Irina Ivanova

Index funds provide investors with simple, cheap, transparent exposure to a diversified bundle of securities. Index funds are one of the strongest investments an investor can make, in my opinion, and in the opinion of many of the greatest investors in the world, including Warren Buffett. In Buffett’s own words a low-cost index fund is the most sensible equity investment for the great majority of investors.

Index funds are generally fantastic investments, but as with all investments, some are stronger than others, and some are particularly appropriate for specific types of investors. In my opinion, for long-term investors, the following three index funds are best.

First, the Vanguard Total World Stock ETF (VT), which provides investors with exposure to almost the entire global equity investable universe. VT’s incredibly well-diversified holdings and strong performance track-record make it a fantastic investment opportunity for long-term investors, especially for those looking for as much diversification as possible.

Second, the Invesco S&P 500 Equal Weight ETF (RSP), which provides investors with equal-weighted exposure to the 500 largest U.S. companies. RSP invests more heavily in best-performing mid-caps and small-caps than most equity index funds, leading to best-in-class long-term total returns. RSP’s diversified holdings and strong performance track-record also make it a fantastic investment opportunity for long-term investors, especially those looking for the highest potential long-term total returns.

Third, the Invesco CEF Income Composite Portfolio ETF (PCEF), a CEF fund of funds, providing investors with diversified exposure to almost all relevant asset classes and a fully-covered, growing, 9.1% yield. PCEF’s diversified holdings and strong dividend yield also make it a fantastic investment opportunity for long-term investors, especially for long-term income investors.

In my opinion, the three funds above are all strong investment opportunities, and the best index funds for long-term investors. Other funds might be better at current prices and valuations, and others might be combined into stronger portfolios, but the above are the best all-around choices, in my opinion.

VT – All-Cap U.S. Equity Index ETF

Broad-Based, Diversified, Global Equity Holdings

VT is a broad-based all-cap global equity index

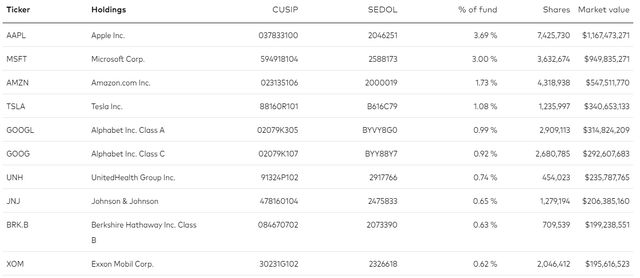

ETF. VT’s underlying index is quite broad, which results in an incredibly well-diversified fund, with exposure to over 9000 securities. As with most other well-known equity index funds, the fund’s largest holdings consist of well-known mega-cap stocks, including Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN). Unlike most other well-known equity index funds, the fund’s holdings also include smaller companies, both mid-caps and small-caps. Largest holdings are as follows.

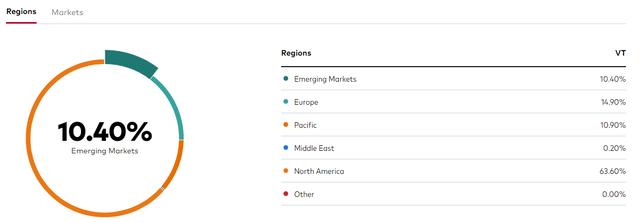

VT is a global equities fund, with exposure to both U.S. and international equities, and with investments in dozens of countries from across the globe. As with most global equity funds, VT is overweight U.S. equities, due to the size of the country’s economy and public equity market. Regional exposures are as follows.

