IrenevanderMeijs/iStock via Getty Images

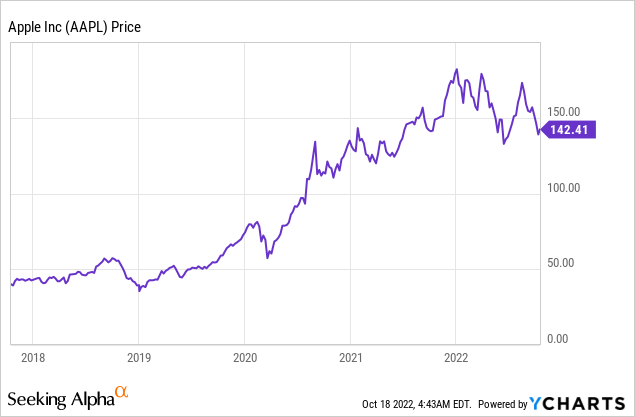

Some buy-and-hold investors may consider this blasphemy, but since late 2019 Apple’s (NASDAQ:AAPL) stock price has grown increasingly disconnected from the reality of its underlying business. Apple’s stock is ground zero for investors that expect stimulus-fueled levels of consumer spending to last forever. In reality, investors are tripping over each other to pay a peak multiple for consumer discretionary stocks like AAPL at peak earnings. This is unlikely to succeed as an investing strategy. To this point, the present valuation of Apple is a gift to investors, who now have the opportunity to sell while the stock is overvalued and allocate money elsewhere.

The Pandemic Didn’t Fundamentally Change Apple’s Business

Of course, Apple is a profitable business. But the beauty of looking at Apple’s income statement is that it can tell you why the company is making more money and whether the share price is increasing faster or slower than the business.

- Apple’s share price shows powerful gains, trading for about 5.9x more than it did 10 years ago.

- EPS is up a lot over the last 10 years (3.8x), but not as much as the share price.

- And EPS, in turn, is up a lot more than net income (2.4x).

- When you subtract out corporate tax cuts and the benefit from lower interest rates, earnings are only 2.1x the levels of 10 years ago.

- Moreover, nearly all of this growth has come recently during the pandemic. From 2012 to 2019, earnings before interest and taxes had only grown about 16%! The rest was all from tax cuts, lower interest rates, stimulus, and Apple’s buyback. Not to discount the wisdom of buybacks in general- it was great when Apple was buying its shares back at like 10x earnings. But recently at 30x earnings? Not so much!

It’s strange when you think about it, but Apple’s story has been similarly borne out among thousands of companies with the same trend of Market Cap Growth > EPS Growth> Net Income Growth> EBIT Growth. Valuations have risen faster than earnings, which in turn have been juiced by stimulus, falling interest rates, and deficit-financed corporate tax cuts. In the end, investors are getting a lot of sizzle and not much steak.

If you’re buying Apple here, you really need a compelling reason why Apple’s business has fundamentally improved since 2019. I don’t see one, besides people getting free money from the government. iPhone sales have been higher post-pandemic than previously, but consider that the US government handed out approximately $10,000 per family in stimulus in 2021. That’s tax-free cash in addition to wages 95% of people were making working in 2021, so it was generally pure profit to recipients. In addition, remember that consumers had limited choices for travel, entertainment, and events, which directed spending towards consumer goods like Apple’s.

But what will happen to consumer spending this holiday season without $10,000 per family in free money and with raging inflation squeezing budgets? A massive miss in profits for consumer discretionary companies is the most likely outcome. Analysts are now slowly starting the process of revising Apple’s earnings estimates down. The danger here is deceptive, as evidenced by the recent earnings misses of Adobe (ADBE), FedEx (FDX), and Restoration Hardware (RH) that reported off-cycle. Traders are excited because banks like Bank of America (BAC) reported higher profits from the Fed’s interest rate hiking campaign. However, as the earnings cycle turns to consumer discretionary and tech there will likely be a bunch of stocks getting routed, with high-profile stocks like Apple and Amazon (AMZN) being likely victims.

