Beth Gwinn/Getty Images Entertainment

We are now in the critical stages of the holiday shopping season. Black Friday has come and gone, and we’re just about four weeks away from Christmas. For technology giant Apple (NASDAQ:AAPL), this is the busiest time of the year, as the current quarter generates the most revenue of any period in the company’s fiscal year. Unfortunately, it looks like one ghost of recent Christmas past has returned, threatening to again be the Grinch this holiday season.

The coronavirus is again spreading throughout China, and the country’s zero-covid policy is putting a clamp down on some major areas. There have been some major protests at Foxconn’s Zhengzhou plant, a major production facility for the iPhone. Last Friday, Wedbush analyst Dan Ives stated that store checks appear to show major iPhone Pro 14 shortages, with many stores having supplies that are 25% to 30% below normal as we head into December. Apple has already warned that iPhone Pro shipments will take longer than previously anticipated, thus hurting sales in the holiday quarter.

Lower than normal inventories of Pro models are a double negative this year. First of all, Apple didn’t put its newest chipset in the two base models of the smartphone, further separating the top of the line models, which appears to have shifted the sales mix towards the Pro versions. The second thing is that due to the way the calendar falls, this December fiscal Q1 is 14 weeks long, actually ending on the 31st of the month. Last year’s period ended on Christmas, so there is extra time to rack up sales this year.

In a separate analyst note talking about iPhone lead times stabilizing, Evercore’s Amit Daryanani talked about the financial impact of current iPhone shutdowns. The firm’s previous estimate called for roughly $3 billion of sales to be pushed out into the March quarter, but the analyst now thinks that the number could be double that. I’ll talk about overall estimates in a bit, but I don’t think that the street currently has a $6 billion headwind factored in. That would resemble what we saw in recent quarters from Apple, where supply constraints across the board pressured the top line by several billion dollars each quarter.

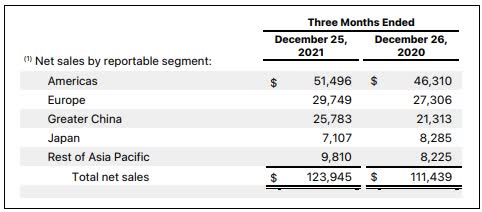

Unfortunately, the lack of production isn’t the only issue that China’s covid problem will create. In October, retail sales in the country unexpectedly declined by 0.5%, and that trend could easily continue into early next year. Communications equipment was one of the worst categories with an 8.9% decline. As the graphic below shows, Greater China was Apple’s fastest growing geographic segment in last year’s fiscal Q1 period, but it wouldn’t be a surprise to see sales in that region decline in this year’s December quarter. Dollar values seen below are in millions.

Q1 2022 Segment Sales (Apple Earnings Report)

Apple was already facing sales headwinds around the globe from inflationary pressures and rising interest rates hurting consumer spending. When the company reported fiscal Q4 results back in October, analysts were looking for 3.5% revenue growth in this year’s holiday period. That number essentially implied sales to be about flat when you factor in the extra week this year. However, as of Sunday, the average revenue estimate had already declined by nearly $2.5 billion. The current consensus of $125.85 billion implies just 1.54% reported growth, which basically means a slight decline considering the extra time.

With the rise in interest rates and reduction in the Fed’s balance sheet worrying the markets about consumer spending, analysts have become a bit less bullish on Apple throughout 2022. The average price target topped out over $191 earlier this year, but it has dipped almost 10% from the peak, now sitting at $174 and change. The overall street rating on the name is at a 14-month low currently. If just one more analyst moves away from either a Buy or Strong Buy rating to a Hold or perhaps even a Sell, we’ll have the highest percentage of Hold/Sell ratings since February 2021.

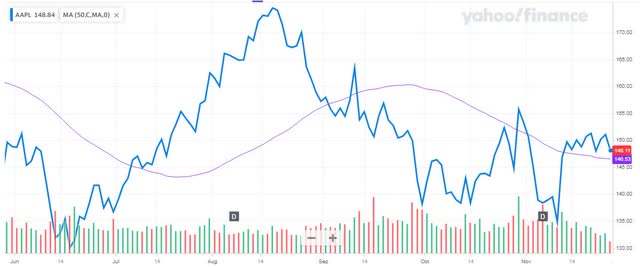

When thinking about Apple shares, I don’t like how the setup looks currently. As the chart below shows, the stock has been making a series of lower highs and lower lows since the summer peak. Shares are also just a couple of bucks above the 50-day moving average (purple line). When the stock has gone below this key technical level, it has seemingly lost another $10 or more each time. Should we see more market weakness into year’s end, we could see the stock try to retest its recent lows.

AAPL Last 6 Months (Yahoo! Finance)

In the end, it appears that the Grinch is returning for Apple this holiday season. The coronavirus is spreading again in China, and with that country’s very restrictive policy regarding the pandemic, the technology giant is seeing meaningful disruptions to iPhone production. Analysts are now starting to estimate the sales impact for the December quarter, which could end up being in the mid single digit billions or more. Essentially, Apple may report a year over year total sales decline when factoring in the extra week in the December 2022 period, which likely will make the bears happy. While I still like the name in the long run, the chart doesn’t look great right now, so investors looking to buy might want to wait to see if we get another downturn if shares lose the 50-day moving average again.

Be the first to comment