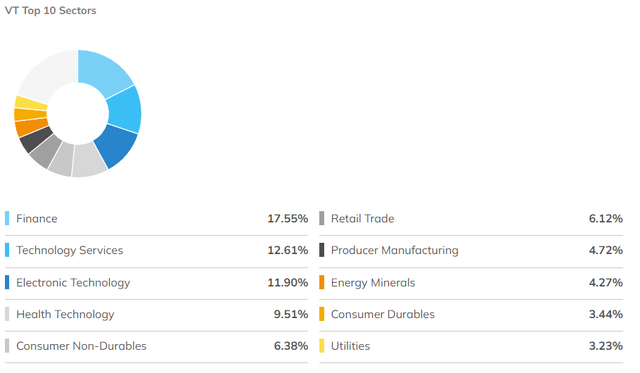

VT provides investors with balanced exposure to most relevant industry segments. The fund is slightly overweight financials, due to said industry’s outsized role in several foreign markets. VT is not overweight tech, unlike many of its peers, due to the industry’s relatively small role in foreign markets. Industry exposures are as follows.

Almost all equity index funds are diversified, but VT is really on a league of its own. Most equity funds invest in hundreds of securities, VT invests in thousands. Most equity funds focus on securities of a specific size, generally large-caps, while VT invests in securities of all sizes. Most equity funds invest in a single country, VT invests in dozens. Some equity funds invest in all relevant industry segments, including VT.

VT is a broader, more diversified fund relative to its peers on most relevant metrics, tied on industry segment exposure. Diversification serves to reduce portfolio risk, volatility, and potential losses during downturns. VT’s significant diversification also all but precludes the possibility of significant underperformance: can’t underperform the market if you track the market. Stocks go up, VT goes up, with extremely few exceptions, as VT includes almost all relevant global stocks, with extremely few exceptions.

VT’s broad-based, diversified, global equity holdings are a significant benefit for the fund, and its core investment thesis. VT’s diversified holdings make it a particularly compelling investment opportunity for long-term equity investors looking for the most diversification possible: the fund includes basically everything, with no material exclusions.

Strong Performance Track-Record

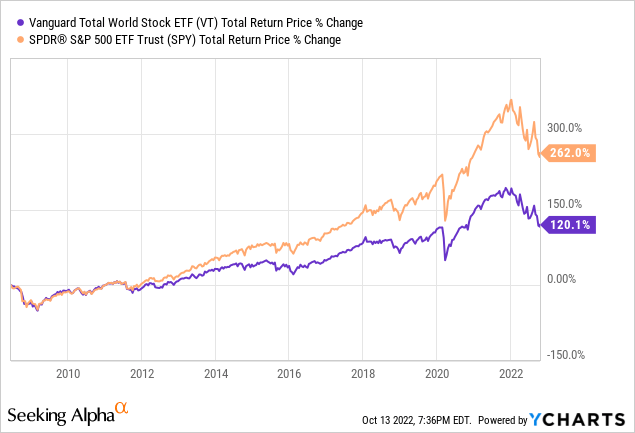

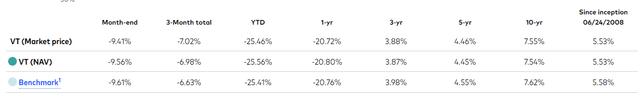

VT invests in equities, one of the strongest, best-performing asset classes in the world. VT’s performance tends to be quite strong, with the fund generally delivering high single-digit annual returns. Returns have only averaged 6.7% per year since inception due to unfortunate timing: the fund was created mere months before the financial crisis of 2008. Returns for the past decade have averaged 7.0% – 8.0% per year. Returns since inception have been weaker, at 5.5%, due to bad timing: the fund was created in the middle of the housing bubble and attendant financial crisis. Returns for the fund’s underlying index have been much better, at around 9.0% – 10.0% for decades.

VT’s performance track-record is good, and generally consistent. Losses do periodically occur, but significant underperformance is somewhere between rare and impossible. Remember, funds can’t underperform the market if they track the market. VT tracks the global equity market, so it can’t underperform relative to said market. It can underperform relative to other investment funds and asset classes, including U.S. equities, high-yield corporate bonds, and the like. VT has underperformed relative to U.S. equities since inception, and by quite a large margin.