What To Expect From Apple’s Earnings: Not Sustainable

Apple reports quarterly earnings after the market closes on Thursday, October 27th. As always, Apple’s report will be followed by their quarterly earnings call (and posted on Seeking Alpha shortly after). Analysts expect earnings of $1.27 for the quarter. Apple no longer gives earnings guidance- there’s no requirement to do so even though they did so in the past. But this causes investors to get too excited about Apple’s prospects rather than actually looking at the numbers. For investors to expect profits to simply level off with the rug pulled on stimulus is naive. Even before the recent revisions, Wall Street analysts had only projected mid-single-digit EPS growth for Apple over the next few years. That’s not a huge vote of confidence. If you take these estimates at face value, Apple trades for over 22x next fiscal year’s earnings with middling growth prospects. By contrast, the S&P 500 currently trades for about 15.6x analyst earnings estimates and has roughly equal growth prospects. The long-running story for Apple of course has been growth in services revenue, but I expect that to slow dramatically as the amount they can squeeze Google (GOOG) dramatically slows. If Apple can tell TSMC (TSM) no on price increases, then Google can likely do the same for Apple.

This wouldn’t be so bad except for the likelihood that earnings estimates are wildly inflated due to the massive stimulus in 2021. Once you account for the stimulus, I don’t think there’s much that fundamentally changed for Apple, its products, or its business prospects. In fact, people are likely to delay upgrading iPhones for years since they upgraded en masse in 2021 and early 2022. Apple is oddly out of step with the rest of the industry on this- they recently had to pull a U-turn on a planned 7% ramp in production. We can draw some clues on demand from the broader semiconductor market, with Micron (MU) and Nvidia (NVDA) acknowledging the slowdown in September, with Intel (INTC) announcing weak results and job cuts shortly after. Taiwan Semiconductor announced results a few days ago and warned of weakening demand. There’s also the issue of the strong dollar, which eats away at Apple’s US dollar profits on sales made outside the US. If past cycles are any guide, earnings for mature consumer-centric companies like Apple are likely to fall substantially. Without stimulus, AAPL’s earnings could easily trend back to a bit above its pre-pandemic numbers, pushing the stock below $100 and likely below $75. There are severe, structural problems with the ability of consumers to continue to spend at the rate they are, and consumer discretionary companies are on the frontlines of this change. Raging inflation, lack of stimulus, declines in real earnings, etc., all have a hand in this. And when the hammer eventually drops on student loan forbearance, that’s another 1% or more of the national income sucked back into the U.S. Treasury- equivalent to a fairly broad income tax hike.

Mega Cap Tech Valuations: Signal And Noise

There’s a classic experiment in statistics where if you put a bunch of people’s guesses together, the highest numbers are likely to be overestimated, while the lowest numbers are likely to be underestimated. For example, if we poll 100 people on how many jellybeans are in a jar or what the margin of victory will be for a candidate in the midterm elections, the highest estimates are likely to be wrong. The high estimates tend to have more noise in them than the ones in the middle. Financial markets aren’t so different. Research shows companies that have the world’s largest market caps tend to subsequently underperform. High P/E ratios combined with high-popularity stocks end up being far more noise than signal and are best avoided.

Apple is the world’s most valuable company, and it has been this way for a while. But in contrast to my previous research on the disposition effect and Apple stock being worth more than the business as late as 2019, you simply can’t justify the near tripling in price since then. By contrast, you can sell Apple and put your money in a basket of small-cap stocks (IJR) that are trading at similar valuations to 2019. Don’t be fooled by stocks that see huge gains in share price without corresponding growth in the underlying business. History shows that doing this means you’ll be consigned to years of low or negative returns.

Bottom Line

For a variety of reasons that are unlikely to prove sustainable, Apple has nearly tripled in price since the summer of 2019. Seeking Alpha’s quant model gives the stock an F for valuation and a D+ for growth. This mirrors the lack of enthusiasm for Wall Street analysts on Apple’s growth prospects. AAPL is now among the most overvalued large-cap names. Investors should consider selling and either allocating to Treasury bills that pay 4-4.5% annually, or to small-cap stocks that trade for less than half the valuation of Apple. Do you agree? Feel free to share your thoughts in the comments!

Be the first to comment