nikkytok/iStock via Getty Images

Investment Thesis

We’ve passed the two year mark since AppHarvest (NASDAQ:APPH) completed its SPAC merger. The business has spent over $400 million in cash since then. But I still don’t think it has shown evidence that it can be sustainably profitable.

I think that recent financing developments are positive. But management has started diluting shareholders to fund operations. Since I last covered the company, its stock has dropped by 55%. My outlook is still mostly unchanged. I really like the company’s mission, but I’m bearish due to its poor financial health.

Where Is The Funding Coming From?

In my earlier analysis, I focused on AppHarvest’s high capital expenditures as a major risk. The company spent $87 million on CapEx in the first half. It expects to spend another $85 million to $90 million in the second half. This CapEx alone is more than the cash the business has on its balance sheet. Once I factor in the company’s operating losses, it’s clear that the business will have to find outside funding.

This is tricky. The company has a very high amount of debt. Its debt burden is over nine times as high as its lifetime revenue. Because of this, it has not raised much capital from traditional financial institutions. Agribusiness lenders focused on sustainability provided the company’s two largest outstanding loans.

The biggest piece of news in the last quarter was AppHarvest’s funding announcement in late July. The company secured a $50 million loan from the Greater Nevada Credit Union. The loan is backed by the USDA, who will guarantee 80% of the loan. I think that the terms of this funding are reasonably good. The company has a term of 23 years and is interest only for the first three. Its rate is fixed at 6.45% for the first five years. This is a high rate, but it’s likely better than what AppHarvest would be able to get elsewhere. On their last earnings call, management discussed their plans for this money.

As we draw upon our existing credit line arrangements with equilibrium in the recently closed USDA loan guarantees to satisfy the majority of CapEx. We estimate that USDA loan will release cash collateral from our JPMorgan facility and that approximately $28 million in net cash to our end of quarter cash balance of $51 million, for a total of approximately $79 million in pro forma cash balance.

The estimated $30 million in balance sheet cash needed to satisfy our 2022 CapEx would be a draw on this amount. With the addition of the USDA loan guarantees, we strengthened our set of available financing options.

In addition to the availability on the committed equity facility with B. Riley, we also intend to realize liquidity from our Berea salad greens farm, the last facility in our network that remains unlevered as of today.

AppHarvest plans to use these funds to pay off an existing loan with JPMorgan. After that, it plans to spend $30 million of its cash on capital expenditures. The other $55 million to $60 million in CapEx will be financed with outside money.

In the near term, I think that this is really good. The cost of debt is rising, and it is becoming tougher to find money for speculative projects. Most importantly, it proves to me that the company can get government financing if needed. The company could secure more loans of this type, helping cut its cost of debt.

But I also have some concerns. Management has started to dilute investors as I predicted they might. They sold over 3 million shares in the last quarter at an average price of $2.80. This generated about $9 million. In total, shareholders were diluted by about 4% in the last quarter.

On their earnings call, management said that they plan to continue issuing new shares. This is clearly bad for shareholders, especially when the stock is near all time lows. The company may have to issue a lot of shares to generate a meaningful amount of cash.

Profitability Is Still An Issue

The company has extended its runway, but it still hasn’t addressed my main concern. Management hasn’t proven the company’s core business model. AppHarvest’s operations are extremely capital intensive. I don’t think the business has proven that it can be profitable and consistent.

AppHarvest is still losing money on its core products. The company brought in just $4.4 million in the quarter. It spent over $14 million producing this inventory. For every dollar the company made, it spent $3.20 to fulfill that order. Its gross margins were negative 224%.

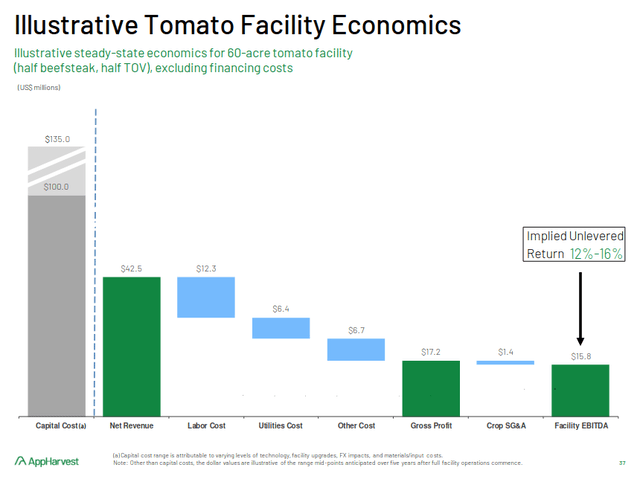

I want to compare this to the company’s long term targets. Here are management’s projections from their analyst day presentation in December 2020.

