DKart/iStock Unreleased via Getty Images

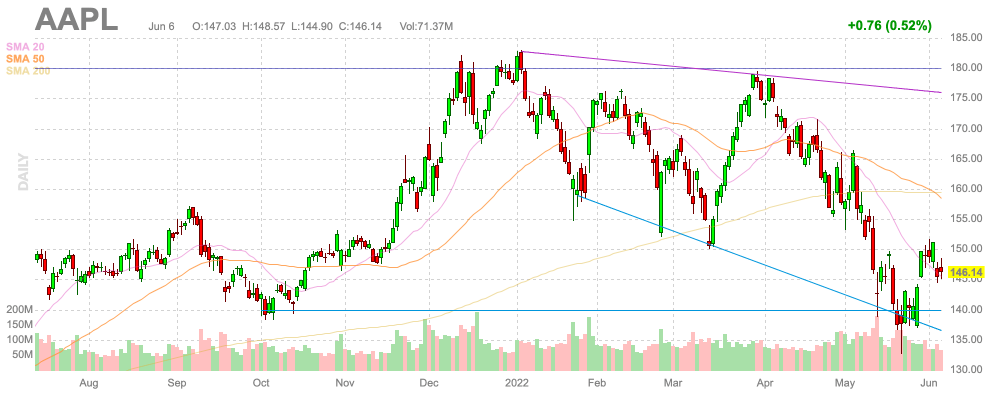

In no huge surprise here, Apple (NASDAQ:AAPL) App Store revenue has decelerated to limited growth due in part to tough comps. Investors need to now understand how to handle this expected slowdown with the stock still trading at healthy valuation levels. My investment thesis remains very Bearish on the tech giant here trading at $146 in the face of obvious slower growth, if not actual negative numbers.

Source: FinViz

Last Bastion Falls

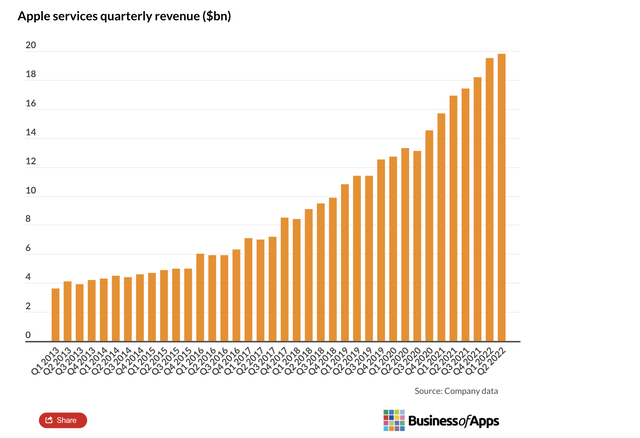

The major reason investors started awarding Apple with far higher valuation multiples was the shift to recurring revenues via Services. The Katy Huberty data hit hard for longs holding onto the last growth area for the stock.

Without much of a blip, Services revenues have constantly grown. The tech giant is now generating nearly $20 billion in quarterly revenue from Services compared to hardly $4 billion per quarter back in 2013.

While Services growth has helped smooth out the growth rates for Apple, the tech giant is still highly dependent on the iPhone for quarterly sales. iPhone revenues were nearly $200 billion in FY21 while Services clocked in at only $68 billion.

The company is very sparse with Services account details, but Apple now has 825 million paid subscriptions on their platform. The amount surged 165 million over the year ended in March.

The research note by Morgan Stanley analyst Katy Huberty caught the market off guard last week. Despite a $195 price target, the analyst trimmed App Store net revenue estimates to growth of only 4% in May and down to 3% in June. Some of the weakness is due to a slowdown in App Store demand in China where Covid lockdowns should’ve pushed consumers back to spending online, but actually caused a complete slowdown in spending in the country.

App Store revenues is a major contributor to Services growth, but Apple Music, TV and Pay, amongst others, contribute to the Services growth. The concerning part for Apple is that Huberty has a $195 price target on the stock based in part due to expectations for 15% Services growth, yet she now sees this growth targets as in serious doubt.

The stock will have a hard time maintaining the current price, much less reach a target for trading at 30x FY23 EPS estimates of $6.43.

