martin-dm

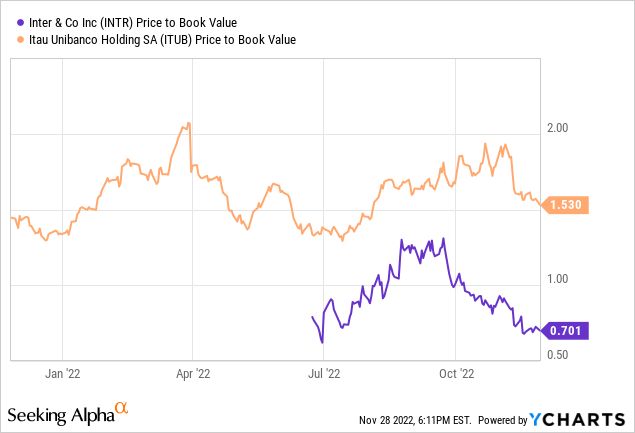

The investment case for Inter & Co (NASDAQ:INTR) is beginning to take shape following a solid quarter, which saw underlying earnings remain strong despite being clouded by some one-off headwinds. Repricing will be the key near-term tailwind, led by the recent increase in credit card rates; the maturing of new client cohorts should also lead to higher profitability over the long run. Yet, INTR stock has underperformed YTD mostly due to concerns about the macro headwinds, as well as the broader expansion strategy. At current levels, INTR stock is trading at a wide discount to book – in stark contrast to the book value premium for incumbent banks like Itau (ITUB). Relative to the consensus beating NIMs and strong asset quality sustained in INTR’s latest quarter, the current valuation discount seems unwarranted.

Solid Earnings Result Clouded by One-Offs

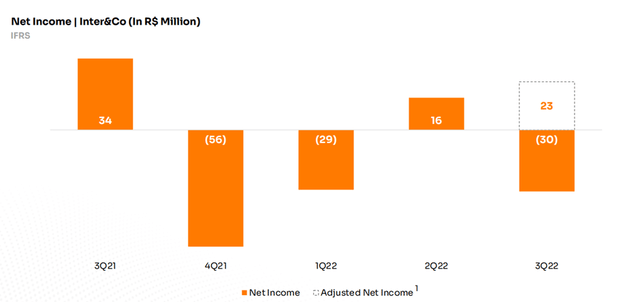

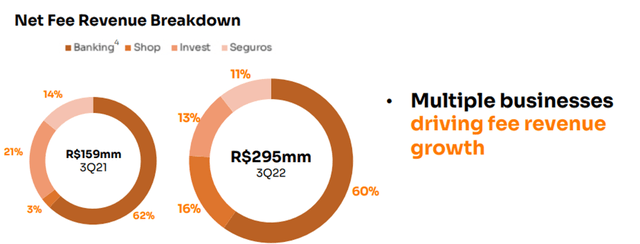

INTR ended Q3 with a headline net loss of BRL30m, but this was mostly down to the negative impact of ~BRL53m from a deflation accrual on the securities portfolio. Adjusting for the one-off impacts on net interest income, the bottom line would have swung to a BRL23m profit instead. Solid fee income growth also contributed to earnings this quarter and now makes up >30% of the net revenue base. In contrast, earnings were weighed down by opex pressure, mainly from non-headcount-related expenses. Still, the net interest margin (NIM) expanded ~50bps QoQ to 7.5% after adjusting for the deflation impact (vs. a ~70bps QoQ decline on headline numbers), as the bank’s funding cost remained low despite a challenging macro.

Inter & Co

The successful repricing of the loan portfolio was another highlight, with most of INTR’s loan segments completely repriced. From here, repricing efforts will move to the longer-duration portfolios (e.g., payroll and real estate loans), which typically take longer due to their duration profile. With the bank shifting its long-term focus toward unlocking operating leverage benefits to drive higher profitability, expect further repricing across the credit portfolio over time. Per management, the target is a complete portfolio repricing by H2 2023, so progress here will be worth monitoring. If INTR can balance this with its commitment to maintaining efficiency and keeping the cost-income ratio in check, the bank should have a compelling margin expansion runway ahead.

Asset Quality Remains Under Control

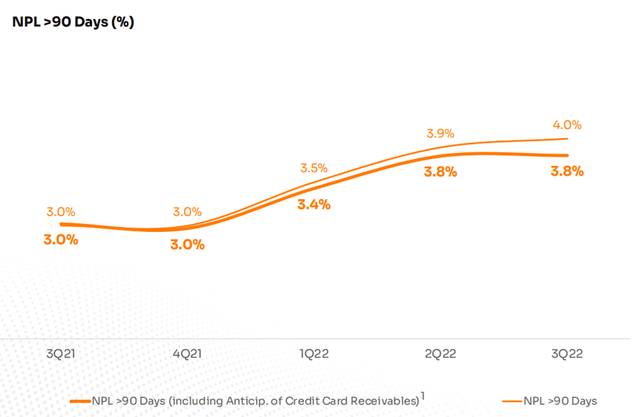

Against a backdrop of asset quality deterioration for the incumbent banks, INTR’s asset quality was largely intact – the NPL ratio only rose a modest +12bps QoQ at 3.99% in the quarter. The only caveat was the increase in stage 3 loans to 5.6% of the total portfolio (from 4.5% previously), indicating deterioration here. Still, management’s success in keeping a lid on NPLs is commendable, with current guidance calling for continued stability in the asset quality ratios over the near term (albeit with minor mix shifts).

Inter & Co

Given INTR’s reputation as a more conservative lender, maintaining exposure to mostly lower-risk secured lending products (note two-thirds of its loan book is collateralized), I view these targets as well within reach. With the bank also actively working on underwriting improvements (e.g., in the risk assessment and collection processes), success here could drive incremental upside ahead. Also helping to insulate the P&L against a downturn is INTR’s increasingly diversified revenue base, comprising more established areas (e.g., investments and insurance), as well as high-growth areas (e.g., marketplace and remittances).

Inter & Co

Digital Optionality

While INTR’s digital platform contributes a minor % of revenue today, the growth has been massive – the >20m client base (>10m active clients) implies a ~ 45% revenue CAGR over the 2015-2021 period. The multi-year digital turnaround places the company at the forefront of the digital banking revolution, as its open investment platform and integrated e-commerce/banking model set it apart from the rest. With more innovations in the pipeline as well, the company’s product development represents a key competitive advantage over the long run.

That said, this growth comes at the cost of overall profitability – INTR’s digital initiatives are nowhere near as profitable as the core business and, thus, have driven margin compression and weighed on the group-level return on equity profile. Until INTR reaches scale in its core markets, this isn’t changing anytime soon. Given the competitive intensity of the digital banking space in Brazil as well, with competitors such as PicPay, MercadoPago (MELI), and iti, expect more investments as INTR looks to win share. Going forward, progress on achieving scale and credit underwriting, a major revenue pool in Brazilian banking, will be key to unlocking the digital monetization potential.

An Unwarranted Valuation Discount

All things considered, this was a good quarter for INTR. The stronger focus on profitability, with the upcoming repricing of its products and cost discipline, should drive further NIM expansion into next year as well. Over the mid to long term, the recent NASDAQ migration should also boost governance and visibility among the global investor community. Some concerns are perhaps warranted given the tough macro, but this needs to be balanced against the positives, including its low-cost funding, solid capital position, and exposure to the fast-growing digital banking space. At current valuations, the market has likely discounted too much, with the YTD decline moving the stock to a steep book value discount, well below its banking peers. Net, I like the risk/reward here.

Be the first to comment