sharply_done

There have been two prevailing themes in the economy over the past twelve months. The first has been the incredibly high inflation rates that we have been seeing in both energy and food. The second is that the stock market has generally delivered very poor returns, with the notable exception of the traditional energy sector. This has caused many investors to begin to look seriously at energy as a place to invest money in order to capitalize on the sector’s positive returns. However, it can be difficult to build a diversified portfolio of energy companies without having access to a considerable amount of capital. One possible solution to this problem is to invest in a closed-end fund that focuses specifically on the sector as these entities provide the investor with a professionally-managed portfolio that can in many cases deliver a higher yield than could be found elsewhere. In this article, we will have a look at one of these funds, the BlackRock Energy and Resources Trust (NYSE:BGR). This is one of the more popular funds in the sector due both to the BlackRock name and its 5.99% current distribution yield. I have discussed this fund before, but a year has passed since then so a great many things have changed. Therefore, this article will specifically highlight these changes and help determine if this fund could be a good addition to your portfolio in light of the changes that have occurred.

About The Fund

According to the fund’s webpage, the BlackRock Energy and Resources Trust has the stated objective of providing investors with a high level of total return. This is certainly not unusual for an equity fund as common equities are at their core total return instruments. After all, investors in these securities typically want both capital gains and dividends. As might be expected then, this fund focuses on current income, current gains, and long-term capital appreciation. In keeping with the name, the fund aims to achieve its objective by investing in equity securities of companies in the energy and natural resources sectors. Interestingly, though, the fund does not specifically state if it focuses solely on common equities or if it can also purchase preferred equity securities issued by these equities. If it can indeed purchase preferred securities, that could provide it with some advantages in achieving the current income part of its investment objective as preferred stocks typically have higher yields than common equities issued by the same company. With that said though, only a few energy or natural resource companies actually have preferred stocks issued so this is likely too small of a group for the fund to find many opportunities.

As stated in the introduction, the stock market has generally performed poorly over the past year. We can clearly see this by looking at the S&P 500 index, which is down 19.27% over the past twelve months:

Seeking Alpha

This overall market decline has affected nearly all sectors of the economy. There is one notable exception, however. That exception is the traditional energy sector, which has delivered very positive returns over the period. We can see this by looking at the iShares U.S. Energy ETF (IYE), which is up 39.20% over the same period:

Seeking Alpha

This stellar performance in the face of a weak market is not difficult to understand. After all, it is primarily driven by crude oil prices, which are likewise up over the same period. Anyone that has filled up a car with gasoline recently can attest to this. Over the past twelve months, the price of West Texas Intermediate crude oil is up 4.05%:

Business Insider

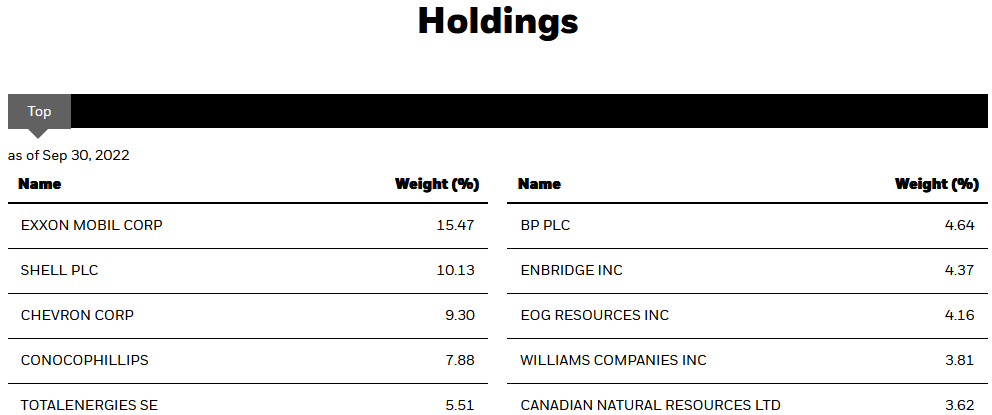

This has naturally sparked interest among some investors that are weary of losing money and are looking to the sector as a way to make back some of their money. These investors have likely started to do some research into the major names in the energy sector and will probably recognize most of the fund’s largest positions. Here they are:

BlackRock

We see here many of the largest energy companies in the world including Exxon Mobil (XOM), Shell (SHEL), Chevron (CVX), TotalEnergies (TTE), and BP (BP). As my regular readers likely know, I have devoted a great deal of time over the years to discussing energy companies here at Seeking Alpha and indeed I have discussed most of the companies on this list. EOG Resources (EOG) and The Williams Companies (WMB) have long been among my top picks in the sector, for example. The fact that most of the companies on this list have rather respectable dividend yields is something else that any investor that is seeking income should appreciate since the dividends that they pay out help the fund maintain its distribution over the long term. We will discuss the distribution in more detail later, but the major takeaway here is that most of these are solid companies that deserve a place in any energy-focused fund.