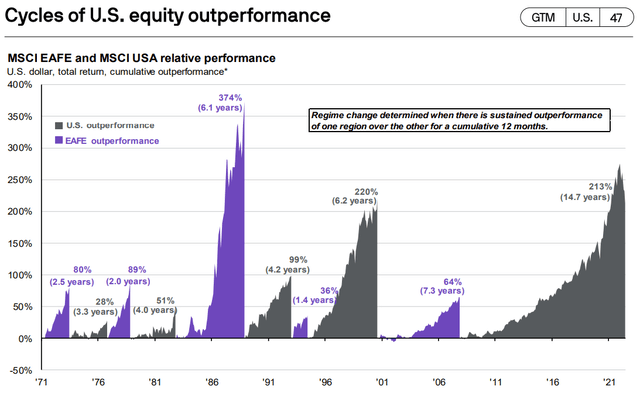

VT’s underperformance is explained by international equity underperformance, and bad timing. International equities have lagged behind U.S. equities since the financial crisis of 2008, but had outperformed before that. VT was created in the middle of 2008, and so has only existed during a long, unprecedented period of U.S. equity outperformance.

J.P. Morgan Guide to the Markets

VT’s long-term performance would be materially stronger if the fund were older, having been created before the dot-com crash or 80s bear market.

In any case, U.S. equities have outperformed international equities for more than a decade now, so some investors have chosen to forego international and global equity funds, to focus exclusively on best-performing U.S. equities. For these investors, RSP is a particularly compelling index fund. Let’s have a look.

RSP – Equal-Weighted S&P 500 Index ETF

Diversified Large-Cap U.S. Equities

Warren Buffett, the most successful investment manager in the world, says the best investment decision most people can do is to own an S&P 500 index fund.

Buffett’s reasoning is simple, and sound. The S&P 500 is the leading U.S. equity index fund, including the 500 largest U.S. companies, subject to a basic set of inclusion criteria. S&P 500 components are all, by definition, the largest, most successful companies in the largest, most successful economy in the world. Every single S&P 500 component has proven themselves adept at growing their operations, outcompeting their peers, and delivering significant, above-average capital gains and shareholder returns: they wouldn’t be a large U.S. company otherwise.

The S&P 500 does exclude smaller U.S. companies, as well as international companies, but these are not strictly necessary investments, at least not in the opinion of most market analysts. The strongest U.S. mid-caps and small-caps should see above-average revenue, earnings, and market-cap growth throughout the years, and so, with time, will join the S&P 500. Although the S&P 500 does not include international equities, most index components have significant international operations, and so benefit from positive developments in said markets. Apple, for instance, sells more iPhones in Europe, China, and other overseas markets, than in North America. China is a particularly important market for the company, as rapid economic growth and a burgeoning middle-class has led to a significant increase in demand for expensive electronic goods, including those developed by the company. Apple is technically a U.S. company, but, in practice, it functions as a global company, with operations in dozens of countries, and sales in hundreds. The same is true for most other S&P 500 components, so said index does provide investors with sufficient (indirect) exposure to international markets.

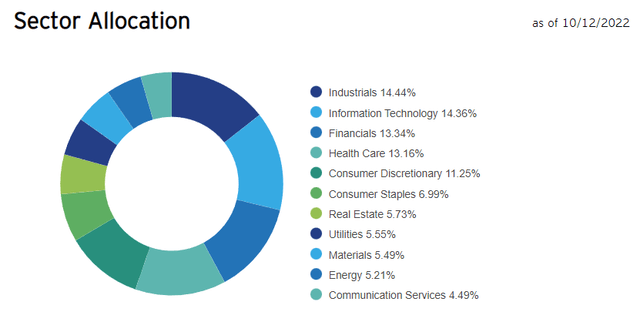

Due to the above, S&P 500 index funds are fantastic investment opportunities. RSP is an S&P 500 index fund, with a twist. Most index funds are market-cap weighted, so larger companies have greater portfolio weights. RSP is an equal-weighted fund, so all companies have the same weight: 0.20%. The fund’s weighting scheme significantly reduces portfolio weights for some of the largest U.S. equities, including mega-cap tech stocks like Apple and Microsoft, while increasing weights for comparatively small, albeit still large, companies like Etsy (ETSY) and IBM (IBM). Doing so leads to an incredibly well-diversified and balanced portfolio, with exposure to 500 U.S. equities from all relevant industry segments. These are as follows.

