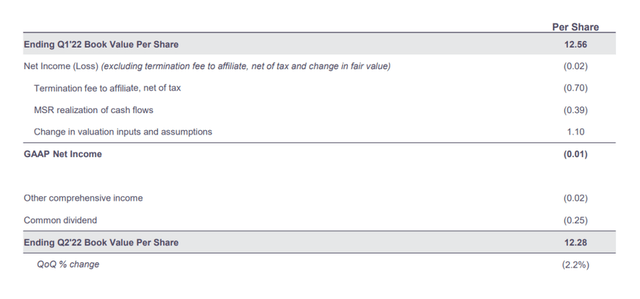

Rithm Capital’s book value remained relatively stable in 2Q-22, falling 2.2% QoQ. The decline in book value was caused by a one-time termination fee of $0.70 per share given to the external manager in connection with the trust’s management being internalized.

Rithm Capital’s book value would have climbed $0.42 per share, or 3.3%, to $12.98 per share if the one-time fee had not been charged.

Since RITM is currently trading at $10.17, the stock’s price implies a 17% discount to book value. The ability to purchase RITM at such a significant reduction to book value is a gift, and I am grateful for it.

Why Rithm Capital Could See A Lower Valuation

So far, Rithm Capital’s MSR position appears to be strong, and rising interest rates will enhance profits growth linked to the trust’s MSR. Having said that, the corporation may face difficulties if the real estate market and the larger economy enter a recession and demand for new mortgage originations falls.

Even if Rithm Capital is becoming more diverse, the company still has a monopoly on the U.S. real estate market, which is a risk in and of itself.

My Conclusion

Rithm Capital pays a 9.8% dividend yield, which is supported by the trust’s distributable earnings.

Rithm Capital’s internalization is projected to result in cost reductions that will increase the trust’s already remarkable low pay-out ratio.

Since Rithm Capital’s stock trades at a 17% discount to its book value of $12.28 per share, the value thesis remains incredibly appealing.

Be the first to comment