ryasick

Midstream Sector Performance

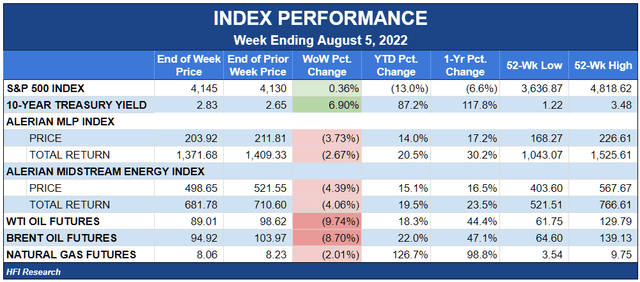

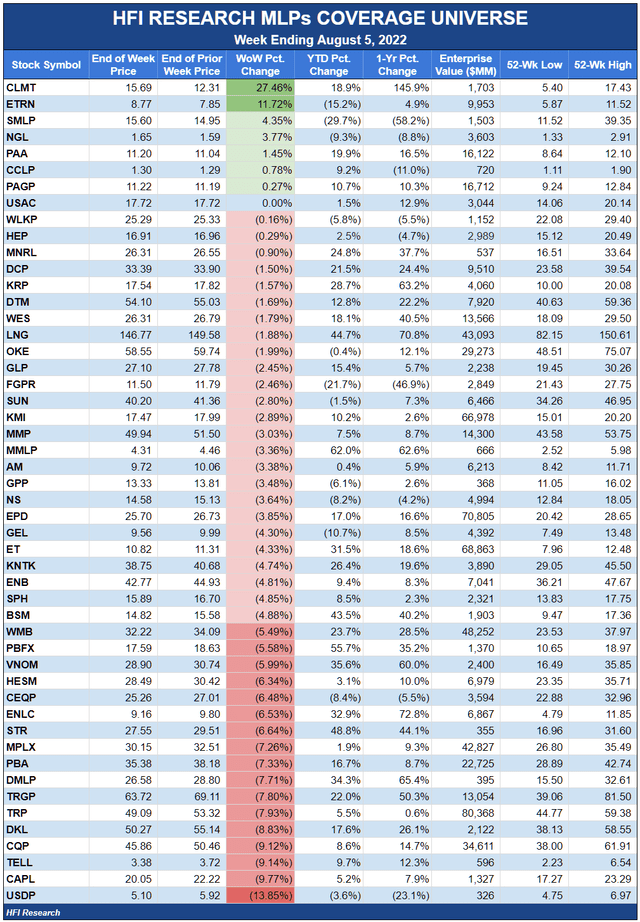

Despite a steady drumbeat of earnings beats and guidance raises, energy equities got clobbered this week. Midstream declined 2.7% as bearish macro sentiment caused a 9.7% plunge in crude oil prices and a 2.0% decline in natural gas prices. As bad as the week was for midstream, the sector was spared the losses of the overall energy sector and E&Ps, as the (XLE) and (XOP) declined by 6.8% and 5.8%, respectively

The crude price declines came as fundamentals weakened at the margin. Time spreads declined, refining margins contracted, and regional price differentials pointed to softer demand, particularly in Asia. Still, these readings have only come off relative to their recent levels, many of which were at or near record highs. Physical market indicators remain bullish on an absolute basis. Inventories are at low levels and are either flatlining or drawing, U.S. and global production are in check, and demand is set to increase seasonally after refinery maintenance. Meanwhile, OPEC and Russia are incentivized to keep prices high, U.S. strategic petroleum reserve outflows are set to fall dramatically, and China is likely to emerge from regional lockdowns later in the year. All these factors tip the scale in favor of the bulls. We expect the momentary downdraft to pass to play out over the next few weeks and to give way to a sustained bullish tailwind thereafter.

The bearish macro sentiment has arrived as energy companies report some of the best quarterly results in their history. What’s more, these companies almost universally pointed to a strong forward outlook. Refiners and midstreamers both reported that any demand destruction from higher refined product prices played out in early July and has since disappeared. They noted that in recent weeks demand has been stimulated by lower refined product prices. These are signposts that the fundamental backdrop for energy companies—and, by extension, their equity values—remains favorable.

This dip in energy equities is arriving as distributions are set to roll in over the next two weeks. We feel strongly that the dip should be bought and that distributions should be allocated to high-quality midstream equities.

Second-Quarter Earnings Continue to Impress

Midstream second-quarter results saw plenty of beats-and-raises. Among major operators who announced this week, only NuStar Energy (NS) missed expectations and failed to raise guidance. Targa Resources (TRGP) missed estimates, but only because estimates had been ratcheted up over recent weeks. TRGP did boost its full-year guidance.

Most other operators also raised guidance due to the combination of growing U.S. production volumes, high power burn, strong domestic consumer and industrial demand, and booming export volumes. Management commentary indicates that these trends are set to continue over the medium term.

In sum, the earnings season has underscored the bullish fundamental conditions for midstream. We believe the magnitude of the selloff in some of the highest-quality names is a gift for long-term investors.

