gorodenkoff/iStock via Getty Images

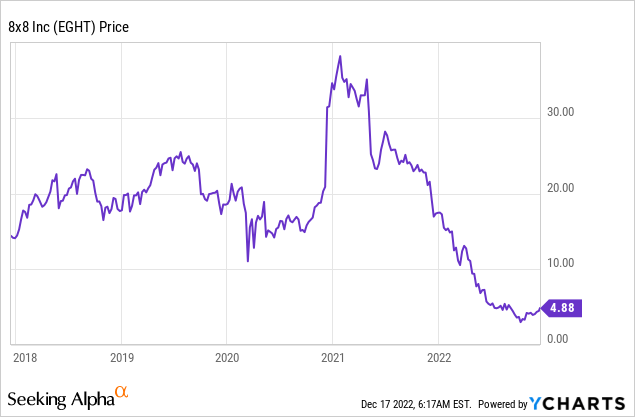

8×8 (NASDAQ:EGHT) is a software company that is offering a unified communications solution for businesses. The company is executing its enterprise growth strategy well and its customers include Mcdonald’s, Regus, Live Oak Bank, and many more. In the second quarter of FY23, 8×8 reported strong financial results, beating both top and bottom-line growth estimates. There are also rumors of a takeover of 8×8, which would make sense given stock price has been butchered by 87% from its all-time highs in February 2021. In this post, I’m going to break down its business model, financials, and valuation, let’s dive in.

Business Model

8×8 is leading communications as a service provider. The company offers a unified “Communications as a Service” platform called XCaaS (Experience Communications as a Service). This solution offers voice, video, and chat in a unified platform, replacing traditional phone lines. According to 8×8’s earnings call, this solution results in a 56% lower total cost of ownership when compared to a multi-vendor strategy. 8×8’s solution is also used as a “virtual” or cloud contact center. Traditional “brick and mortar” contact or call centers require expensive office space and are challenging to scale. However, with a virtual contact center, businesses can benefit from lower costs and greater scalability via remote workers. According to a report by Metrigy (cited by 8×8), also indicates 37% greater agent efficiency, 57% higher customer ratings, and a 100% increase in revenue on average, which is substantial.

8×8 Business Model (Q2,FY23 report)

Its platform has global coverage across 56 countries and integrates seamlessly with Microsoft Teams which makes it a popular solution for calls. Gartner customer reviews indicate 8×8 has 4.4 out of 5 stars which is better than the 4.3 stars for companies such as Dialpad. However, competition such as Connect by AWS has 4.5 stars, as does Five9. 8×8 has recently streamlined its business and sold its Callstats analytics, technology for WebRTC to Irish communications technology company Spearline.

Growing Financials

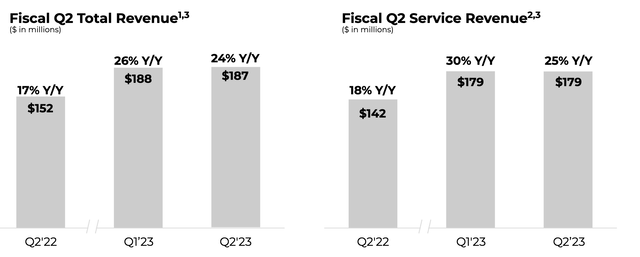

8×8 reported strong financial results for the second quarter of fiscal year 2023. Revenue was $187.39 million, which increased by 24% year over year and beat analyst expectations by $841,000. Service revenue increased by 25% year over year to $179 million and was at the top end of management’s guidance range, which was between $177 million and $180 million.

Revenue (Q2,FY23 report)

At the start of 2022, 8×8 closed its $250 million acquisition of Fuze, a cloud-based communications platform for enterprises. In the second quarter of FY23, Fuze contributed $28.4 million in total revenue, which was a greater amount than management’s prior models.

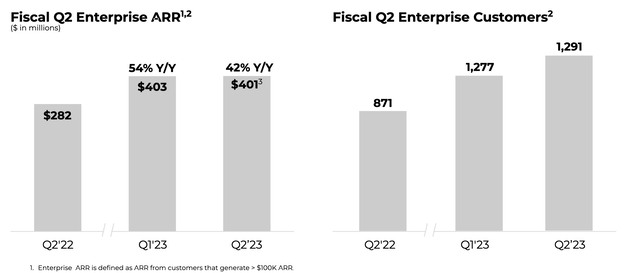

The aforementioned acquisition is part of 8×8’s strategy to “grow upmarket” strategy and increase its number of enterprise customers. Competitor Five9 has also adopted a similar strategy and reported strong success. This strategy makes complete sense as enterprises tend to have higher retention rates, greater upsell opportunities, and better efficiency ratios.

