Sundry Photography

Those that have been following my coverage for airlines in the Americas and Europe know that Delta Air Lines, Inc. (NYSE:DAL) has been my longtime favorite investment. While I believe that airlines do provide significant upside, especially in the current environment where more and more travel demand is coming back online, I am not invested in airlines at the moment, as the airline industry is prone to shocks that significantly affect stock price performance and its longer-term performance. However, that does not mean that I am necessarily bearish on individual names. Some names have significantly better strategies and execution than others, and I believe that Delta Air Lines is one of those names.

In a recent investor report, I marked shares of Delta Air Lines a buy when compared to its peers. As much as I would like to say that shares have significantly appreciated, that is not the case. Shares dropped 7.8% compared to a broader market decline of 5.9%. So, Delta Air Lines is an underperformer, and that does not come as a surprise, as airline names tend to sell off more steeply as the stock market softens and even the airlines with solid management execution suffer from that. However, since publishing my Q2 earnings analysis for Delta Air Lines, shares are down 2.6%

In this report, I will have a look at Delta Air Lines’ Q3 earnings, touching on the year-over-year and year-over-three and performance as well as the guidance and comment from management.

Year-Over-Year Delta Air Lines Results Jump on Adjusted Basis

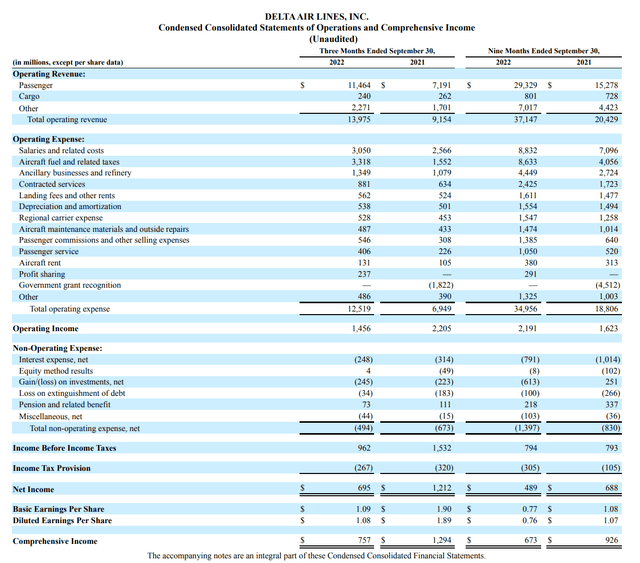

Delta Air Lines year-over-year results (Delta Air Lines)

The year-over-year figures are not the most meaningful, as we are basically comparing two different worlds, but that does not make them completely useless. Passenger revenues jumped by 60% despite a $70 million revenue pressure from Hurricane Ian, half of which impacted Q3 results on a 17% increase in capacity. So, the improvement is mostly carried by increased unit revenues and better load factors. Passenger revenue increased across the board, but the most important observations are that main cabin ticket revenues increased by 59%, and 72% for premium products. Those premium products reflect to a large extent business travel. That is an interesting improvement, as early on in the pandemic, Delta Air Lines was one of the leading names that strongly felt that corporate travel would never recover. Luckily for them, and in line with my view, they were wrong.

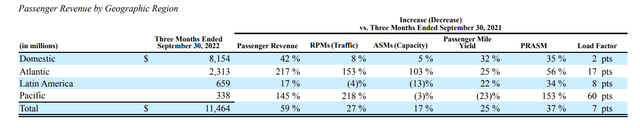

Passenger revenue by geographic region (Delta Air Lines)

Passenger revenue by geographic region shows where the passenger operating revenue strength is located. It, for sure, was not in Latin America. While revenues there improved by 17%, capacity declined by 13% and revenue passenger miles contracted by 4% reflecting positive but partial offset. Domestic revenues remained strong, with a 42% increase in revenues on a 5% capacity expansion and 35% improvement in unit revenues.

One thing that I have been pointing out at various times when assessing airlines is that long-haul travel has yet to come back, and we are in the early innings of that. Atlantic and Pacific improvement show exactly that. Passenger revenues increased by 217% and 145% on a 103% increase in capacity for the Atlantic and a 3% capacity decrease for the Pacific. Unit revenues increased by 56% and 153%, respectively. Noteworthy is that the Pacific region was the only region with a decrease in passenger-mile yield, which can be attributed to the area still being most impacted by travel restrictions.

Cargo revenues decreased slightly, which should not come as a surprise as the global economy is cooling, and more cargo capacity is coming online. Other revenues increased by 34%, driven by increased maintenance activities, higher volume and pricing on refinery sales, improved sales from the partnership with American Express (AXP), and improved lounge access revenues. The other revenues represent 16% of the current revenues, and while classified as “other,” possibly suggesting they are less important, it is the other revenues that clearly portray Delta’s revenue stream diversification.

On the cost side, costs increased by 80%. Salaries and related costs increased by 19%, reflecting increasing hiring and a 4% pay bump. Fuel costs increased by 114%. Even though fuel costs surged, the refinery as a fuel hedge instrument decreased the gallon costs by 6% and all fuel hedges combined reduced costs by 4.5%. Costs in other areas increased by a combination of increased volume and inflationary pressures. Delta Air Lines had an operating income of $1.5 billion compared to $2.2 billion last year, and so you could say profits dropped. However, adjusting for the Government grant recognition, operating earnings jumped from $383 million to $1.456 billion, reflecting an adjustment to operating margin expansion from around 4% to over 10%. Adjusted costs per unit revenue went from $0.96 to $0.90 marking a 7% improvement. While this is not the general way to assess unit costs, it does reflect how Delta Air Lines is improving its revenue generation.