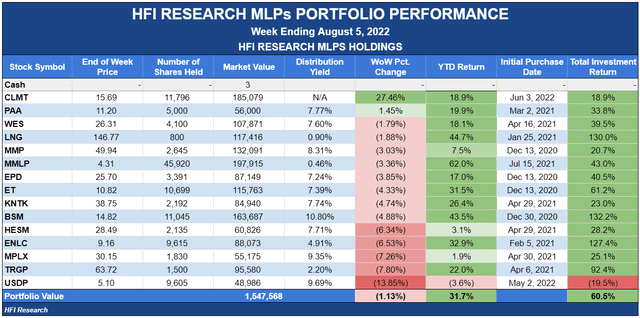

Weekly HFI Research MLPs Portfolio Recap

Our portfolio outperformed its benchmark, the Alerian MLP Index, by 1.4%. The steep declines in our commodity-exposed holdings—namely, gathering and processing companies and mineral interest owner Black Stone Minerals (BSM)—were significantly offset by our position in Calumet Specialty Products Partners (CLMT), which we added in size due to its tremendous long-term capital appreciation potential, but also because its idiosyncratic risk/return profile reduces our portfolio’s exposure to oil and natural gas prices. We expect CLMT to do well from our purchase price largely irrespective of macro oil and gas market conditions. Fortunately, it behaved as intended this week, offsetting our other holdings’ declines as it surged on CLMT’s second-quarter earnings report and announced transactions.

We covered our holdings’ earnings reports extensively in articles published to subscribers throughout the week, and we’ll round out the rest over the coming week.

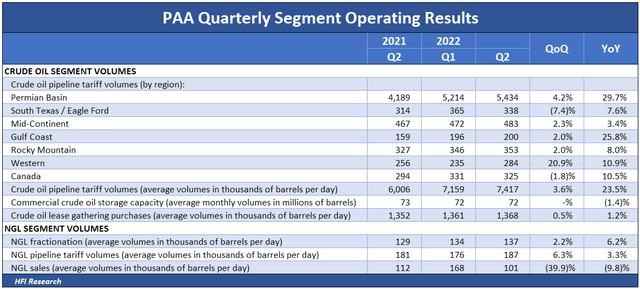

Plains All American (PAA) reported particularly good second-quarter results. Besides CLMT, it was our only other gainer for the week. Coming into second-quarter earnings, expectations for crude oil transportation volumes had been downbeat relative to natural gas and NGLs. PAA’s results demonstrated that increasing Permian volumes are bolstering well-positioned crude-weighted operators as well as gassier players.

Like our other holdings, PAA beat consensus analyst expectations and raised full-year guidance. The company’s Permian crude volumes grew a whopping 29.7% from the year-ago quarter, while pipeline tariff volumes increased 23.5%.

We expect continued volume gains, and PAA’s financials should benefit from the significant operating leverage in its systems.

PAA’s management has done a good job allocating capital over the past two years. In the second half of 2022, we believe the company will continue to deleverage and step up its unit repurchases. Then in early 2023, we expect a large distribution increase. PAA units trade at a price that implies 20% upside to our price target, and we recommend PAA as a Buy.

MPLX (MPLX), Targa Resources (TRGP), and USD Partners (USDP) were our laggards. MPLX reported a good quarter, and its 7.3% decline was a head-scratcher. It remains one of our favorite midstream stalwarts with a large and safe 9.4% distribution yield. Future distribution increases, which we view as likely for next quarter, will increase that yield on today’s price.

TRGP was punished after it slightly missed EBITDA expectations. We believe the selloff in the undervalued shares is a buying opportunity. The company is investing in growth and used the recent decline in the TRGP share price to repurchase 1.5 million shares. Capital allocation skill is vital in navigating midstream, and TRGP management has proven itself as among the best capital allocators in the business.

USD Partners is our only holding that reported a disappointing second quarter. Cash flow came in weak, while the outlook is soft due to contract expirations. Still, the distribution is well covered, and we expect results to pick up over the next few quarters as Canadian oil market fundamentals turn from a headwind to a tailwind and management wins new business. Management reported that it is in negotiations with customers to replace the expiring contracts with new and existing customers. It is also having “detailed discussions” around its DRUbit by Rail offering. Dan Borgen has proven his ability to roll out new crude-by-rail offerings in the past, and we don’t expect that to change with USDP’s new market opportunities. We rate USDP as a Buy.

News of the Week

Aug. 3. Brigham Minerals (MNRL) is reportedly exploring options that include a sale or merger. The news supported MNRL shares, which ended the week down only 0.9%. We believe MNRL shares are fully valued at their current price, so a sale would make sense to us. We’re always interested in following Bud Brigham’s investment activity, and we’ll be watching for a sale and where he ends up investing afterward.

Aug. 5. Energy Transfer (ET) disclosed a pipeline rupture in Louisiana in July that released a quantity of gas capable of supplying 40,000 homes for a day. The company also pleaded no contest to environmental crimes related to the construction of its Mariner 2 Pipeline and Revolution Pipeline. The Mariner’s construction involved drilling fluid seeping into drinking water, while the Revolution’s construction involved a blast that destroyed local property. ET’s agreement with the Pennsylvania attorney general included a $10 million fine, which management probably views as a cost of doing business in the overly aggressive manner in which it operates. These two events are part of a longstanding pattern of ET’s operational deficiencies. Unitholders should be aware that they may continue. We believe they risk growing more severe if the company becomes consumed with expansion. We own ET units and plan on holding them until they reach our price target. But we’re not fans of management, whose practices have made it difficult to hold with confidence several times since we purchased ET units in December 2020.

Capital Markets Activity

Aug. 3. Williams (WMB) announced it had placed a private offering of $1.0 billion of 4.65% Senior Notes due 2032 at a price of 99.635% of par and $750 million of 5.3% Senior Notes due 2052 at 99.954% of par. The company plans to use the proceeds for general corporate purposes.

Aug. 4. TC Energy (TRP) entered into an agreement with a syndicate in which underwriters have agreed to purchase 28.4 million TRP shares at a price of C$63.50 for gross proceeds of $1.8 billion. The company plans to use the proceeds to fund the construction of the Southeast Gateway Pipeline, an offshore natural gas pipeline in southeast Mexico. The share offering contributed to TRP units’ 7.9% decline during the week, which was significantly more than its large Canadian peers.

Be the first to comment