In general terms, RSP is less diversified than VT, but is sufficiently diversified regardless. Exposure to mid-caps, small-caps, and international equities is ideal, but not necessary, in my opinion, and in the opinion of many important analysts and investors.

Strong Performance Track-Record

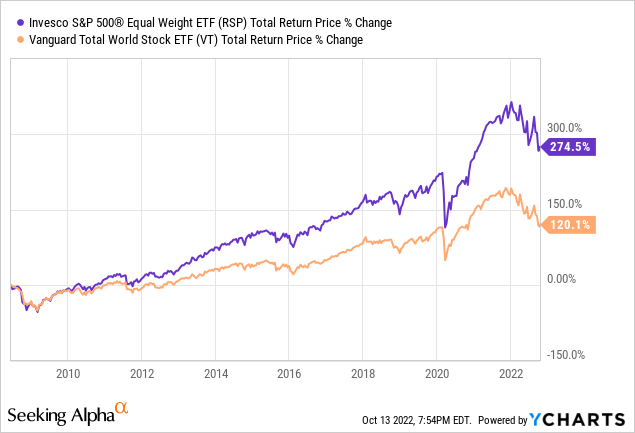

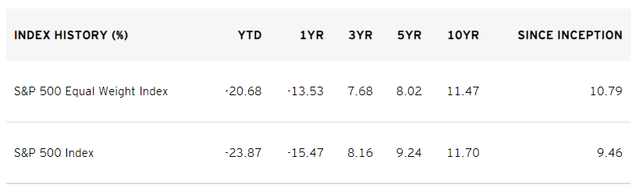

RSP invests in U.S. equities, one of the strongest, if not the strongest, best-performing asset class in the world. RSP’s performance thus tends to be quite strong, with the fund generally achieving annual total returns in the low double-digits. Returns have averaged 10.8% since inception, almost twenty years ago.

RSP sometimes performs very differently from more well-known U.S. equity indexes, including the market-cap weighted S&P 500 index, due to the fund’s relatively unique weighting scheme. It is common for the fund to outperform and underperform relative to its peers, but the fund tends to outperform, as has been the case since inception.

RSP’s outperformance is due to the fund’s greater exposure to smaller S&P 500 components. These companies tend to have higher growth rates and cheaper valuations than their peers, leading to market-beating returns. RSP invests quite heavily in these companies, and so the fund tends to outperform as well.

As should be clear from the above, RSP’s performance track-record is materially stronger than that of VT. In fact, RSP has achieved more than twice the returns of VT since inception, outstanding results.

RSP’s outperformance was due to the unfortunate timing on VT’s inception, international equity underperformance, and the strong performance of the fund’s smaller holdings. I do not believe that RSP will outperform VT by such a large margin moving forward, but slight outperformance seems likely, in my opinion at least.

RSP is less diversified than VT, but has a stronger performance track-record, and could continue to outperform in the future. As such, RSP seems like the better fund for investors looking for the highest potential returns, while VT seems like the more appropriate choice for those looking for the maximum amount of diversification. Although both funds are fantastic investment opportunities, both yield very little, a deal-breaker for more income-focused investors. For these, PCEF might be a better fit. Let’s have a look.

PCEF – CEF Fund of Funds

Diversified Multi-Asset Class Exposure

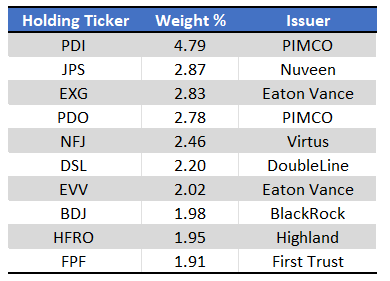

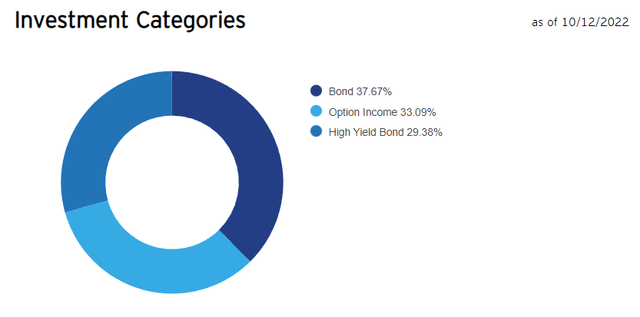

PCEF is a multi-asset index ETF, investing in CEFs focusing on investment-grade bonds, high-yield bonds, and equity option income / call options. PCEF invests in the three major income-producing asset classes or fund classifications, which make it a perfect choice for income investors and retirees.