We do, however, see quite a few changes on the largest positions list compared to the last time that we discussed this fund. The most notable one is that BP, Enbridge (ENB), EOG Resources, and The Williams Companies are all new to the list. These companies replaced Pioneer Natural Resources (PXD), Marathon Petroleum (MPC), Equinor (EQNR), and Suncor (SU). For the most part, this is not a bad change as it improves the fund’s diversity somewhat. This is particularly true with Enbridge and The Williams Companies as these are both pipeline operators and not traditional resource producers. For the most part, pipeline operators enjoy much more stable cash flow than upstream resource producers by virtue of their business models. Thus, the addition of these companies to the largest positions list might add a bit of stability to the fund and the contribution of their high dividend yields should not be ignored! EOG Resources is one of the best companies in the sector, as I discussed in a recent article, so I likewise cannot complain about this one replacing one of the former positions. Overall, these changes appear to reflect rather smart decisions on the part of the fund’s management.

The fact that there were so many changes to the portfolio over the past year may lead one to believe that the BlackRock Energy and Resources Trust has a fairly high turnover rate. This is not the case, though, as the fund’s annual turnover is only 61.00%. This is not especially high for an equity fund, some of which have an annual turnover over 100%. This is nice to see because of the drag that high turnover puts on a fund’s returns. After all, it costs money to trade stocks or other assets so the more the fund the trades, the higher its expenses. This is one of the reasons why index funds have become so popular as they do almost no trading and their expenses are quite low. With that said, a high turnover does not necessarily mean that a fund will underperform but it does create an extra hurdle that management must jump over in order to deliver the returns that investors expect. In the case of the BlackRock Energy and Resources Trust, it has certainly outperformed the S&P 500 over the past year as it is up 14.68%:

Seeking Alpha

As my regular readers on the topic of closed-end funds are no doubt well aware, I do not generally like to see any single position in a fund account for more than 5% of the fund’s total assets. This is because that is approximately the point at which an asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the fund’s assets then this risk will not be completely diversified away. Thus, the concern is that some event will occur that causes the price of a given asset to decline when the market as a whole does not. If the asset accounts for too much of the portfolio then it might end up dragging down the entire fund with it in such a scenario. I illustrated this quite effectively in a recent article. As we can see above, there are five positions that each account for more than 5% of the portfolio. One of these, ExxonMobil, accounts for more than three times that limit. Thus, any investor should ensure that they are willing to take on the risks of these companies individually before taking a position in the fund.

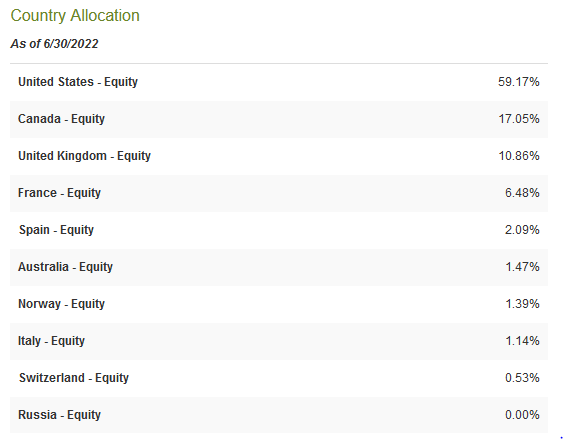

One nice thing about the BlackRock Energy and Resources Trust is that it is quite well diversified internationally. We may be able to guess this by looking at the largest positions list as there are a number of non-American companies on the list. In fact, only 59.17% of the fund’s portfolio is invested in American companies:

CEF Connect

One characteristic that we frequently see with global funds is that they are more heavily invested in the United States than the country’s actual representation in the global economy. The United States only accounts for a little less than 25% of the global gross domestic product but it tends to have a 60%+ weighting in most global funds. We do see that here, although this one does have slightly more than 40% allocated to foreign markets. This is nice because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take an action that proves to have an adverse impact on a company in which we are invested. We saw a great example of this back in 2021 when the incoming Biden Administration unilaterally canceled the permits for the construction of the KeystoneXL pipeline and effected caused all the money that TC Energy (TRP) had spent on it to that point to be wasted. The only realistic way to protect ourselves against this risk is to ensure that only a relatively small portion of our assets is exposed to the whims of any given government. The BlackRock Energy and Resources Trust appears to be doing an admirable job at this, which does add somewhat to the fund’s appeal.