Year-Over-Three Shows Strong Performance

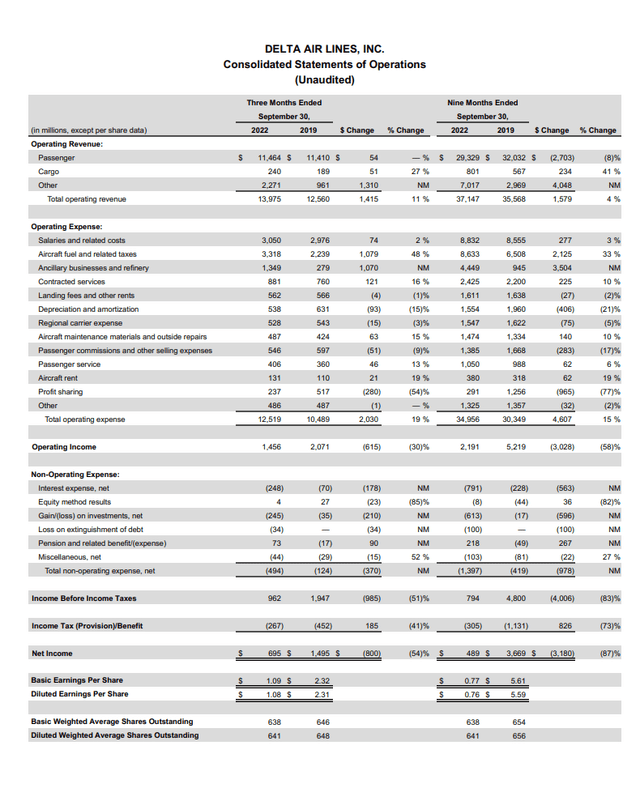

Delta Air Lines Year-over-three results (Delta Air Lines)

Whereas the year-over-year figures give some indication on how we are moving away from pandemic results, the year-over-three figures show how close or far off Delta – or any airline for that matter – is to achieving pre-pandemic results. Year-over-three, Delta Air Lines revenues increased to a new high of $13.975 billion, marking an 11% higher revenue compared to pre-pandemic levels. Passenger revenues have recovered to match that of pre-pandemic levels, and most of the revenue gained comes from other revenues.

Main cabin ticket sales are down 2% and premium product sales are up 8%. By region, Domestic is up 2% on 15% higher unit revenues while Atlantic is up 12% on 25% higher revenues. Latin American is down 2% on 21% higher revenues. The Pacific revenues are down 51%, but its unit revenues increased by 55% and are an indication that revenue recovery is underway. Overall, unit revenues are 24% higher on passenger level with 83% capacity recovered.

On cost-level, we are not seeing anything surprising. Costs are 19% higher, mostly carried by higher costs for fuel and refinery. Costs per unit revenue are $0.895 compared to $0.835, signaling that there is still 7% of cost improvement to do to get to 2019-levels. Possibly, as Delta Air Lines transforms its business, there are even better unit costs to be realized.

Guidance: Bullish On Cost Improvement

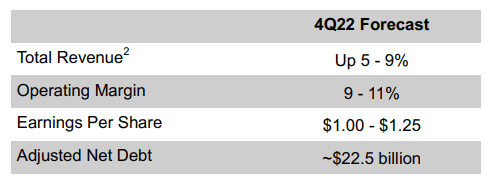

Delta Air Lines Q4 2022 Guidance (Delta Air Lines)

For the fourth quarter, Delta Air Lines forecast revenue up 5 to 9 percent on capacity being down 8 to 9 percent as the company increases. This is driven by continued strong pricing, though unit revenues are only expected to grow by mid-teens rather than the 21% improvement seen in Q3.

More interesting is that Delta Air Lines is guiding for 12 to 13 percent higher cost excluding fuel. As some cost components are inflated and capacity has not been fully recovered, the fact that costs will be 12 to 13 percent higher compared to Q4 2019 is not the surprise itself. The surprise is that Delta Air Lines will be improving costs by 10 points.

Delta Air Lines

There are a couple of factors that drive the sequential improvement:

- Improved operational reliability: during the third quarter Delta Air Lines had to cancel flights which increased costs and reduced capacity providing a double blow to cost per available seat-mile.

- Capacity expansion and recovery of long haul both Atlantic and Pacific: Delta Air Lines will be flying above pre-pandemic capacity on Atlantic and the capacity addition from long-haul flying provides a significant boost to cost amortization decreasing the unit costs.

- Increase in domestic stage length: by increasing the stage length the mile component for the cost per available seat mile is going up, reducing the CASM figure.

Conclusion: Delta Air Lines Is A Strong Buy On Positive Execution

We don’t know what the current economic uncertainty will do to Delta, and it could very well be that next quarter, things will look more bleak. However, for the upcoming quarter, demand and capacity restoration remains healthy, and we see how Delta Air Lines is diversifying its revenue streams in an effort to reach $7 in earnings per share by 2024 and a cash flow of $4 billion. Given the uncertainty, we have to see whether that will actually happen, but the execution path that management is following is stellar. With capacity, most prominently international capacity, not yet fully back, business travel has significant recovery space. I do believe that the upside, in combination with management capitalizing on that from multiple directions, is not reflected in the current stock price, providing an entry point with significant upside potential.

Be the first to comment