edb3_16/iStock via Getty Images

Is paper storage dead? For years, bears have tried to make the case that Iron Mountain (NYSE:IRM) would go the way of the buggy whip due to the global digitization of records.

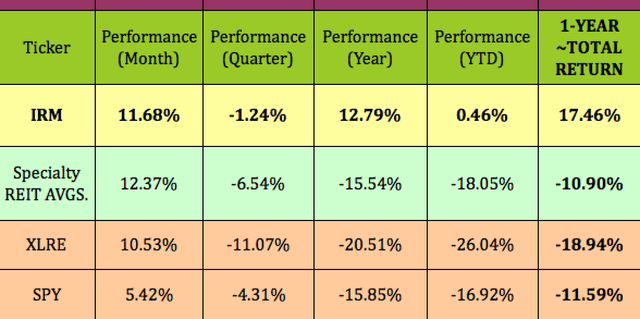

However, the market doesn’t quite agree, as evidenced by IRM’s outperformance over the past quarter, year, and year to date. It’s near an all-time high.

IRM’s ~total one-year return has also left the S&P, Real Estate sector, and Specialty REIT industry in the dust. Pretty good for a company that started out in an old iron mine, growing mushrooms:

Company Profile:

Iron Mountain Inc., founded in 1951, is the global leader for storage and information management services. Trusted by more than 225,000 organizations around the world, and with a real estate network of more than 85 million square feet across more than 1,400 facilities in over 50 countries, Iron Mountain stores and protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. (IRM site)

IRM is a REIT which has been adding more tech to its offerings over the past few years, via its expansion into data centers and document digitization services.

Earnings:

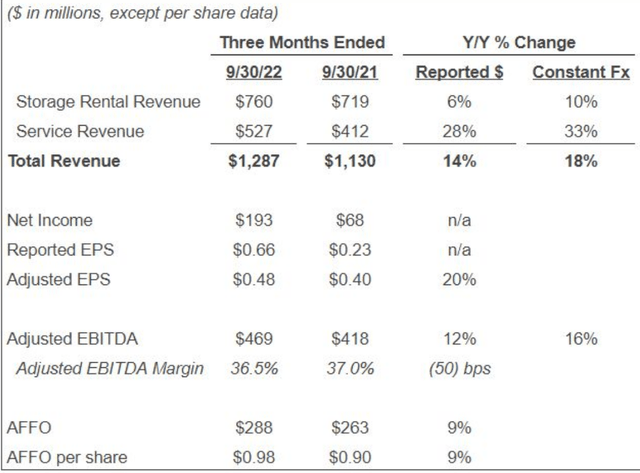

Q3 ’22 was a record quarter, with revenue up 14%. While Storage revenue remained IRM’s biggest segment, with 59% of total revenue, Service revenue had more growth, hitting 28% for the quarter.

Net income grew 2.8X, while adjusted EPS rose 20%, and adjusted EBITDA rose 12%. AFFO and AFFO/share both rose 9% in the quarter:

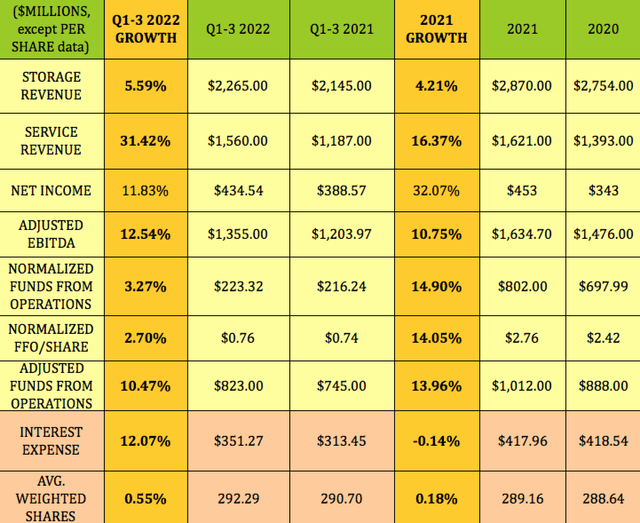

Those Q3 ’22 growth figures were roughly consistent with Q1-3 ’22 figures for Storage and Service, which rose 5.6% and 31% respectively. Net income was up ~12%, while adjusted EBITDA rose 12.5%.

Normalized FFO slowed down a bit, rising 3.3%, vs. ~15% in full-year 2021, while AFFO rose 10.5%, vs. 14% in 2021. Interest expense rose 12%, after being ~flat in full-year 2021:

2022 Guidance:

In September 2022, management announced a global program, “Project Matterhorn” designed to accelerate the growth of IRM’s business.

This program’s investments will focus on transforming IRM’s operating model to a global operating model, and is designed to allow the company to shift from a product-based to a solution-based sales approach. Management expects to incur ~$150.0M in costs annually related to Project Matterhorn from 2023 through 2025.

Management expects IRM’s strong growth trends to continue, and issued upbeat guidance for Q4 ’22, with similar amounts to Q3 ’22’s performance. They expect revenue of ~$1.3B, adjusted EBITDA of ~$470M, AFFO of ~$280M, and AFFO/share of ~$0.94.