Tough Comps

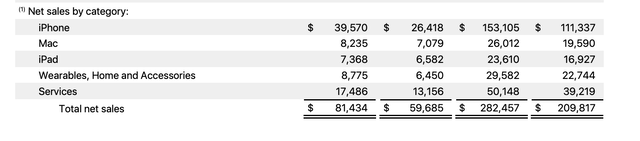

For some reason, Apple investors don’t appear to understand the impact of tough comps on quarterly financial results. Last June quarter, the tech giant reported revenues grew 36% to $81.4 billion.

Apple reported the following FQ3’21 results by category:

Investors should note how iPhone sales beat expectations by $5 billion and Services topped estimates by over $1 billion and generated 33% growth. Mac and iPad revenues were solid, but the key iPhone and Services revenue outperformance is what led to the 36% growth in the quarter and what contributes to the extremely tough comps this year.

Huberty is already highlighting how a key cog in Services revenues is set to disappoint. The major question is why analysts still expect Apple to reach targets like her $195 for Morgan Stanley and $200 per Dan Ives a few days back.

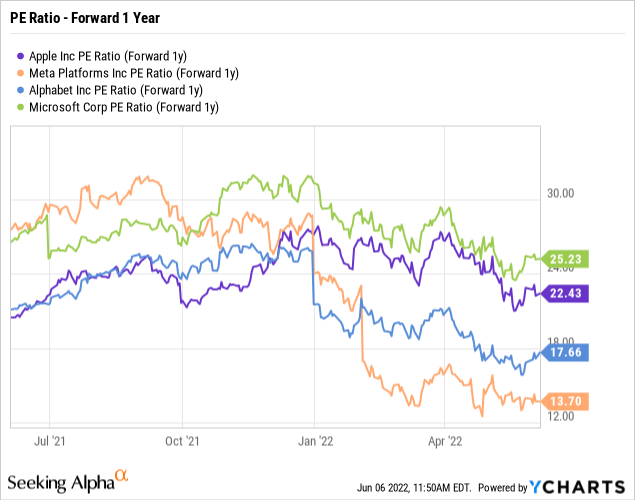

All of the tech giants have seen forward PE ratios collapse, but Apple is hanging onto an elevated multiple similar to Microsoft (MSFT). Both Alphabet (GOOG) (GOOGL) and Meta Platforms (FB) have seen PE ratios collapse far below 20x 2023 numbers.

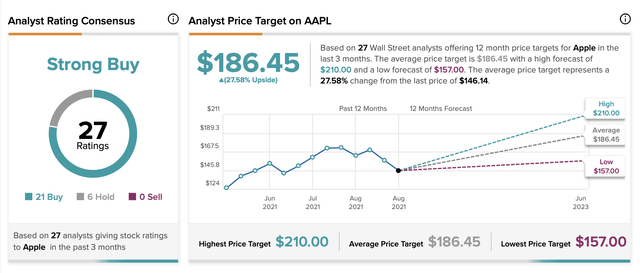

Analysts are still uniformly bullish on these tech giants, regardless of where they trade. Meta Platforms trades at $190 and the consensus price target up at $285 provides for 50% upside. Alphabet has a very similar target with the stock trading at $2,360 and the consensus target up at $3,250 for 38% upside.

The current projected Apple upside is 28%, but the data from Meta and Alphabet suggests the stock is likely to fall to a more reasonable multiple when weak June results are reported. Neither of those tech stocks were ultimately propped up by big analyst targets like the $186 target on Apple.

WWDC didn’t provide any juice to the bullish thesis either. A bunch of new features and updates to existing production lines aren’t what the stock needs at these valuations when the market wanted launch information on the AR/VR device. Influential analyst Ming-Chi Kuo had predicted the headset wouldn’t be released at the developers conference.

All of the data points to the stock needing to slide further. The analysts appear bullish on Apple, but the general view is that June quarter revenues could actually fall from the levels of last year. Investors must wait for much lower prices similar to what has already happened to other tech giants like Alphabet and Meta Platforms.

Takeaway

The key investor takeaway is that Apple investors really haven’t felt any pain and this appears a must for the market to see a low. The tech giant could easily report a revenue decline from the FQ3’21 levels, yet the stock still trades around late 2021 levels after Apple had just reported surging revenues in the June quarter.

Be the first to comment