Fundamentals Of Energy

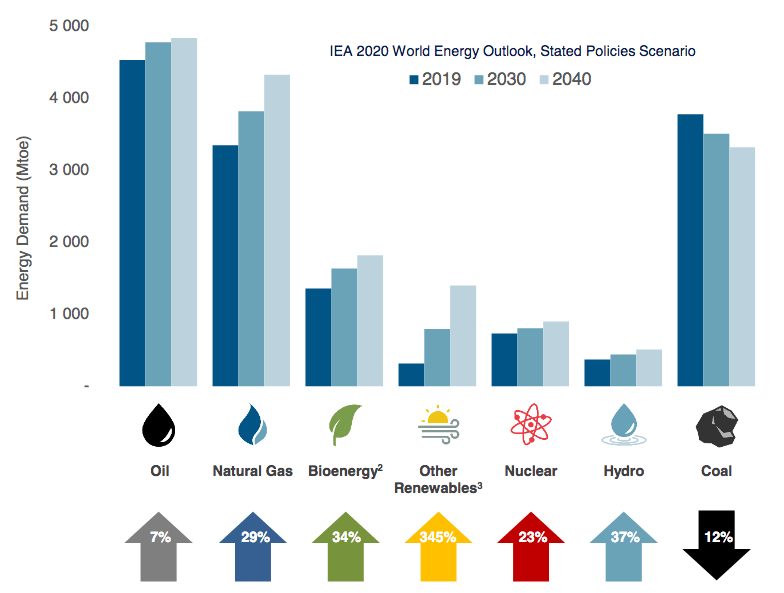

As we have already seen, the performance of the BlackRock Energy and Resources Trust is greatly affected by energy prices. This is largely because the financial performance of the companies that it invests in is highly correlated with energy prices. Fortunately, the fundamentals for both crude oil and natural gas are quite positive and point for higher prices going forward. The fact that these resources have strong fundamentals might be surprising to many investors because the media and politicians have been telling us that traditional fossil fuels will soon be obsolete. However, nothing could be further from the truth. In fact, according to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2022 World Energy Outlook

Perhaps surprisingly, the growth in natural gas demand will be driven by concerns about climate change. As everyone reading this is no doubt well aware, these concerns have induced governments all around the world to impose a variety of incentives of mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common of these mandates is to encourage utilities to retire old coal-burning power plants because coal is by far the most heavily polluting of any fuel currently in use. This generation capacity is largely being replaced by renewable sources of energy but renewable technologies have one major flaw. That flaw is that they are unreliable. After all, wind power does not work when the air is still and solar power is much less effective when the sun is not shining. In order to overcome this deficiency, a common strategy is to supplement renewables with natural gas turbines. This is because natural gas is reliable and burns much cleaner than any other fossil fuel. Thus, it provides a means to keep the grid operational when renewables are unable to perform this task.

The case for forward crude oil demand growth may be somewhat harder to understand. After all, many nations around the world (including the United States) are actively attempting to discourage the use of crude oil within their borders. However, it is a very different story when we look at the various emerging markets around the world. These nations are expected to see tremendous economic growth over the projection period. This economic growth will have the effect of lifting many people out of poverty and putting them securely into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is much closer to their counterparts in the developed nations than what they have now. This will require the consumption of growing amounts of energy, including energy derived from crude oil. As the populations of these nations are much larger than the populations of the developed nations, the growing demand for crude oil here will more than offset the stagnant-to-declining demand in the developed nations.

However, it is highly unlikely that energy producers will increase production sufficiently to satisfy this demand growth. The energy industry has been chronically underinvesting in production and midstream capacity since the 2015 energy bear market, which is one reason why the offshore drilling industry never recovered from that event. In fact, according to Moody’s, the oil and gas industry must immediately increase spending on upstream production alone by $542 billion in order to avoid the next supply shock. There is, to put it mildly, no chance that the industry will actually do this. After all, it is under tremendous pressure from politicians and environmental activists to improve the sustainability of its operations. In addition, the energy industry has generally underperformed most others over the past decade and investors have begun to demand much higher returns. Thus, we will likely have a situation in which the demand for oil and gas will grow more rapidly than the supply. The laws of economics tell us that this leads to higher prices. As the stock prices of the companies that the BlackRock Energy and Resources Trust invests in are positively correlated with energy prices, this should prove to be a good situation for the owners of the fund.