AppHarvest December 2020 Analyst Day Presentation

Management projected $17.2 million in gross profit on $42.5 million in revenue. This sounds promising, but these projections have failed to materialize. The company is far from reaching these targets. It is spending over twice as much as was expected in operating expenditures. At the same time, it is only generating 40% of the estimated sales.

At the current run rate, the company is spending $56.4 million annually on its cost of goods sold alone. Even if the business hit its lofty revenue target, it would still have negative gross margins. I’m assuming no incremental cost for additional production. This is a generous assumption.

A lot of these metrics are moving in the wrong direction. The company sold only six million pounds of tomatoes in Q2. This is down from 6.9 million in the previous quarter. Management said the lower yield was caused by a plant health issue. The company’s average selling price dipped from $0.75 to $0.72. At the same time, the cost of goods sold increased over the prior quarter.

AppHarvest December 2020 Analyst Day Presentation

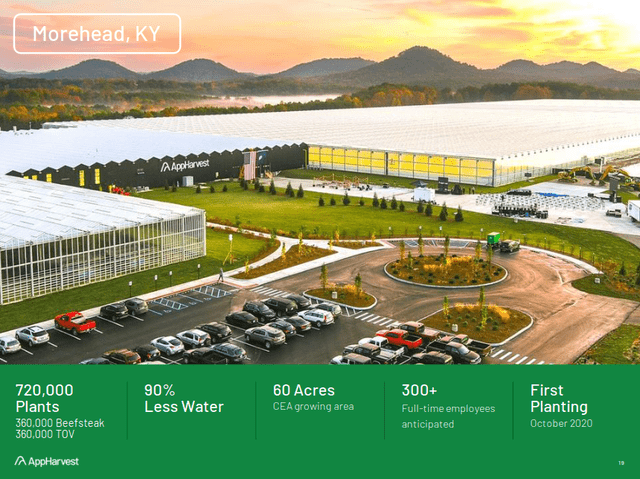

Management is shifting expectations to the fourth quarter. AppHarvest currently has one facility open in Morehead, Kentucky. It plans to open three more before the end of the year. I think that this will be the point when investors finally get more insight into the company’s future. But if these new facilities have unit economics anything like the current one, this will make the problem worse, not better.

The Valuation Still Requires High Growth

It’s difficult to value a company like AppHarvest. The business is losing money by almost every conceivable metric. In its last 10-Q filing, the company said that it expects to continue burning cash “for the foreseeable future.”

Adjusting for net debt, the company has an enterprise value of about $260 million. This is over 11 times the midpoint of its 2022 revenue guidance. I’m going to assume that the three new facilities open at a similar run rate. Even with this assumption, the business has an enterprise value to sales ratio of almost 3 times. This seems high for an industry that typically has low gross margins.

I think that the company could be fairly valued if it reaches its SPAC projections. But right now, there is a very high risk that it will miss these targets badly. Even though the stock price is 96% off its highs, the business is far from a deep value play. Considering this, I feel that the risk to reward is still unfavorable.

How Likely Is A Turnaround?

AppHarvest is an extremely risky investment. Right now, I see major risks in its financing and its core business model. But the company’s recent USDA loan shows that it has the ability to secure outside financing. The debt markets are unfavorable, but government backing could extend AppHarvest’s runway.

I also want to mention the very high share price volatility. The company is a highly speculative small cap. Shares could jump significantly on any positive news. There are weeks when share prices have moved 20% to 30% with no meaningful catalyst. Because of this, I’d recommend making a detailed plan before taking any short position.

Final Verdict On AppHarvest

AppHarvest’s updates are positive, but my outlook is still unchanged. The company has secured some financing, but it is still deeply unprofitable. Management is diluting shareholders. I think that rate hikes will be a continuing drag on the share price.

I would only consider buying if I saw evidence that the company could make a sustainable profit. Until then, the risk to reward is still too unfavorable for me.

Be the first to comment