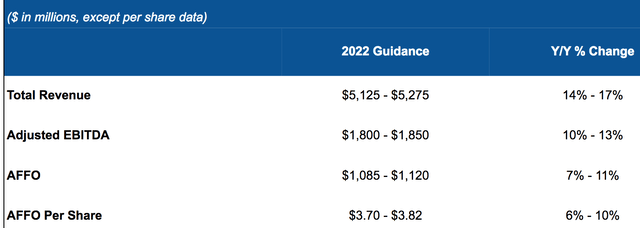

For full-year 2022, guidance indicates total revenues to grow at least 14%, with adjusted EBITDA up at least 10%. AFFO is expected to grow at least 7%; while AFFO/share should be up 6% to 10%:

Dividends:

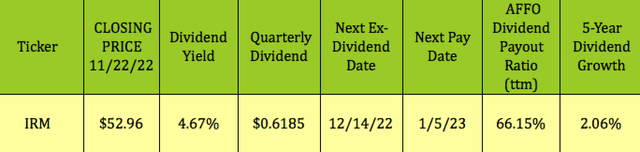

At its 11/22/22 closing price, IRM yielded 4.67%. Management has maintained the current $.6185 quarterly dividend since Q4 ’19, hence the 2% five-year dividend growth average. IRM goes ex-dividend next on 12/14/22, with a 1/5/23 pay date.

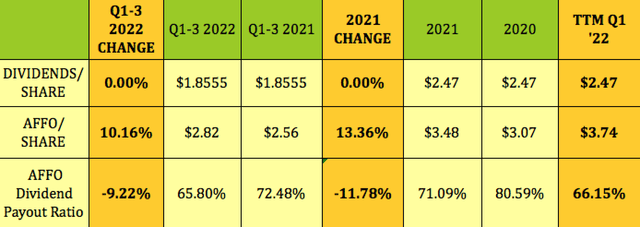

IRM’s earnings growth has improved its AFFO dividend payout ratio during the past seven quarters, dropping it from ~81% to 71% in 2021, and a further drop to 65.80% so far in 2022:

Profitability and Leverage:

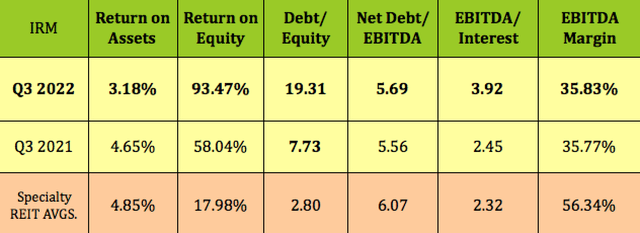

IRM had a big decline in Equity in 2022, which accounts for part of the much higher ROE and debt/equity figures. Net long-term debt increased to $10.23B, as of 9/30/22, vs. $8.96B at 12/31/21.

In March, 2022, IRM recognized a loss of ~$105.8M associated with the de-consolidation of the businesses included in the acquisition of OSG Records Management (Europe). The total goodwill impairment write-off for Q1-3 ’22 was $158.4M.

Net debt/EBITDA was stable year-over-year, while EBITDA/Interest rose substantially, to 3.9X, vs. 2.5X in Q3 ’21.

Debt and Liquidity:

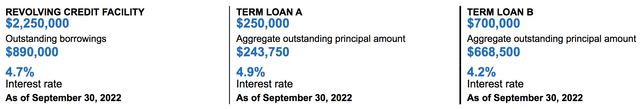

IRM has a revolving credit facility, a term loan A, and a term loan B.

In March 2022, management entered into an amendment to the Credit Agreement which extended the maturity date of the Revolving Credit Facility and Term Loan A from June 3, 2023 to March 18, 2027.

They also refinanced and increased the borrowing capacity that IMI and certain of its US and foreign subsidiaries are able to borrow from $1.75B to $2.25B.

Term Loan A was also refinanced with a new $250M Term Loan A, with an increased net total lease adjusted leverage ratio maximum allowable from 6.5x to 7.0x, in addition to removing the net secured lease adjusted leverage ratio requirement.

79% of IRM’s debt is at fixed rates, at a 5% average interest rate, with 6.3 years weighted average maturity. IRM had $1.5B in liquidity, as of 9/30/22.

IRM’s corporate debt is rated BB- stable by S&P, and Ba3 stable by Moody’s.

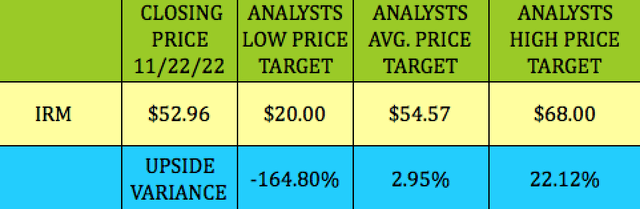

Analyst Targets:

At its 11/22/22 closing price, IRM was ~3% below analysts’ $54.57 average price target, and 22% below their $68.00 highest price target. That $54.57 average target should be higher, but it’s brought lower by the ridiculous $20.00 lowest price target.

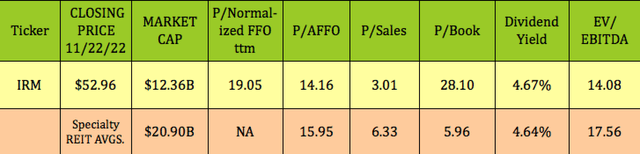

Valuations:

With IRM’s smaller equity amount, its P/Book has ballooned to 28X. It does look cheaper than overall Specialty REIT averages on a P/Sales, P/AFFO, and EV/EBITDA basis, but keep in mind that the Specialty REIT sub-industry is a mix of many different types of businesses. One of the traditional problems with analyzing IRM is that it has a unique business – it’s not quite a tech company, nor is it a typical REIT.

Parting Thoughts:

If you already own IRM, there are some juicy $55.00 covered calls for April 2023 with a ~$3.20 bid. IRM is near an all-time high. Conversely, if you’re looking to establish a new position, there are also some attractive put bids of ~$2.90 at the $50.00 strike.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment