ipopba

Cloud-based ‘Communications Platform as a Service’ (CPaaS) company Sinch AB (OTC:CLCMF) is coming off another quarter of strong FCF generation, though much of the positive delta was down to one-off working capital inflows. The working capital movements should reverse in the coming quarters, though, driving more FCF volatility and compounding near-term headwinds from price adjustments amid the macro uncertainty. Thus, I don’t see an acceleration in organic FX-neutral gross profit growth anytime soon, even with Q4 set to benefit from an easier YoY comparison and seasonality.

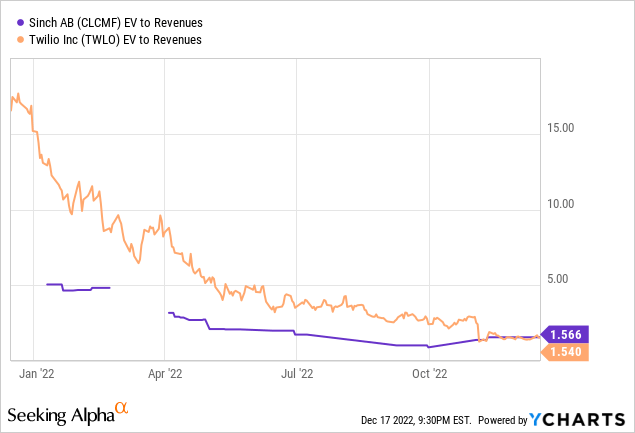

Plus, not all the overhangs have been cleared, with the appointment of a new CEO still pending and the risk of more dilutive M&A also a concern. The stock has also re-rated over the last month or two and now trades in line with key peer Twilio (TWLO) at ~1x EV/Sales. Net, I am neutral here.

Emerging Signs of a Growth Recovery

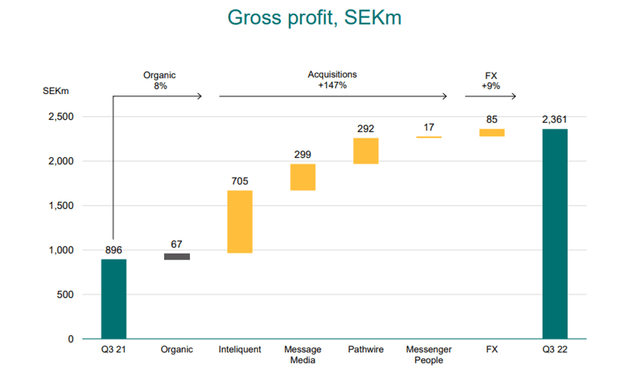

Sinch reported a solid set of Q3 numbers overall, with organic FX-neutral revenue growth at +13% and organic FX-neutral gross profit growth at +8%. The headline sales numbers were also helped by a higher inorganic contribution, more than offsetting any transitory FX tailwinds. Of note, this is the first time Sinch has posted high single digits % growth since Q3 2021, as the business looks to be stabilizing after a rocky H1.

By segment, messaging was the bright spot, accelerating to +11%, while growth in email also held firm at +22%. The small/medium business segment was the key detractor, decelerating to +9% (down from +18% in Q2 2022). The latter was mainly down to a continued normalization in traffic volumes post-COVID, while weakness in Australia also weighed on the performance. Another key headwind in Q3 was pricing, with renegotiations at a large customer still weighing on growth. Perhaps more importantly, though, operational progress remains solid – Sinch’s customer intake has improved, with 47 new enterprise customers added to messaging and 4.3k self-sign-up customers onboarded from US small/medium businesses.

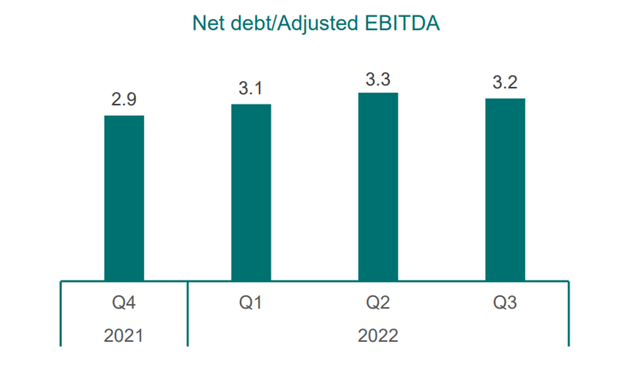

On the margin side, things are looking better as well. Having incurred the initial restructuring costs earmarked from its cost-saving plan, Sinch is already seeing its costs flattening out. This bodes well for the P&L as the company benefits from more cost-reduction program benefits in FY23. Also benefiting is the free cash generation. Sinch posted another quarter of robust FCF and sustained good conversion rates, though the headline numbers were helped by a significant working capital inflow in Q3 due to a one-off reduction in receivables. Still, management’s commitment to managing leverage levels was positive, with the cash flow-driven paydown driving a 3.2x net debt/adj. EBITDA ratio for the quarter.

