Leestat

We expected LyondellBasell Industries (NYSE:LYB) stock to bottom in August, but we were too early. While we cautioned near-term downside volatility, LYB formed its bottom only in September, ahead of its Q3 earnings call. However, LYB still managed to outperform the S&P 500 (SPX) (SP500) slightly since our previous call, as it posted a total return of -5.9% (Vs. SPX’s -6.3%).

Accordingly, we believe the market had already anticipated a weak Q3 earnings card, as it bottomed in September. Notably, the result was underwhelming enough for Wall Street analysts to bring out their pessimism, as they slashed LyondellBasell’s forward earnings projections significantly, sending its NTM EBITDA multiples surging.

However, for a commodity chemicals producer, we believe this is the moment investors should have been waiting for: The Street marking down estimates in a hurry.

Also, we are confident that China’s recent easing of COVID restrictions has not been factored into its earnings projections. As such, there could be upside surprises to the consensus estimates if China’s reopening could spur its operating results in 2023. Management also emphasized at a recent conference that they are looking forward to China’s reopening. As such, China’s importance to LyondellBasell’s operating performance cannot be overstated, as CFO Michael McMurray accentuated:

China is the largest consumer of petrochemicals in the world for polyethylene, which is our biggest and most profitable business. They’re the largest consumer of polyethylene in the world. China, hopefully, will reopen in the not-too-distant future. Our point of view, we won’t see [any kind of] reopening effect until the second quarter [of 2023]. (Citi 2022 Basic Materials Conference)

Interestingly, China has since accelerated its reopening as it tore down its dynamic COVID zero restrictions across the country. However, its “let it rip” strategy has also caused a resurgence of COVID cases in many cities, rekindling the fear seen in the early days of COVID. After nearly three years of stringent lockdowns by the authorities, China’s residents are understandably fearful of getting infected even if they are vaccinated.

Therefore, the expectations of a recovery in consumer spending and industrial activity could be delayed. Despite that, economists are still confident that China’s GDP growth should recover markedly from a lower base in 2022. Also, China’s top officials are reportedly looking at a GDP growth rate of more than 5% in 2023 as Chinese President Xi Jinping looks to lift the malaise in its economy.

However, we believe it’s still too early to assess the impact of China’s recovery on LyondellBasell’s forward projections. Despite that, we are confident that LYB’s price action suggests that the worst is likely over for its investors.

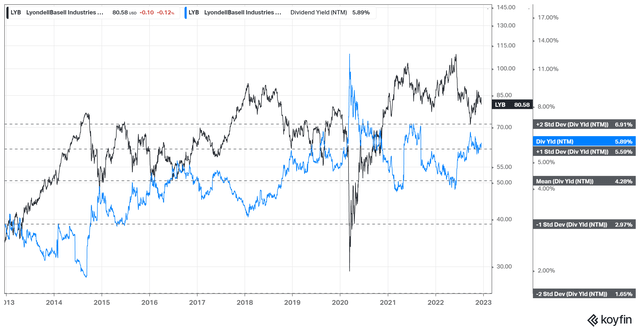

LYB NTM Dividend yields % valuation trend (Koyfin)

As seen above, LYD last traded at an NTM dividend yield of 5.89%, above the one standard deviation zone over its 10Y average. Hence, we parse that the market has reflected significant risks in its valuation.

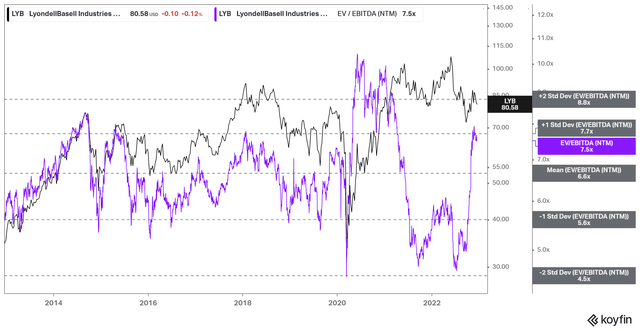

LYB NTM EBITDA multiples valuation trend (Koyfin)

Coupled with the significant cuts in its forward earnings projections, which led to a remarkable surge in its NTM EBITDA multiples, we parse that the Street has likely penciled in its pessimistic assumptions. As such, it should help LYB consolidate constructively unless the market anticipates the global economy faltering markedly, leading to a severe recession.

We discussed this possibility in a recent SPX article, highlighting that such a scenario cannot be ruled out, even though it isn’t our base case. Economists and market strategists could not agree on whether the Fed’s increasingly hawkish stance through 2023 could drive the economy toward a soft or hard landing.

Hence, investors need to be prepared for a worse downturn, which we believe may not have been reflected in LYB’s valuation. Therefore, China’s recovery could be critical to mitigating LyondellBasell’s worsening macro backdrop to help LYD bottom out constructively.

Takeaway

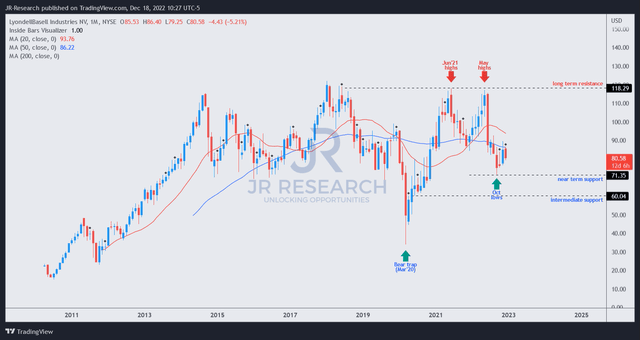

LYB price chart (monthly) (TradingView)

As seen above, LYB bottomed out in September/October but has struggled for momentum.

However, that’s expected, as we don’t expect a sharp recovery in LYB’s upward momentum, given the intensifying macro challenges, with the global economy likely falling into a recession, with the impact uncertain.

Notwithstanding, the critical factor is for LYB to hold its recent lows. As long as those lows can be sustained, LYB should be set up constructively for a medium-term re-rating as the macro outlook improves, with China as a vital growth underpinning.

Maintain Buy.

Be the first to comment