PCEF is an incredibly well-diversified fund, with exposure to most important asset classes, through investments in over one hundred CEFs, with exposure to thousands of underlying securities. Asset allocations and largest holdings are as follows.

PCEF’s diversified holdings reduce portfolio risk, volatility, and potential for underperformance, all significant benefits for the fund and its shareholders. PCEF is diversified enough that it could even function as an investor’s only portfolio holding: it includes exposure to most relevant asset classes and hundreds of funds.

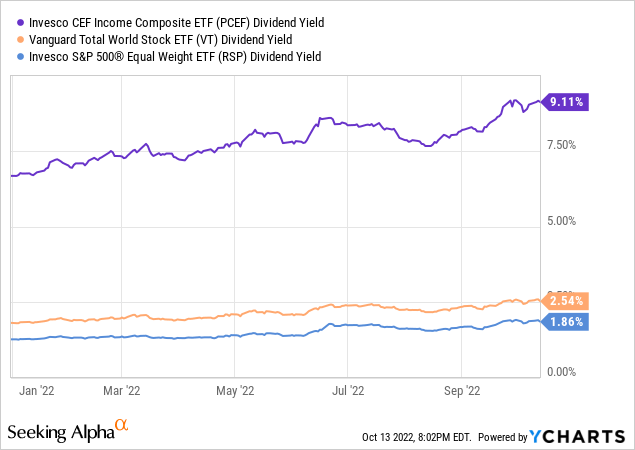

Strong, Fully-Covered, Growing 9.1% Dividend Yield

PCEF focuses on bond funds, especially high-yield corporate bond funds. These are relatively high-yielding securities, which results in a relatively high-yielding portfolio and fund. PCEF currently yields 9.1%, an incredibly strong yield on an absolute basis, significantly higher than average for an index fund, and higher than RSP and VT.

ETFs almost always distribute all income to shareholders and nothing else. As such, ETF dividends tend to be fully-covered by underlying generation of income, as is the case for PCEF. Fully-covered dividends are sustainable dividends, a benefit for the fund and its shareholders.

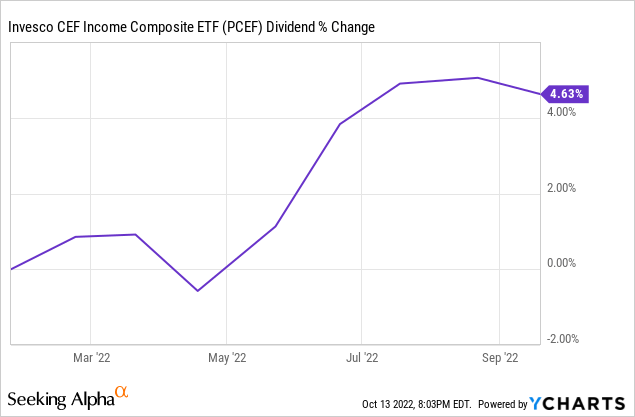

PCEF’s dividends are quite strong, and will likely grow stronger in the coming months. Interest rates are rising across the board, as the Federal Reserve aggressively hikes reference rates to combat inflation. Higher interest rates have led to higher coupon rates for most bonds, meaning greater income for bond investors. Bond funds benefit too, and these comprise most of PCEF’s holdings. As bond funds see higher income, bond fund dividends should increase too. These should lead to higher income for PCEF, allowing the fund to hike its dividends as well. This is a relatively long, fraught process, but also an incredibly likely, almost certain one. Higher interest rates almost certainly mean higher dividends for PCEF. Importantly, the process has already started to play out. As per PCEF’s corporate website, the fund currently sports a SEC yield, a standardized measure of short-term generation of income, of 10.2%. PCEF is currently generating a bit more in income than it distributes to shareholders, which will almost certainly result in dividend hikes moving forward. PCEF’s dividends have risen YTD, as expected.