In the second quarter of FY23, 8×8 reported Annual Recurring Revenue [ARR] growth of 42% year over year for its enterprise customers, which now makes up 58% of total ARR. Its mid-market customers grew at a slower 23% year over year and contributed to 18% of ARR. This is a similar dynamic to competitor Five9, which also experienced sluggish demand from its mid-market segment due to the macroeconomic environment. Its small business segment also reported a similar dynamic with ARR declining by 2% year over year.

Enterprise ARR (Q2,FY23 report)

At a product level, the company’s XCaaS (Experience Communications as a Service) platform has proven to be immensely popular, growing its ARR by 40% year over year. This unified platform contributed to 35% of ARR as of Q2, FY23.

The notable customer wins in the second quarter included Casey’s the third-largest convenience store chain in the U.S. with over 2,400 locations across 16 states. This company plans to replace its traditional phone line service with 8×8’s UCaaS platform for all stores, resulting in 5,000 seats which is substantial.

Another customer win was Medline, a leading healthcare manufacturer, with an army of over 30,000 employees globally. In addition, Delek, a downstream energy company adopted 8×8’s UCaaS solution for Microsoft Teams for its 2,500 users. 8×8 also recognized account expansions from its existing customers. For example, the University of Bristol in Great Britain, increased its number of seats by 25%. 8×8 has also continued to build out its partner program and added 3 new partners in the third quarter of 2022, which included “Cloud Revolution”, a Microsoft partner of the year finalist for 2022.

Profitability and Balance Sheet

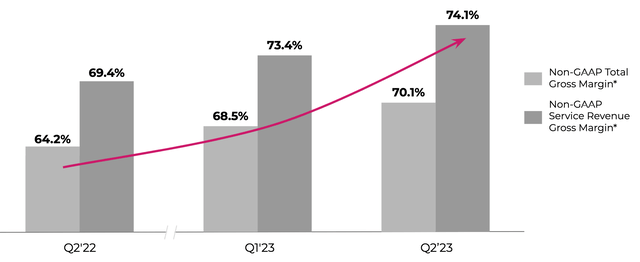

8×8 reported a gross margin [non-GAAP] of ~70%, which increased by 5% year over year. The aforementioned acquisition of Fuze has resulted in positive operating efficiency and margin improvement.

Gross Margin (Q2,FY23 report)

In terms of expenses, the company increased its R&D by 15%, which I don’t believe is a bad sign as the company invests in product improvement. The company recently slashed its headcount by 10% and has started to see efficiencies in its sales and marketing spend.

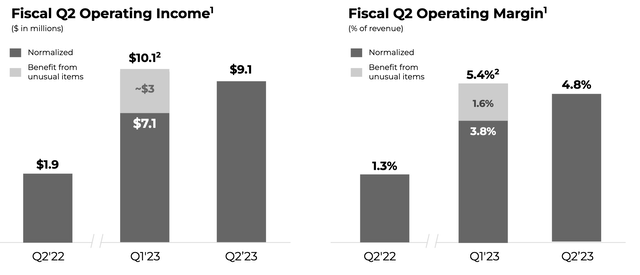

The company reported earnings per share of negative $0.10 which beat analyst expectations by $0.16. On a Non-GAAP basis, the company did report a profit of $9.1 million, or $0.05 EPS, which beat analyst estimates by $0.02.

Operating Income (Q3FY23)

8×8 has a stable balance sheet with cash, cash equivalents, and restricted cash of ~$132 million. The company does have fairly high debt of $597.8 million, but the majority of this debt, $516.7 million, is long-term debt. Management is also being proactive and has refinanced over 80% of its convertible notes due in 2024. In addition, the company has bought back 10.7 million shares of stock.