Distribution Analysis

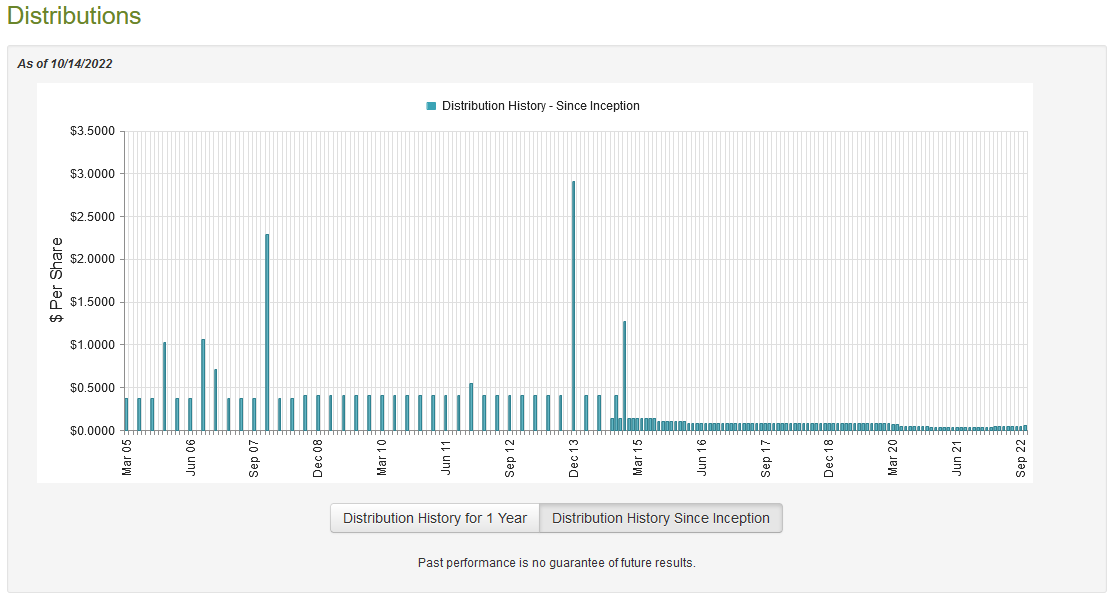

As stated earlier, one of the objectives of the BlackRock Energy and Resources Trust is to provide its investors with a high level of current income. In addition, a few of the companies that the fund invests in traditionally pay very high dividend yields. As such, we might expect that the fund will boast a fairly high yield. This is indeed the case as the fund pays a monthly distribution of $0.0585 per share ($0.702 per share annually), which gives the fund a 5.99% distribution yield at the current price. The fund’s distribution has varied considerably over the years, which is partially a function of crude oil prices:

CEF Connect

This certainly might be discouraging to anyone that is looking for a steady and secure source of income to use to pay their bills, but admittedly this fund is not really intended for that purpose. As many bills tend to increase with energy prices, it can provide a hedge against that, though. The thing that we are going to look at here is how well it can maintain its distribution going forward.

Fortunately, we do have a very recent report that we can consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. This is a much more recent report than we had the last time that we looked at the fund and it should give us a good idea of how well the fund performed during the very strong commodities market in the first half of this year. During the six-month period, the fund brought in $8,054,595 in dividends from the assets in its portfolio. After we net out foreign withholding taxes, the fund had $7,669,013 available to cover its expenses. It naturally paid its expenses out of this amount, leaving it with $5,784,584 available for the shareholders. This was not nearly enough to cover the $7,392,254 that the fund actually paid out in distributions during the period.

However, the fund has some other methods that it can use to obtain the money that it needs to pay its distributions. The most important of these is capital gains and the BlackRock Energy and Resources Trust had a considerable amount of success in this area during the six-month period. The fund realized $14,263,079 in capital gains and had another $37,445,050 in unrealized gains. This was more than enough to cover the distribution when combined with the net investment income. Overall, the fund saw its assets increase by $42,879,068 during the period even after accounting for the distribution and the fund conducting a share buyback during the period. This gives us a great deal of confidence that it should have no problem maintaining the distribution and likely explains why the fund has been boosting its distribution over the past few months.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Energy and Resources Trust, the usual way to value it is by looking at a metric known as the net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are obtaining the fund’s assets for less than they are actually worth. That is fortunately the case with this fund. As of October 14, 2022 (the most recent date for which data is available as of the time of writing), the BlackRock Energy and Resources Trust had a net asset value of $13.45 per share but it only trades for $11.72 per share. This gives it a 12.86% discount to net asset value, which is certainly a very attractive price to buy any closed-end fund. This is also quite a bit better than the 11.93% discount that the fund has traded for the past month. Overall, the price certainly looks right here.

Conclusion

In conclusion, the BlackRock Energy and Resources Trust is one reasonably attractive way to play the best-performing sector so far this year. The fund looks likely to benefit from the fundamentals in the crude oil and natural gas sector as higher prices for these fuels with time should push up its price further than the positive return that it has already delivered so far this year. The fact that the fund trades for an incredibly attractive price only adds to its appeal. Overall, this 5.99%-yielding fund might be worth considering for your portfolio.

Be the first to comment