PCEF’s strong, fully-covered, growing 9.1% dividend yield is a significant benefit for the fund and its shareholders, and make the fund an incredibly strong investment opportunity for long-term income investors.

As an aside point, PCEF is an incredibly strong index fund for long-term income investors, some actively-managed funds and portfolios are stronger, if riskier, choices. The Saba Closed-End Funds ETF (CEFS) is quite similar to PCEF, but is actively-managed, offers a slightly stronger 10.0% dividend yield, and stronger performance track-record as well. I last covered CEFS here.

Performance Track-Record

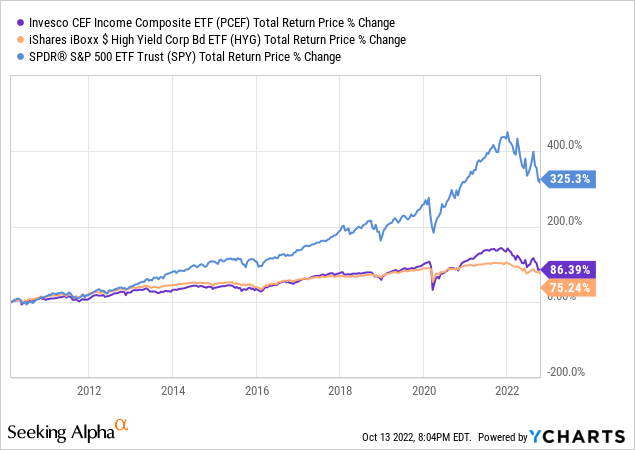

PCEF’s performance track-record seems about average. Returns have averaged 5.64 per year since inception, in-line with the fund’s underlying asset mix. Returns have been slightly higher than average for a bond index fund, but significantly lower than average for an equity index fund. PCEF invests in both bonds and equities, but mostly bonds, so the fund’s performance track-record is broadly consistent with its asset mix. PCEF’s returns have been somewhat lower than expected, due to widening discounts to NAVs.

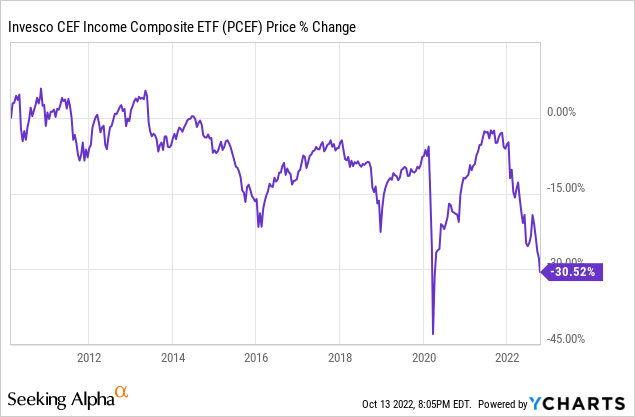

PCEF’s returns have consisted entirely of income. There have been capital losses since inception, almost entirely concentrated in the past few months of rising interest rates / plummeting bond prices. Losses are quite high at 30.5%, but somewhat lower when considering the fund’s decades-long existence.

Moving forward, I expect PCEF’s performance to materially improve, due to increasing dividends and stabilizing bond prices.

Conclusion

Index funds provide investors with simple, cheap, transparent exposure to a diversified bundle of securities, and are one of the strongest investments an investor can make. In my opinion, VT, RSP and PCEF are the best index funds for long-term investors.

VT provides the greatest amount of diversification.

RSP provides the strongest performance track-record and highest potential returns.

PCEF provides the strongest dividend yield.

All three are fantastic choices, and hopefully there is an appropriate fund for any and all investors.

Be the first to comment