Advanced Valuation

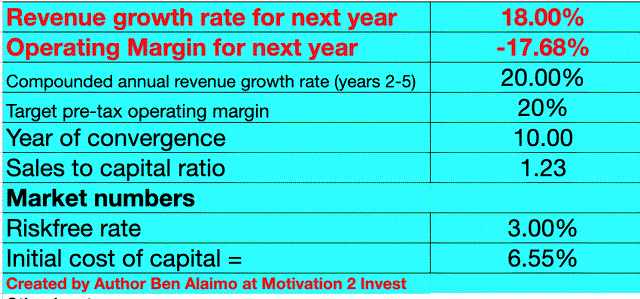

To value 8×8 I have plugged its latest financials into my discounted cash flow model. I have forecasted 18% revenue growth for next year, which is aligned with management’s estimates and also takes into account a tepid macroeconomic environment. However, in years 2 to 5, I have forecasted the company to grow its revenue at 20% per year, as economic conditions improve.

8×8 stock valuation 1 (created by author Ben at Motivation 2 Invest)

The challenge for 8×8 will be to reach consistent GAAP profitability. As a software company, it should be able to benefit from increased operating leverage as it scales. I have forecasted the company can increase its operating margin to 20% over the next 10 years, which is below the 23% average for the software industry.

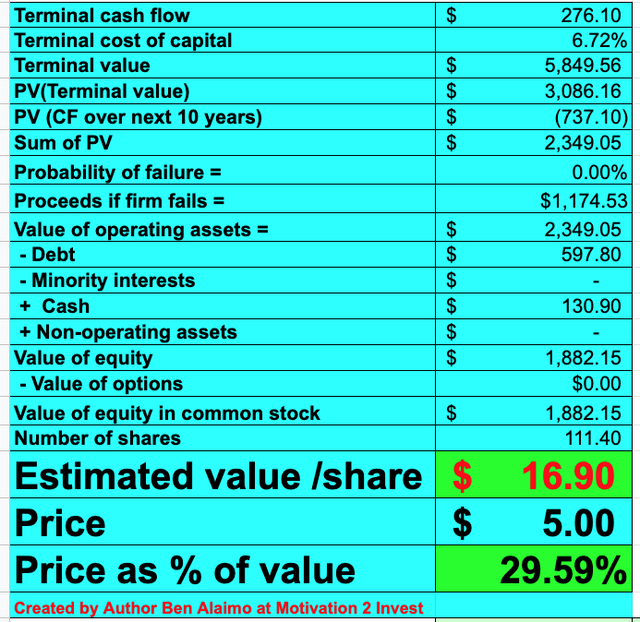

8×8 stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $16.90 per share, the stock is trading at ~$5 per share at the time of writing and thus is deeply undervalued.

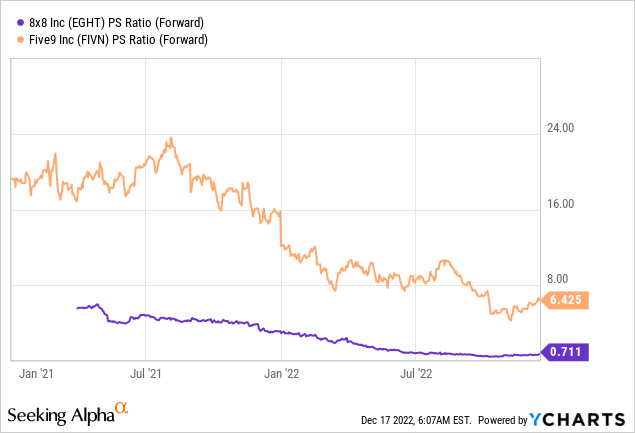

As an extra datapoint, 8×8 trades at a price-to-sales ratio = 0.7, which is ~82% cheaper than its 5-year average. The company also trades at a substantially cheaper PS ratio than competitor Five9, which trades at a PS ratio = 6.4.

Risks

Competition/Recession

8×8 faces a lot of competition in the world of cloud contact centers and communications. I previously mentioned Connect by AWS and Five9 as competitors with slightly higher customer ratings on Gartner. The forecasted recession is also likely to impact business customers as they delay big transformation projects.

Final Thoughts

8×8 continues to improve its product and has executed its “upmarket” growth strategy to a tee. The business has also scaled its partner network and beaten financial growth estimates in the recent quarter. Its stock price has been decimated by the macroeconomic environment and despite a recent increase, the stock still looks to be deeply undervalued.

Be the first to comment