Near-Term Headwinds to Weigh on the EBITDA Outlook

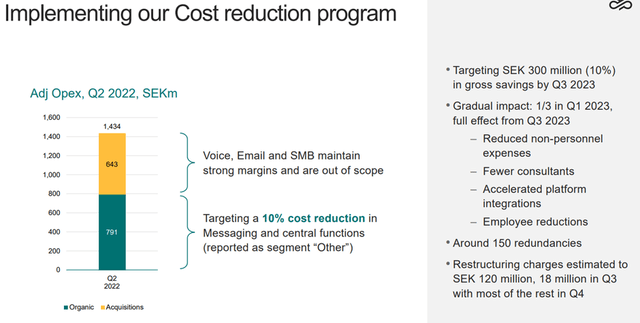

While Sinch does not typically provide full-year guidance, its existing financial framework remains intact. To recap, this includes adj EBITDA per share growth of 20% per year (organic and via M&A) and net debt to adj EBITDA below 3.5x. The former might fall short in the near term, though, as negative price adjustments at one of its largest customers will weigh more heavily on Q4 due to seasonality. The broader macro weakness is also a factor for the gross profit outlook, and with organic gross profit growth already down to the high-single-digits in Q3, I am bearish on the FY23 prospects. Operating profitability could benefit, however, from the realization of cost-saving benefits from the ongoing restructuring program. Q4 will see margin headwinds from most of the upfront costs being incurred, but this should reverse into a tailwind in FY23.

The leverage target will be an easier ask. Having benefited from a significant working capital inflow in Q3, the net debt/EBITDA ratio is already below target at 3.2x. Even with more working capital outflows on the horizon, there should be sufficient FCF generation and profitability to keep debt levels in check. Sinch has also been strong on the cash conversion front and still expects to convert >40% of its adj EBITDA into cash flow from operations net of investments despite a challenging near-term outlook. Thus, as the headwinds fade over time, a 40-50% mid to long-term conversion seems well within reach.

Key Overhangs Remain

Sinch is currently in the process of a new CEO search after prior CEO Oscar Werner stepped down from his position earlier this year. Johan Hedberg (company founder and prior CEO from 2010 to 2018) is taking over as interim CEO. Thus, the strategic direction of the company is unclear and, in particular, if the rollup strategy of recent years will continue.

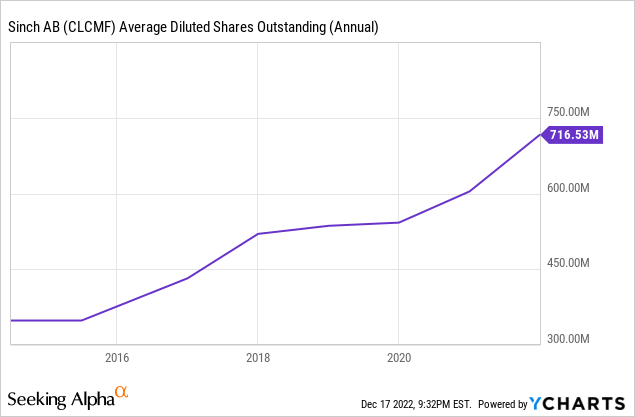

Since the IPO in 2015, Sinch has largely funded its acquisition spree via equity – the total outstanding share count has risen from ~324m at the time of its IPO (on a split-adjusted basis) to >700m. So while the M&A has helped growth, it has come at a hefty price to shareholders. Further, recent acquisitions have seen significantly higher transaction multiples – in 2021, MessageMedia and MessengerPeople cost 9-10x sales, and Pathwire cost an eye-watering low-teens sales multiple. With higher rates driving tech valuations lower across the board, it seems unlikely that these acquisitions will pay off anytime soon.

A CPaaS Rollup with Risks

Sinch’s rollup strategy has fallen out of favor with investors, as evidenced by the stock de-rating alongside the rest of the ‘growth’ stock universe YTD. Beyond the technical factors, though, the company has also been plagued with a slowdown across its business lines and operational headwinds. While cost-cutting should help margins in the coming quarters, near-term headwinds from a slowing macro and price renegotiations could drive further weakness ahead.

Plus, the recent CEO departure remains an overhang, along with the risk of future M&A-driven dilution. Yet, the stock has traded higher over the last month and is now priced in line with key peer TWLO, driving a less favorable risk/reward. While I am neutral at this juncture, key catalysts, including a new CEO announcement and signs of operational progress in the upcoming Q4 results, will be worth monitoring.

Be the first to comment